Maryland Option to Purchase a Business

Description

How to fill out Option To Purchase A Business?

If you require complete legal document templates, download or print them from US Legal Forms, the largest assortment of legal forms available online.

Utilize the site’s user-friendly and convenient search feature to locate the documents you need.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the desired form, click the Purchase now button. Select the pricing plan that suits you and enter your details to create an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the Maryland Option to Purchase a Business with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to access the Maryland Option to Purchase a Business.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

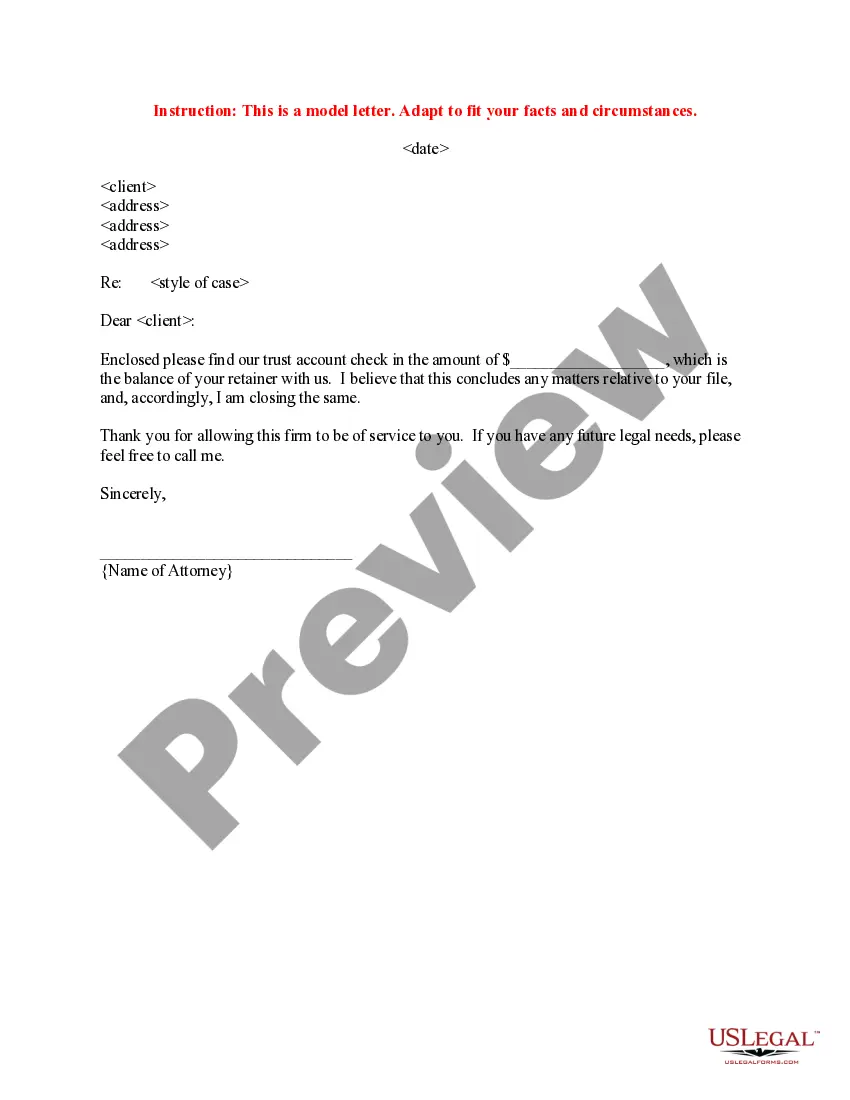

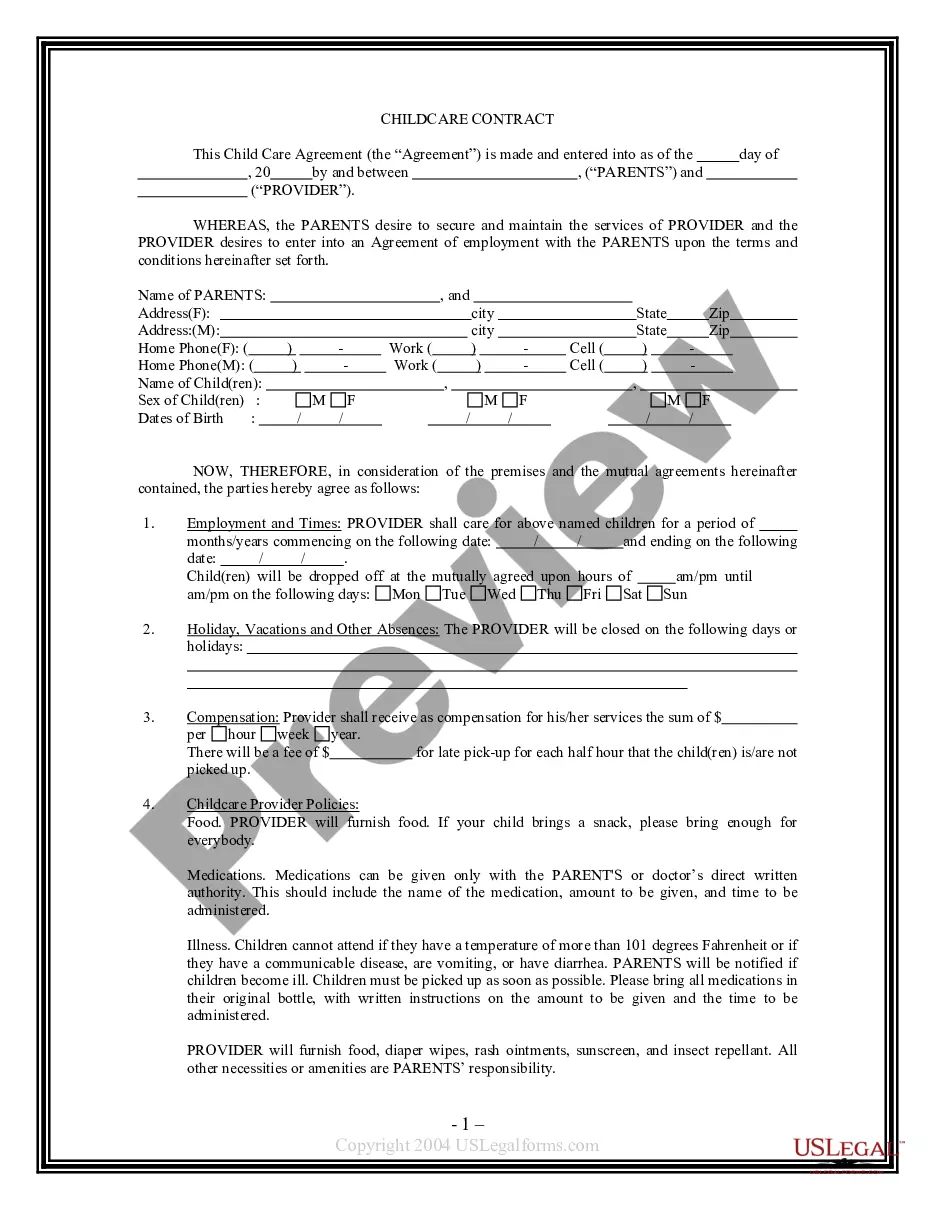

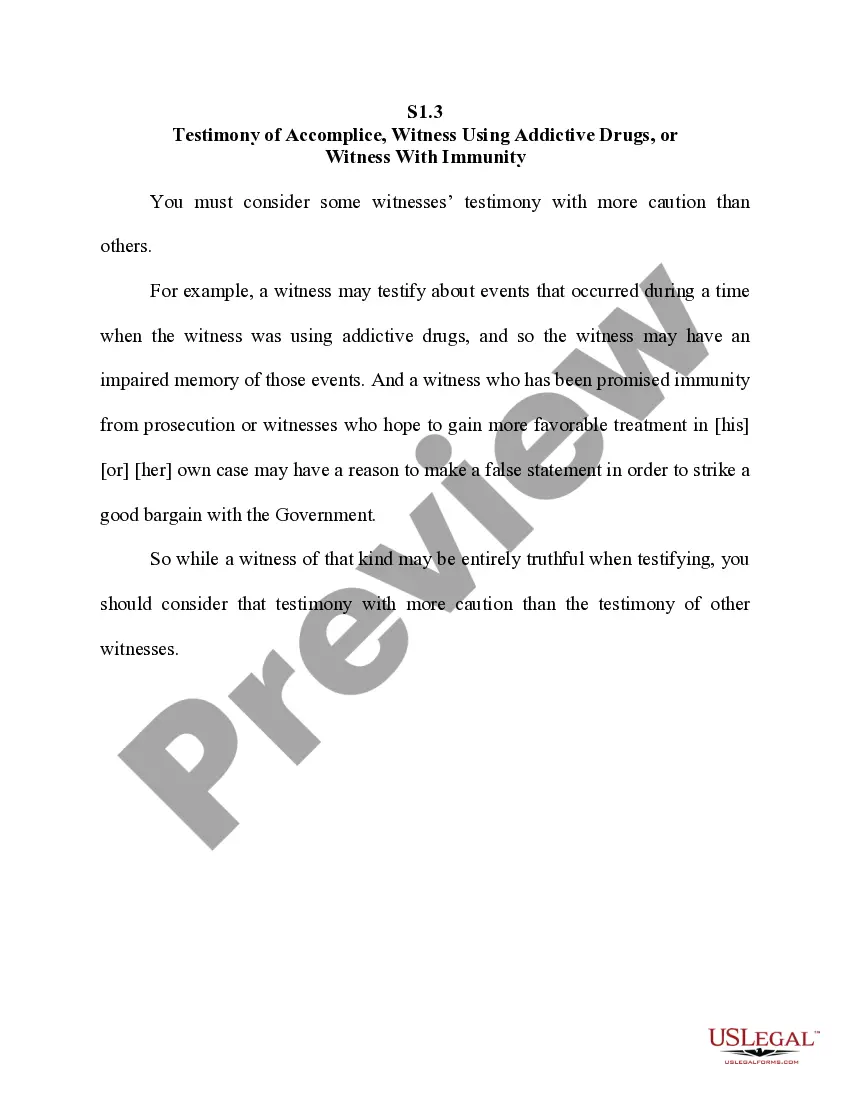

- Step 2. Use the Review option to examine the contents of the form. Remember to read the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to discover alternative forms in the legal form collection.

Form popularity

FAQ

