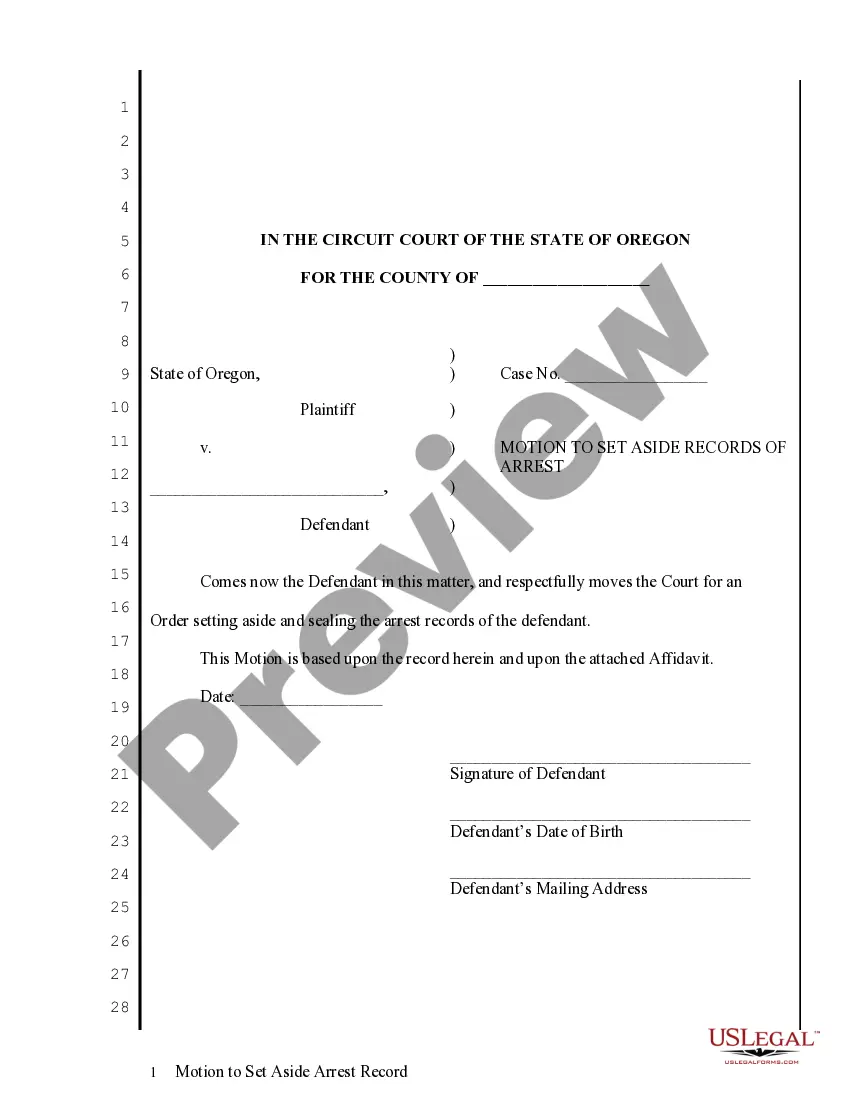

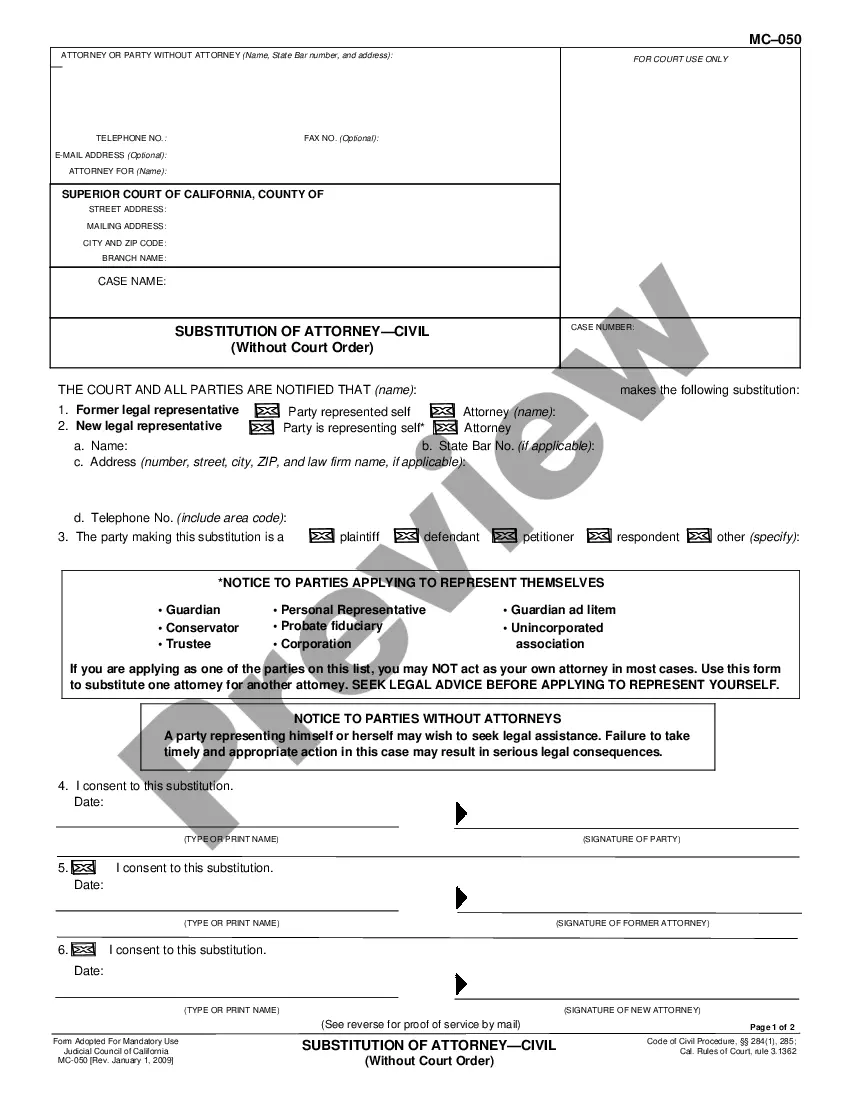

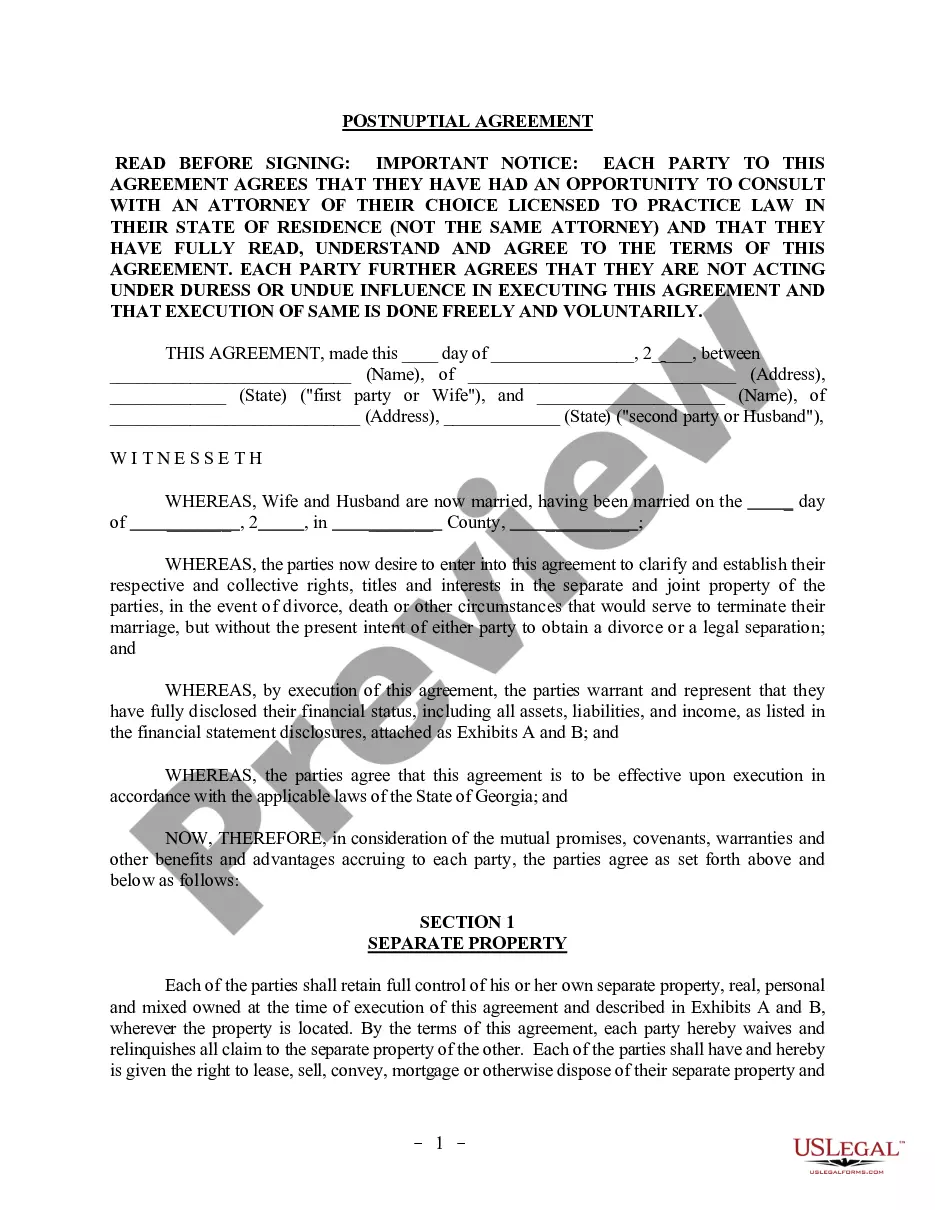

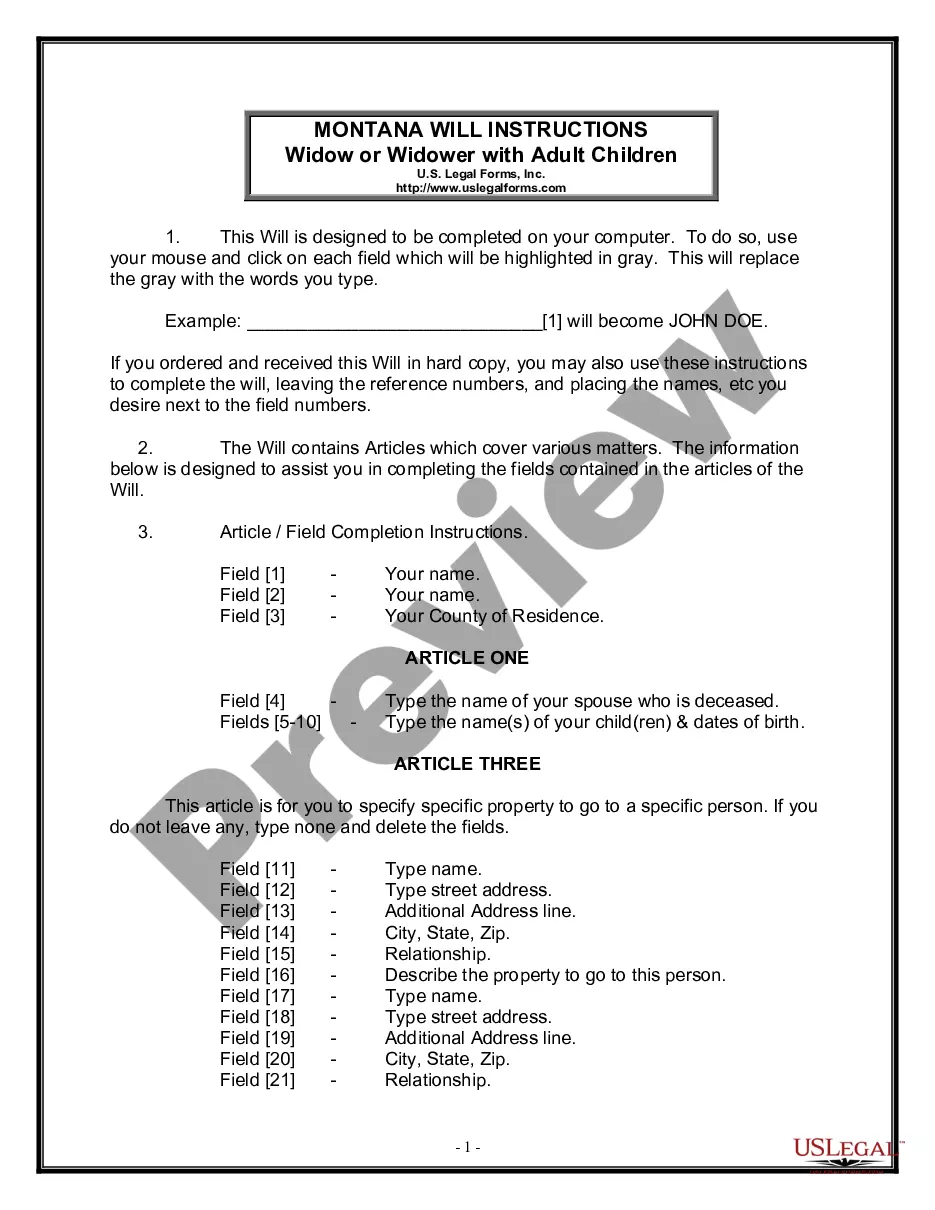

The Maryland Personal Property Tax Petition of Appeal is a form used to appeal a personal