Maryland Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Consumer Loan Application - Personal Loan Agreement?

Are you presently in a position where you require documents for various company or personal tasks nearly every day.

There are numerous legal document templates accessible online, but locating versions you can trust is not easy.

US Legal Forms provides a vast array of form templates, such as the Maryland Consumer Loan Application - Personal Loan Agreement, designed to comply with state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service offers well-crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are currently familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Maryland Consumer Loan Application - Personal Loan Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

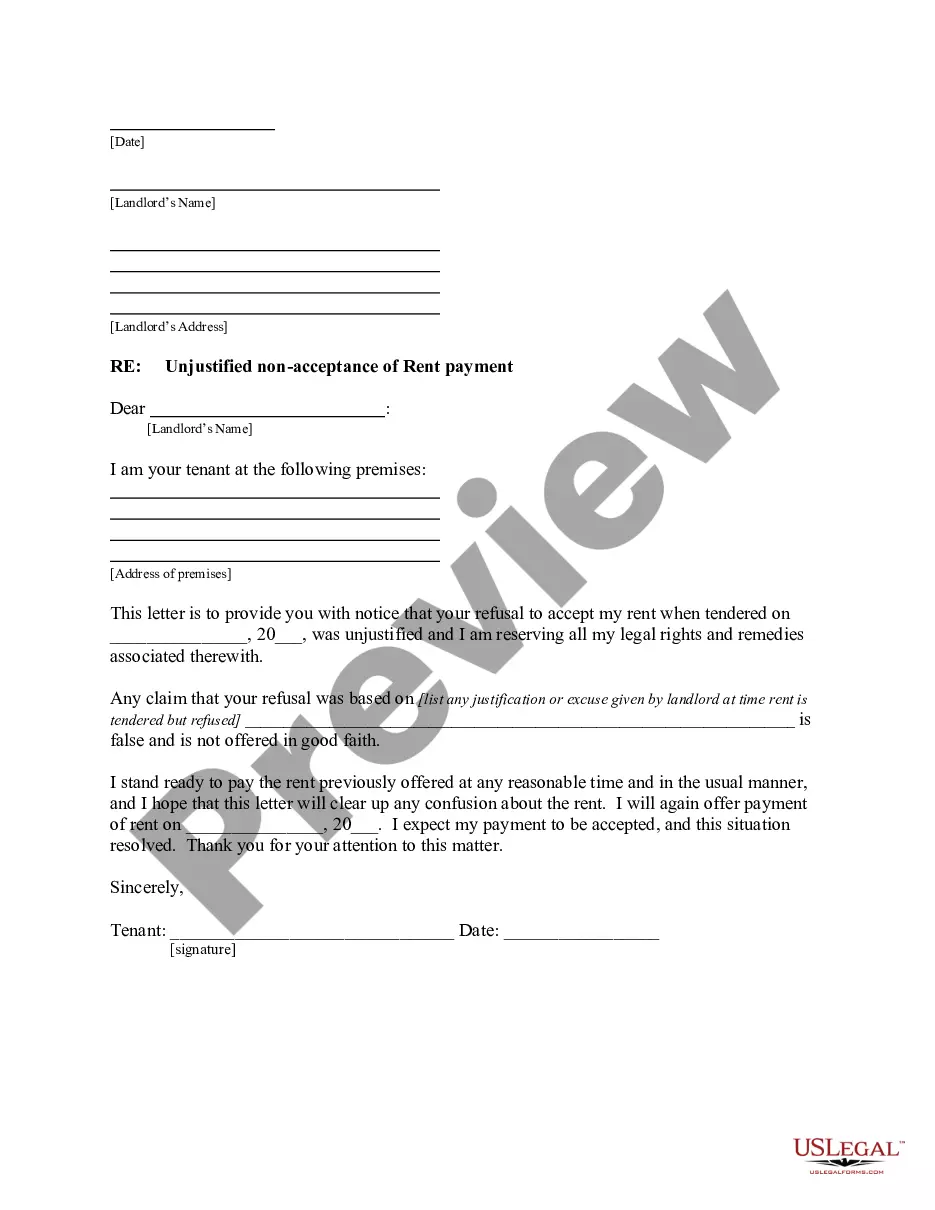

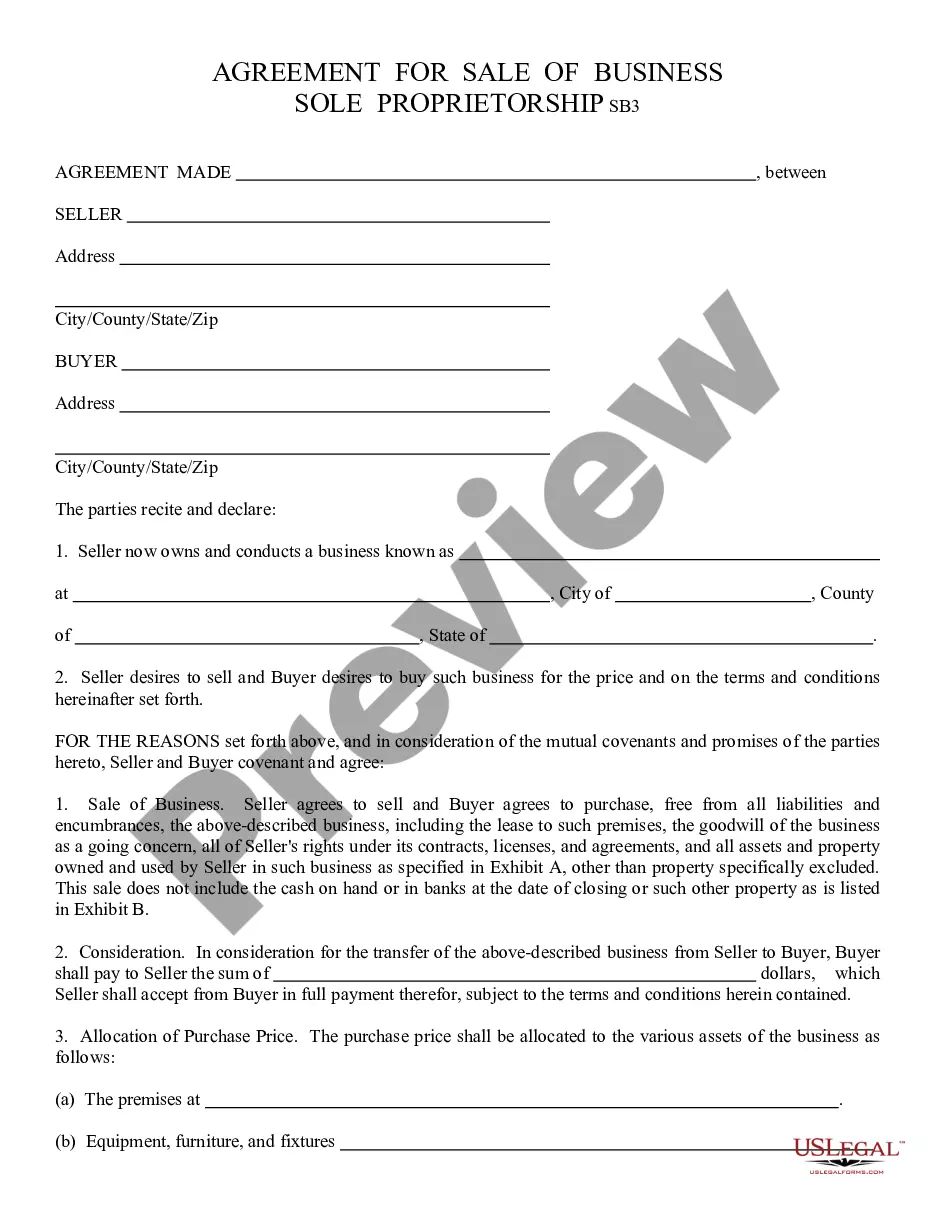

- Use the Review button to check the form.

- Read the details to confirm you have selected the right form.

- If the form is not what you are looking for, utilize the Search area to locate the form that meets your needs and requirements.

- Once you find the appropriate form, click Get now.

- Select the pricing plan you want, fill out the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- Choose a convenient document format and download your version.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Maryland Consumer Loan Application - Personal Loan Agreement whenever needed. Click the required form to download or print the document template.

Form popularity

FAQ

A consumer credit contract is a formal written agreement to borrow money, or pay something off over time, for personal use. You pay interest and fees for the use of the bank or finance company's money. One or more of your assets might secure the loan. Examples include: vehicle finance to buy a car, van, or boat.