In Maryland, using a PO box as your business address is generally not sufficient for official registrations. You must provide a physical street address for your business entity. This is important for legal documentation and correspondence. Therefore, ensure that you have a suitable brick-and-mortar location or a registered office to comply with Maryland business regulations.

To amend your Maryland limited liability company articles of organization just file Articles of Amendment by mail, in person or by fax with the Maryland State Department of Assessments and Taxation (SDAT). The SDAT LLC amendment form is in fillable format and you have to type on it.

A close corporation is a legal entity much like a company. A CC is run and administered by its members, who must be natural persons (i.e. not other legal entities). A close corporation's members are like a company's shareholders.

Selling a Maryland LLC can have many tax, debt, and legal implications that you don't want to handle without professional advice. You can also transfer ownership of a Maryland LLC by completely dissolving it. This frees up members to sell their ultimate shares of business assets to third parties.

Close corporations are generally smaller businesses who desire the limited liability and tax benefits of a corporation but whose stockholders wish to maintain streamlined managerial control of the business.

Below is a list of actions required when closing a business in Maryland.Step 1 End or Cancel Your Business with the Maryland Department of Assessments & Taxation.Step 2 Close Your Business with the Comptroller of Maryland.Step 3 Close Your Business with the IRS.Step 4 Close Your Business with local agencies.More items...

If wondering, can you sell an LLC, the answer is yes. However, remember that in order to sell your LLC, you need an actual buyer and you need to agree on the sale price. Therefore, you might need a professional who can help value your business.

The Maryland articles of incorporation cost $100 plus a $20 organization fee with the Maryland State Department of Assessments and Taxation. We custom draft your Maryland articles of incorporation when you hire Northwest to start your Maryland business.

To amend your Maryland limited liability company articles of organization just file Articles of Amendment by mail, in person or by fax with the Maryland State Department of Assessments and Taxation (SDAT). The SDAT LLC amendment form is in fillable format and you have to type on it.

Is there a filing fee to dissolve or cancel a Maryland LLC? There is a $100 filing fee to cancel your Maryland LLC. Expedited processing costs an additional $50. There's also a credit card processing fee of 3% (around $5).