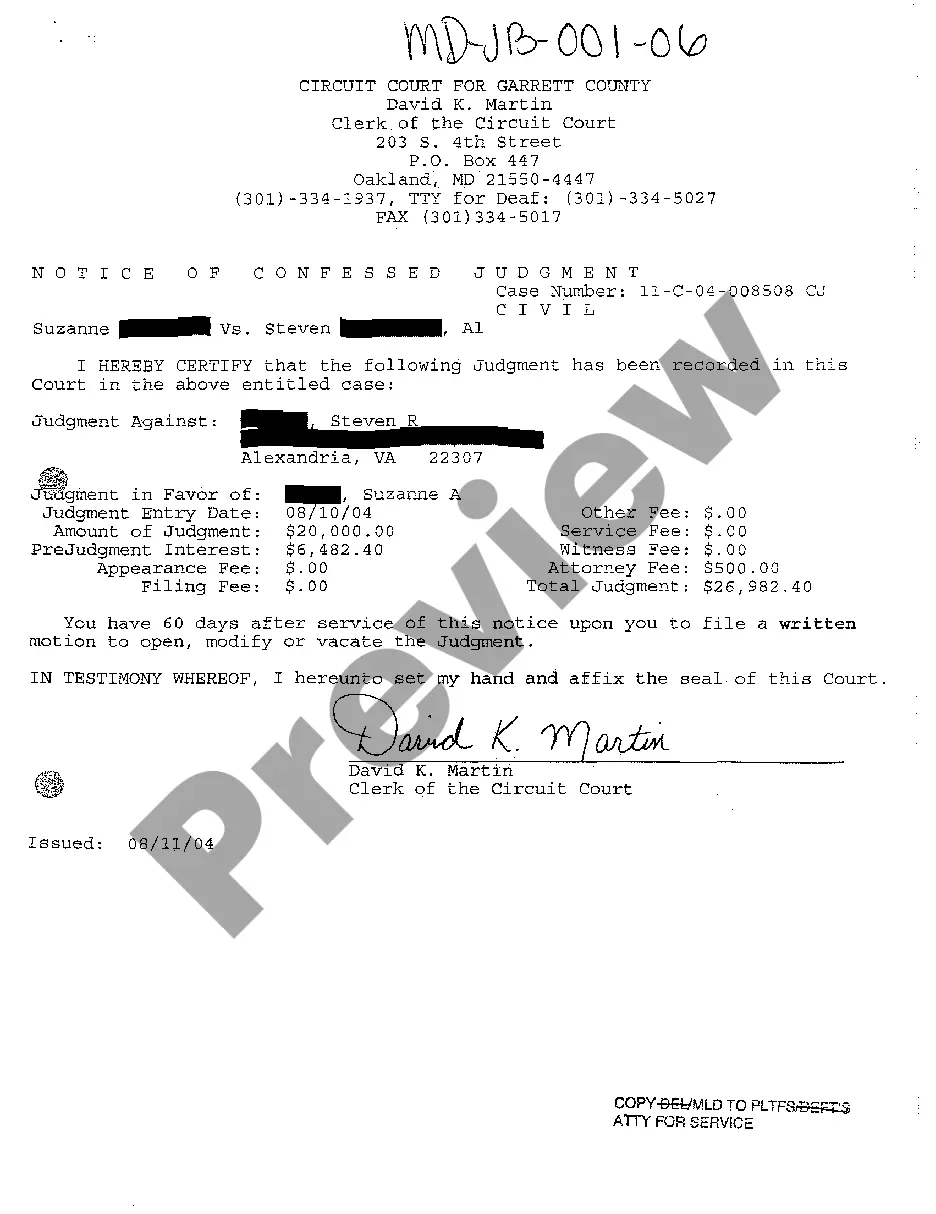

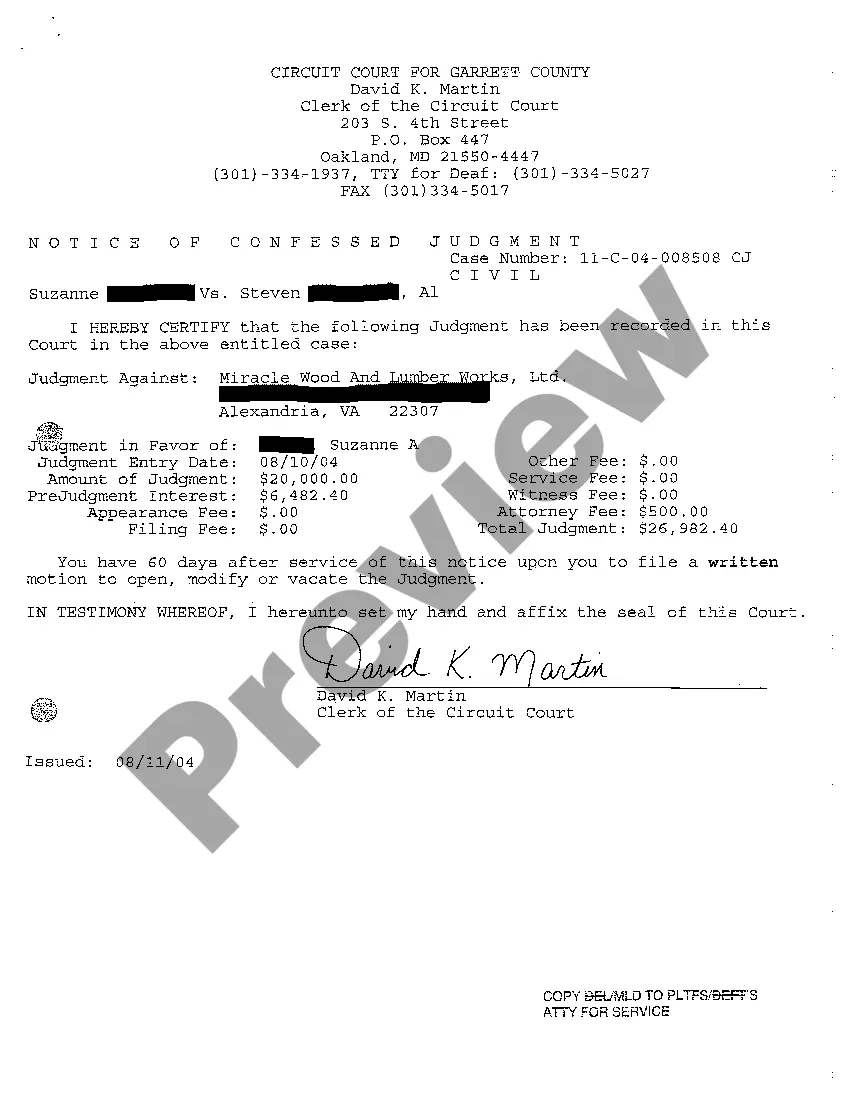

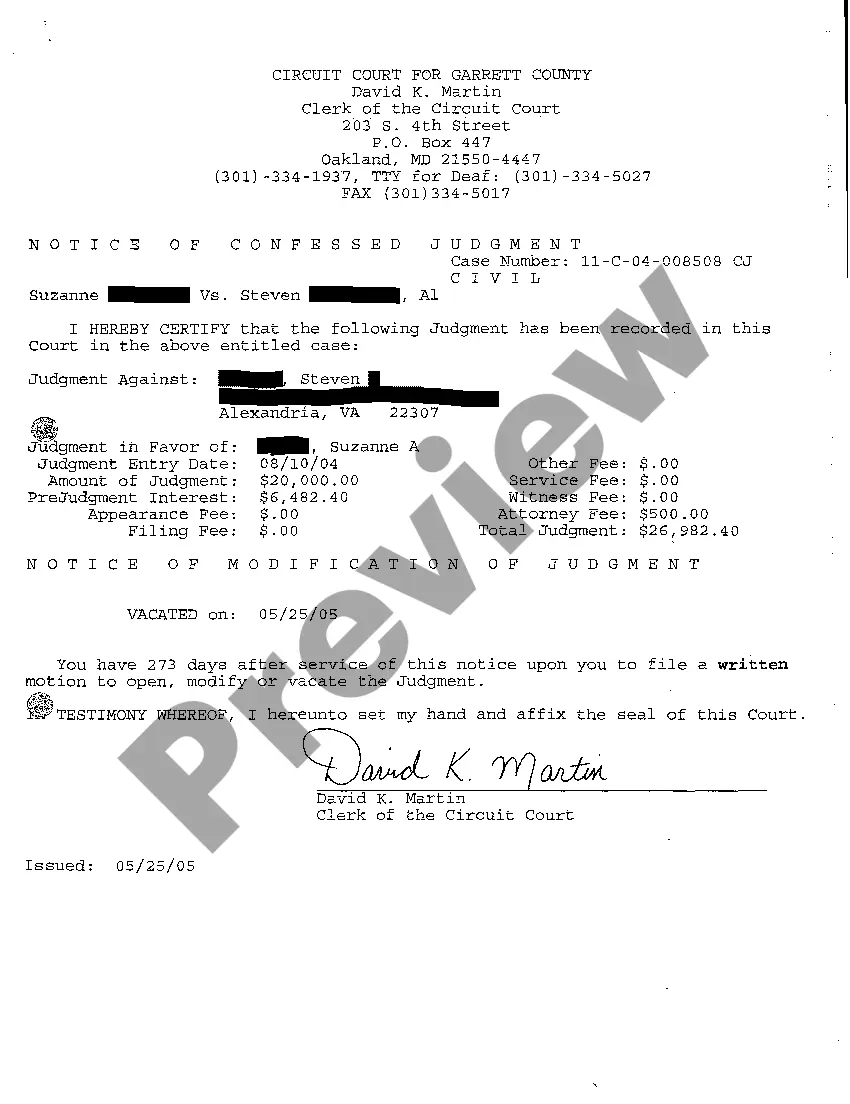

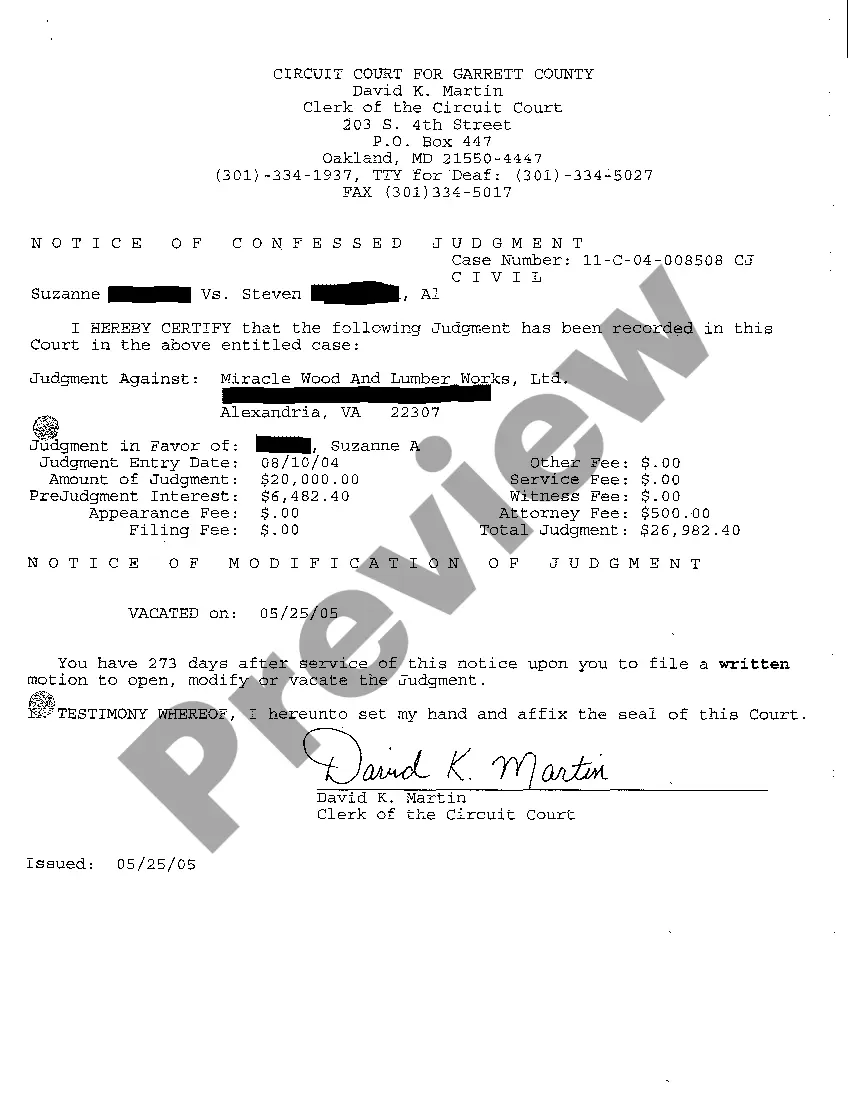

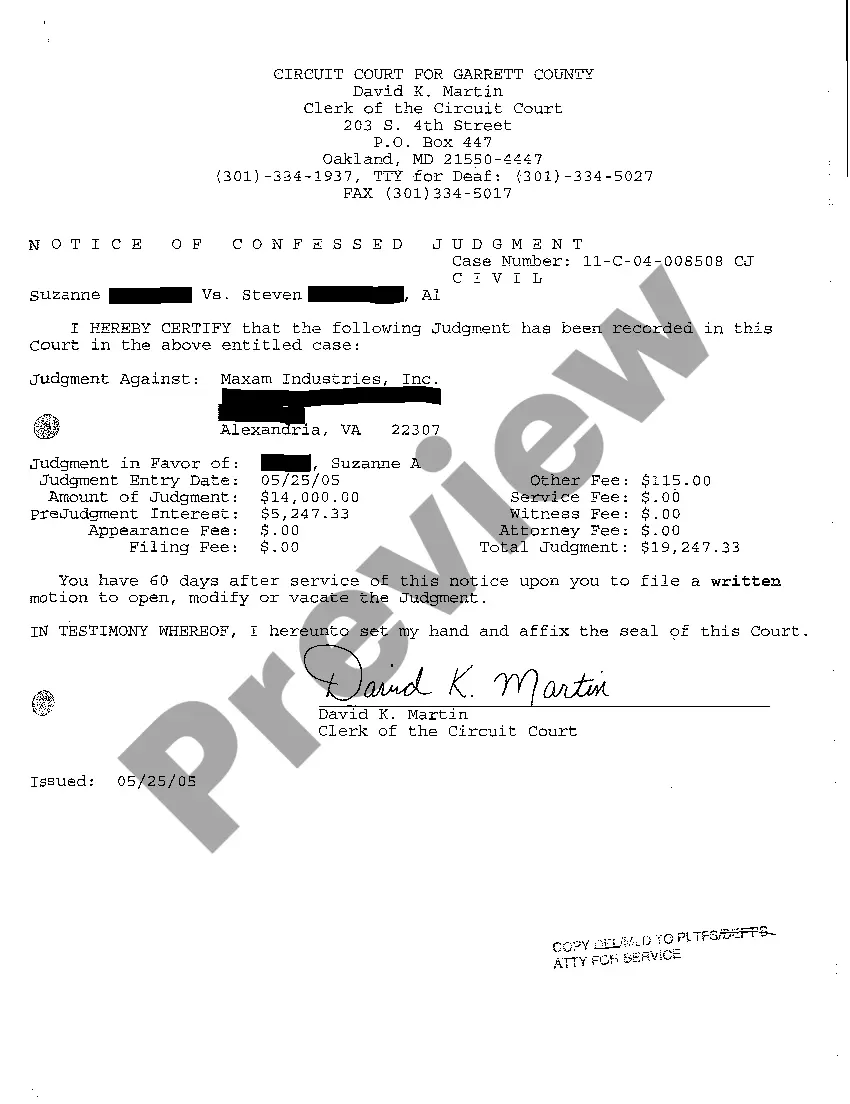

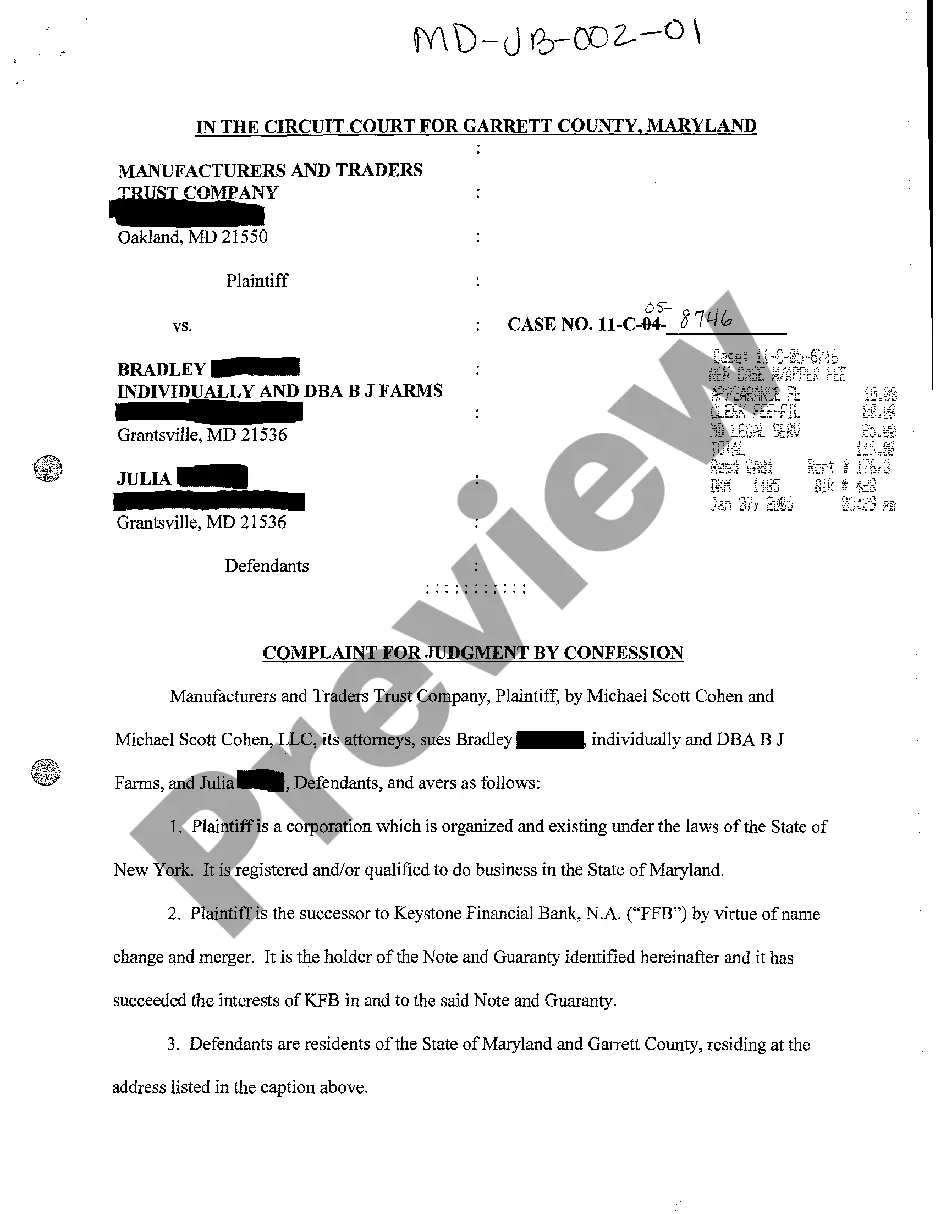

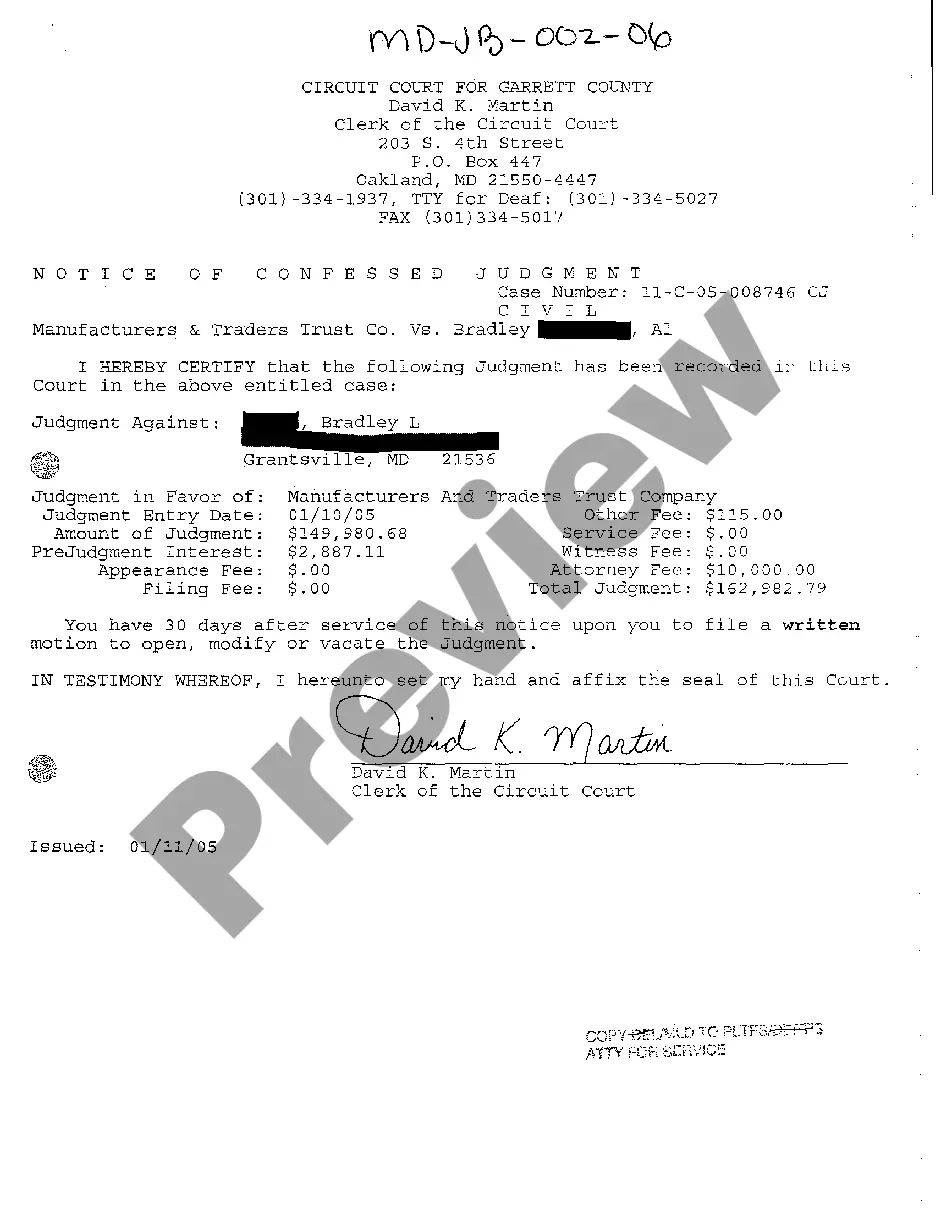

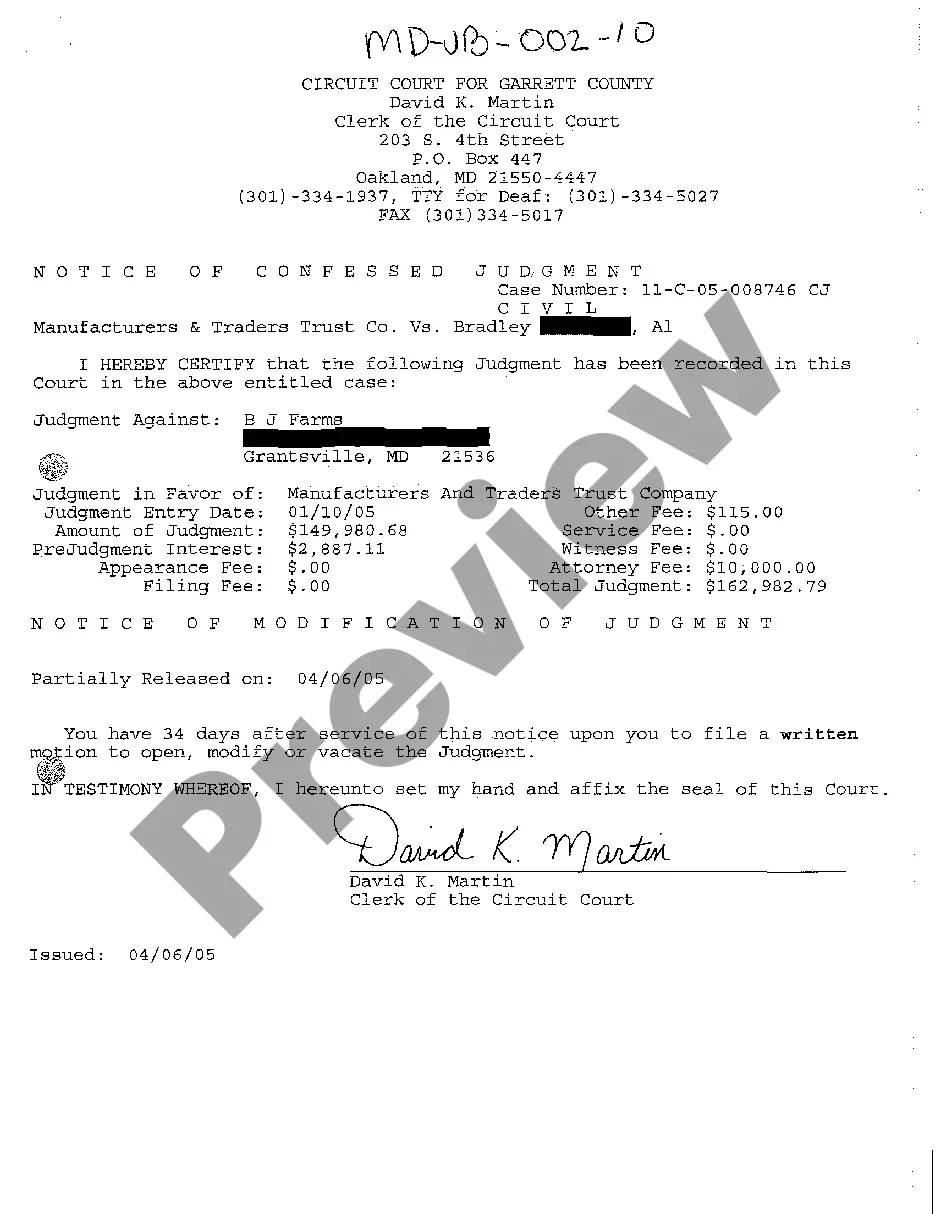

Maryland Notice of Confessed Judgment

Description

How to fill out Maryland Notice Of Confessed Judgment?

You are invited to the most important legal documents library, US Legal Forms.

