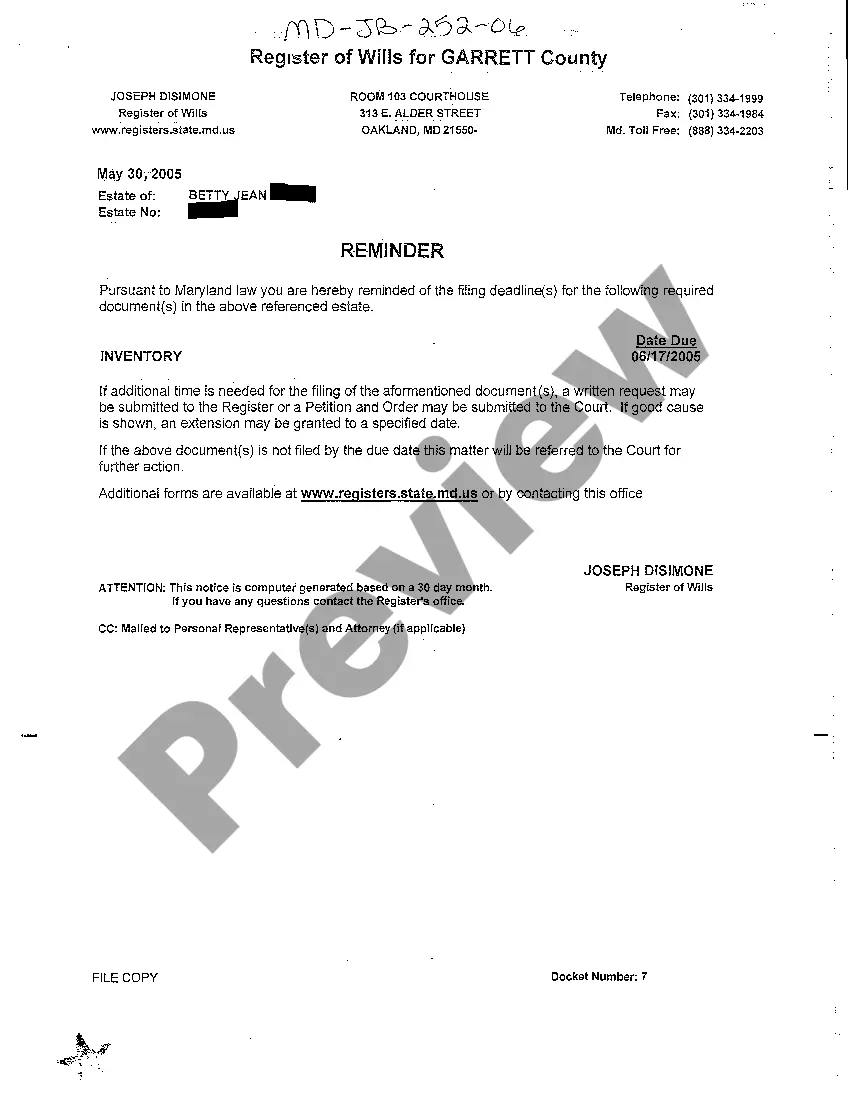

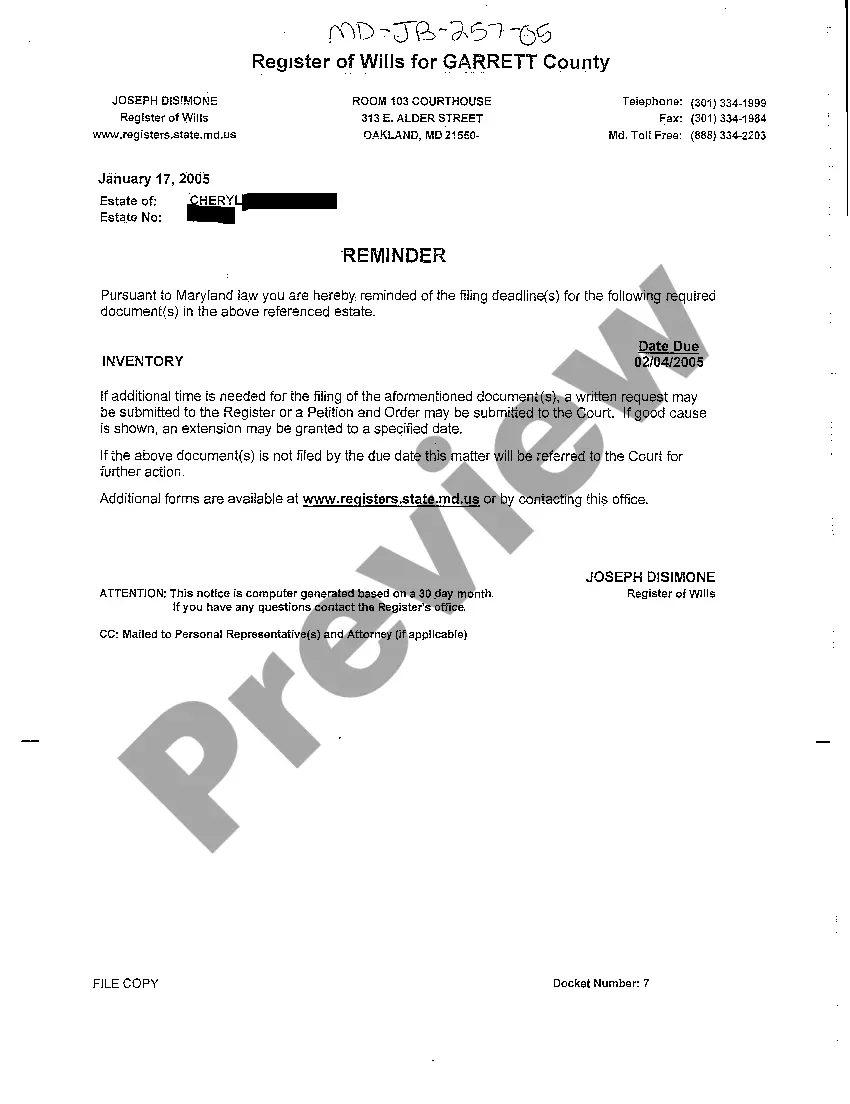

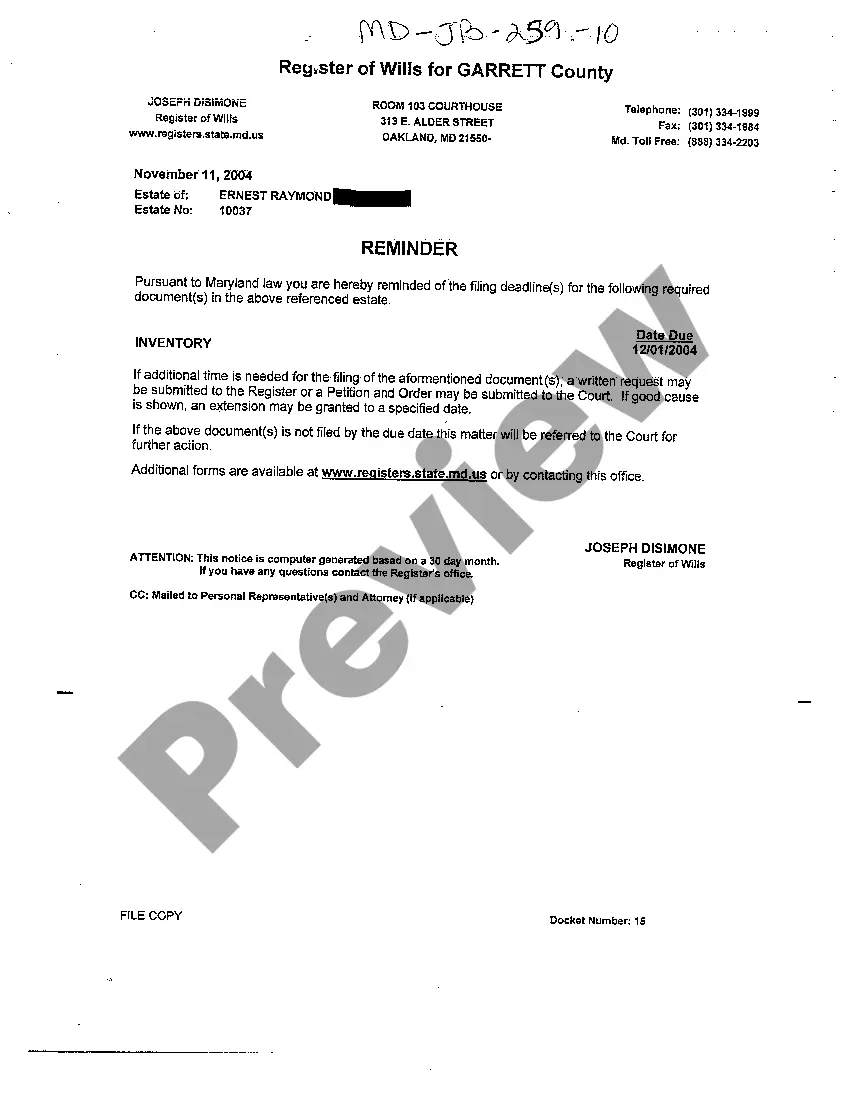

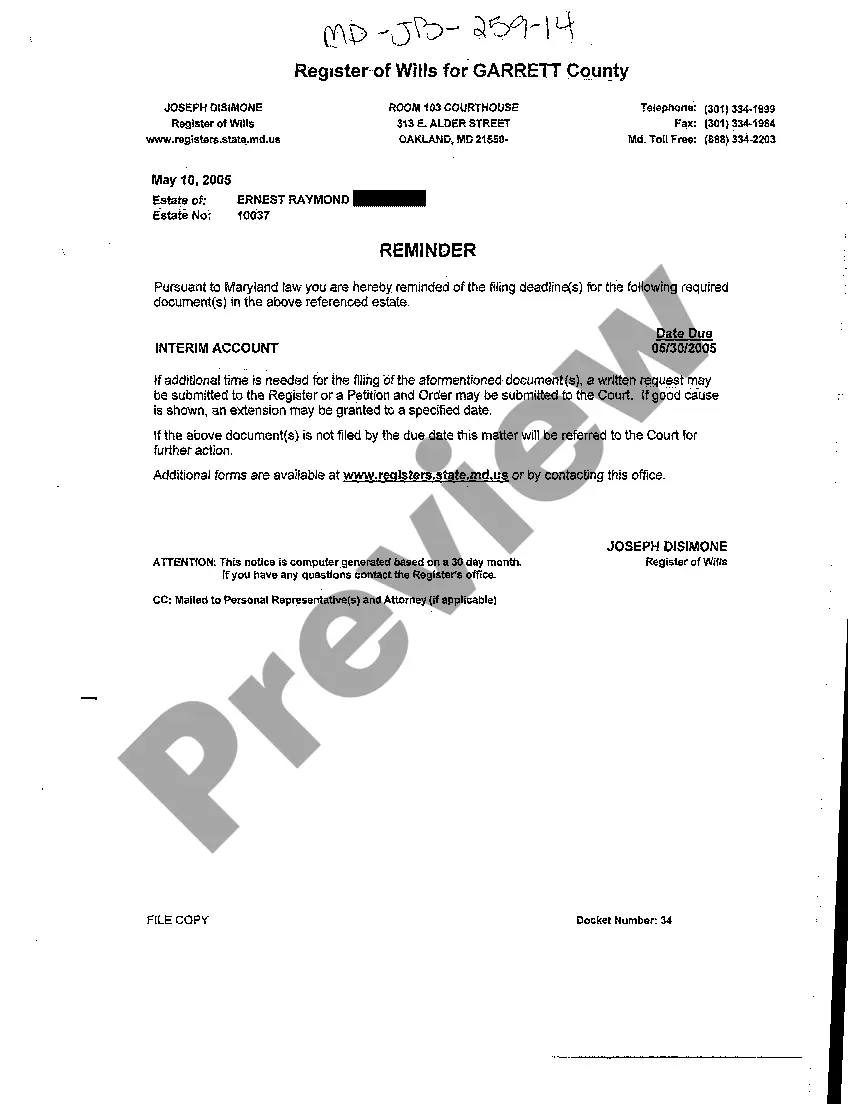

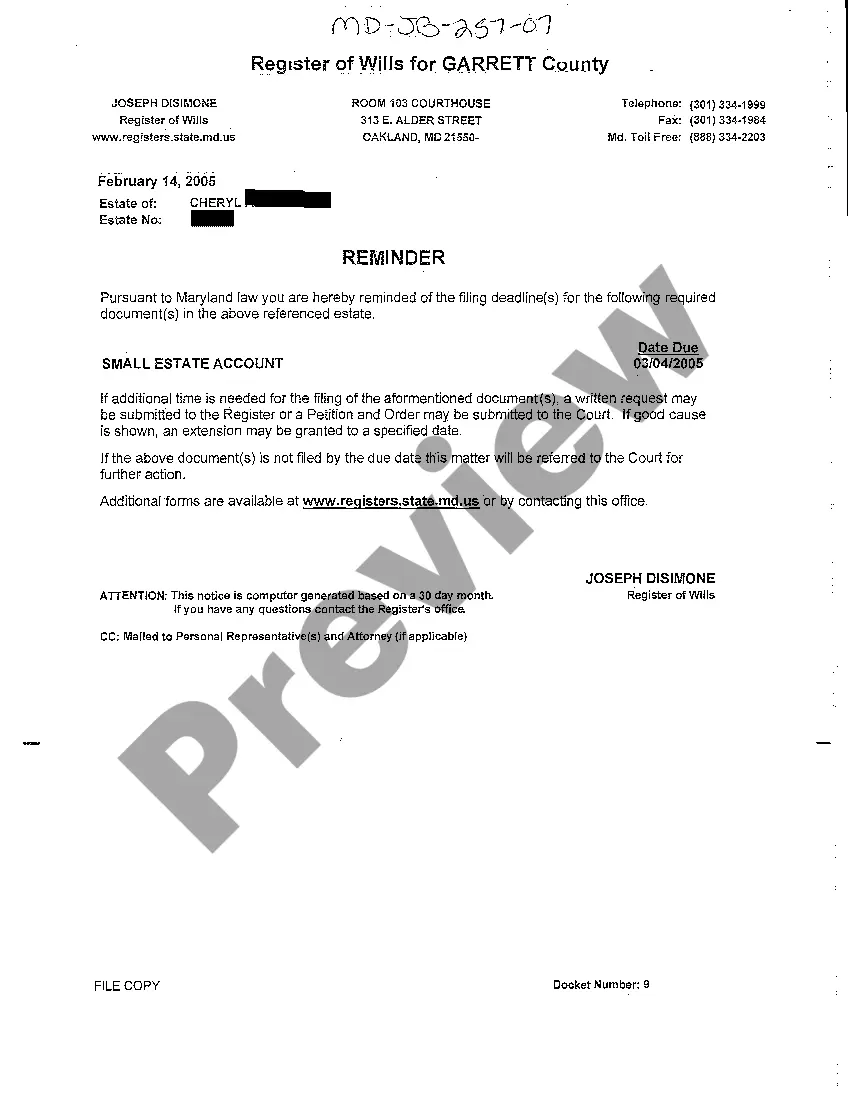

Maryland Reminder of Deadline for Filing Small Estate Account

Description

How to fill out Maryland Reminder Of Deadline For Filing Small Estate Account?

You are invited to the most essential legal documentation library, US Legal Forms.

Here you can discover any template, including Maryland Reminder of Deadline for Filing Small Estate Account templates, and download them (as many as you desire).

Create official documents in a matter of hours, rather than days or weeks, without having to spend a fortune on a legal expert.

If the document aligns with your needs, simply click Buy Now. To set up an account, select a pricing plan. Register using a credit card or PayPal account. Download