US Legal Forms - one of many biggest libraries of legitimate kinds in the United States - offers a variety of legitimate file themes it is possible to down load or print. Making use of the site, you may get 1000s of kinds for enterprise and specific functions, sorted by groups, suggests, or search phrases.You can find the most up-to-date models of kinds like the Maryland Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust in seconds.

If you have a registration, log in and down load Maryland Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust in the US Legal Forms local library. The Obtain option will appear on every develop you view. You get access to all earlier delivered electronically kinds in the My Forms tab of your account.

If you would like use US Legal Forms the first time, listed here are easy recommendations to get you started off:

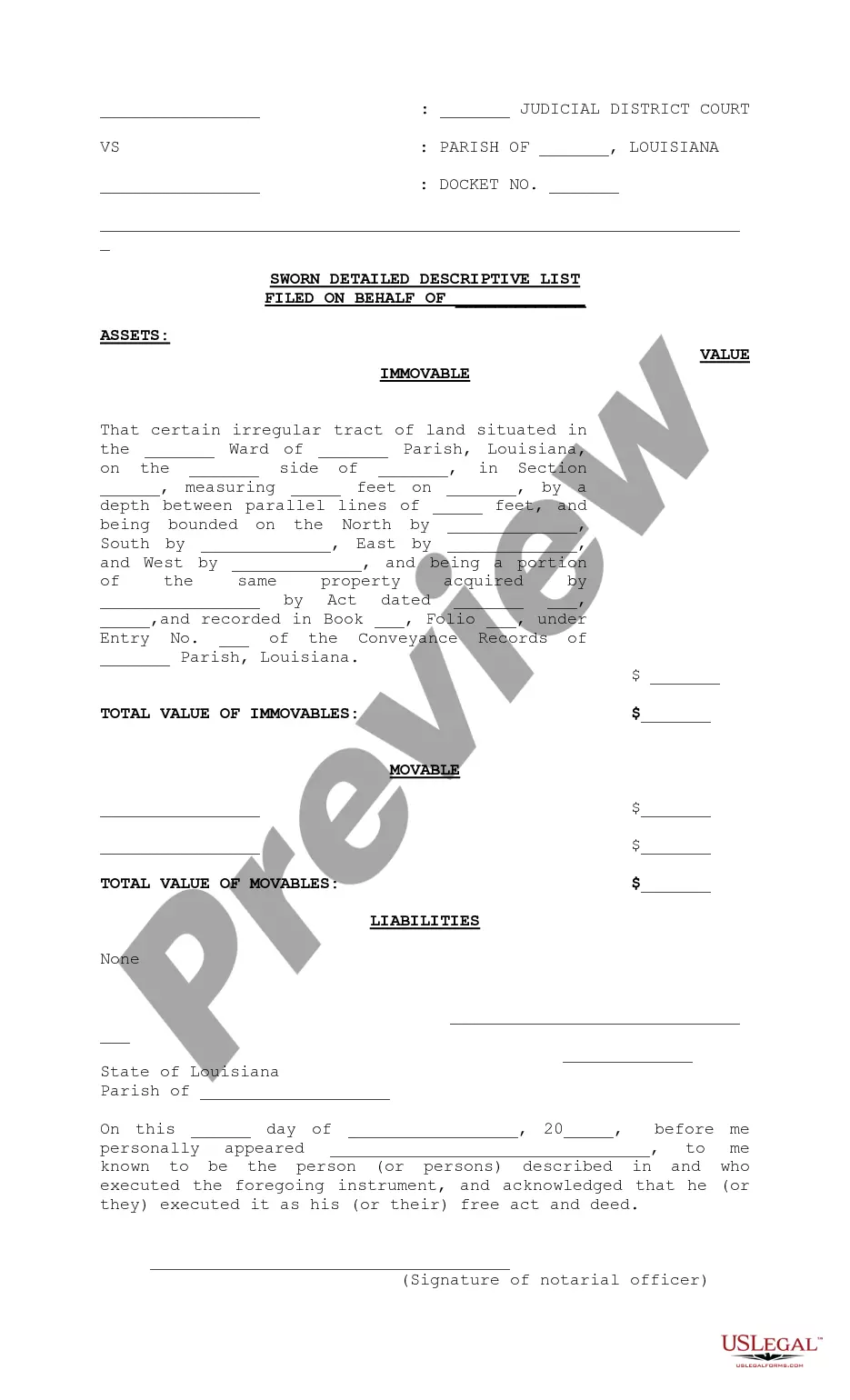

- Make sure you have selected the best develop for your area/county. Click the Preview option to analyze the form`s content material. See the develop explanation to ensure that you have selected the right develop.

- In the event the develop doesn`t suit your specifications, use the Research field at the top of the display screen to get the one who does.

- Should you be pleased with the form, confirm your decision by clicking on the Buy now option. Then, select the rates program you favor and give your credentials to register for the account.

- Process the deal. Utilize your bank card or PayPal account to accomplish the deal.

- Find the structure and down load the form on your product.

- Make changes. Fill out, revise and print and indicator the delivered electronically Maryland Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust.

Each and every format you included in your bank account lacks an expiration date and is also your own for a long time. So, if you would like down load or print an additional version, just proceed to the My Forms section and then click on the develop you want.

Obtain access to the Maryland Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust with US Legal Forms, one of the most extensive local library of legitimate file themes. Use 1000s of expert and express-particular themes that meet up with your organization or specific needs and specifications.