property tax assessment. The form can be used to appeal an assessment for a variety of reasons, including an incorrect assessment, incorrect property classification, or an incorrect tax rate. The petition must be filed with the local assessor's office and must be accompanied by supporting documents and evidence. There are three types of Maryland Personal Property Tax Petition of Appeal: an appeal for an incorrect assessment, an appeal for an incorrect classification, and an appeal for an incorrect tax rate. Each type of petition requires specific documentation and evidence in order to be successful.

Maryland Personal Property Tax Petition of Appeal

Description

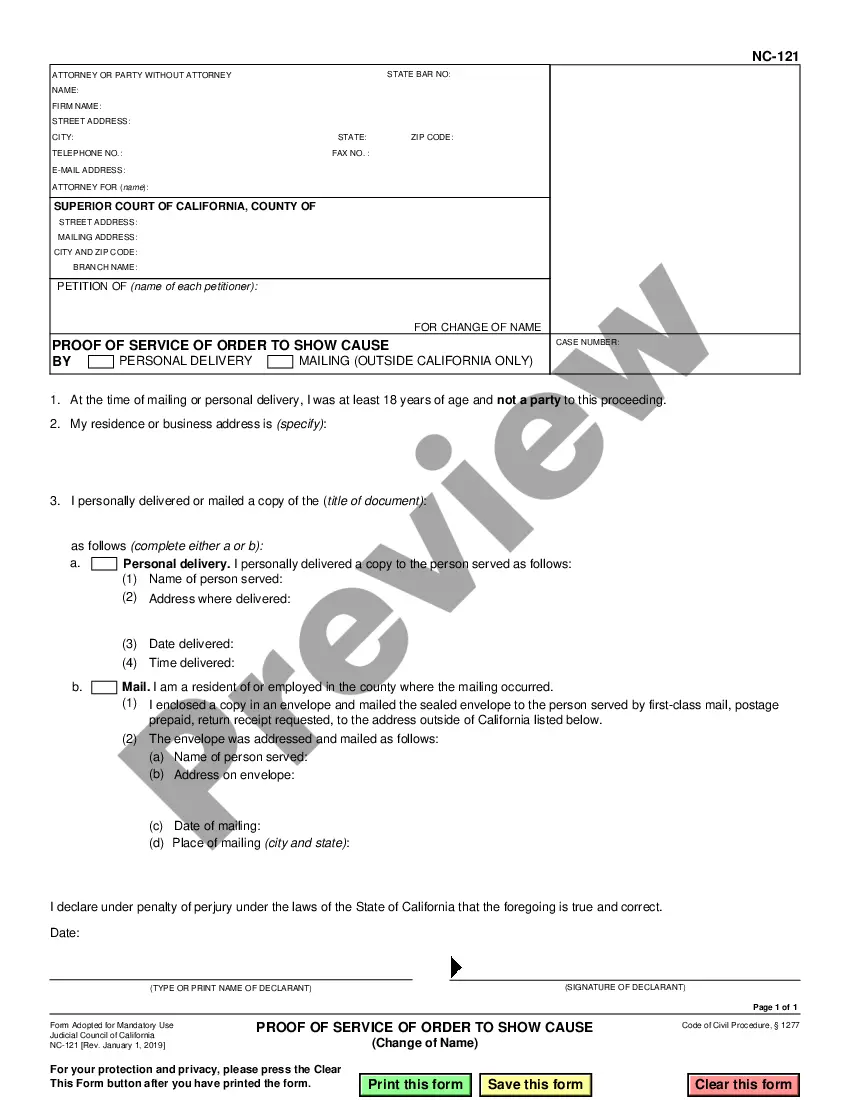

How to fill out Maryland Personal Property Tax Petition Of Appeal?

