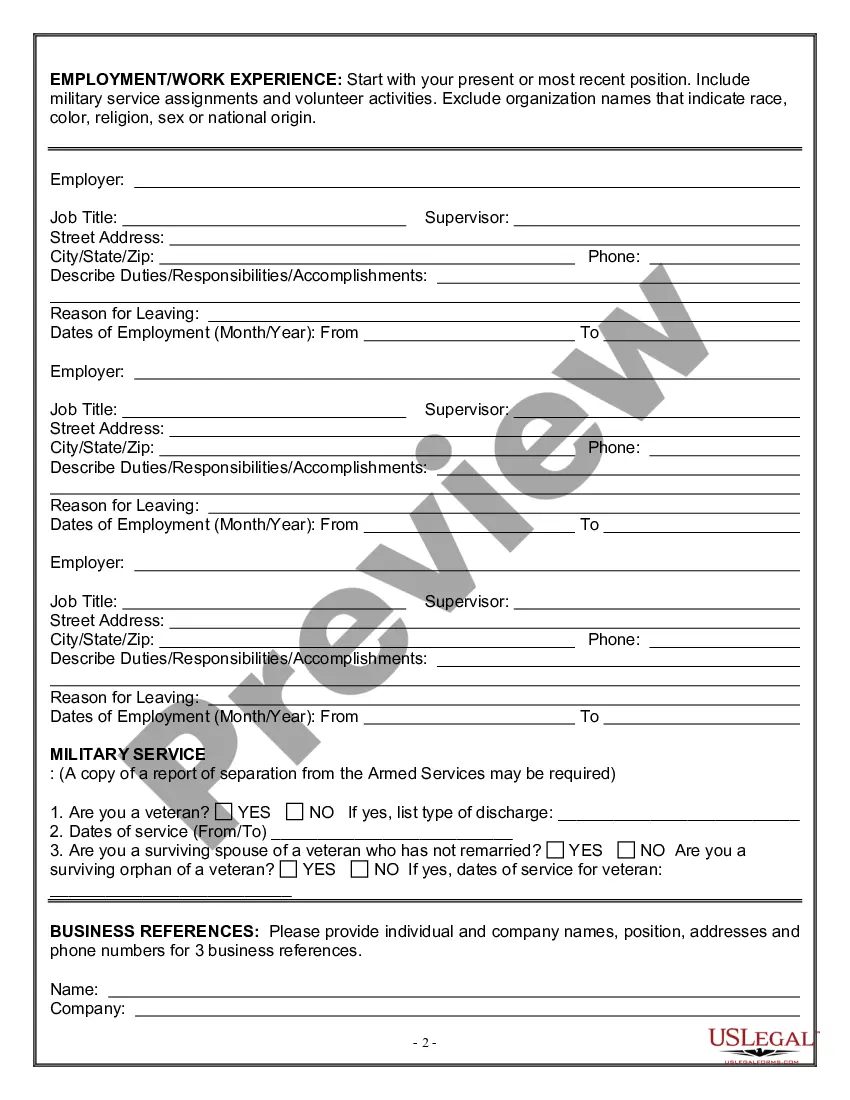

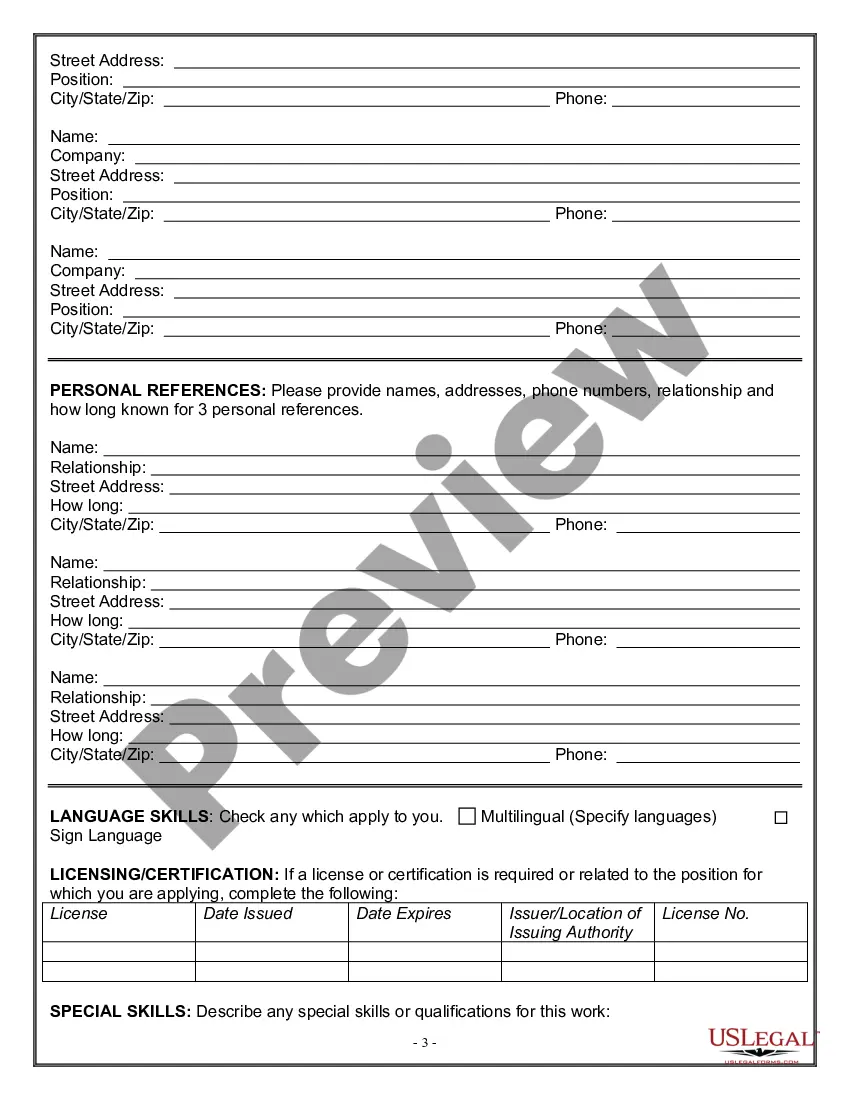

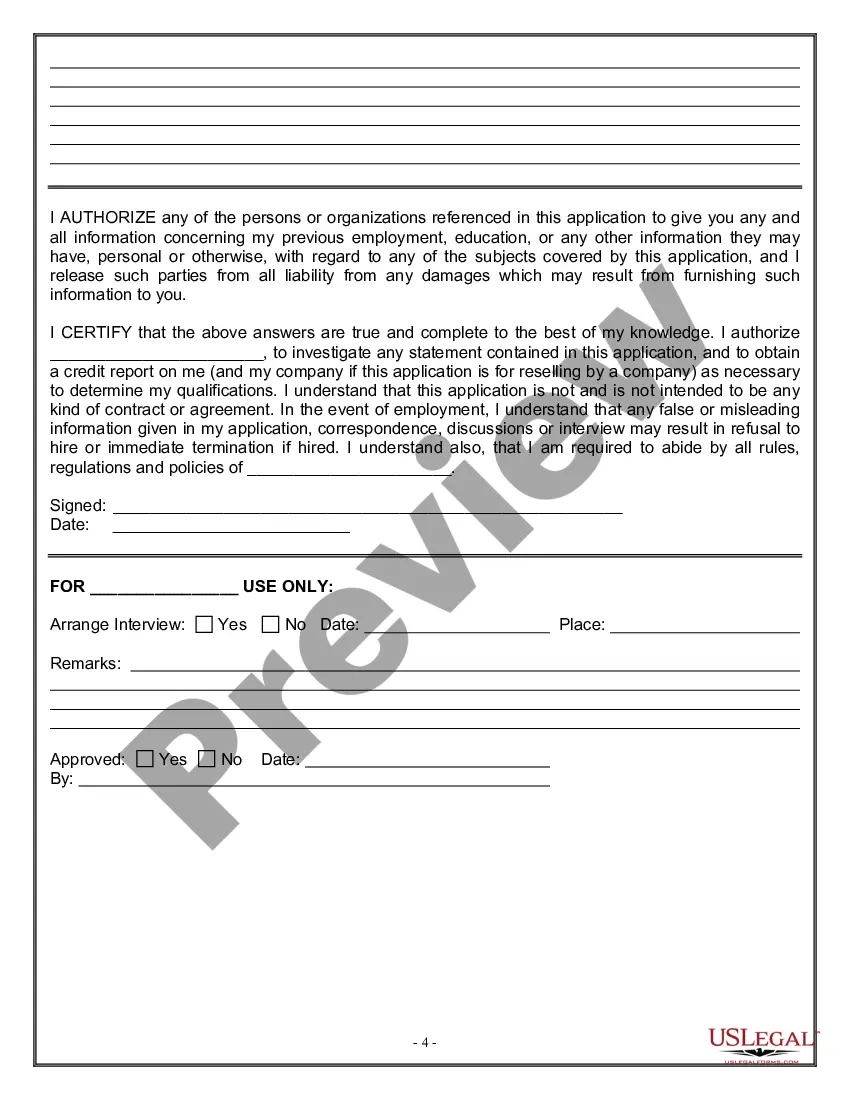

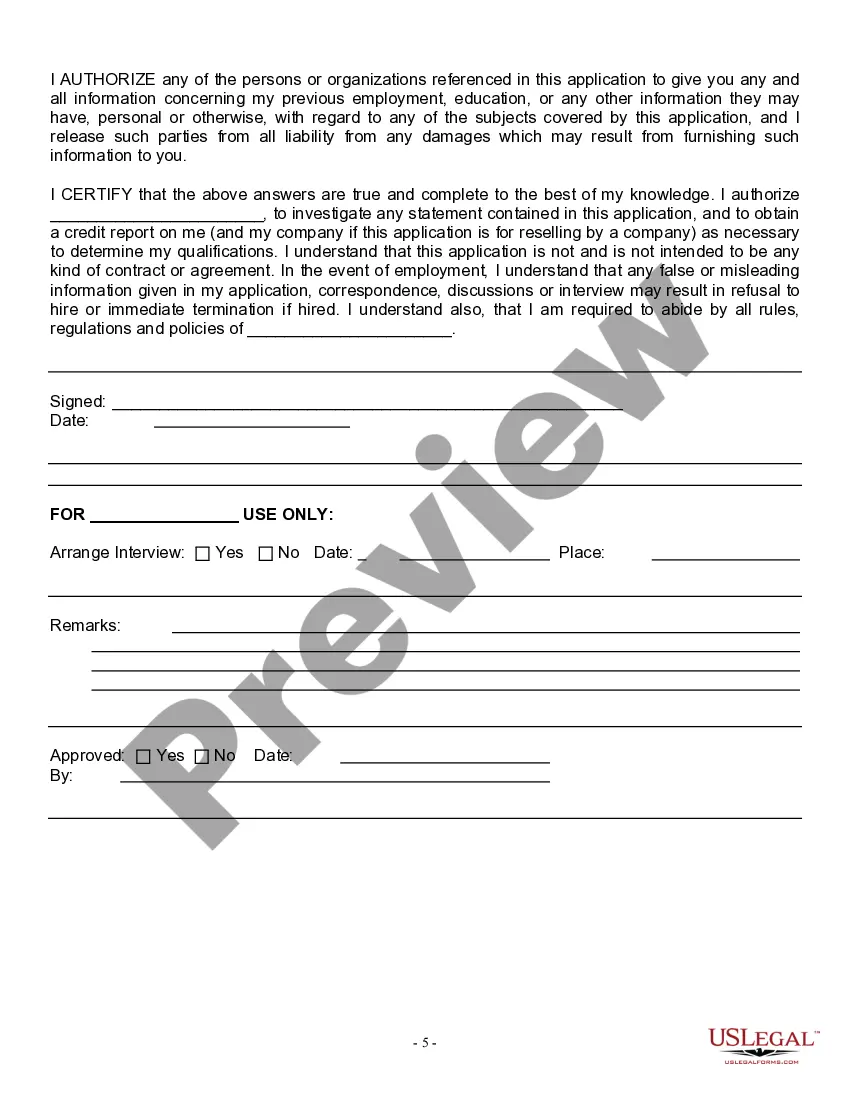

Maryland Employment Application for Waiting Staff

Description

How to fill out Employment Application For Waiting Staff?

Selecting the appropriate legal document format can be challenging.

Clearly, there are countless templates available online, but how can you find the legal document you need.

Utilize the US Legal Forms website. This service provides a wide array of templates, such as the Maryland Employment Application for Waiting Staff, suitable for both business and personal purposes.

You can view the form using the Preview button and review the form details to ensure it is the right one for you.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download button to retrieve the Maryland Employment Application for Waiting Staff.

- Use your account to view the legal documents you have previously ordered.

- Navigate to the My documents section of your account to download another copy of the document you need.

- For first-time users of US Legal Forms, here are some simple steps you should follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

