Maryland Assignment of Money Due

Description

How to fill out Assignment Of Money Due?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a broad selection of legal paper templates that you can obtain or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will find the most recent forms such as the Maryland Assignment of Money Due in just a few minutes.

If you already have a monthly subscription, Log In and obtain the Maryland Assignment of Money Due from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to get you started: Make sure you have selected the correct form for your city/state. Click on the Review button to examine the form’s content. Read the form description to ensure you have chosen the right one. If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking on the Purchase now button. Then, select the payment plan you prefer and provide your details to register for an account. Complete the transaction. Use a credit card or PayPal account to finalize the purchase. Choose the format and download the form to your device. Make changes. Fill out, edit, print, and sign the downloaded Maryland Assignment of Money Due. Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Gain access to the Maryland Assignment of Money Due with US Legal Forms, one of the most extensive libraries of legal document templates.

- Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- Explore a wide range of documents for various purposes.

- Enjoy a user-friendly experience for easy navigation.

- Access forms that are regularly updated to ensure compliance.

- Easily manage your downloaded forms within your account.

Form popularity

FAQ

To stop a garnishment in Maryland, you can file a motion with the court that issued the garnishment order. It’s important to present valid reasons for stopping the garnishment, such as financial hardship or errors in the garnishment process. Additionally, understanding your rights regarding a Maryland Assignment of Money Due can be beneficial, as it may provide alternative solutions for managing debts. The US Legal Forms platform can guide you through the necessary legal procedures to halt a garnishment effectively.

In Maryland, the statute of limitations for collecting most debts is generally three years. This means that you must initiate legal action within this timeframe to recover the money owed. Understanding this timeline is crucial, especially if you're considering options like a Maryland Assignment of Money Due. For assistance in navigating these legalities, US Legal Forms offers resources that can help you understand your rights and options.

Recovering money from a debtor can be straightforward if you follow the right steps. Start by documenting the debt, then attempt to contact the person to arrange a payment plan. If informal efforts fail, you might want to consider legal options like a Maryland Assignment of Money Due. This allows you to assign the debt to a collection agency or another party, increasing your chances of recovering the owed amount. The US Legal Forms platform simplifies this process with helpful templates and instructions.

To collect money someone owes you, start by reaching out to them directly to discuss the debt. If this approach fails, consider using a formal demand letter or seeking mediation. Additionally, you can explore options like a Maryland Assignment of Money Due, which allows you to legally transfer the right to collect the debt to another party. Consider using the US Legal Forms platform to access the necessary documents and guidance.

To recover money from someone who owes you, start by communicating directly with them to discuss the debt. If informal attempts fail, you may consider drafting a formal demand letter. Using the Maryland Assignment of Money Due can also help enforce your rights and streamline the recovery process. If necessary, seeking legal assistance through platforms like uslegalforms can provide tools and templates to aid in your collection efforts.

In Maryland, the statute of limitations for most debts is three years. This means that creditors have three years to file a lawsuit to collect a debt. After this period, the debt becomes uncollectible in court, but the borrower still owes the money. If you have concerns about a debt, consider utilizing the Maryland Assignment of Money Due to explore your options.