the file in your preferred format (Word or PDF). Print the document and complete it with your or your business’s details. After you’ve filled out the Maryland Reminder of Deadline for Filing Small Estate Account, forward it to your legal advisor for confirmation. It's an additional step but an essential one to ensure you are fully protected. Join US Legal Forms now and gain access to thousands of reusable templates.

- Obtain the state-specific template in a few clicks and rest assured knowing it was authored by our state-certified legal attorneys.

- If you’re already a registered user, simply Log In to your account and click Download beside the Maryland Reminder of Deadline for Filing Small Estate Account you wish.

- Because US Legal Forms is internet-based, you will always have access to your saved templates, regardless of the device you’re using.

- Locate them within the My documents section.

- If you haven’t created an account yet, what are you waiting for.

- Follow our guidelines below to get started.

- If this is a document specific to your state, verify its validity in the state where you reside.

- Review the description (if available) to ensure it’s the correct template.

Form popularity

FAQ

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

An executor acts until the estate administration is completed or if they resign, die or are removed for cause.

Is there a time limit on applying for probate? Though there is no time limit on the probate application itself, there are aspects of the process which do have time scales. Inheritance tax for example, is a very important part of attaining probate in the first place and must be done within 6 months of date of death.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

In NSW you have 12 months from the date of death to lodge a claim in court.

Closing the bank account typically is the last step after the court or beneficiaries have approved the executor's accounting and the estate is ready to close. There may be a few final bills requiring payment, such as compensation to the executor for her services.

Step 1, Determine whether You are the Personal Representative. Step 2, Petition to Probate the Estate. Step 3, Make an Inventory of the Estate. Step 4, Assess any projected Inheritance Taxes. Step 5, Consolidate the Estate and Manage Expenses.

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.

If an estate is not properly probated and closed in a timely manner, there may be a number of consequences that can jeopardize the estate: The statute of limitations for creditors' claims is extended. Assets may lose value or be lost altogether. The state may claim the assets.