Maryland Bill of Sale - Quitclaim

Description

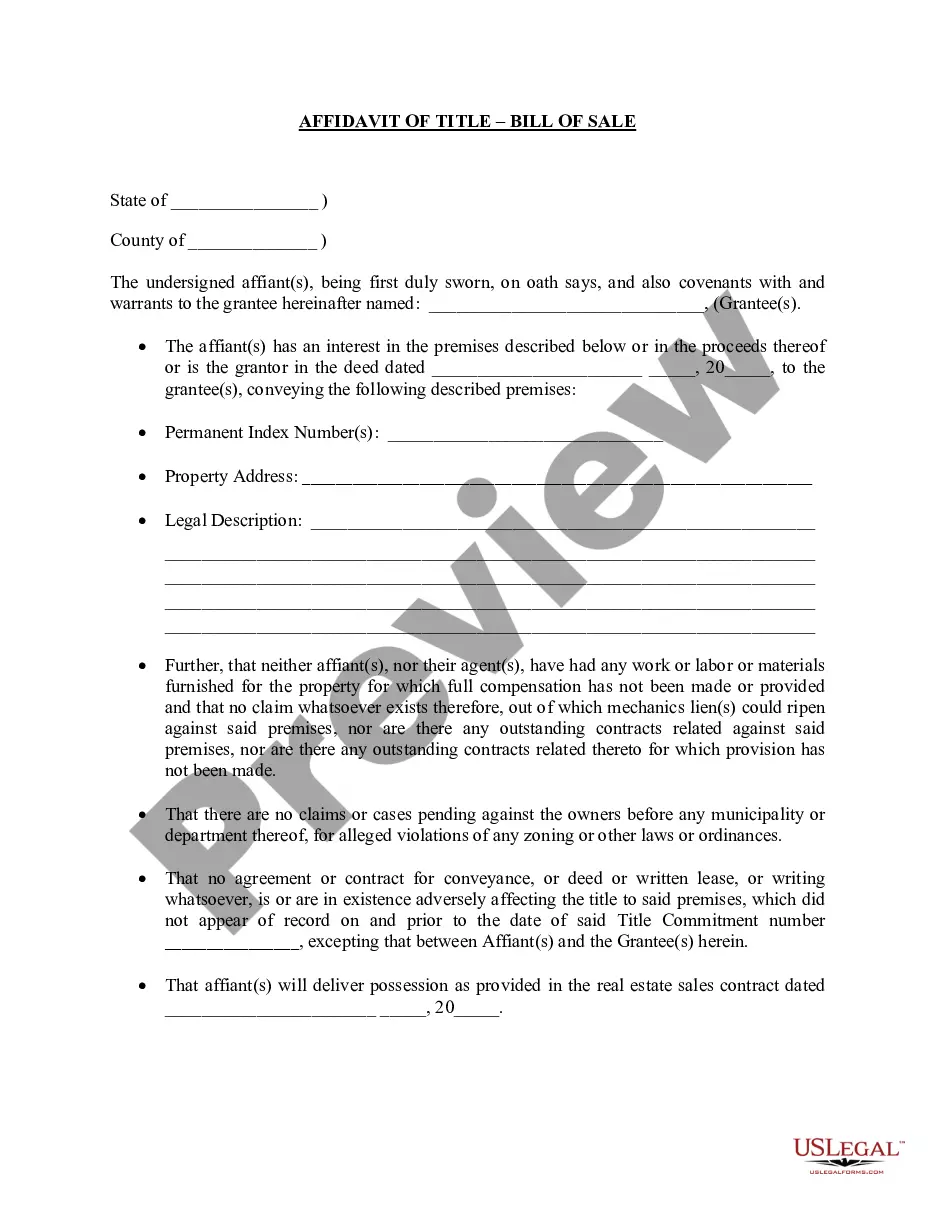

How to fill out Bill Of Sale - Quitclaim?

US Legal Forms - one of the largest repositories of legal documents in the country - provides a variety of legal form templates that you can download or print.

By using the website, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Maryland Bill of Sale - Quitclaim within seconds.

Check the form details to confirm that you have selected the right form.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you already have a subscription, Log In to access the Maryland Bill of Sale - Quitclaim in the US Legal Forms library.

- The Download option will appear on every form you view.

- You can access all previously downloaded forms in the My documents tab of your account.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Review option to analyze the content of the form.

Form popularity

FAQ

In Maryland, a bill of sale is often necessary to transfer title for certain types of property, especially vehicles and personal items. For real estate transactions, like those involving a quit claim deed, the deed itself serves as the primary document for transferring ownership. However, it's advisable to have a bill of sale for a complete record. US Legal Forms offers templates and guidance on the Maryland Bill of Sale - Quitclaim to streamline this process.

To get a copy of your quit claim deed, you will need to contact the appropriate county office where the deed was recorded. Typically, this is the Clerk of the Circuit Court. Keep in mind that knowing the parcel number or property address can expedite the process. For a convenient solution, you can also visit US Legal Forms, where you may find resources for accessing your Maryland Bill of Sale - Quitclaim.

Verifying a bill of sale generally involves checking that all required information is accurate and complete. In Maryland, you can validate a Maryland Bill of Sale - Quitclaim by cross-referencing with public records, like property titles, if applicable. Using platforms like uslegalforms can provide templates and guidance to ensure your bill of sale is properly executed and documented.

A quitclaim deed in Maryland must contain specific information to be valid. It should include the names of the grantor and grantee, a clear property description, and the signature of the grantor. Additionally, while it's not mandatory, including a Maryland Bill of Sale - Quitclaim can clarify the intent and transfer rights between the parties involved.

Yes, a bill of sale remains valid even if it is not notarized in Maryland. The key components, such as buyer and seller information, asset description, and signatures, must be present. This makes your Maryland Bill of Sale - Quitclaim enforceable in a court of law, so long as it meets the necessary requirements, providing both parties with legal protection.

Maryland does not mandate that a bill of sale be notarized for it to be effective. This means you can complete your Maryland Bill of Sale - Quitclaim without a notary, provided all necessary information is included. Nonetheless, notarizing the document can bolster its credibility and serve as a safeguard for both parties involved in the transaction.

In Maryland, a bill of sale does not require notarization to be legally valid. However, notarization can add an extra layer of protection and authenticity. It may be beneficial to notarize a Maryland Bill of Sale - Quitclaim, especially for significant transactions. Notarized documents can help reduce disputes and clarify ownership.

Yes, you can prepare a quitclaim deed yourself; however, it is essential to understand the specific requirements in Maryland to ensure its validity. If you feel unsure about drafting the document correctly, utilizing USLegalForms can simplify the process and ensure that all legal aspects are covered. This support can help you confidently execute your Maryland Bill of Sale - Quitclaim without complications.

Quitclaim deeds are particularly beneficial for individuals transferring property among family members or in situations where trust exists, such as between spouses or parents and children. They provide a quick and straightforward way to transfer property without going through lengthy legal processes. However, they may not suit all transactions, especially where financial institutions are involved. If you’re considering this option, the Maryland Bill of Sale - Quitclaim from USLegalForms can guide you.

The primary danger of a quitclaim deed is that it can lead to disputes over property ownership, especially if the title is unclear or contested. Because the grantor does not guarantee clear ownership, buyers might face legal challenges in the future. Furthermore, if the grantor has outstanding debts tied to the property, the new owner could face financial liabilities. Therefore, utilizing a platform like USLegalForms can help mitigate these risks while preparing your Maryland Bill of Sale - Quitclaim.