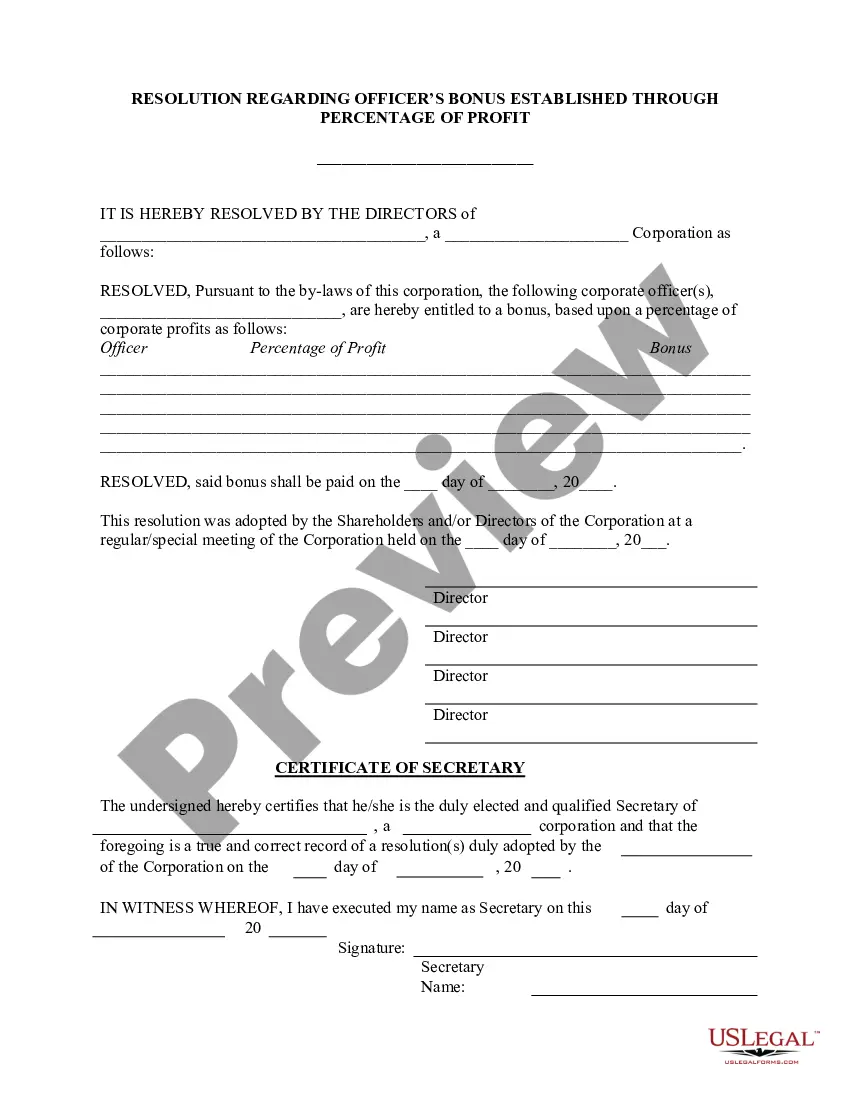

Maryland Officers Bonus - Percent of Profit - Resolution Form

Description

How to fill out Officers Bonus - Percent Of Profit - Resolution Form?

If you want to completely, download, or print authorized document templates, use US Legal Forms, the largest collection of legal forms that can be accessed online.

Utilize the site’s simple and convenient search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to acquire the Maryland Officers Bonus - Percent of Profit - Resolution Form in just a few clicks of the mouse.

Every legal document template you download is yours indefinitely. You have access to every form you acquired with your account. Navigate to the My documents section and select a form to print or download again.

Compete and download, and print the Maryland Officers Bonus - Percent of Profit - Resolution Form with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to obtain the Maryland Officers Bonus - Percent of Profit - Resolution Form.

- You can also access forms you previously acquired in the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/state.