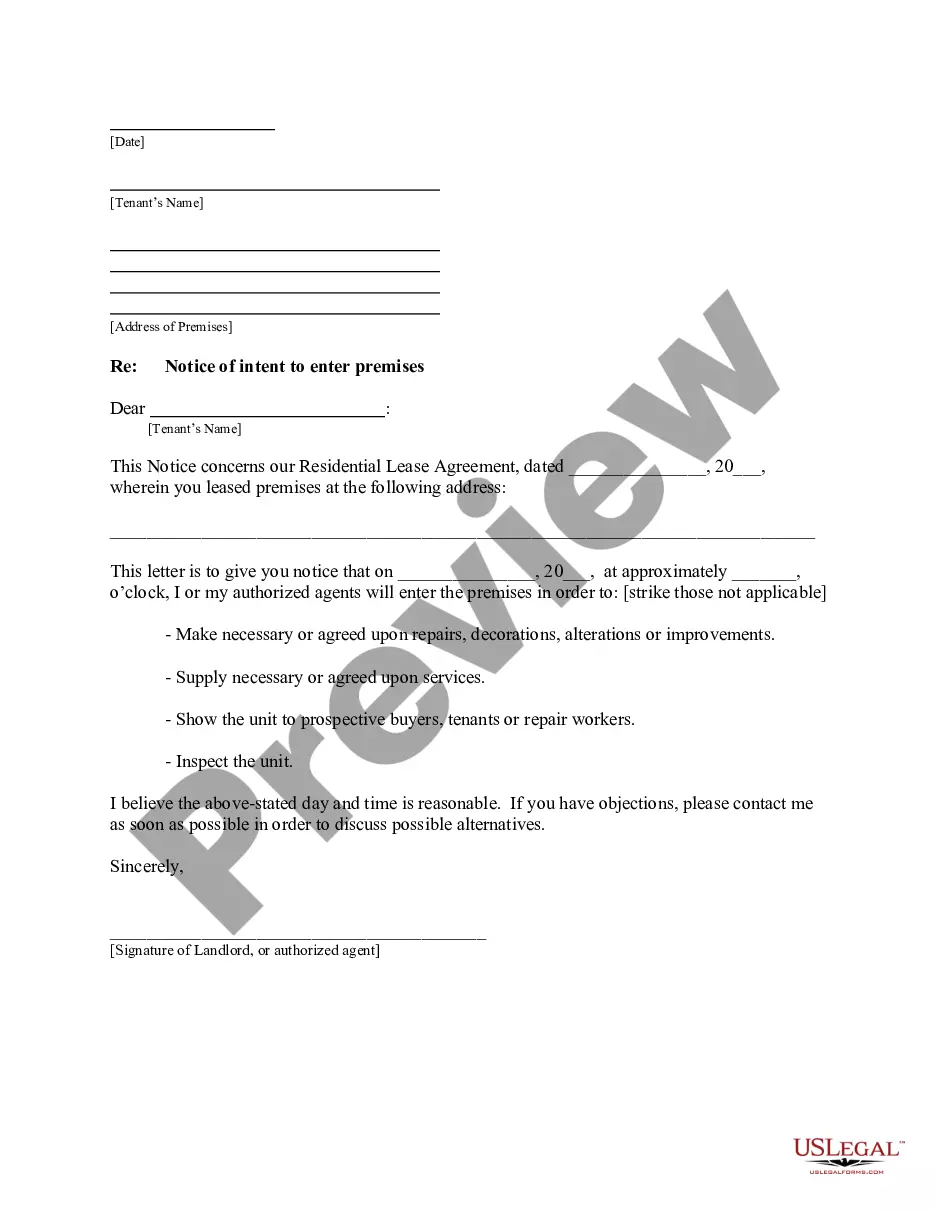

How much time and resources do you typically spend on composing official paperwork? There’s a greater option to get such forms than hiring legal experts or spending hours searching the web for an appropriate template. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, including the Maryland Personal Property Tax Petition of Appeal.

To obtain and prepare an appropriate Maryland Personal Property Tax Petition of Appeal template, adhere to these simple steps:

- Look through the form content to ensure it meets your state requirements. To do so, read the form description or use the Preview option.

- In case your legal template doesn’t satisfy your needs, locate a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Maryland Personal Property Tax Petition of Appeal. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Select the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely reliable for that.

- Download your Maryland Personal Property Tax Petition of Appeal on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you securely keep in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most trustworthy web solutions. Join us now!