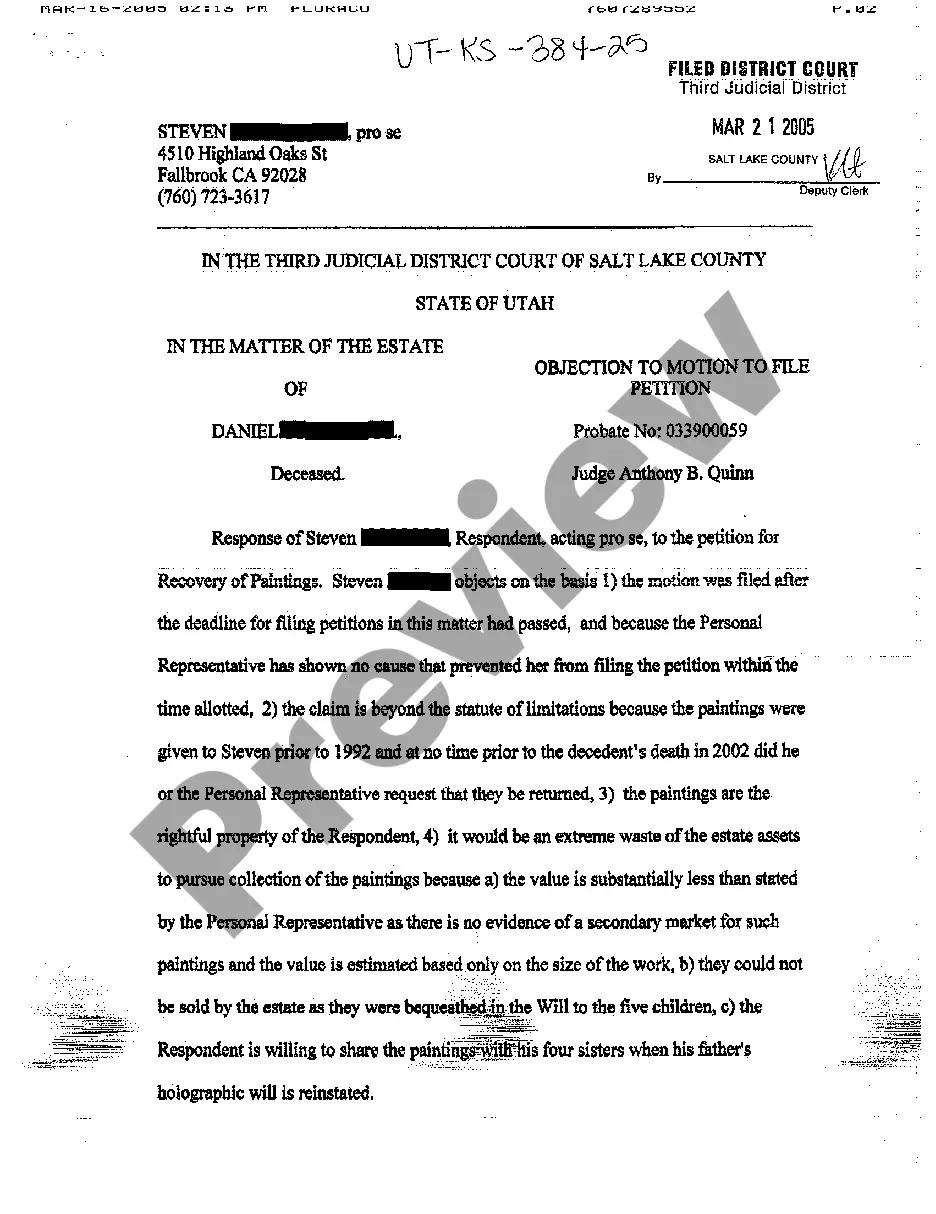

Rule 2 621 in Maryland pertains to the procedure for filing claims against an estate. This rule outlines the necessary steps and requirements for creditors seeking to assert their claims. By understanding this rule, you can better navigate the legal landscape surrounding the Maryland Assignment of Money Due. Resources from US Legal Forms can help clarify these procedures and provide the necessary forms for your claim.

To file a claim against an estate in Maryland, you must submit your claim in writing to the personal representative of the estate. This claim should include details about the debt, the amount owed, and any supporting documentation. It's important to follow the proper procedures to ensure your claim is considered valid. For those seeking assistance, US Legal Forms offers resources and templates to streamline the Maryland Assignment of Money Due process.

In Maryland, creditors have a limited time frame to file a claim against an estate, which is typically six months from the date of the decedent's death. This deadline is crucial for ensuring that all debts are settled before the estate is distributed. If creditors miss this deadline, they may lose their right to collect on the debts owed. Understanding the timeline for filing a claim can help you navigate the Maryland Assignment of Money Due more effectively.