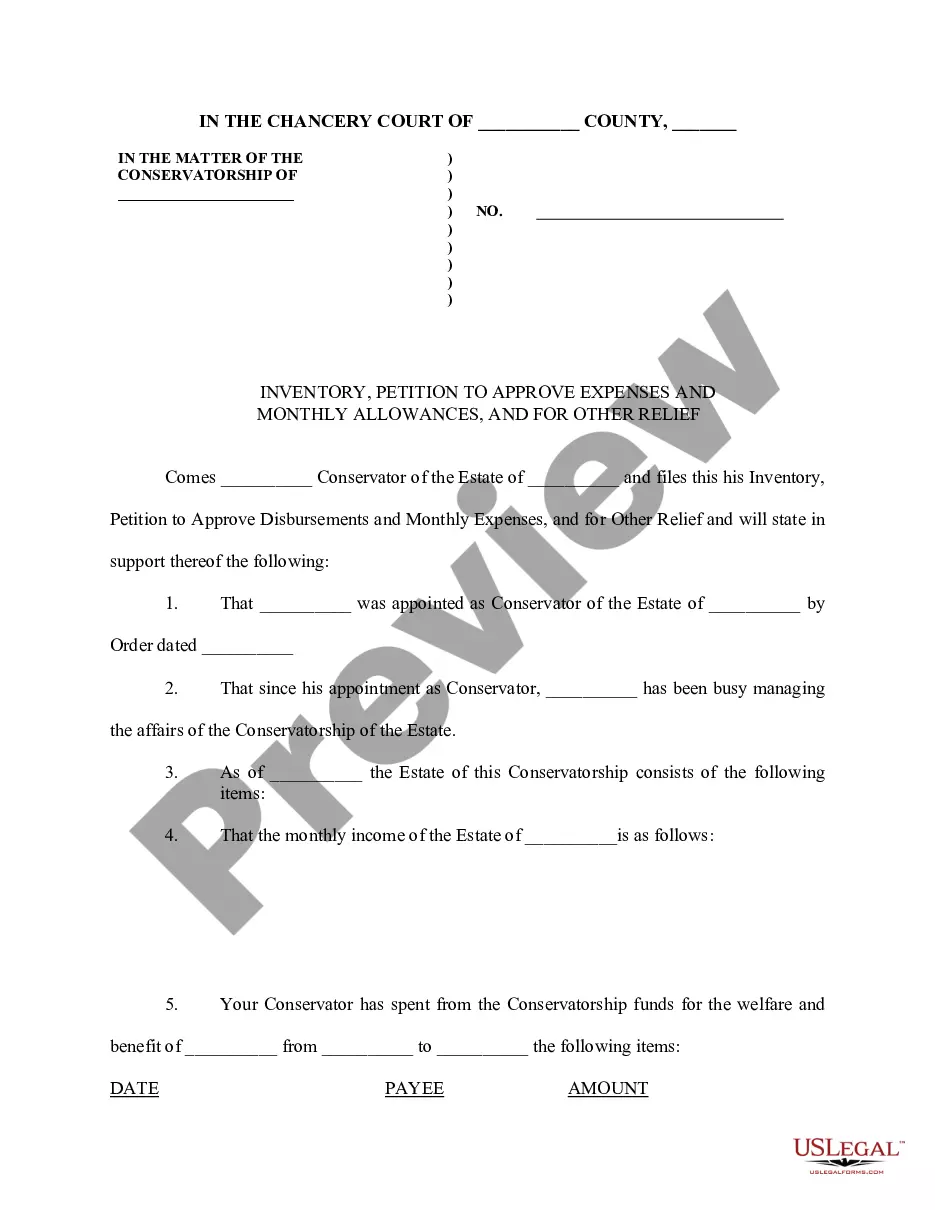

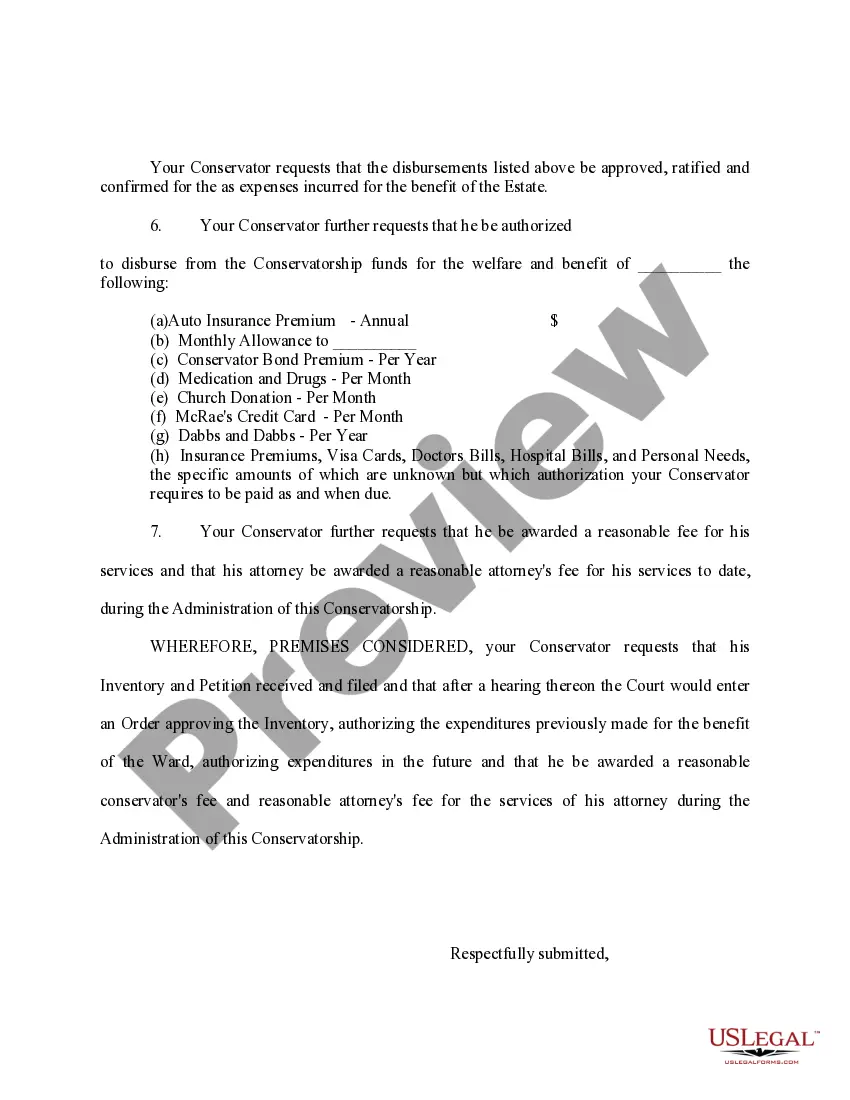

Maryland Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief

Description

How to fill out Inventory, Petition To Approve Expenses And Monthly Allowances, And For Other Relief?

You can invest hours on the web trying to find the legal file template which fits the state and federal specifications you require. US Legal Forms gives thousands of legal varieties which are evaluated by pros. It is simple to obtain or print out the Maryland Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief from your assistance.

