Maryland Limited Liability Partnership Agreement

Description

How to fill out Limited Liability Partnership Agreement?

Are you currently in a situation where you require documents for either business or personal purposes almost daily.

There are numerous legitimate document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides a vast collection of form templates, including the Maryland Limited Liability Partnership Agreement, which is crafted to comply with both state and federal requirements.

Once you find the correct form, click Purchase now.

Select a convenient document format and download your copy.

- If you're already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Maryland Limited Liability Partnership Agreement template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and verify that it is for the appropriate city/county.

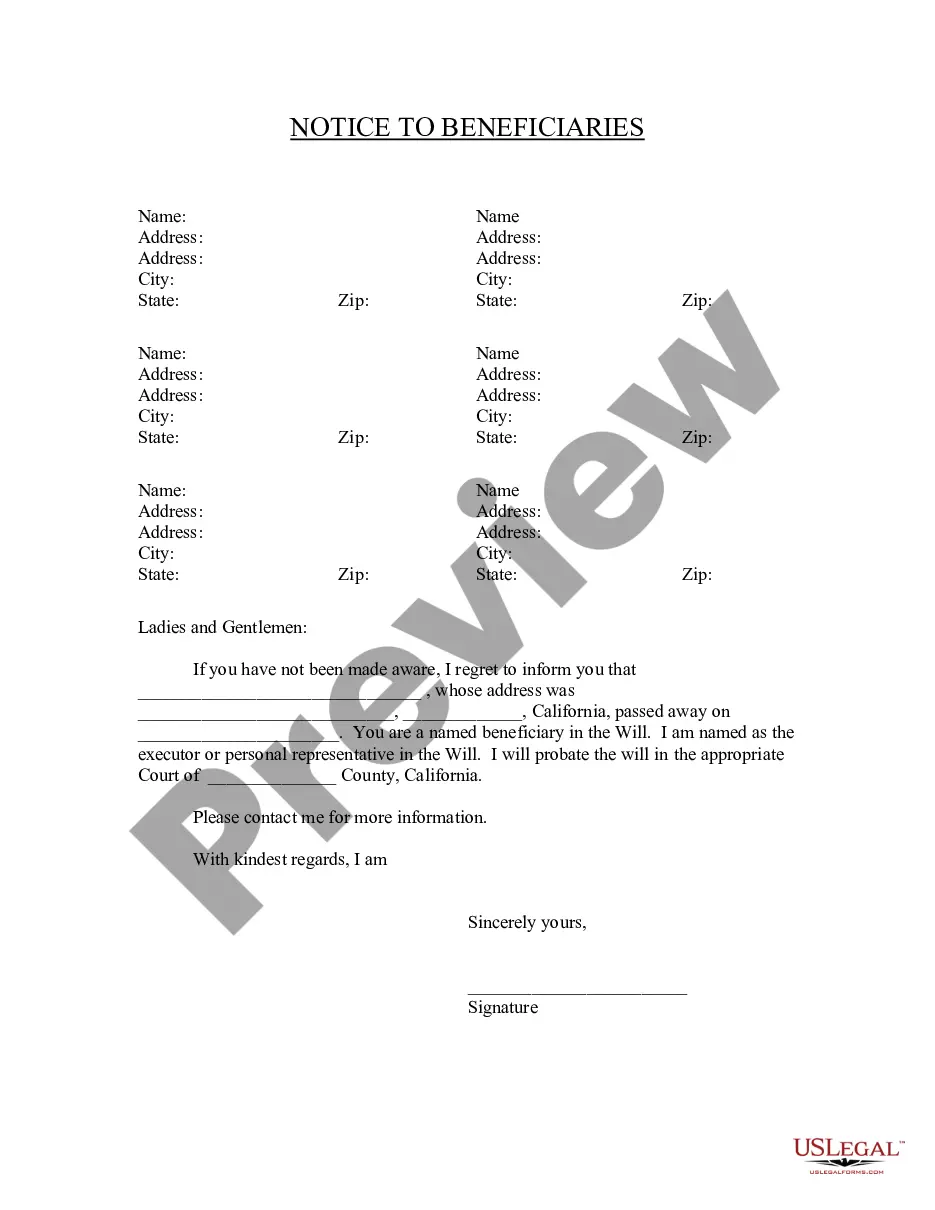

- Utilize the Preview button to review the document.