The Department has also extended the deadline for jobless workers to file a claim under the PUA program through October 6, 2021. Up until that date, the Department will accept new initial claims for PUA benefits for weeks of unemployment ending between December 12, 2020, and September 4, 2021.

Maryland employers are now required by law to report, within 20 days, employment information (date hired, rate of pay, etc.)

New Hire Form (PDF)Multistate Reporting Form (PDF)W-4 Form (IRS)I-9 Form (INS)MW507- Employee's Maryland Withholding Exemption Certificate Link.

To be eligible for this benefit program, you must a resident of Maryland and meet all of the following: Unemployed, and. Worked in Maryland during the past 12 months (this period may be longer in some cases), and. Earned a minimum amount of wages determined by Maryland guidelines, and.

Salaried employees, who fit the description of "Executive," "Administrative" or "Professional," are generally exempt under the law from receiving overtime, regardless of the number of hours they are required to work in a week.

Please be assured that Maryland does not have a waiting week like many other states do. No matter when or how they file, Marylanders become eligible for benefits starting the day after they separated from employment. Your payment will be backdated to the date you became unemployed, not when your claim was processed.

You must be unemployed through no fault of your own, as defined by Maryland law. You must have earned at least a minimum amount in wages before you were unemployed. You must be able and available to work, and you must be actively seeking employment.

The adjudication process takes on average three weeks, but our department is diligently working through claims as quickly as possible to shorten that timeline. As these claims are adjudicated, some may be denied.

Benefit Amount - The weekly benefit amount is the amount of money you may receive and ranges from $50 to $430. The weekly benefit amount is based upon the amount of money you earned from your previous employers during a specific time period as well as other factors (e.g., number of dependents).

To qualify for PUA benefits, you must not be eligible for regular unemployment benefits and be unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic.