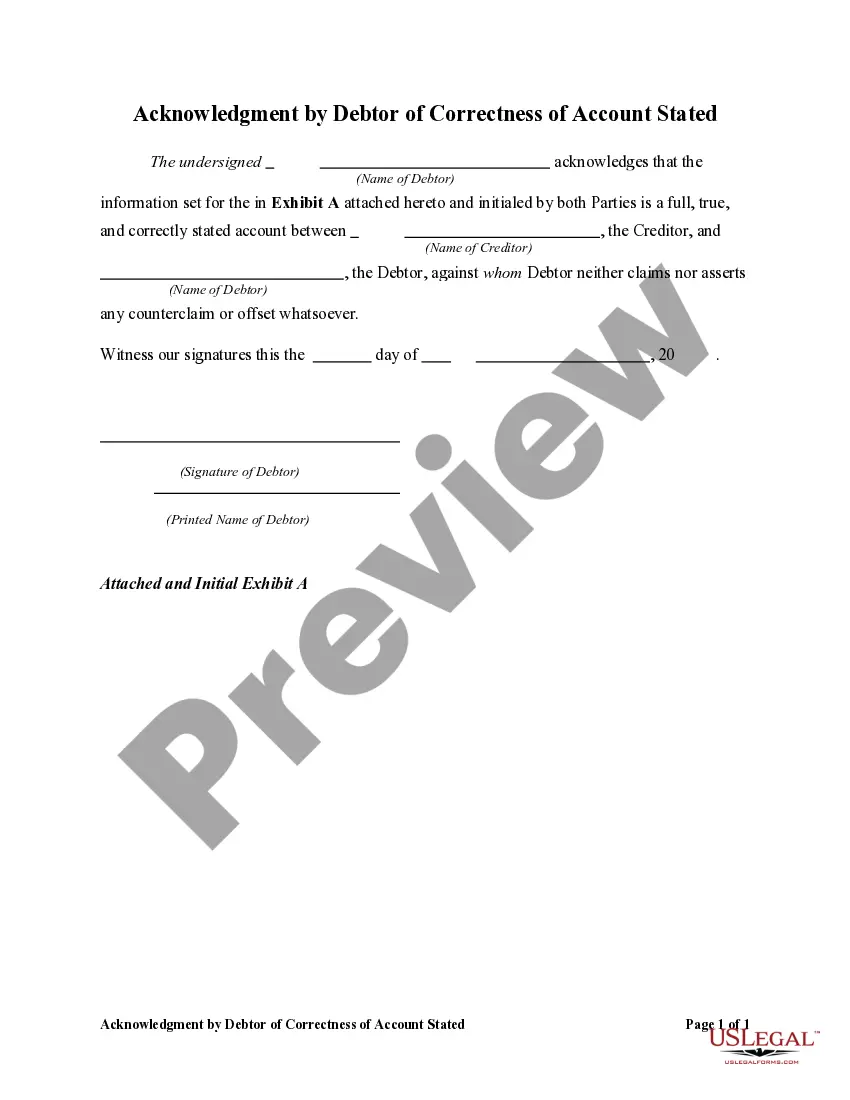

Maryland Receipt for Payment of Account

Description

How to fill out Receipt For Payment Of Account?