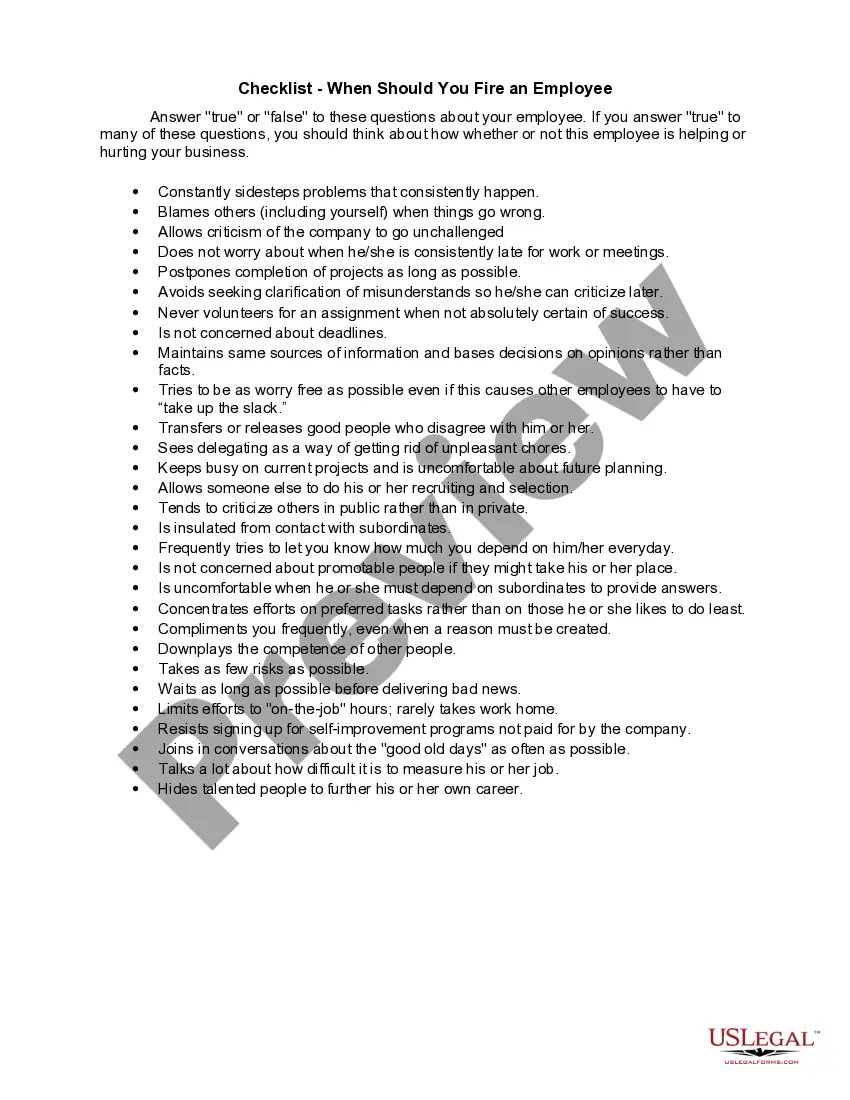

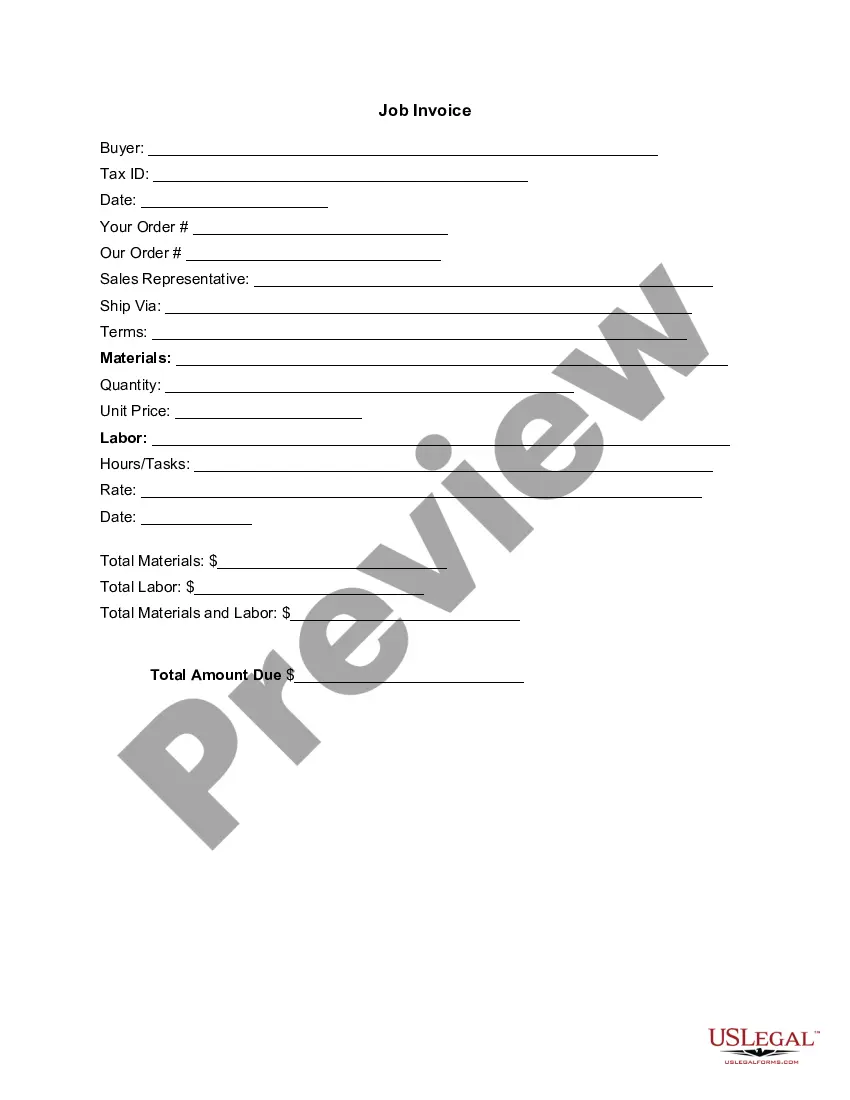

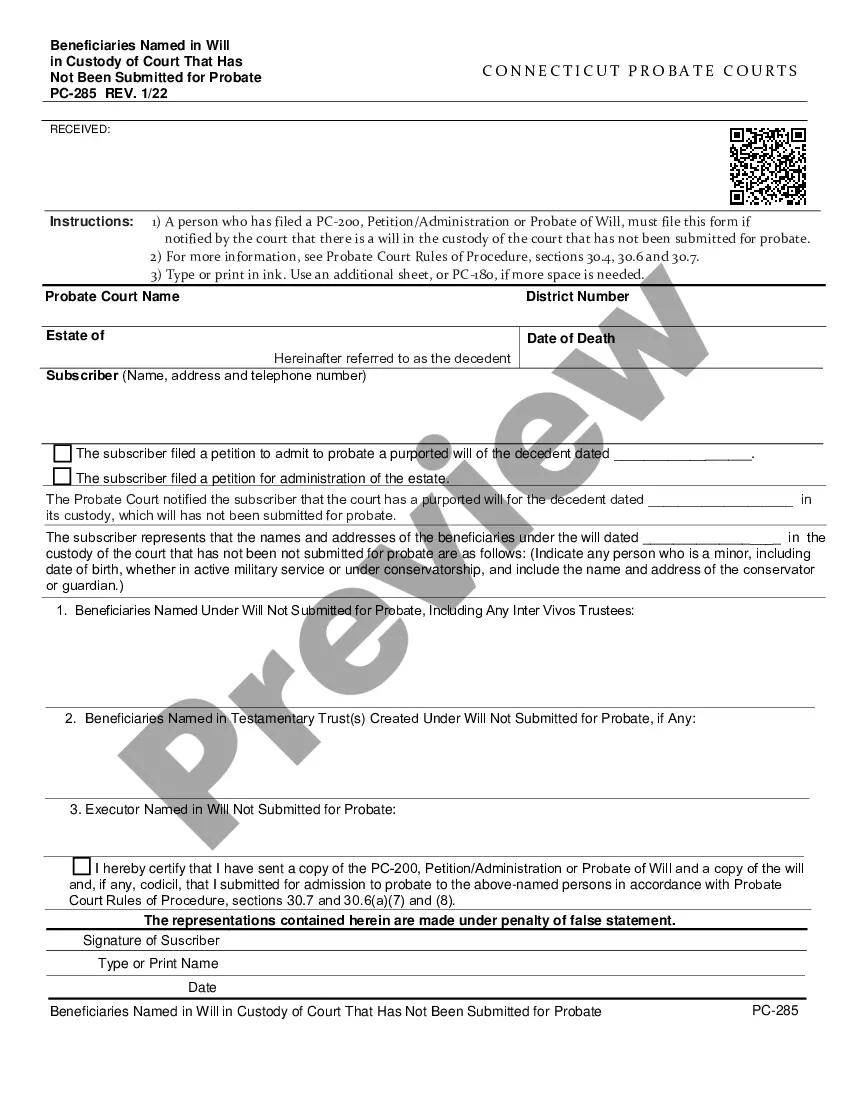

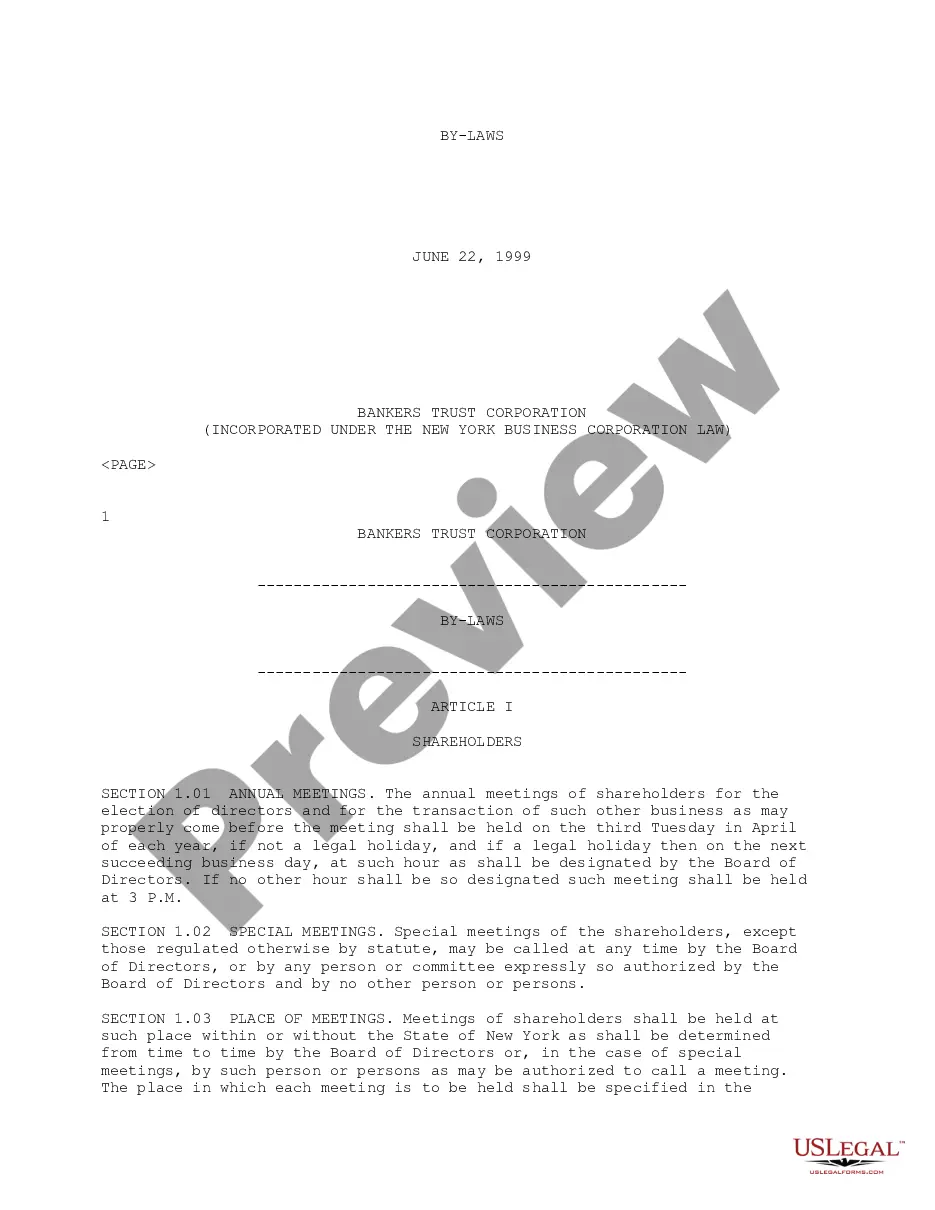

- Step 2. Use the Preview option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You may utilize your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Maryland Officers Bonus - Percent of Profit - Resolution Form.

Form popularity

FAQ

Maryland form 202 is used for the filing of the income tax return for S Corporations. This form allows S Corporations to report their income, deductions, and any tax directly to the state of Maryland. When bonuses are allocated, utilizing the Maryland Officers Bonus - Percent of Profit - Resolution Form ensures all aspects of your income are accounted for accurately.

You can file Maryland form 510 online or by mailing it to the Maryland Comptroller’s office. Be sure to consult the Maryland tax website for specific mailing addresses and electronic filing procedures. Using the Maryland Officers Bonus - Percent of Profit - Resolution Form can aid in determining the correct income allocations, streamlining the filing process for your partnership or LLC.