- Check the details to ensure you have selected the correct form.

- If the form does not meet your expectations, use the Search box to find a form that satisfies your needs.

Form popularity

FAQ

The structure of a limited partnership consists of both general and limited partners. General partners manage the partnership and handle daily operations, while limited partners provide capital and have liability protection from business debts. This balanced structure allows investors to participate in the business without exposing themselves to significant risks. A Maryland Limited Liability Partnership Agreement helps clearly define these roles and protects the interests of all partners.

A limited partnership requires at least one general partner and one limited partner, establishing clear roles within the organization. Additionally, the partnership must have a written agreement that outlines each partner's contributions, responsibilities, and profit distribution methods. Lastly, registering the partnership in the state where you operate, such as Maryland, is essential to comply with legal standards, often facilitated by a Maryland Limited Liability Partnership Agreement.

To write a simple partnership agreement, begin by stating the partnership's name and its purpose. Clearly define each partner's contributions, roles, and how profits will be shared. Additionally, include provisions for handling disputes and what happens if a partner wishes to leave the partnership. Utilizing a Maryland Limited Liability Partnership Agreement can help streamline this process and ensure legal compliance.

Drafting an LLP agreement requires clarity and attention to detail. Start by identifying the partners involved and outlining the structure of management and operations. Then, specify the contribution of each partner, profit-sharing arrangements, and dispute resolution mechanisms. For ease, consider using a Maryland Limited Liability Partnership Agreement template, which can guide you through the essential components.

Writing a limited partnership agreement involves several key steps. First, outline the partnership's purpose and define the roles of general and limited partners. Next, include crucial details such as profit distribution, management duties, and procedures for adding new partners. Using a Maryland Limited Liability Partnership Agreement template can simplify this process, ensuring you cover all necessary legal aspects.

A good example of a limited partnership is a real estate investment firm where investors contribute capital but do not participate in the business's daily operations. In this structure, general partners manage the partnership while limited partners enjoy liability protection without active involvement. This setup showcases how the Maryland Limited Liability Partnership Agreement can effectively define roles and responsibilities.

Yes, Maryland recognizes domestic partnerships, providing certain legal benefits to couples who meet specific criteria. While forming a Maryland Limited Liability Partnership Agreement, you can address the rights and responsibilities of each partner within the partnership framework. This agreement is essential for both legal clarity and protection, as it specifies how the partnership operates and resolves potential disputes. Understanding these nuances will help you make informed decisions for your partnership.

To set up a small business partnership in Maryland, start by defining your partnership's structure and goals. Next, draft a Maryland Limited Liability Partnership Agreement that outlines roles, responsibilities, and profit-sharing among partners. It's crucial to register your partnership with the Maryland State Department of Assessments and Taxation to ensure compliance with state laws. Additionally, consider consulting a professional for guidance and to create a solid foundation for your business.

To form an LLC in Maryland, you need to choose a unique name that complies with state rules, appoint a registered agent, and file the Articles of Organization with the state. Additionally, creating an operational structure through an LLC operating agreement is beneficial for clarifying management roles. Using US Legal Forms can simplify obtaining all necessary documents, including the Maryland Limited Liability Partnership Agreement, which can help you organize your LLC effectively.

The process of forming an LLC in Maryland typically takes about 5 to 10 business days if you file your application online. However, the time may vary if you choose to submit your application by mail or if there are any issues with your submission. To expedite the process, ensure all forms are completed accurately. You can also check out resources for a Maryland Limited Liability Partnership Agreement on US Legal Forms to streamline your setup.