Here you can acquire any template such as Maryland Notice of Confessed Judgment forms and retain them (as many as you desire/need).

Create official documents within a few hours, instead of days or even weeks, without having to spend a fortune on a lawyer.

Once you’ve completed the Maryland Notice of Confessed Judgment, send it to your attorney for validation. While it’s an extra step, it’s essential for ensuring you’re fully protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- Obtain the state-specific template in just a few clicks.

- Feel assured knowing it was created by our skilled attorneys.

- If you’re already a registered user, just Log Into your account and click Download next to the Maryland Notice of Confessed Judgment you need.

- Since US Legal Forms is online, you’ll typically have access to your downloaded forms, no matter the device you’re using.

- Find them within the My documents section.

- If you haven’t created an account yet, what are you waiting for.

- Follow our guidelines below to start.

- If this is a document specific to your state, verify its applicability in your state.

Form popularity

FAQ

Fighting a confession of judgment requires a solid understanding of your rights under Maryland law. You can argue that the confession was obtained improperly, or that it does not comply with the legal standards set forth in the Maryland Notice of Confessed Judgment. Consulting with a knowledgeable attorney can provide you with the insights needed to challenge the judgment effectively. Additionally, platforms like US Legal Forms can assist you in finding the necessary legal documents and guidance for your case.

