The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

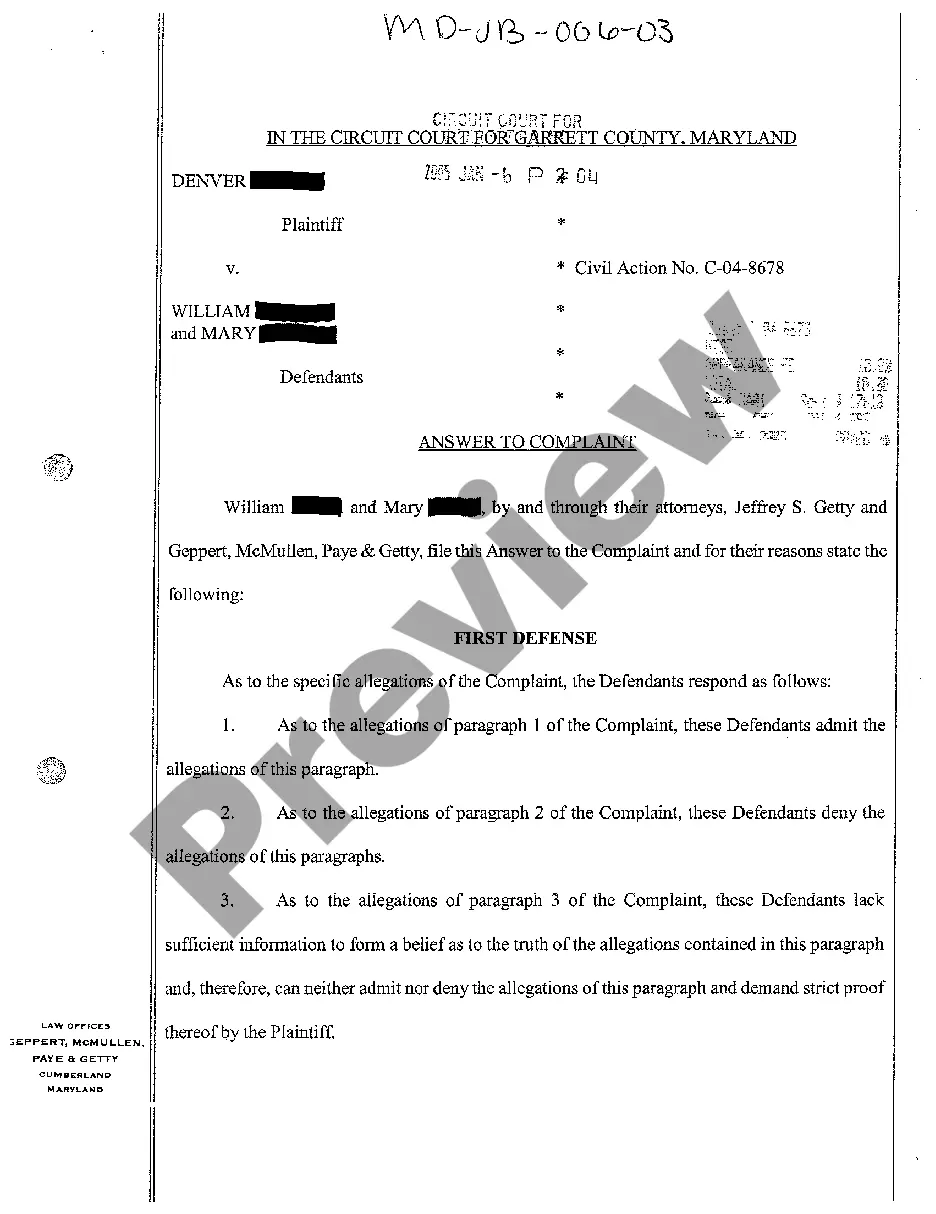

Maryland Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

How to fill out Request For Disclosure Of Reasons For Increasing Charge For Credit Regarding Credit Application Where Action Was Based On Information Not Obtained By Reporting Agency?

You are able to devote several hours on the web searching for the legal record web template that fits the state and federal specifications you will need. US Legal Forms provides thousands of legal types which are reviewed by pros. You can easily obtain or produce the Maryland Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency from your service.

If you already possess a US Legal Forms bank account, you can log in and click on the Obtain switch. Following that, you can full, edit, produce, or sign the Maryland Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency. Every legal record web template you buy is the one you have permanently. To acquire another version for any obtained type, check out the My Forms tab and click on the related switch.

Should you use the US Legal Forms website the first time, follow the basic guidelines below:

- First, make sure that you have chosen the right record web template for that region/town that you pick. Look at the type outline to make sure you have selected the correct type. If available, make use of the Review switch to appear with the record web template as well.

- If you would like get another edition in the type, make use of the Search field to get the web template that meets your requirements and specifications.

- Upon having located the web template you would like, click on Buy now to carry on.

- Find the pricing plan you would like, key in your qualifications, and register for an account on US Legal Forms.

- Complete the purchase. You can utilize your Visa or Mastercard or PayPal bank account to pay for the legal type.

- Find the format in the record and obtain it to your system.

- Make modifications to your record if required. You are able to full, edit and sign and produce Maryland Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

Obtain and produce thousands of record templates using the US Legal Forms Internet site, that provides the most important variety of legal types. Use specialist and status-particular templates to handle your small business or individual demands.

Form popularity

FAQ

Section 623(a)(5): Duty of furnishers to provide date of delinquency on charge-off, collection or similar accounts | Federal Trade Commission.

Duty to Promptly Correct and Update Information. Section 623(a) of the FCRA also requires a person who regularly furnishes information to CRAs to promptly notify a CRA if the person determines the previously furnished information is not complete or accurate.

Sections 623(a)(1)(A) and (a)(1)(C). If at any time a person who regularly and in the ordinary course of business furnishes information to one or more CRAs determines that the information provided is not complete or accurate, the furnisher must promptly provide complete and accurate information to the CRA.

Section 611(e) of the Fair Credit Reporting Act: Federal Trade Commission Program Referring Consumer Complaints About Possible Act Violations To The Three Nationwide Consumer Reporting Agencies, and Securing Complaint Resolution Information From Them: Tags: Privacy and Security. Credit Reporting.

Section 605(h)(1) of the Fair Credit Reporting Act requires that, when providing a consumer report to a person that requests the report (a user), a nationwide consumer reporting agency (NCRA) must provide a notice of address discrepancy to the user if the address provided by the user in its request ?substantially ...

Section 1681a of the Fair Credit Reporting Act defines an ?investigative consumer report? as ?a consumer report or portion thereof in which information on a consumer's character, general reputation, personal characteristics, or mode of living is obtained through personal interviews with neighbors, friends, or ...

(a) Every consumer reporting agency shall, upon request and proper identification of any consumer, clearly and accurately disclose to the consumer: (1) The nature and substance of all information (except medical information) in its files on the consumer at the time of the request.

Reporting of Medical Debt: The three major credit bureaus (Equifax, Transunion, and Experian) will institute a new policy by March 30, 2023, to no longer include medical debt under a dollar threshold (the threshold will be at least $500) on credit reports.