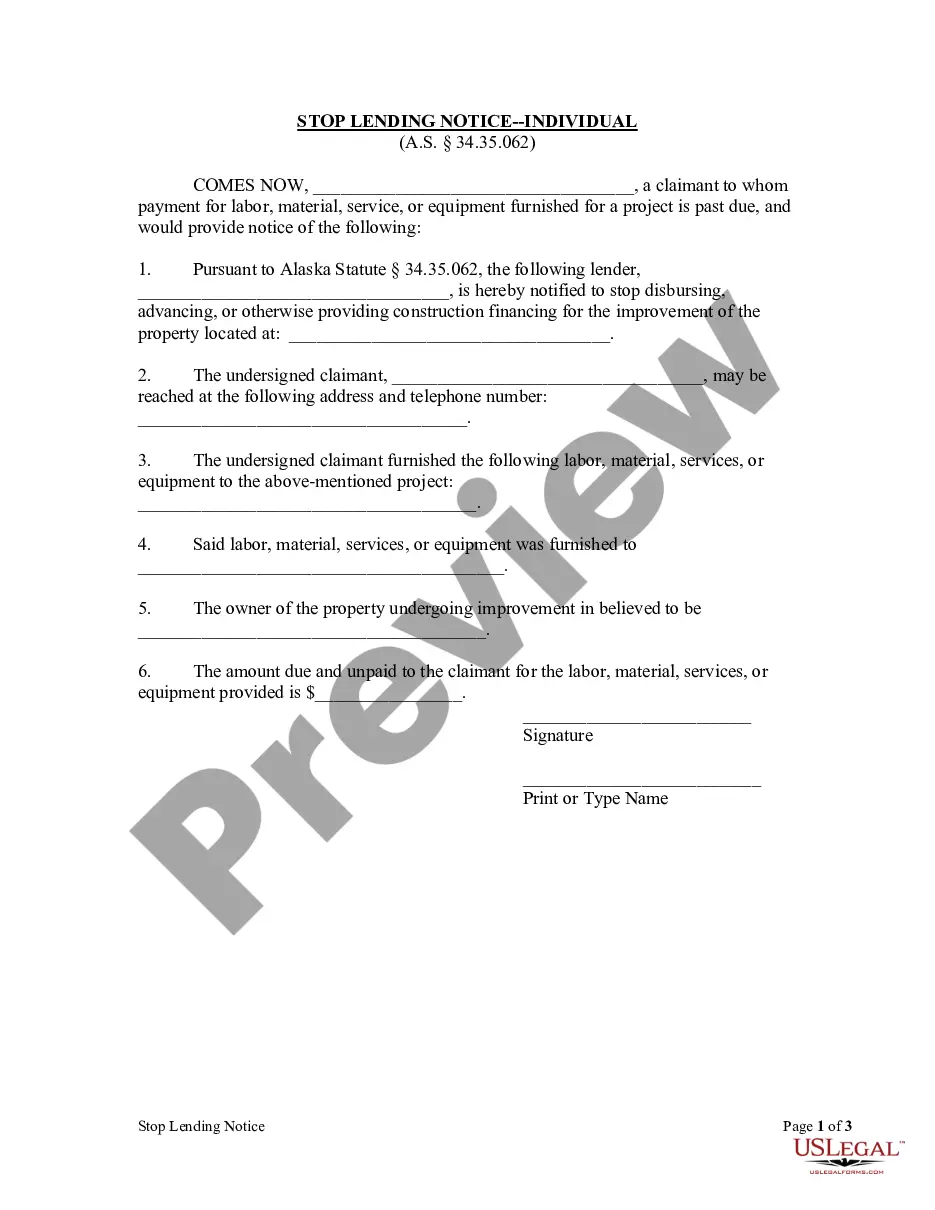

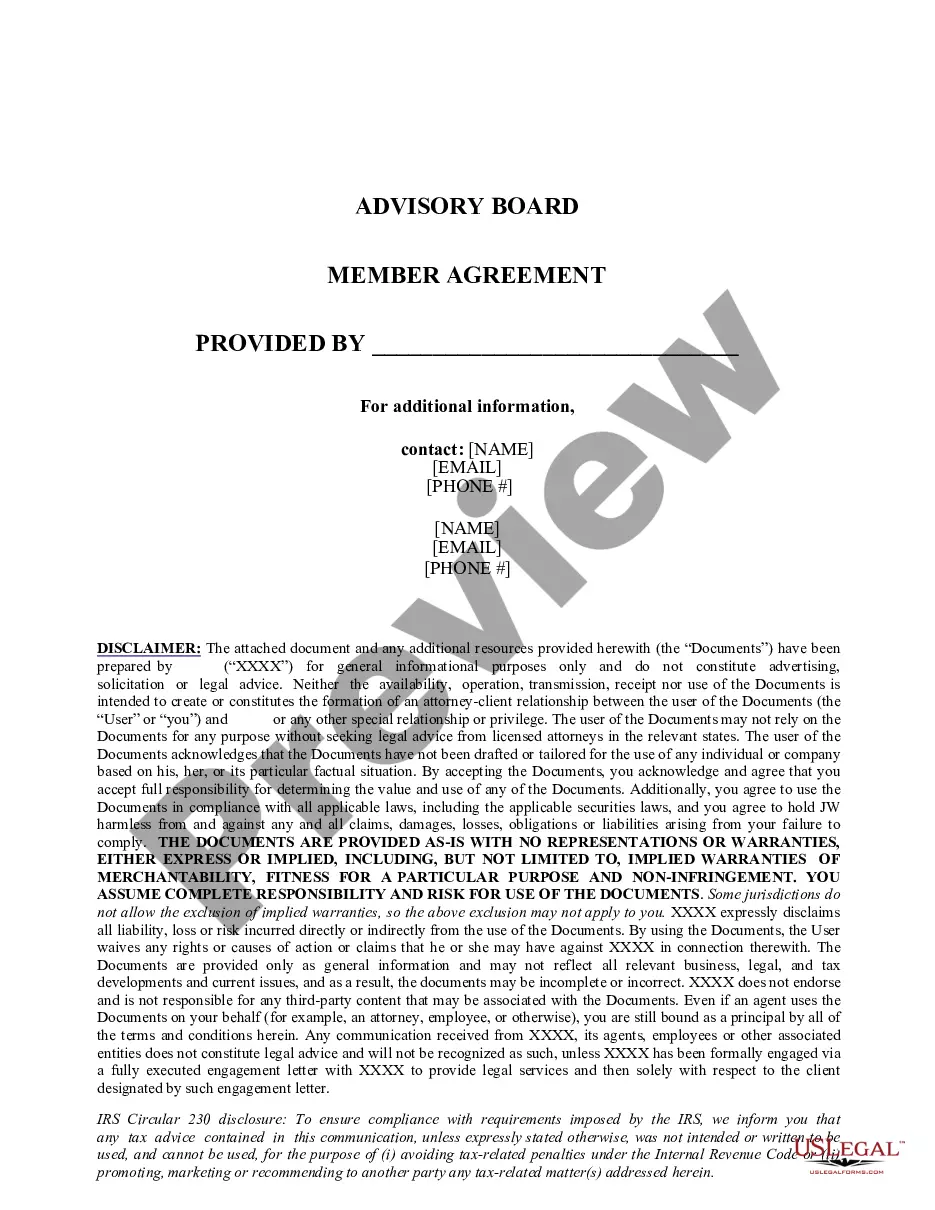

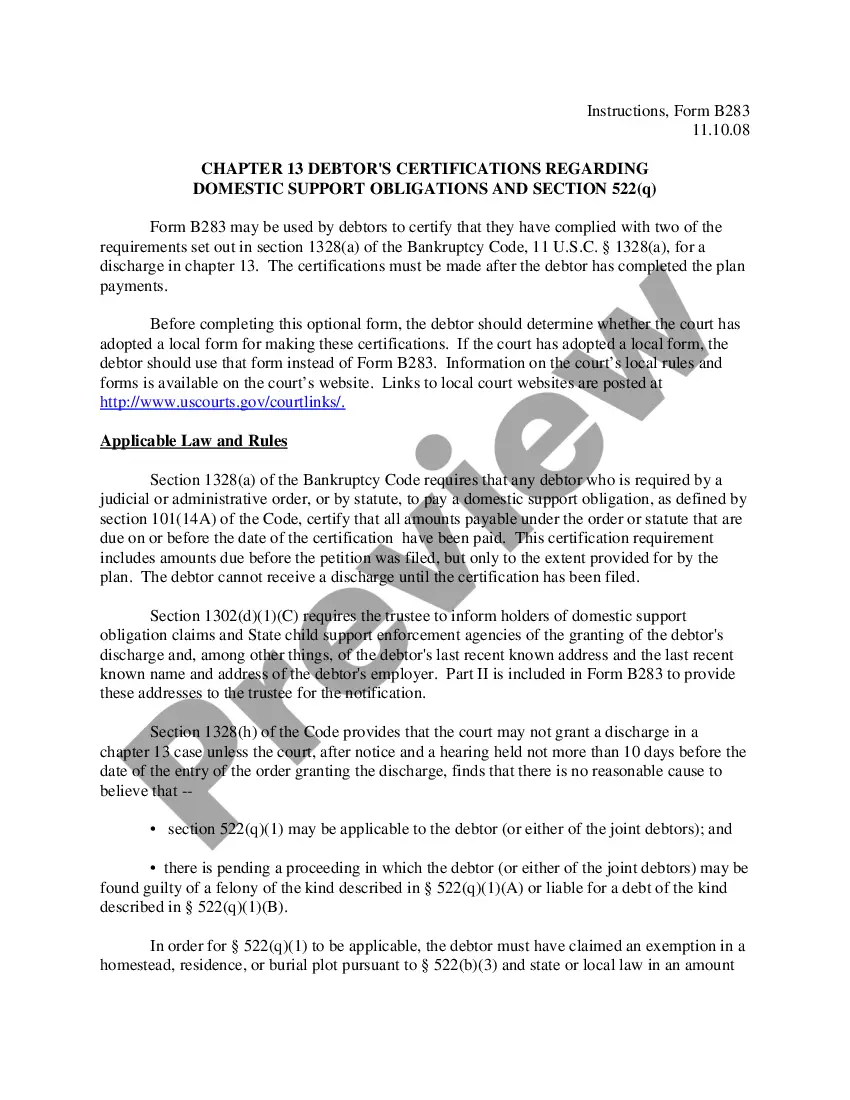

US Legal Forms - one of the greatest libraries of authorized forms in the United States - provides a wide range of authorized document templates you are able to down load or printing. Making use of the internet site, you will get a huge number of forms for company and individual functions, sorted by categories, states, or search phrases.You will find the most recent types of forms like the Maryland Receipt for Payment of Account in seconds.

If you currently have a monthly subscription, log in and down load Maryland Receipt for Payment of Account through the US Legal Forms local library. The Acquire key can look on every form you view. You gain access to all in the past saved forms in the My Forms tab of your profile.

If you want to use US Legal Forms for the first time, here are easy guidelines to help you get started out:

- Be sure to have picked out the correct form for your personal city/region. Select the Review key to examine the form`s content. Browse the form description to ensure that you have chosen the proper form.

- In case the form does not suit your specifications, use the Lookup industry on top of the display screen to discover the one which does.