MD form 510 must be filed by any partnerships or LLCs that operate in Maryland and earn income. This includes entities that have distributed income to partners or members, whether in the form of salaries, bonuses, or shares of profits. By understanding how the Maryland Officers Bonus - Percent of Profit - Resolution Form plays a role in your business operations, you can ensure accurate filings and compliance.

To avoid an underpayment penalty in Maryland, ensure that you are making timely estimated tax payments and that these payments align with your actual tax liability. Keeping accurate financial records and staying informed about any requirements, such as the Maryland Officers Bonus - Percent of Profit - Resolution Form, can help you remain compliant. Regularly reviewing your payment status can further minimize the risk of penalties.

In Maryland, the corporate return form is typically form 500, which is utilized by corporations to report their income and expenses. Proper submission of this form ensures that businesses comply with Maryland tax laws. If you receive bonuses, it's essential to consult the Maryland Officers Bonus - Percent of Profit - Resolution Form to accurately account for these earnings in your return.

The Maryland form 500 is the state’s corporate income tax return form that must be filed by corporations operating in Maryland. This form allows businesses to report their profits and calculate their tax liabilities accurately. When dealing with additional earnings like bonuses, the Maryland Officers Bonus - Percent of Profit - Resolution Form can be a vital tool to ensure all financial factors are considered.

A form 500E payment in Maryland refers to a specific payment that business entities make when addressing tax liabilities. It is often connected to the Maryland corporate income tax framework. Using the Maryland Officers Bonus - Percent of Profit - Resolution Form can help you calculate any potential bonuses that may affect your tax obligations, ensuring compliance with state regulations.

Maryland tax relief is available to individuals who meet certain criteria, including income levels and residency status. To qualify, you should be a Maryland resident and have income that falls within the limits established by the state. Additionally, the Maryland Officers Bonus - Percent of Profit - Resolution Form can guide you through the specifics related to your eligibility for any bonuses or tax relief associated with profits.

Writing a UN draft resolution involves articulating a specific issue along with proposed actions. The document should follow a clear format, starting with a preamble stating the purpose, followed by operative clauses that outline proposals. Even though more complex, understanding similar frameworks can enhance your approach to drafting something like the Maryland Officers Bonus - Percent of Profit - Resolution Form in a corporate setting.

A corporate resolution for signing authority is a document that grants specific individuals the power to sign documents on behalf of the company. It's crucial for finance, contracts, and legal agreements. When you’re dealing with important financial matters, such as the Maryland Officers Bonus - Percent of Profit - Resolution Form, having such resolutions in place ensures clarity and legal backing.