Maryland Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion

Description

How to fill out Sample Letter For Debtor's Motion For Hardship Discharge And Notice Of Motion?

Discovering the right authorized document design could be a have difficulties. Obviously, there are a lot of templates available online, but how would you find the authorized develop you need? Make use of the US Legal Forms internet site. The support offers 1000s of templates, including the Maryland Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion, that can be used for business and private needs. Each of the forms are inspected by specialists and fulfill federal and state requirements.

If you are presently listed, log in in your bank account and click the Obtain switch to have the Maryland Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion. Make use of bank account to look with the authorized forms you possess acquired formerly. Check out the My Forms tab of your own bank account and get yet another copy of your document you need.

If you are a fresh consumer of US Legal Forms, listed here are easy recommendations for you to stick to:

- Initially, ensure you have selected the appropriate develop to your metropolis/county. You can examine the shape utilizing the Review switch and browse the shape outline to guarantee it will be the best for you.

- In case the develop is not going to fulfill your expectations, use the Seach field to find the appropriate develop.

- Once you are certain that the shape is proper, go through the Get now switch to have the develop.

- Select the prices program you desire and enter the necessary info. Design your bank account and pay money for the order using your PayPal bank account or charge card.

- Select the file file format and download the authorized document design in your product.

- Total, change and printing and signal the attained Maryland Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion.

US Legal Forms may be the biggest collection of authorized forms in which you can see different document templates. Make use of the company to download expertly-produced paperwork that stick to state requirements.

Form popularity

FAQ

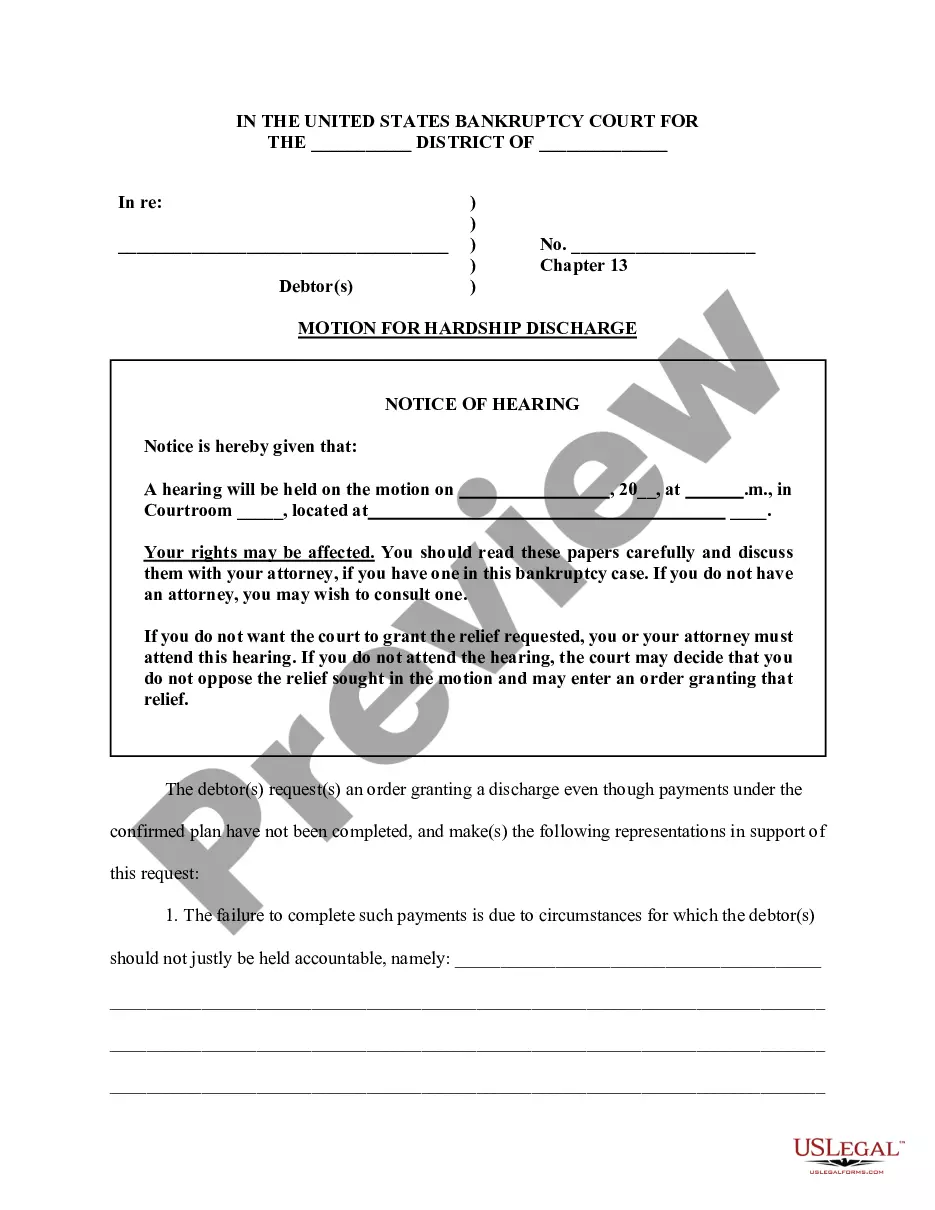

In Chapter 13 bankruptcy, a hardship discharge is a court-authorized elimination of debt when a debtor is prevented from completing the repayment plan due to financial hardship that arose while their case is open.

For restitution, or damages, awarded in a civil action against the debtor as a result of willful or malicious injury by the debtor that caused personal injury to an individual or the death of an individual.

How Long Does Chapter 13 Discharge Take? Discharging debt through Chapter 13 may take 6 to 8 weeks after the final payment is made on your 3 to 5-year repayment plan (whichever was approved by the bankruptcy court).

What happens when a creditor files an objection? A creditor's objection does not automatically prevent a discharge of debt. The debtor gets a chance to file an answer to the objection, and the court may hold a hearing to decide the issue. This is called an adversary proceeding, and it works much like any other lawsuit.

In chapter 12 and chapter 13 cases, the debtor is usually entitled to a discharge upon completion of all payments under the plan. As in chapter 7, however, discharge may not occur in chapter 13 if the debtor fails to complete a required course on personal financial management.

After Plan Completion: After all payments have been completed, the Chapter 13 Trustee will file a Motion to Return any Excess Funds to Debtor and to Terminate any Payroll Deduction by Employer. If the Motion is granted, the Court will enter an order granting the motion and issue two notices.

How Long Does Chapter 13 Discharge Take? Discharging debt through Chapter 13 may take 6 to 8 weeks after the final payment is made on your 3 to 5-year repayment plan (whichever was approved by the bankruptcy court).

If your case is dismissed, you are entitled to a refund of any money that is still in the trustee's possession. However, the trustee has to get approval from the court to send the money back to you, and they are allowed to take their administrative fees out of that money before refunding it.