Maryland Suggestion for Writ of Garnishment

Description

How to fill out Suggestion For Writ Of Garnishment?

Are you presently in a place the place you need to have files for sometimes business or individual purposes virtually every working day? There are plenty of legitimate document templates available online, but getting kinds you can trust is not straightforward. US Legal Forms gives a large number of develop templates, like the Maryland Suggestion for Writ of Garnishment, which are written to satisfy state and federal specifications.

In case you are previously familiar with US Legal Forms website and possess a merchant account, just log in. Afterward, you are able to obtain the Maryland Suggestion for Writ of Garnishment format.

Should you not come with an account and wish to start using US Legal Forms, adopt these measures:

- Discover the develop you need and ensure it is for that right city/state.

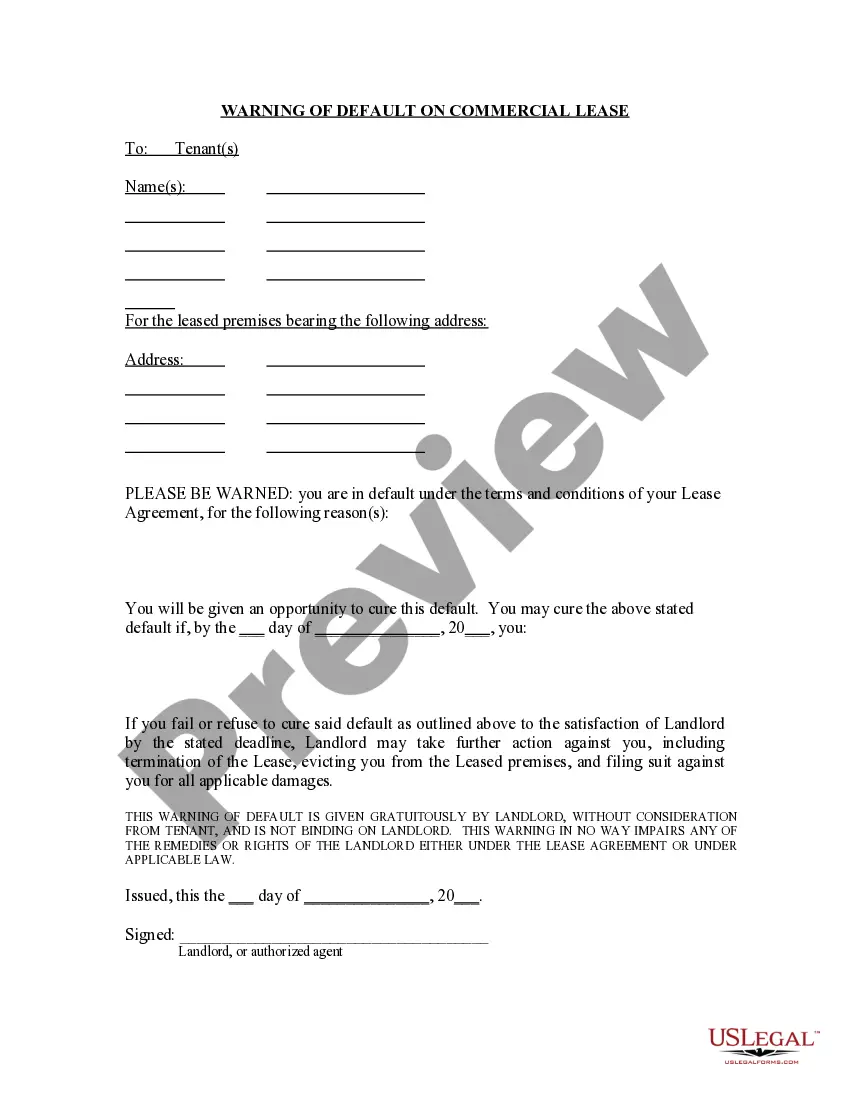

- Use the Preview switch to analyze the form.

- See the description to actually have chosen the right develop.

- In the event the develop is not what you are looking for, make use of the Look for field to obtain the develop that meets your requirements and specifications.

- If you obtain the right develop, click Acquire now.

- Pick the pricing prepare you want, submit the required information and facts to make your money, and pay money for an order using your PayPal or credit card.

- Decide on a hassle-free document structure and obtain your version.

Discover all the document templates you might have purchased in the My Forms food selection. You can obtain a further version of Maryland Suggestion for Writ of Garnishment any time, if necessary. Just go through the needed develop to obtain or print out the document format.

Use US Legal Forms, probably the most substantial assortment of legitimate kinds, to save time as well as steer clear of errors. The assistance gives professionally produced legitimate document templates that can be used for a range of purposes. Make a merchant account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

But generally, you have two courses of action. 1) Filing for an Exemption Can Help. Under Maryland law, you can file an injunction for exemption relief under certain circumstances to protect or ?exempt? some or all of your wages. ... 2) Bankruptcy Can Stop Wage Garnishment in Maryland. ... 3) Recovering Garnishments.

Rule 3-643 - Release of Property from Levy (a) Upon Satisfaction of Judgment. Property is released from a levy when the judgment has been entered as satisfied and the costs of the enforcement proceedings have been paid.

Rule 3-645.) You may be entitled to claim an exemption of all or part of your money or property, but in order to do so you must file a motion with the court as soon as possible. If you do not file a motion within 30 days of when the garnishee was served, your property may be turned over to the judgment creditor.

Money in a bank account may be protected from garnishment. This is called an exemption. Maryland law provides for an automatic exemption in the amount of 500 dollars. This means at least 500 dollars in your bank account will be protected without you taking further action.

Subject to the provisions of Rule 2-645.1, this Rule governs garnishment of any property of the judgment debtor, other than wages subject to Rule 2-646 and a partnership interest subject to a charging order, in the hands of a third person for the purpose of satisfying a money judgment.

3-646(i) - Withholding and Remitting of Wages While the garnishment is in effect, the garnishee shall withhold all garnishable wages payable to the debtor. If the garnishee has asserted a defense or is notified that the debtor has done so, the garnishee shall remit the withheld wages to the court.

Collect evidence showing how detrimental the wage garnishment is to your financial stability or how you qualify for an exemption. In either case, the creditor may agree to a solution that doesn't involve a garnishment, such as an adjustment payment plan or a settlement for a lump sum.

You may request an exemption to the garnishment. You must make your request within 30 days of when the garnishment was served on the bank. Use the form Motion for Release of Property from Levy/Garnishment (DC-CV-036).