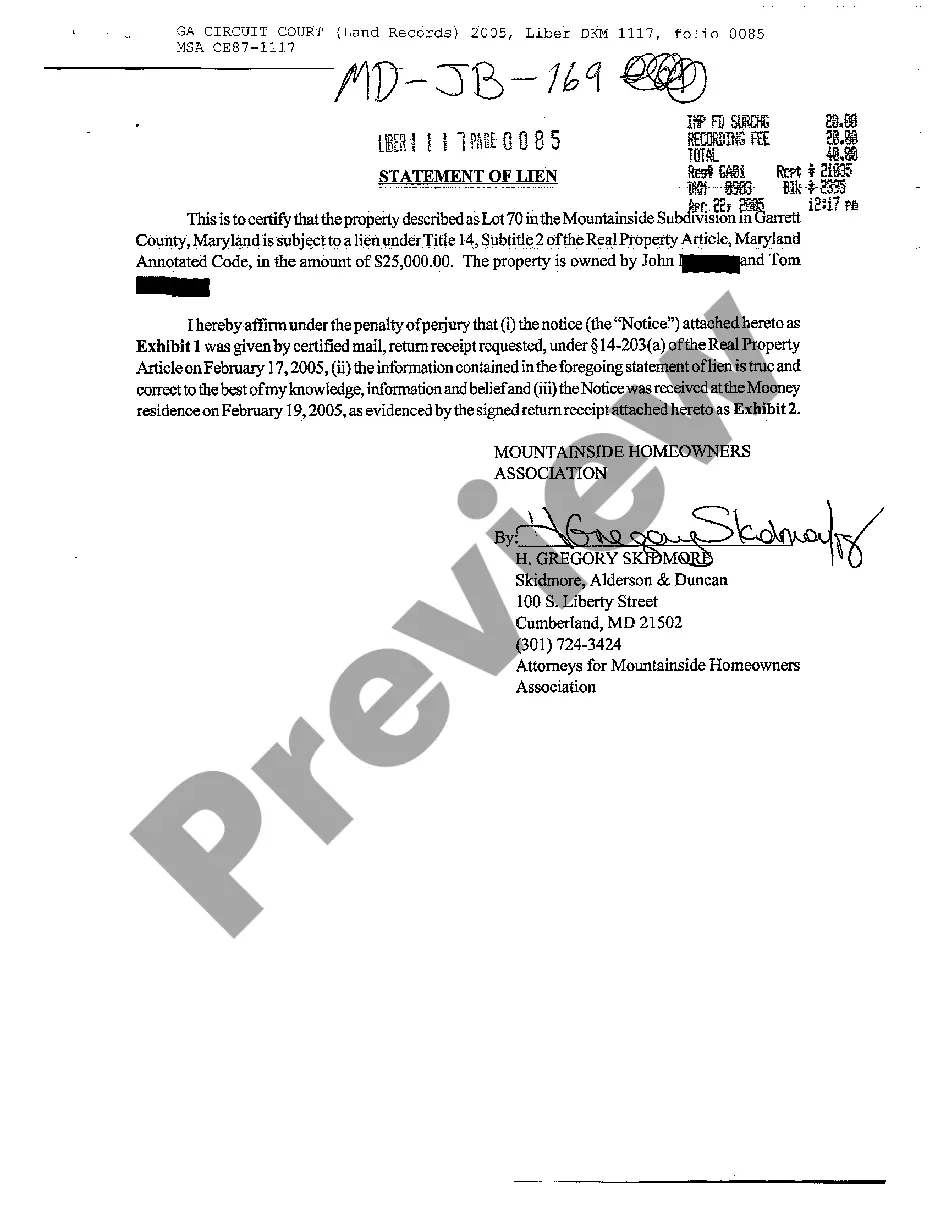

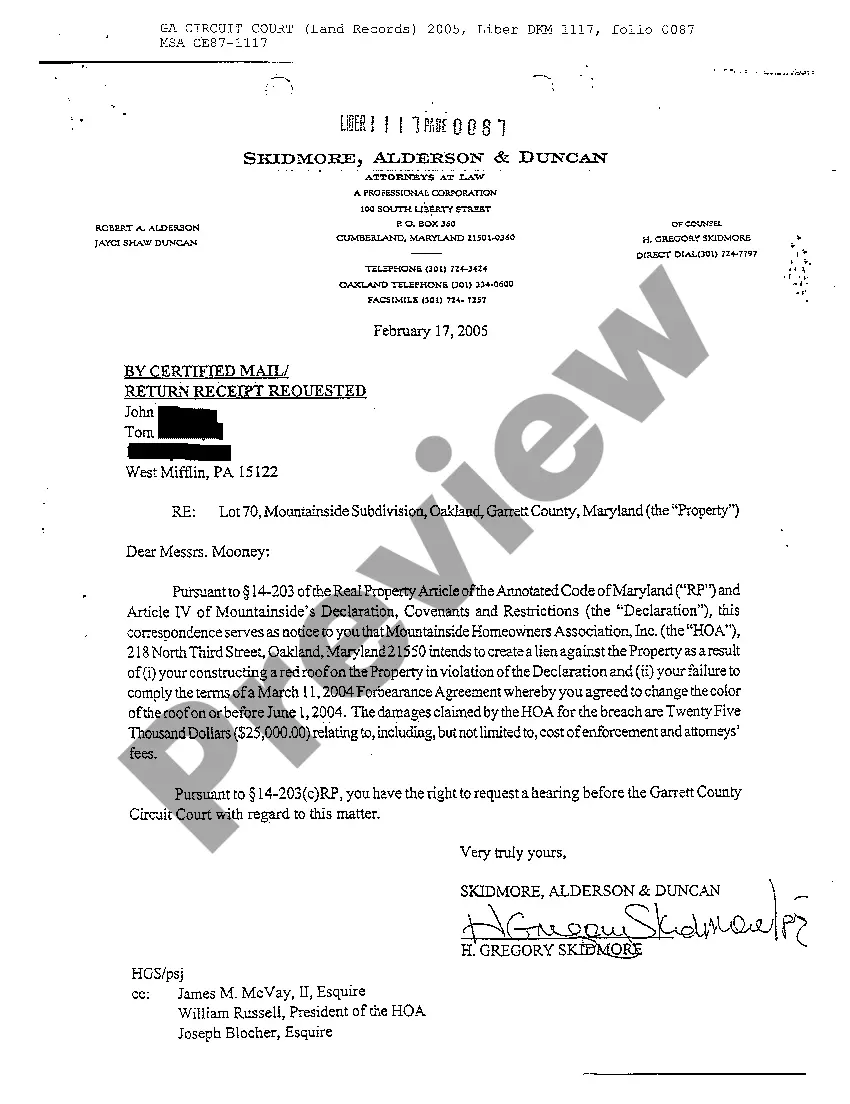

Maryland Statement of Lien

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Statement Of Lien?

Greetings to the most crucial legal documents archive, US Legal Forms. Here you can obtain any template including Maryland Statement of Lien forms and download them (as numerous as you wish/require). Prepare formal documents in several hours, instead of days or even weeks, without having to spend a fortune with a lawyer. Acquire your state-specific form in a few clicks and feel confident knowing that it was crafted by our certified attorneys.

If you’re already a registered user, just Log In to your account and click Download next to the Maryland Statement of Lien you require. Since US Legal Forms is online-based, you’ll typically have access to your saved templates, regardless of the device you’re using. Find them within the My documents section.

If you haven't created an account yet, what are you waiting for? Follow our instructions below to get started.

Once you’ve completed the Maryland Statement of Lien, submit it to your attorney for verification. It’s an extra step but an important one to ensure you’re fully protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- If this is a state-specific form, verify its validity in your state.

- Review the description (if available) to determine if it’s the suitable template.

- View additional content with the Preview feature.

- If the document meets all of your requirements, simply click Buy Now.

- To create your account, select a pricing plan.

- Utilize a credit card or PayPal account to register.

- Save the document in the format you prefer (Word or PDF).

- Print the file and fill it with your or your business’s details.

Form popularity

FAQ

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials. It can be difficult to determine the work completion date.

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

How long does a judgment lien last in Maryland? A judgment lien in Maryland will remain attached to the debtor's property (even if the property changes hands) for 12 years.

There, a construction lien on a commercial project must be filed with a county clerk within 90 days of the last day services or materials were provided. Filing a construction lien on residential projects requires filing a Notice of Unpaid Balance and Right to File Lien within 90 days of the last day of service.

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials. It can be difficult to determine the work completion date.

You may apply for a clear title in person at any of the MVA's full-service branch offices or by mail to the MVA's title file unit. You must submit the Maryland Notice of Security Interest Filing (SIF) and/or the lien release letter you received, plus the current title for your vehicle.

Liens against property can be recorded at the Department of Land Records alongside deeds. Search for liens online using Maryland Land Records (mdlandrec.net). Some liens come from court judgments. Unpaid taxes on the property may result in a lien.

How long does a judgment lien last in Maryland? A judgment lien in Maryland will remain attached to the debtor's property (even if the property changes hands) for 12 years.