If you currently have a US Legal Forms account, you are able to log in and then click the Download switch. Next, you are able to complete, change, print out, or sign the Maryland Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief. Every single legal file template you buy is your own property for a long time. To have another duplicate of the obtained type, proceed to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms website for the first time, adhere to the straightforward instructions beneath:

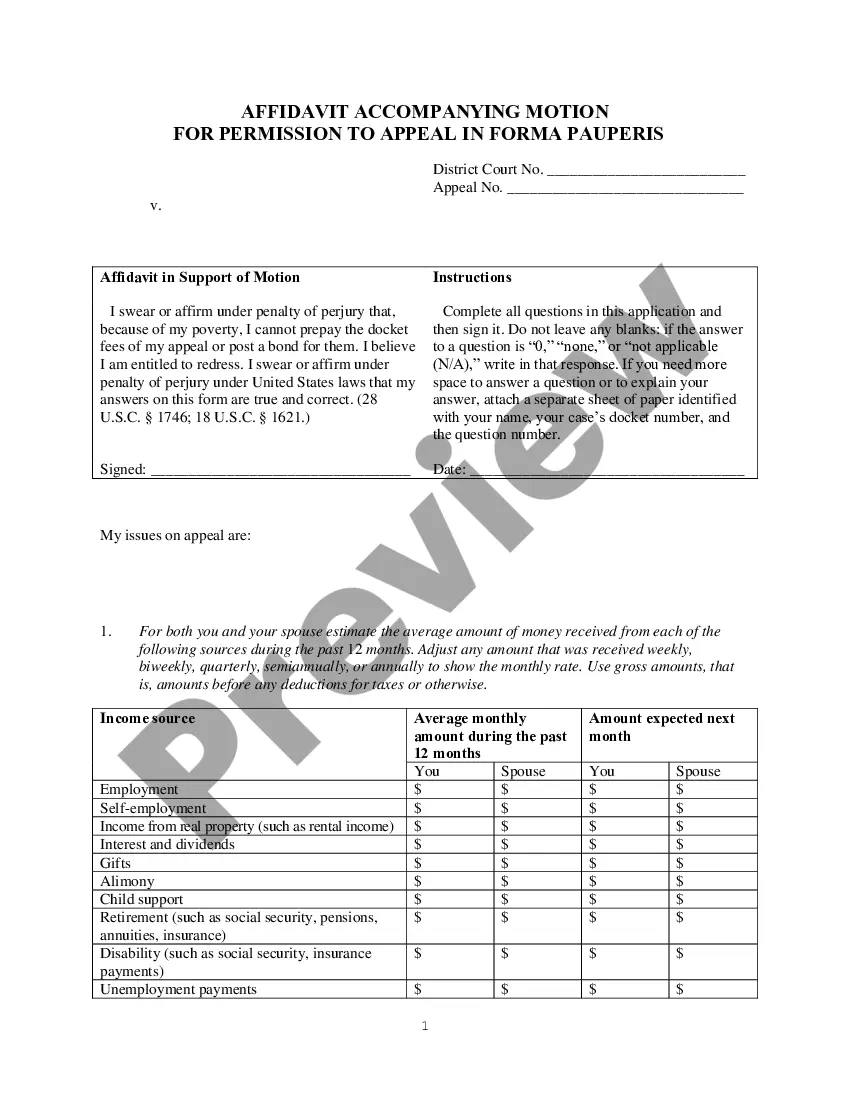

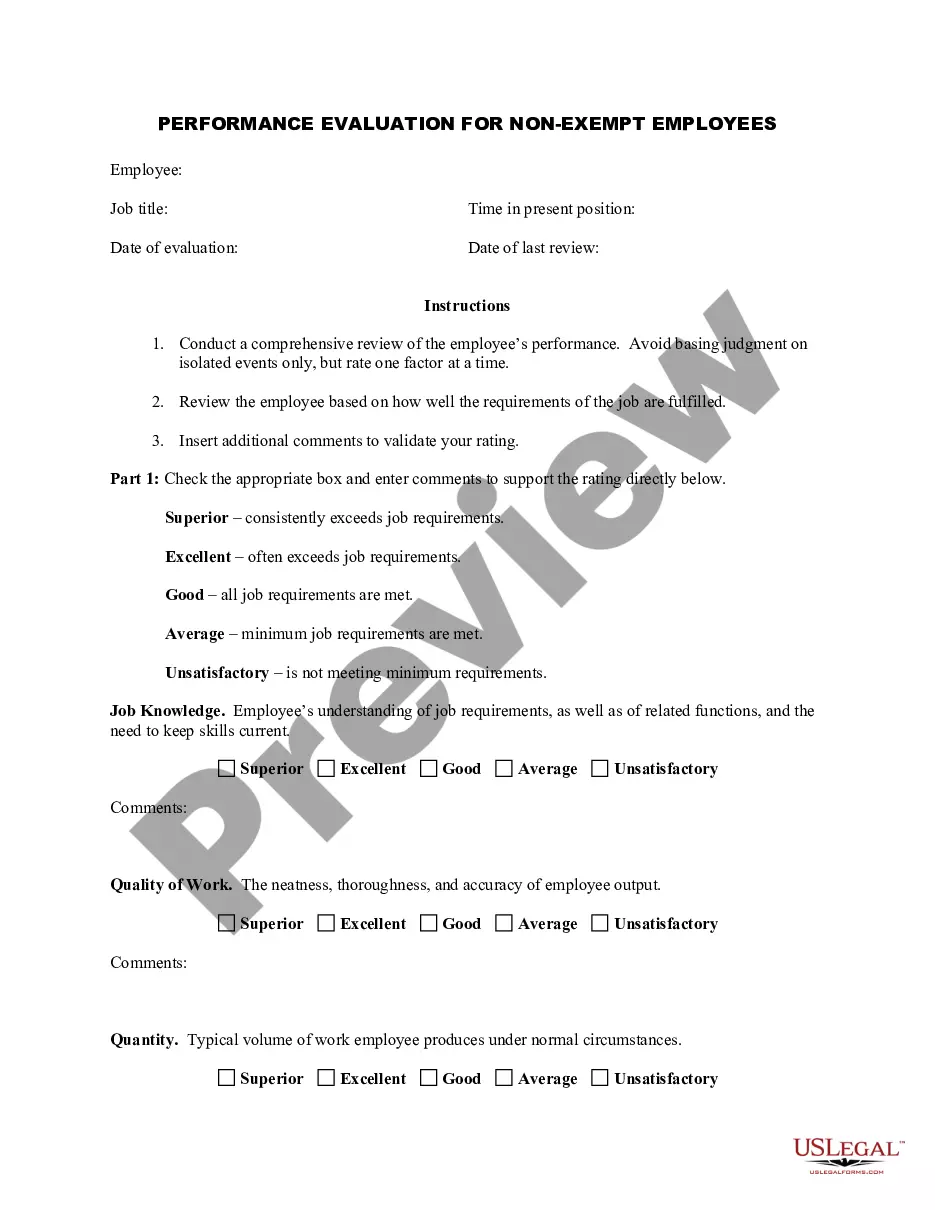

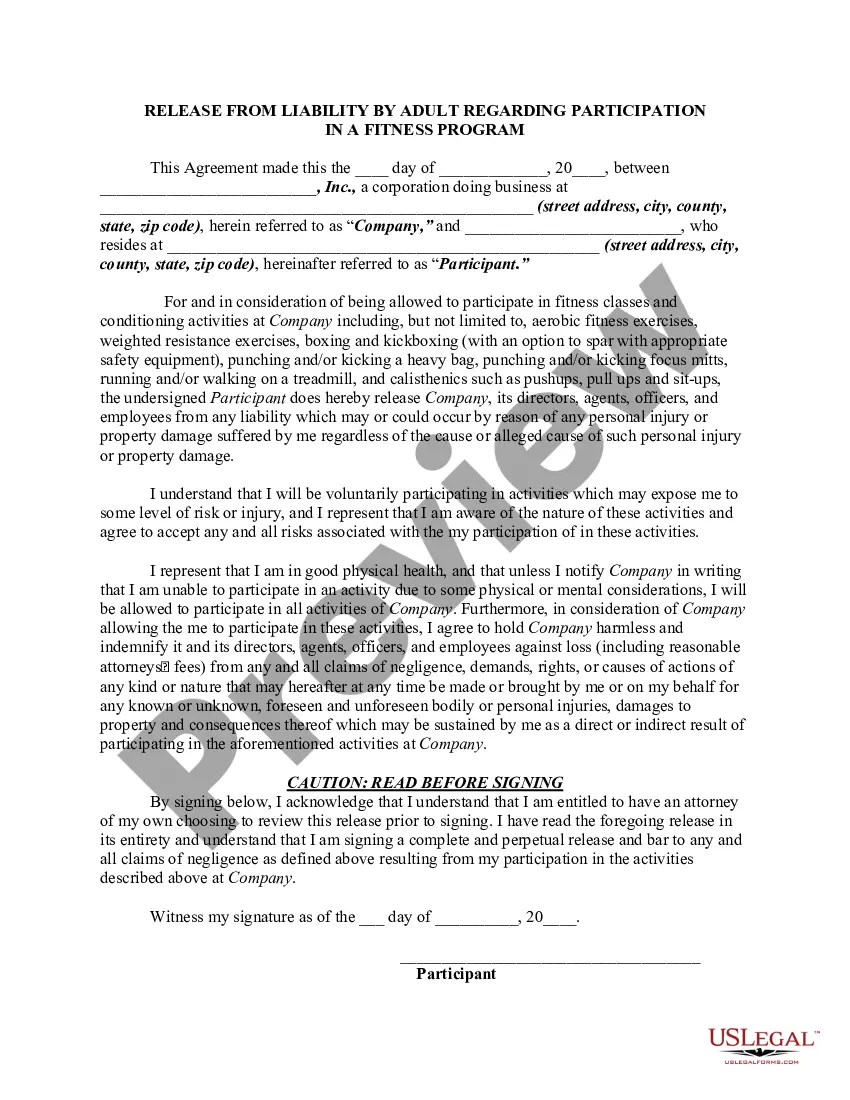

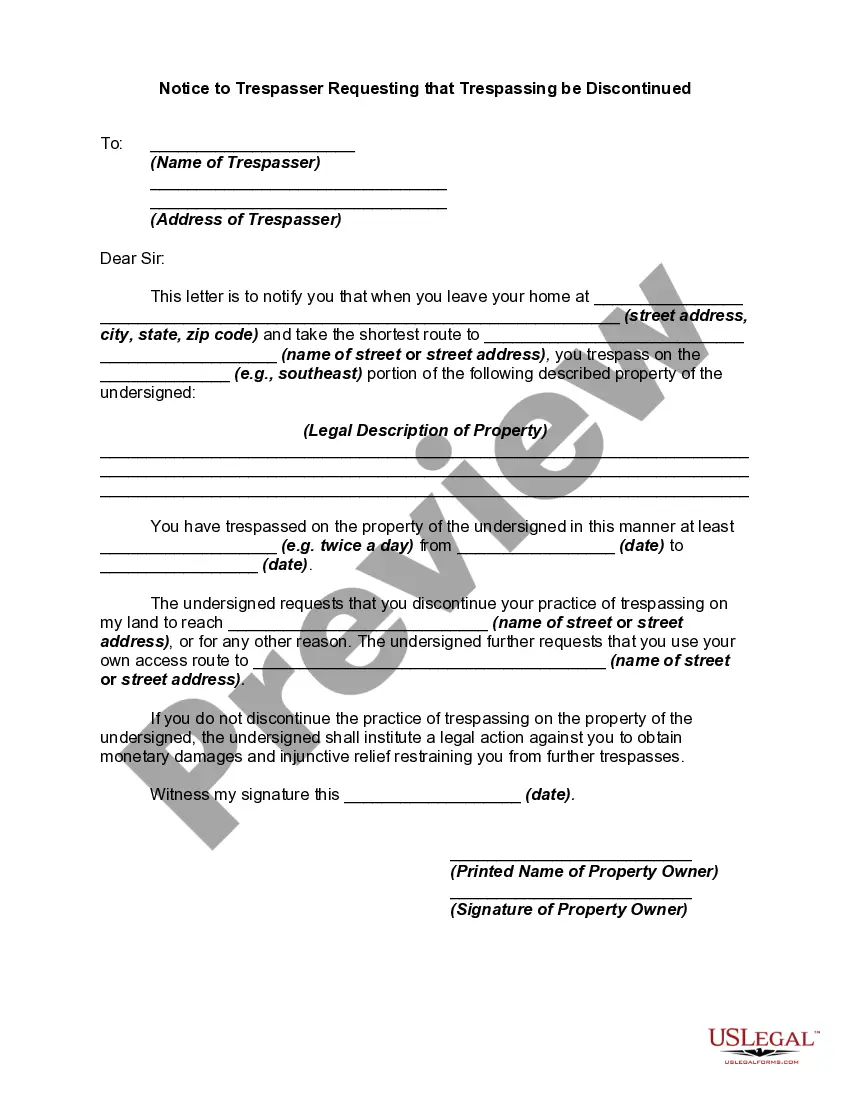

- Initially, be sure that you have chosen the right file template for your state/area of your liking. See the type description to ensure you have selected the right type. If available, use the Review switch to look throughout the file template at the same time.

- If you wish to discover another version in the type, use the Research area to get the template that fits your needs and specifications.

- Upon having located the template you desire, click on Buy now to continue.

- Pick the rates plan you desire, key in your credentials, and sign up for a free account on US Legal Forms.

- Total the purchase. You can utilize your Visa or Mastercard or PayPal account to purchase the legal type.

- Pick the formatting in the file and obtain it in your system.

- Make alterations in your file if required. You can complete, change and sign and print out Maryland Inventory, Petition to Approve Expenses and Monthly Allowances, and for Other Relief.

Download and print out thousands of file layouts using the US Legal Forms site, which provides the largest collection of legal varieties. Use specialist and status-specific layouts to tackle your company or person requires.

