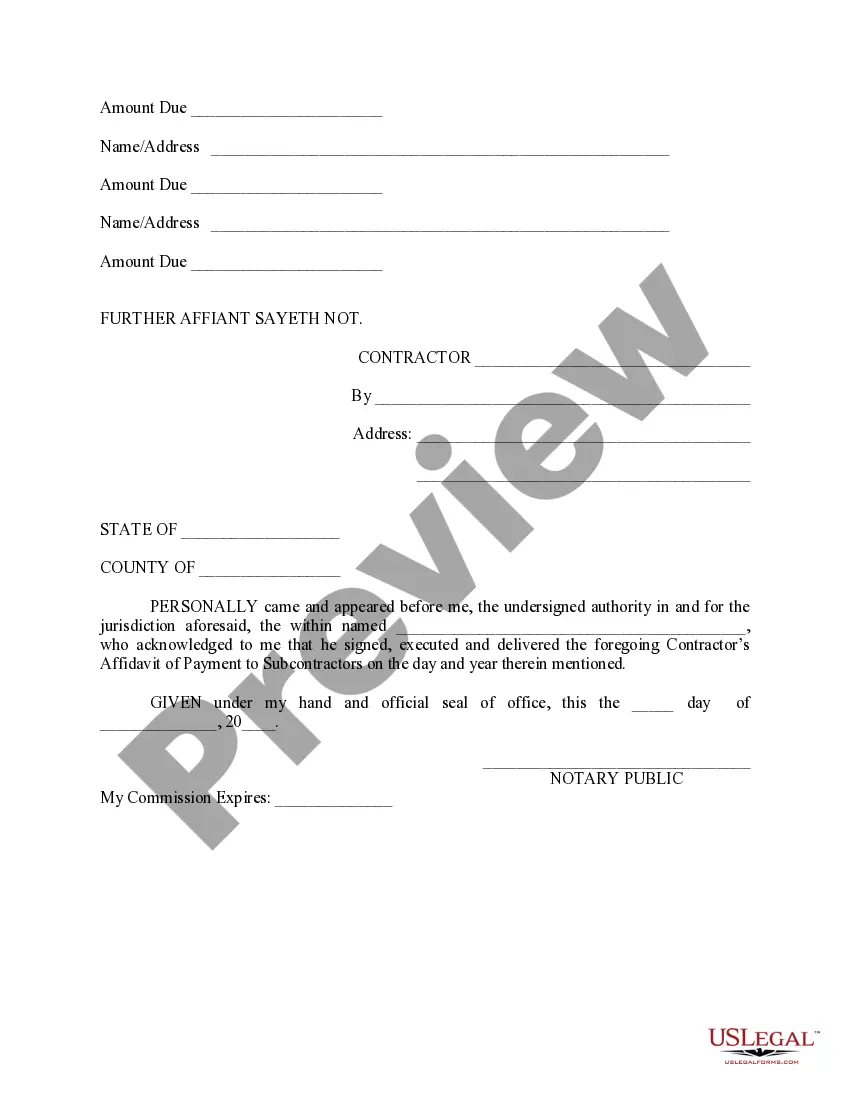

Maryland Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

Selecting the most suitable legal document template can be challenging.

Certainly, there are numerous templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have chosen the correct form for your city/state. You can check the form using the Preview button and read the form description to confirm it's the correct one for you. If the form does not fulfill your needs, use the Search area to find the appropriate form. Once you are certain that the form is suitable, click the Acquire now button to obtain the form. Choose the pricing plan you prefer and enter the requested information. Create your account and complete your order using your PayPal account or credit card. Then select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Maryland Contractor's Affidavit of Payment to Subs. US Legal Forms is the largest collection of legal forms where you can discover various document templates. Use the service to download correctly crafted documents that meet state requirements.

- The service offers countless templates, such as the Maryland Contractor's Affidavit of Payment to Subs, which is useful for both business and personal purposes.

- All forms are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Maryland Contractor's Affidavit of Payment to Subs.

- Utilize your account to browse the legal forms you have previously acquired.

- Go to the My documents tab of your profile and obtain another copy of the document you need.

Form popularity

FAQ

But the IRS auditor says you cannot deduct an expense if you did not send out Form 1099. Your subcontractor labor can be a pretty significant amount, maybe your largest expense. The tax you would owe if your subcontractor labor expense is disallowed would be staggering. But you paid the expense, and can prove it.

If the contractor defaults or otherwise doesn't take care of your wages, you can file a claim with the surety company to get at least part of your money. The surety company then takes the contractor to court to recover the amount.

The prime contractor has a direct contractual agreement with the property owner. If the contractor isn't paid, he can sue on the contract and record a mechanic's lien. But subcontractors, workers and suppliers don't have a contract with the property owner.

When Can Contractors Withhold Payment From Subcontractors? The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

How to get paid (faster) on every construction projectGet licensed.Write a credit policy.Prequalify potential customers.Get the contract in writing.Collect information about the property and other parties.Track your deadlines.Send Preliminary Notice.Submit Detailed Pay Applications or Invoices.More items...?

The courts recognize the subcontractor's right to sue the owner directly for the payment of its claim to the extent that the master contract creates an express obligation on the owner's part (must) as opposed to a mere option (may) to make payment to the general contractor conditional upon the latter's having

A direct payment clause says that if you have paid the main contractor for work done by subcontractors and your money is not passed on to them, you can pay the subcontractor directly and deduct the payment from any other monies due to the main contractor.

The ability to withhold payment needs to be written out in the contract because, in most states, verbal agreements for commercial work are not binding and will not hold up in court. With a written contract that both parties agree to, it's safe for a contractor to withhold payment if a vendor becomes non-compliant.