Form popularity

FAQ

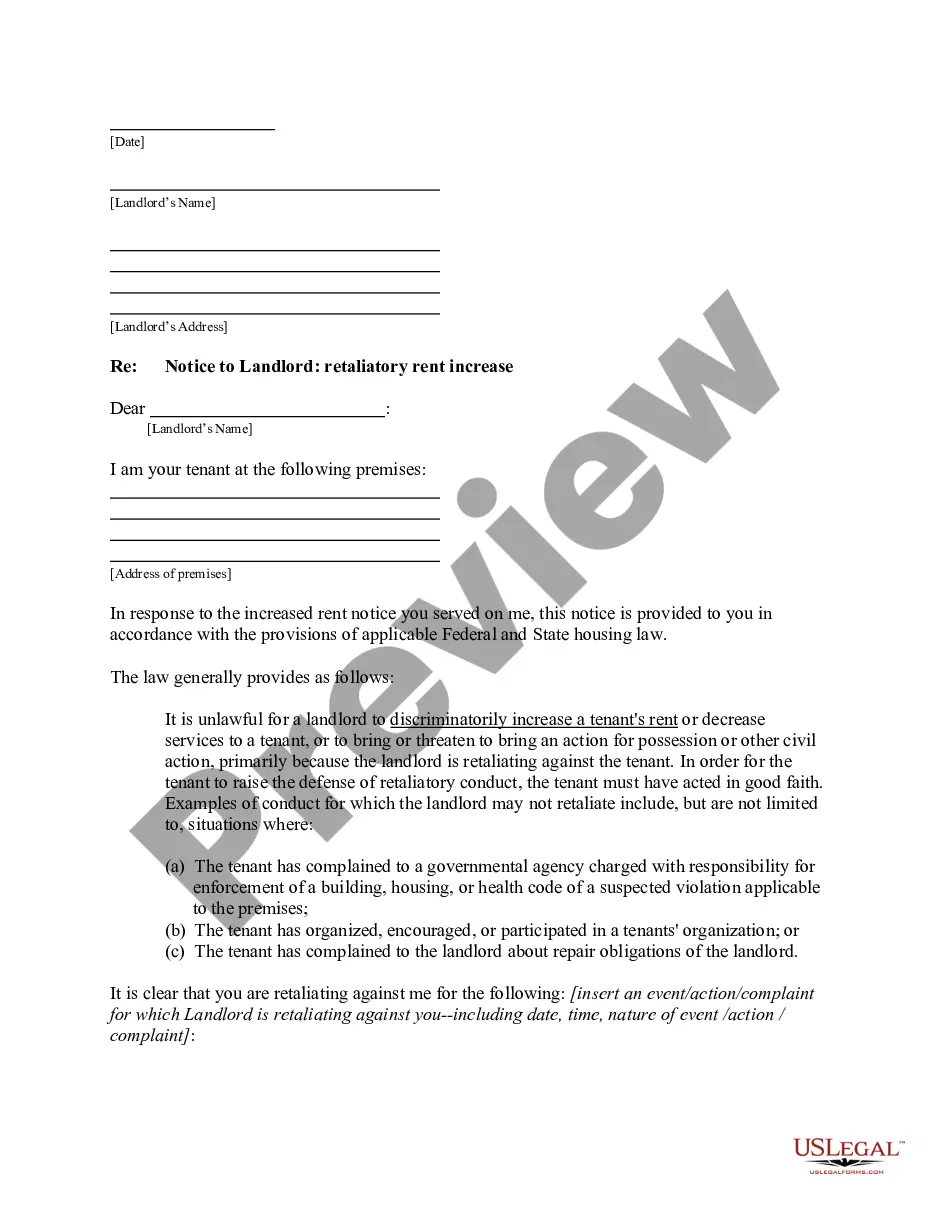

You must be present at the Maryland Tax Court appeal (no written hearings). There are no fees for filing an appeal to this level; hearings at this level are de novo, meaning nothing prior is considered. The Hearing date, time, and location are determined by the Clerk to the Maryland Tax Court.

A taxpayer may call the Clerk's office to request the forms be sent or the forms can be downloaded from this site. Please note there is no system in place at this time for the electronic filing of Petitions of Appeal. All Petitions must be either mailed or delivered to the Tax Court's Baltimore address.

Penalty charges for late payments can be up to 25 percent of the amount of tax you owe.

Be at least 65 years of age.

Welcome to the Comptroller's Online Appeal Request system. As a taxpayer, you have the right to file an appeal if you receive the following: A notice of assessment for a tax, fee, interest or penalty charge; or. A notice denying your refund.

You can file your appeal in one of the following ways. Request an Appeal Online at the Maryland Online Hearing Appeal Request system. Request an Appeal by E-mail by sending it to cdhearings@marylandtaxes.gov.

Tax appeals are a common way to resolve disagreements you have with the IRS that relate to items you report on your return. If you decide to go this route, there are procedures you must follow to insure you retain your right to an appeal.