Form popularity

FAQ

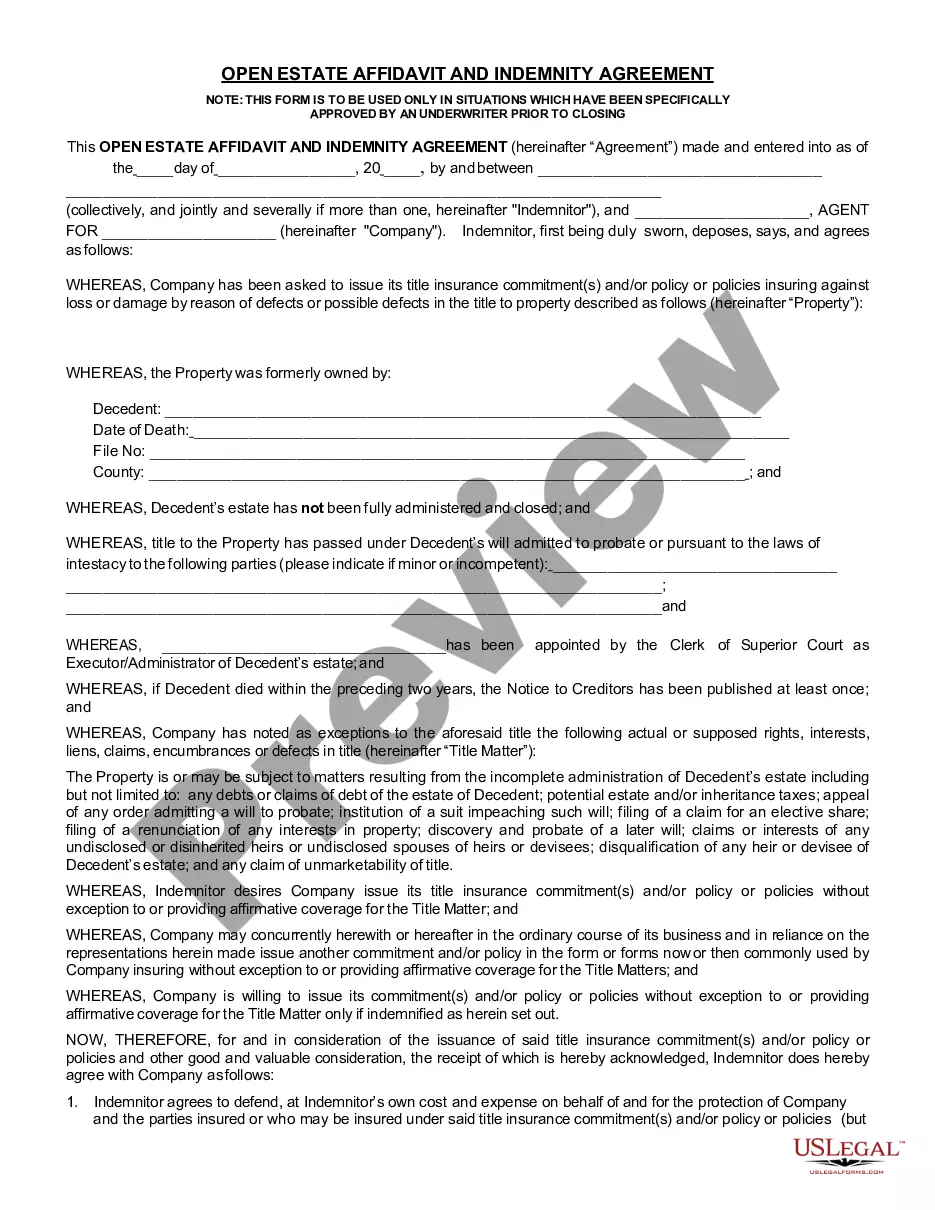

Maryland also has an inheritance tax. If the inheritor is the deceased's child or direct descendent, the spouse of a child or direct descendent, a spouse, parent, grandparent, sibling, stepchild or stepparent, the inheritance tax does not apply. If money is left to anyone else there is a 10% Maryland inheritance tax.

The Maryland Inheritance Tax applies to all beneficiaries unless they have a specific exemption from the tax. A decedent's spouse, child, stepchild, grandchild, step-grandchild, parent, grandparent or sibling are exempt from paying Maryland Inheritance Tax.

Estate and inheritance taxes are taxes levied on the transfer of property at death. An estate tax is levied on the estate of the deceased while an inheritance tax is levied on the heirs of the deceased.

Maryland Inheritance Tax Exemptions The inheritance tax does not apply when property is inherited by the deceased person's: spouse. child (biological or legally adopted), stepchild, former stepchild, grandchild, or other lineal descendant. parent (including stepparent or former stepparent)

MD Form 1130, which may also referred to as Petition And Order For Funeralexpenses, is a probate form in Maryland. It is used by executors, personal representatives, trustees, guardians & other related parties during the probate & estate settlement process.

Date of Death: Prior to 1/1/1970$500 to surviving spouse1/1/1970 to 6/30/1981$1,000 to surviving spouse7/1/1981 to 6/30/1991$2,000 to surviving spouse7/1/1991 to 9/30/2013$5,000 to surviving spouse10/1/2013 to Current$10,000 to surviving spouse

In general, any inheritance you receive does not need to be reported to the IRS. You typically don't need to report inheritance money to the IRS because inheritances aren't considered taxable income by the federal government. That said, earnings made off of the inheritance may need to be reported.

& Trusts § 3-201. Section 3-201 - Family allowance (a) A surviving spouse or registered domestic partner is entitled to receive an allowance of $10,000 for personal use.