A consumer loan is a loan given to consumers to finance specific types of expenditures. In other words, a consumer loan is any type of loan made to a consumer by a creditor. The loan can be secured (backed by the assets of the borrower) or unsecured (not backed by the assets of the borrower).

(1) Consumer means an individual who obtains or has obtained a financial product or service from you that is to be used primarily for personal, family, or household purposes, or that individual's legal representative. (2) Examples in the case of a financial institution other than a credit union.

A personal loan (also known as a consumer loan) describes any situation in which an individual borrows money for personal need, including making investments in a company. All personal loans have three common elements: Evidence of the debt (promissory note) An amount borrowed (principal)

What is Consumer Credit? A consumer credit system allows consumers to borrow money or incur debt, and to defer repayment of that money over time. Having credit enables consumers to buy goods or assets without having to pay for them in cash at the time of purchase.

What is a Consumer Loan? A Consumer Loan is a loan that banks offer to customers to buy household goods and appliances and even personal devices. These include television sets, air-conditioners, home theatre systems, refrigerators, laptops, mobile phones, cameras and even modular kitchens.

The biggest difference between a consumer loan and a personal loan is that consumer loans can include revolving credit. Personal loans are nonrevolving financial lending products that provide borrowers with a lump sum of money and payment schedule for repaying the loan.

Who is Required to Obtain an Installment Loan License? Maryland statute 12-103 requires all business entities who make loans or extensions of credit, other than mortgage loans, to obtain a license with the Commissioner of Financial Regulation.