Maryland Detailed and Specific Policy with Regard to Use of Company Computers

Description

How to fill out Detailed And Specific Policy With Regard To Use Of Company Computers?

Have you ever found yourself in a scenario where you need documentation for both professional or specific aims almost every day.

There are countless legal document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, including the Maryland Detailed and Specific Policy Regarding the Use of Company Computers, which are crafted to meet federal and state regulations.

Once you locate the suitable form, click Buy now.

Select a convenient document format and download your copy. You can access all the document templates you have purchased in the My documents section. You can acquire another copy of the Maryland Detailed and Specific Policy Regarding the Use of Company Computers anytime, if necessary. Simply click on the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and begin making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Maryland Detailed and Specific Policy Regarding the Use of Company Computers template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct area/region.

- Utilize the Preview button to check the form.

- Review the description to make sure you have selected the right form.

- If the form isn't what you need, use the Lookup field to discover the form that meets your needs and requirements.

Form popularity

FAQ

To obtain information from the Maryland State Department of Assessments and Taxation (SDAT), you can visit their official website or contact their offices directly. They provide resources and guidance on filing requirements and deadlines. By adhering to the Maryland Detailed and Specific Policy with Regard to Use of Company Computers, you can ensure your business remains compliant and informed.

Form 1 must be filed by all entities, including corporations and limited partnerships, that conduct business in Maryland and wish to report personal property tax. This includes any company that owns tangible personal property within the state. It's essential to align your practices with the Maryland Detailed and Specific Policy with Regard to Use of Company Computers to avoid any compliance issues.

You can file articles of incorporation in Maryland through the Maryland State Department of Assessments and Taxation (SDAT). This process can typically be completed online or via mail. Understanding the Maryland Detailed and Specific Policy with Regard to Use of Company Computers ensures that all documents are filed correctly and timely.

Yes, Maryland requires taxpayers to complete a state tax form to report income earned and determine tax liability. Most individuals and businesses will need to fill out the appropriate forms based on their income type. To stay compliant with the Maryland Detailed and Specific Policy with Regard to Use of Company Computers, make sure you use the correct forms as prescribed by the state.

Individuals who earn income in Maryland, including residents and non-residents, must file a Maryland income tax return. This requirement extends to partnerships and corporations engaged in business activities within the state. Understanding the Maryland Detailed and Specific Policy with Regard to Use of Company Computers can assist in accurately reporting income and fulfilling tax obligations.

In Maryland, any business that owns personal property or operates a business entity must file a personal property tax return. This includes corporations, partnerships, and limited liability companies (LLCs). Familiarizing yourself with the Maryland Detailed and Specific Policy with Regard to Use of Company Computers helps ensure compliance and avoid unnecessary penalties.

Filing Form 1 late in Maryland can lead to significant penalties that include both fines and interest on unpaid balances. Specifically, the state may impose a penalty of 5% to 25% of the unpaid tax amount. It's crucial to stay informed about the Maryland Detailed and Specific Policy with Regard to Use of Company Computers, as delays can result in added complications.

