Maryland Non-Disclosure Agreement for Merger or Acquisition

Description

How to fill out Non-Disclosure Agreement For Merger Or Acquisition?

If you need to finalize, obtain, or print authentic legal document templates, utilize US Legal Forms, the most significant collection of legal forms, available online.

Utilize the website's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of your legal form template.

Step 4. Once you have located the form you need, click the Buy now button. Choose your preferred pricing plan and provide your details to register for an account.

- Employ US Legal Forms to locate the Maryland Non-Disclosure Agreement for Merger or Acquisition with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to access the Maryland Non-Disclosure Agreement for Merger or Acquisition.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions provided below.

- Step 1. Ensure you have chosen the form for the correct city/state.

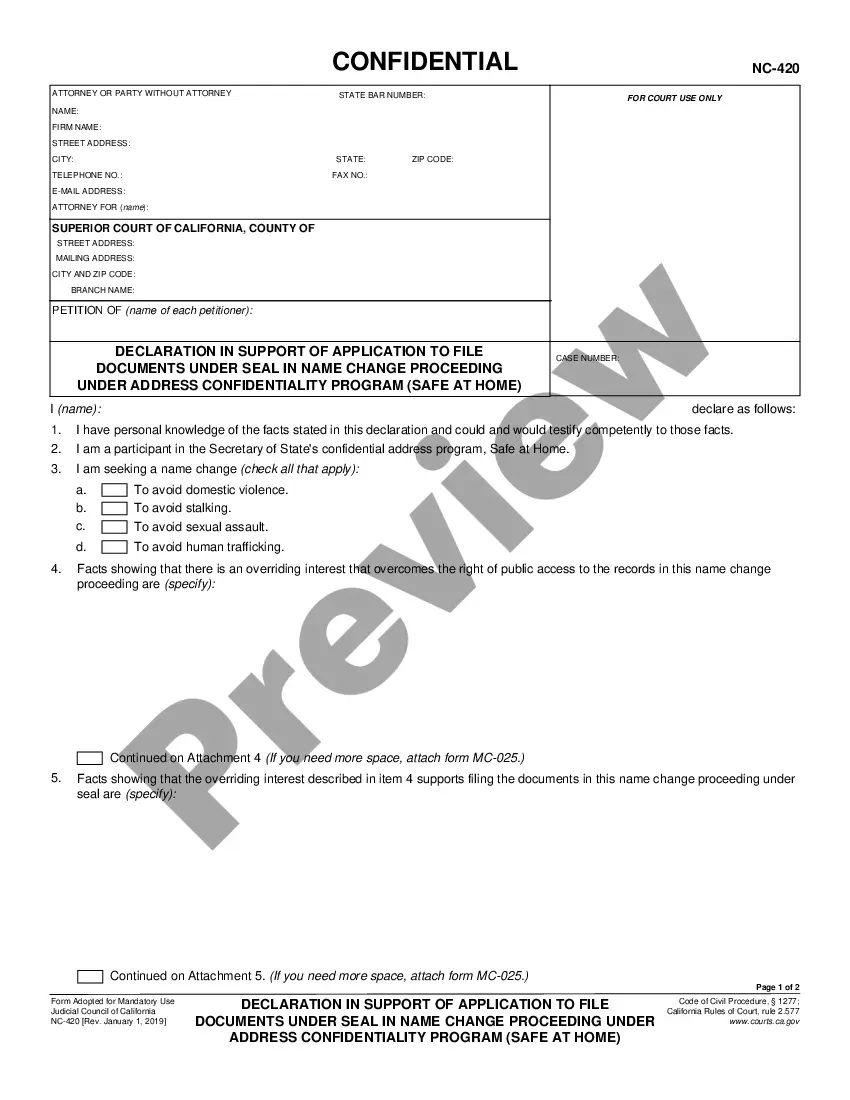

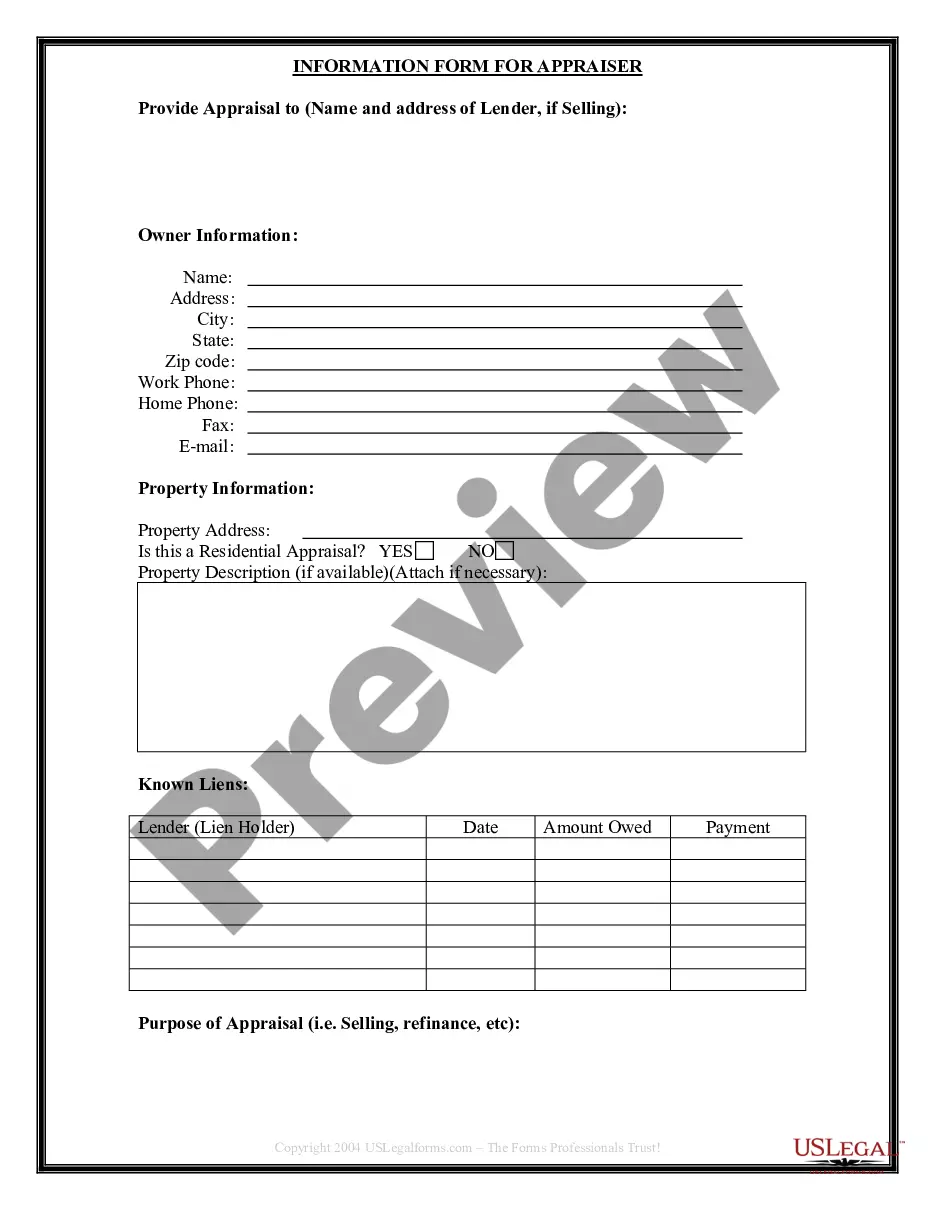

- Step 2. Utilize the Preview option to review the form's content. Remember to read the description.

Form popularity

FAQ

An example of a Maryland Non-Disclosure Agreement for Merger or Acquisition statement could be, 'The parties agree to hold confidential all proprietary information shared during discussions and negotiations regarding the proposed merger or acquisition.' This statement highlights the confidential nature of the information and sets the tone for the agreement, protecting both parties involved.

Filling out a nondisclosure agreement involves several steps. Begin by identifying the parties and providing their respective addresses. Next, define the scope of confidential information and detail any limitations on its use. Finally, make sure to sign and date the Maryland Non-Disclosure Agreement for Merger or Acquisition to finalize the document.

Yes, you can write your own Maryland Non-Disclosure Agreement for Merger or Acquisition, but it is essential to ensure that it covers all necessary aspects. Clearly outline the information to be protected, the parties involved, and the terms of use and confidentiality duration. For best results, consider using a template from US Legal Forms, which offers professionally designed agreements to suit your needs.

To fill out a Maryland Non-Disclosure Agreement for Merger or Acquisition, start by entering the names of the disclosing and receiving parties. Then, describe the confidential information clearly, and specify how it can be used. Make sure to review any terms regarding the duration of confidentiality and sign the agreement to create a legally binding document.

A good Maryland Non-Disclosure Agreement for Merger or Acquisition clearly defines the parties involved and the confidential information shared. It includes provisions on how the information may be used and outlines the duration of the confidentiality obligation. Additionally, a well-crafted NDA specifies the consequences of breach and should be easily understood by both parties.

There are three primary types of Non-Disclosure Agreements: unilateral, bilateral, and multi-party. A unilateral NDA involves one party sharing confidential information, while a bilateral NDA requires both parties to disclose information. In situations involving multiple parties, a multi-party NDA is appropriate. When dealing with mergers or acquisitions, the Maryland Non-Disclosure Agreement for Merger or Acquisition can be tailored to fit any of these formats to meet your specific requirements.

The term MDNA typically refers to a specific type of non-disclosure agreement related to mergers and acquisitions, while NDA is a more general term. Both types of agreements protect confidential information, but the Maryland Non-Disclosure Agreement for Merger or Acquisition is tailored for the specific needs and circumstances of business transactions. Using MDNA can provide clarity and security for parties involved in complex deals.

The primary difference lies in the nature of the agreement. An NDA, or Non-Disclosure Agreement, typically involves one party disclosing information, while a M NDA involves mutual disclosure from both parties. In a merger or acquisition context, a Maryland Non-Disclosure Agreement for Merger or Acquisition often employs a M NDA to protect the confidential information of both entities. This mutual protection helps maintain competitive advantage during sensitive discussions.

M NDA stands for Mutual Non-Disclosure Agreement. In the context of contracts, it refers to a legal document that protects sensitive information shared between two parties. The Maryland Non-Disclosure Agreement for Merger or Acquisition often takes this form to ensure both sides can exchange confidential data without fear of misuse. This helps facilitate trust and transparency during negotiations.

An NDA, or Non-Disclosure Agreement, typically involves one party protecting its confidential information, while a Mutual Non-Disclosure Agreement (MNDA) outlines confidentiality obligations for both parties. Both agreements serve the same purpose of protecting sensitive information, but their scope differs. When entering into negotiations for a merger or acquisition, choosing the appropriate document, like a Maryland Non-Disclosure Agreement for Merger or Acquisition, is essential for clarity and mutual protection.