An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of

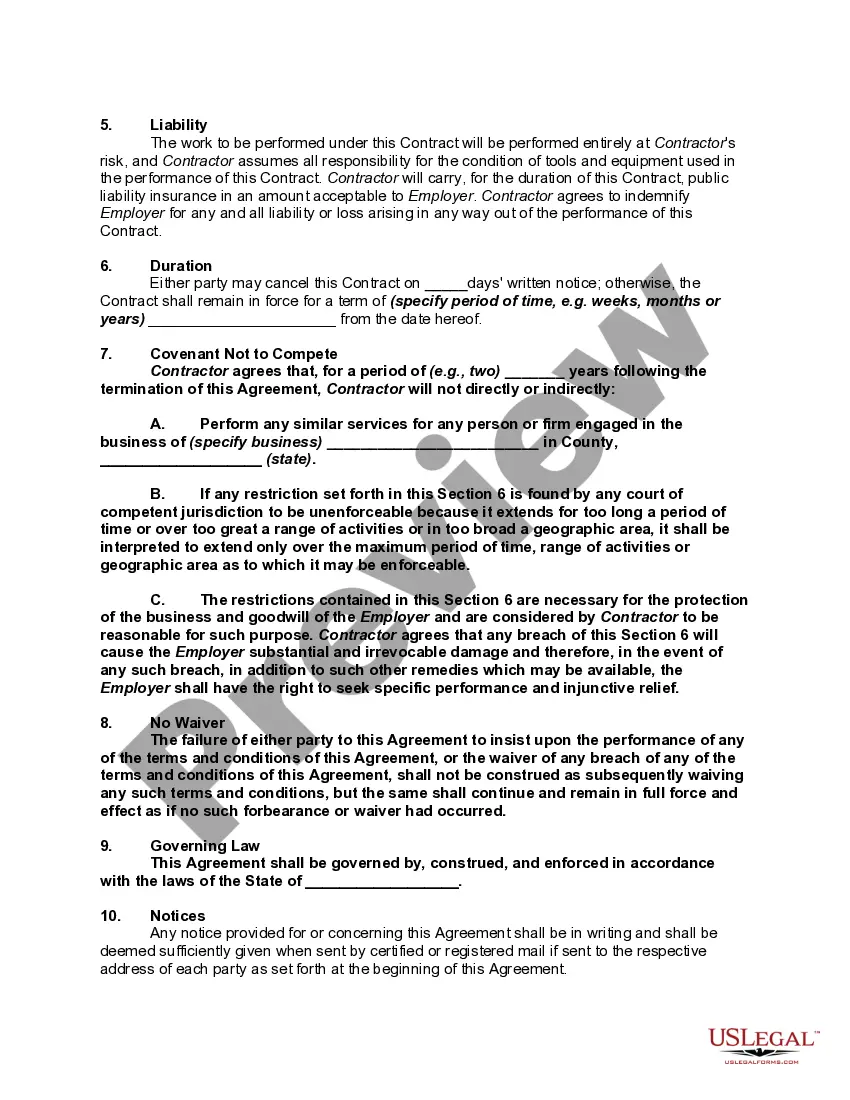

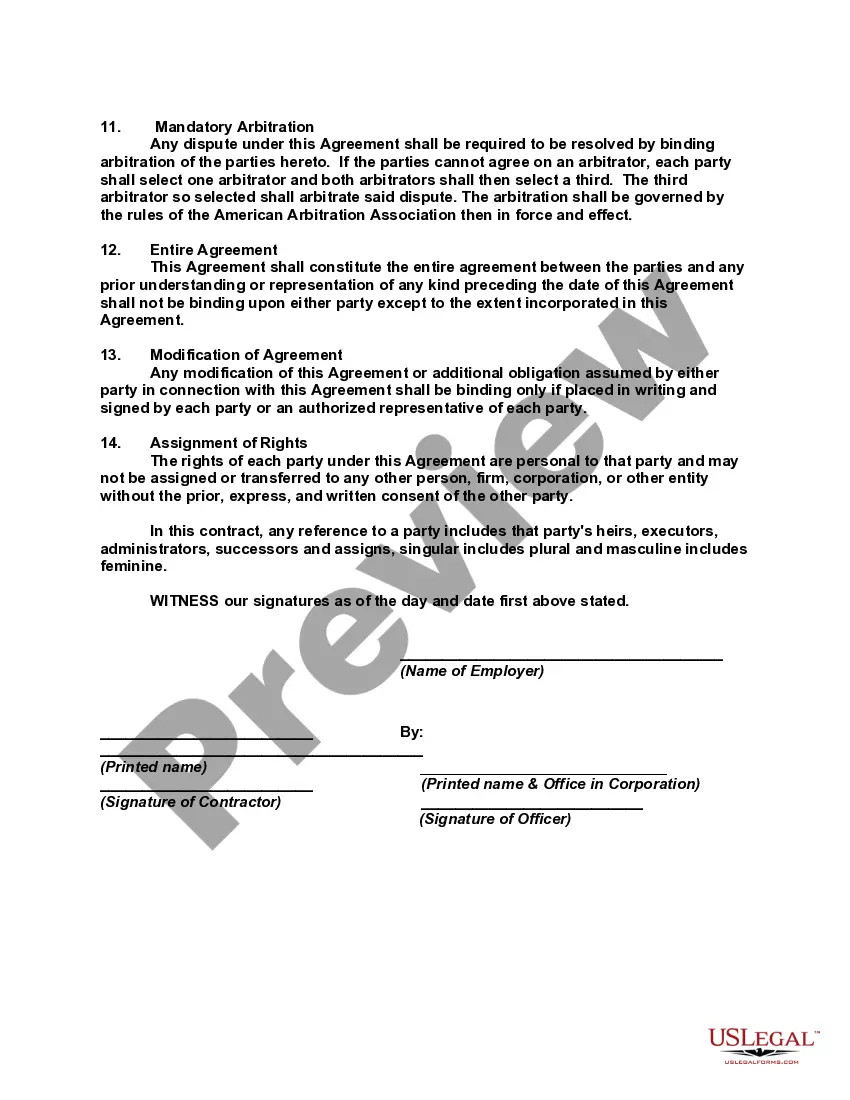

Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete

Description

How to fill out Contract With Self-Employed Independent Contractor With Covenant Not To Compete?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a broad selection of legal document templates that you can either download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents such as the Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete within moments.

If you have an account, Log In to download the Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete from the US Legal Forms library. The Download button will appear on every document you view. You can also access all previously downloaded forms from the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form onto your device. Make modifications. Fill out, adjust, print, and sign the downloaded Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete. Every template you add to your account has no expiration date and is yours to keep permanently. So, if you want to download or print another copy, simply go to the My documents section and click on the desired form. Access the Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete using US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you're using US Legal Forms for the first time, here are straightforward steps to get started.

- Ensure you have selected the correct form for your area/region.

- Click the Preview button to review the content of the form.

- Review the form details to confirm that you have chosen the right document.

- If the form does not meet your needs, utilize the Search section at the top of the screen to find one that does.

- If you're satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred pricing plan and provide your details to create an account.

Form popularity

FAQ

Employee non-compete agreements can be enforceable in Maryland, depending on their terms and context. An effective Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete must serve a legitimate purpose while being fair to all parties involved. Factors like geographic area, time limit, and type of work are evaluated during enforcement. Consulting resources like uslegalforms can provide clarity and support when drafting these agreements.

In Maryland, a covenant not to compete in an employment contract can be enforced under certain conditions. The Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete must align with the state's public policy and must not be overly restrictive. Courts often scrutinize these agreements to ensure they balance protecting the employer’s interests with the employee’s right to work. Therefore, hiring an expert for proper drafting is advisable.

Covenants not to compete can be enforceable in Maryland, but they must meet specific legal requirements. To uphold a Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete, the agreement should be reasonable in scope and duration. Additionally, the restriction must protect legitimate business interests, such as trade secrets or client relationships. If crafted correctly, such covenants can effectively prevent competition.