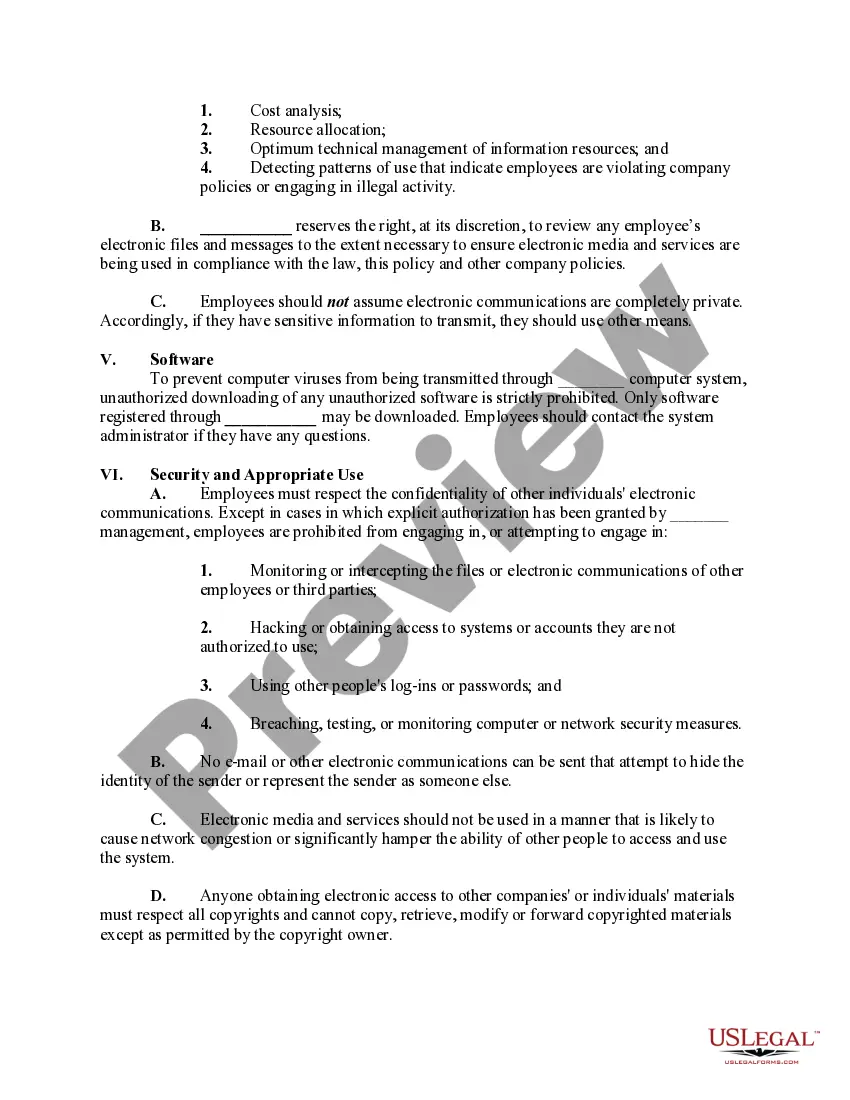

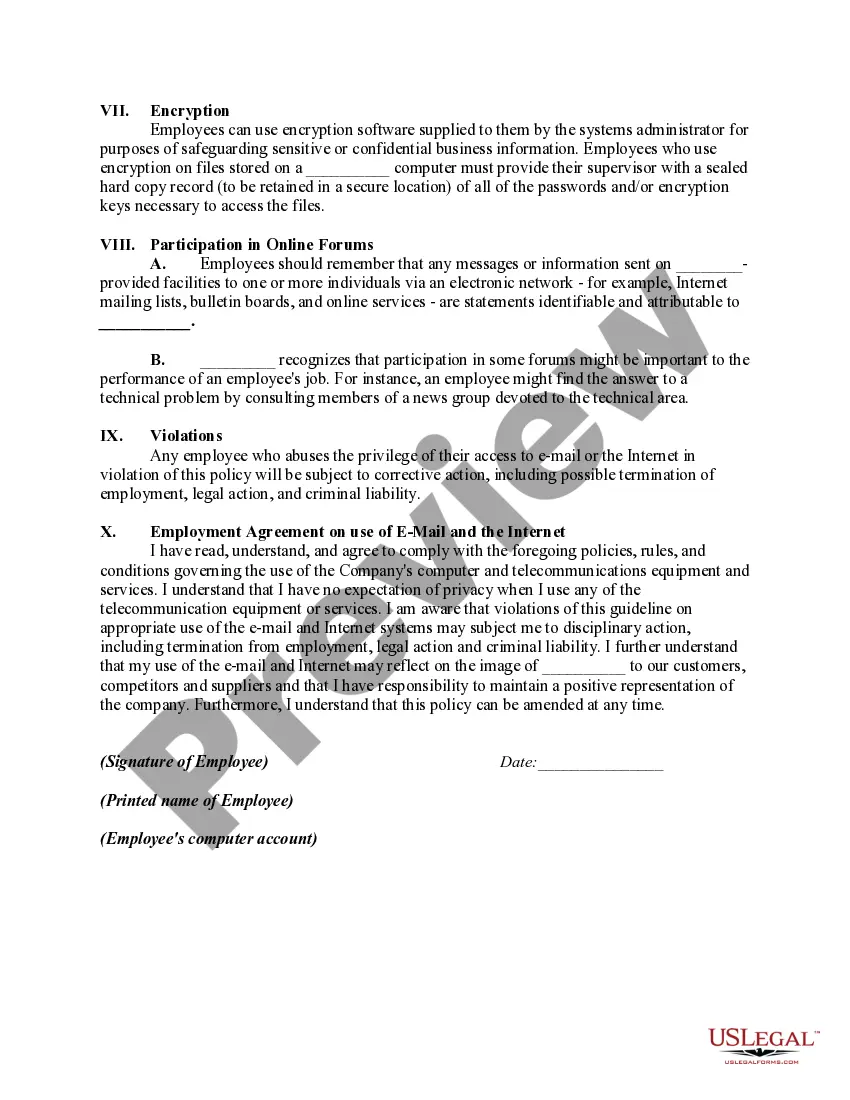

The acceptable use network policy governs how users may interact with a company's network and its resources. This includes guidelines for accessing company databases, using email, and connecting to the internet safely. The Maryland Detailed and Specific Policy with Regard to Use of Company Computers offers a comprehensive approach, ensuring that employees are aware of best practices and potential pitfalls when using the organization's networking capabilities.

An example of an Acceptable Use Policy could specify that employees are permitted to use company computers for business-related tasks only. It may also state that personal use is limited and should not interfere with work responsibilities. The Maryland Detailed and Specific Policy with Regard to Use of Company Computers reinforces such examples, providing practical scenarios to guide employee behavior within a professional setting.

An Acceptable Use Policy typically includes guidelines on internet usage, email communications, and software installations. It also defines prohibited behaviors such as accessing inappropriate websites or sharing confidential information. The Maryland Detailed and Specific Policy with Regard to Use of Company Computers not only lists these expectations but also illustrates the consequences of non-compliance, promoting accountability among employees.