Maryland Corporate Resolution for Bank Account

Description

How to fill out Corporate Resolution For Bank Account?

You might spend time online seeking the appropriate legal document template that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms which can be reviewed by professionals.

You can easily obtain or print the Maryland Corporate Resolution for Bank Account from my service.

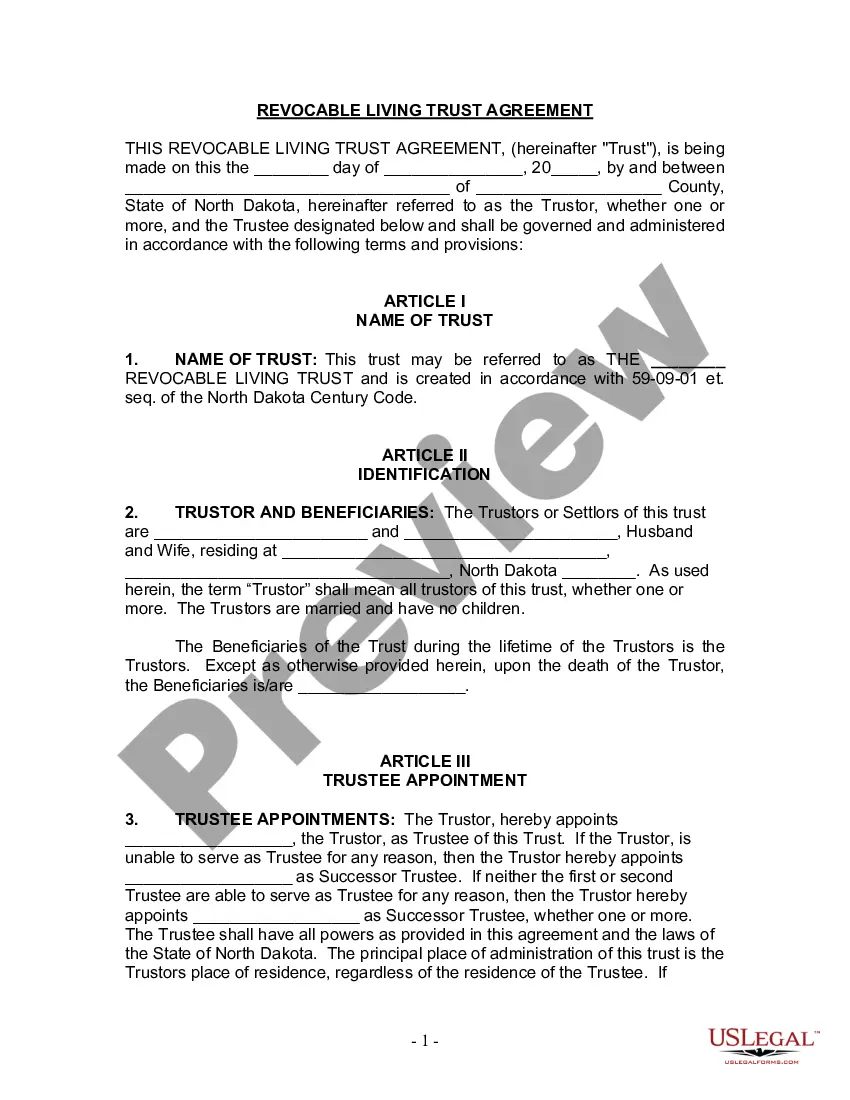

If available, utilize the Preview option to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire option.

- Then, you can complete, modify, print, or sign the Maryland Corporate Resolution for Bank Account.

- Every legal document template you receive is yours indefinitely.

- To retrieve another copy of any purchased form, visit the My documents tab and click on the corresponding option.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you've chosen the correct document template for your locality that you select.

- Refer to the form description to confirm you have chosen the correct form.

Form popularity

FAQ

What should a resolution to open a corporate bank account include?Corporation name and address.Bank name and address.Bank account number.Date of resolution.Certifying signatures and dates.Corporate seal.

The banking resolution document is drafted and adopted by a company's members or Board of Directors to define the relationship, responsibilities and privileges that the members or directors maintain with respect to the company's banking needs.

Our banking resolution is the simplest way for a company to authorize opening a bank account. A banking resolution is required to properly record company decisions and to prove to financial institutions that the person applying for an account is authorized to act on behalf of the company.

Although a company may agree on several different types of corporate resolutions during the meeting, the banking resolution is often the most commonly extracted corporate resolution from the general minutes of the meeting.

A banking resolution is a document that is used to formally authorize the opening of a company bank account. The banking resolution is drafted and adopted by the LLC members to define the roles, obligations, and privileges of each member with respect to banking activities for the company.

What should a resolution to open a corporate bank account include?Corporation name and address.Bank name and address.Bank account number.Date of resolution.Certifying signatures and dates.Corporate seal.

A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances. Corporate resolutions provide a paper trail of the decisions made by the board and the executive management team.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.