Several states, including California, North Dakota, and Montana, do not enforce non-compete agreements. This means that contracts like the Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete may not hold up if challenged in these jurisdictions. It's important to understand your state's stance on these agreements, as it can affect your rights and business strategies. Utilizing resources such as US Legal Forms can help you stay informed and create enforceable contracts tailored to your needs.

In Maryland, non-compete agreements are enforceable under specific conditions. Generally, a Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete must protect legitimate business interests and must not unreasonably restrict the contractor's ability to earn a living. The courts often weigh the duration and geographic scope of the agreement to determine its fairness. If you need assistance crafting a compliant contract, consider using US Legal Forms for reliable templates.

Yes, Maryland enforces non-compete agreements, but there are specific conditions that must be met for them to be valid. Courts in Maryland will assess whether the agreement is reasonable in terms of time, geographic area, and scope of activities restricted. Additionally, the agreement must genuinely protect a legitimate business interest. A Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete can be effective if drafted carefully, ensuring it aligns with these legal standards.

Various factors can void a non-compete agreement, including lack of consideration, overbreadth, or public policy violations. If a non-compete is found to be unreasonable in scope, a court may declare it unenforceable. Thus, when drafting a Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete, thoughtful consideration of these elements is crucial. Utilizing templates from USLegalForms can help ensure that your contract adheres to legal standards.

In Maryland, a non-compete ban can affect independent contractors similarly to employees, but the specifics often depend on the situation. Certain legislation focuses on preventing unreasonable restrictions in contracts with independent contractors. To ensure compliance and clarity, it’s essential to craft your Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete carefully. Consulting legal resources like USLegalForms can provide valuable guidance.

Yes, a covenant not to compete can be enforceable in an employment contract as well. Maryland courts look for reasonableness in terms of duration, geographic area, and the activities restricted. These criteria serve to protect both parties and promote fair competition. Whether for independent contractors or employees, clear wording in your Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete can ensure better outcomes.

Yes, non-compete agreements can be enforced against independent contractors in Maryland. The enforceability largely depends on whether the agreement is reasonable and serves a legitimate business interest. When crafting this agreement, it is important to consider your specific industry and business needs. By using a Maryland Contract with Self-Employed Independent Contractor with Covenant Not to Compete, you lay a solid foundation for enforcement.