Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maryland Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

You can invest time online searching for the legal document template that meets the federal and state standards you need.

US Legal Forms offers thousands of legal documents that can be reviewed by specialists.

You can easily download or print the Maryland Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee from my services.

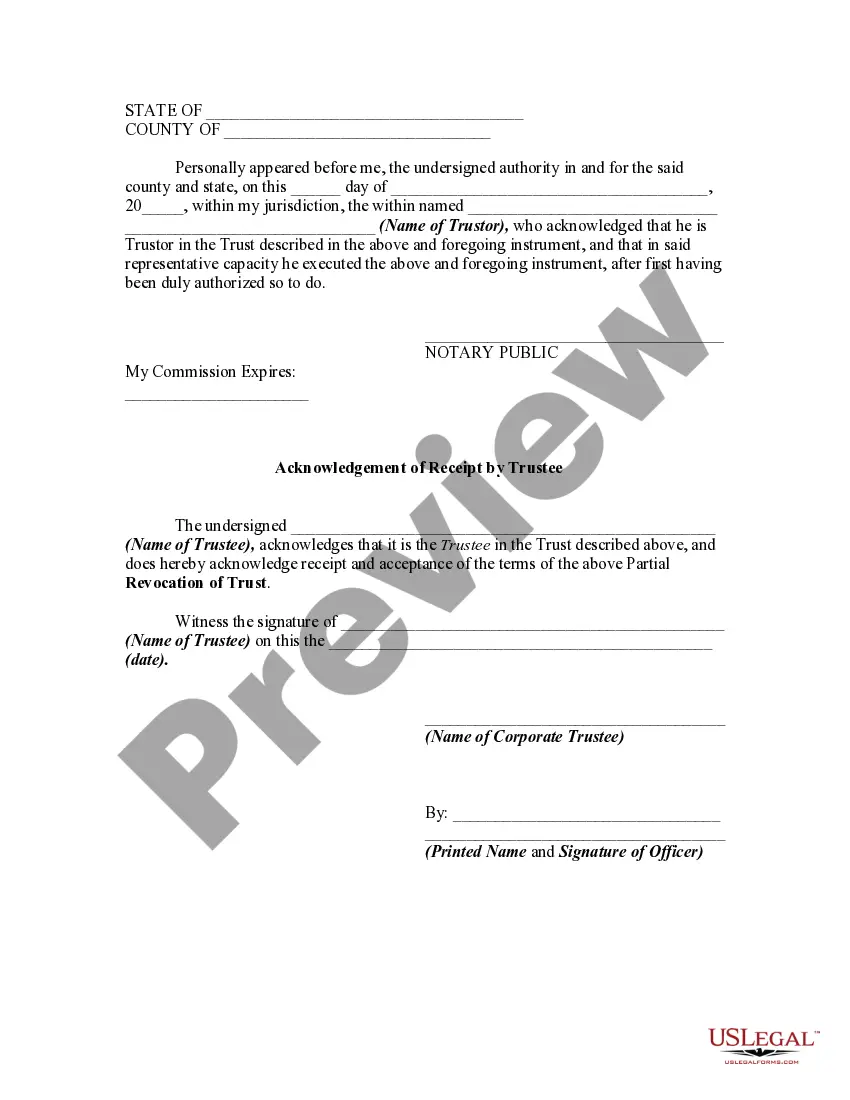

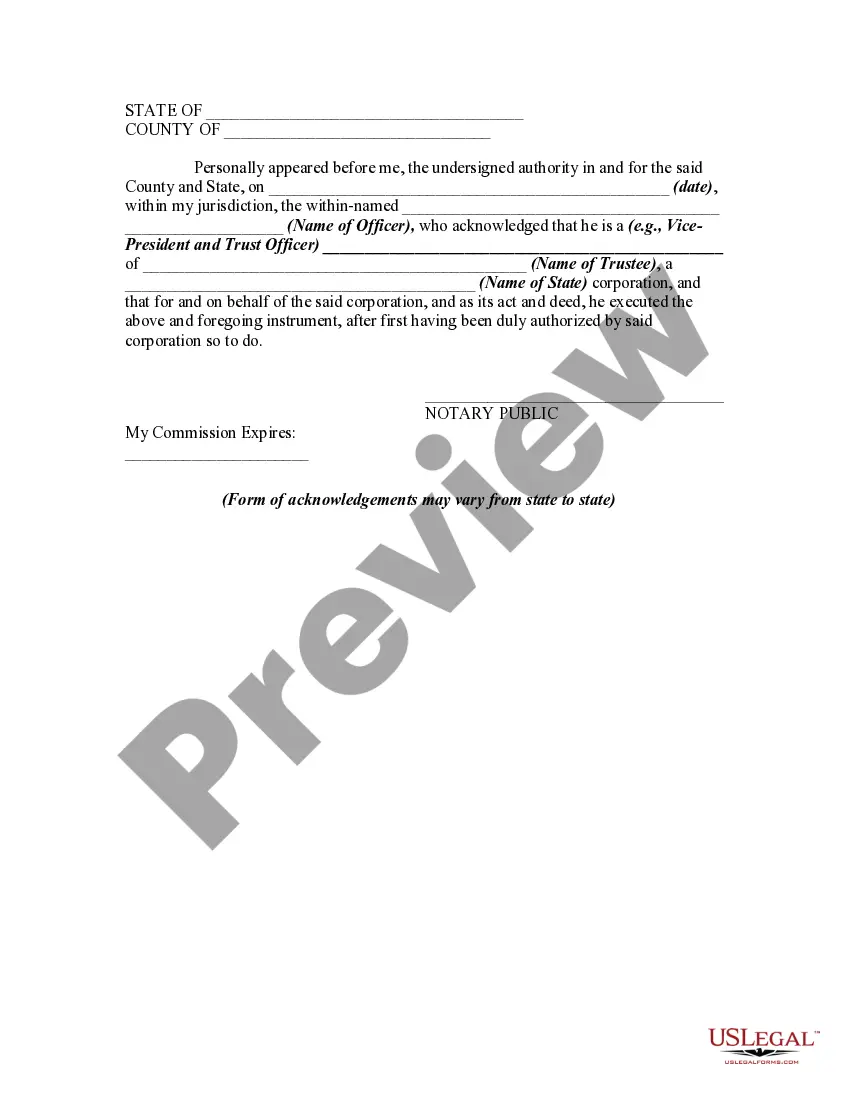

If available, make use of the Review option to examine the document template as well.

- If you already have a US Legal Forms account, you may Log In and select the Download option.

- Then, you may complete, modify, print, or sign the Maryland Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased document, navigate to the My documents tab and click on the respective option.

- If you are using the US Legal Forms site for the first time, please follow the simple instructions below.

- First, ensure you have chosen the correct document template for the region/area of your preference.

- Read the document description to confirm you have selected the right form.

Form popularity

FAQ

Yes, generally, a trust can help avoid probate in Maryland, streamlining the process of asset distribution after a person's death. Trust assets are typically transferred directly to beneficiaries without the need for court proceedings, which can save time and costs. However, it’s vital to ensure the trust is correctly established and maintained, including considerations related to the Maryland Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

The Maryland Trust Act provides the foundational legal framework for creating and managing trusts within Maryland. This comprehensive legislation outlines the rights and obligations of trustees and beneficiaries and addresses issues such as trust validity, modification, and revocation. It is essential for anyone involved in estate planning to understand the Maryland Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, as they are guided by this law.

A qualified beneficiary in the Maryland Trust Act includes anyone who is entitled to receive distributions from a trust, either currently or at a future date. This encompasses not only the beneficiaries explicitly named but also those who would inherit if the current beneficiaries were to pass away. Recognizing who qualifies as a beneficiary is key when considering changes involving the Maryland Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

An example of a revocation of a trust may involve a person creating a trust to manage their assets for their children. Upon remarriage, this individual may revoke that trust to establish a new one that reflects their updated family dynamics and financial goals. This scenario underscores the significance of the Maryland Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee to accurately document such changes.

A partial revocation involves canceling specific terms or elements of a trust while leaving other provisions intact. This can occur when the grantor wishes to remove certain assets from the trust or change specific beneficiaries without dissolving the entire trust. The Maryland Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee is a critical legal tool here, ensuring all parties are formally notified.

There are several reasons someone might choose to revoke a trust. A person might do so due to a change in personal circumstances, such as divorce or the birth of a child, which may necessitate a reassessment of their estate plans. Additionally, revising beneficiary designations or changing trustees can lead to a revocation, highlighting the importance of the Maryland Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Revocation of trust refers to the legal process of nullifying or canceling a trust agreement. When a trust is revoked, the assets within it revert back to the grantor, effectively terminating the trust's provisions. Understanding the implications of revocation is essential for anyone involved, especially in the context of the Maryland Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

An example of revocation of a trust occurs when a trustor decides to cancel their existing trust and create a new one, either for updated terms or changes in beneficiaries. By documenting this decision in writing and following the correct legal procedures, the original trust is effectively revoked. This process is key when navigating Maryland Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

An asset protection trust is often considered the best option for safeguarding assets against creditors. These trusts can provide a level of protection by placing assets out of reach while you retain some control. Consulting with a legal expert can provide guidance on structuring your trust effectively, especially within the context of a Maryland Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Filling out a revocable living trust involves several steps. Start by completing a trust declaration, identifying the trustor, beneficiaries, and trustees. Next, list the assets you wish to include and how they will be managed. This process can be streamlined with resources from UsLegalForms, especially when addressing Maryland Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.