- When you are satisfied with the shape, verify your selection by simply clicking the Acquire now key. Then, select the pricing program you prefer and provide your qualifications to register on an profile.

- Method the purchase. Make use of credit card or PayPal profile to finish the purchase.

- Choose the formatting and down load the shape on your system.

- Make adjustments. Fill out, edit and printing and indicator the saved Maryland Receipt for Payment of Account.

Each web template you included in your money does not have an expiration date which is the one you have permanently. So, in order to down load or printing one more duplicate, just check out the My Forms section and click on on the form you need.

Get access to the Maryland Receipt for Payment of Account with US Legal Forms, by far the most extensive local library of authorized document templates. Use a huge number of professional and condition-certain templates that meet up with your organization or individual requires and specifications.

Form popularity

FAQ

Visit .marylandtaxes.gov to learn about the different ways to electronically file your taxes. There are two ways to make a tax payment by credit card. You can make your payment online through NICUSA or by telephone through Official Payments provided you have received a bill for an existing liability.

You can pay your taxes online, by mail or in person. Search and pay for real or personal property tax information online. Note: You will need a parcel ID, account number or property address, which you will find on your tax bill.

You may also drop off your tax forms and payments* at one of our Local Offices.

How Can I Apply for a Payment Plan? Call the state comptroller's office at 410-974-2432 or 1-888-674-0016. Visit the website of the Office of the Comptroller and apply online. Respond by mail to the tax notice you received from the state. Email cdcollectionind@comp.state.md.us.

If you believe you owe state taxes but have not received a notice, call our taxpayer service office at 410-260-7980 from Central Maryland or 1-800-MDTAXES from elsewhere.

You can pay your Maryland taxes with a personal check, money order or credit card. You may also choose to pay by direct debit when you file electronically. If you file and pay electronically by April 15, you have until April 30 to make the electronic payment, using direct debit or a credit card.

With the State of Maryland recurring direct debit program you don't have to worry about mailing off a check for your individual tax payment plan. If you do not know your payment agreement number, call our Collection Section at 410-974-2432 or 1-888-674-0016.