To file a motion to vacate a judgment in Maryland, you must submit a formal request to the court that issued the judgment. This motion typically needs to state valid grounds for vacating the judgment, such as lack of notice or a mistake. Utilizing resources like uslegalforms can provide the necessary forms and guidance to navigate the process related to Maryland Notice of Confessed Judgment.

Confessed judgment refers to a legal admission by a debtor that they owe a certain amount to a creditor, enabling the creditor to obtain a judgment swiftly. This agreement is typically embedded in a contract, allowing the creditor to bypass the trial process. It is crucial to recognize the implications of confessed judgment, especially in the context of Maryland Notice of Confessed Judgment.

The final judgment rule in Maryland holds that a court's decision can be considered final if it resolves all issues between the parties involved. This means that any appeal must be made after this final judgment is issued. Understanding this rule can help you navigate situations involving Maryland Notice of Confessed Judgment effectively.

A judgment is good for 20 years, but if the plaintiff wants to enforce the judgment against land it is only good for 10 years unless the plaintiff renews it for another 10 years.

A Motion to Vacate is a written request, filed with the Clerk's office, asking the court to undo the order of default and allow you to defend the case. In the motion, you must show the judge a good reason to allow your request and vacate the default. You must tell the judge why you did not file your response in time.

In Maryland, a judgment is only valid for 12 years. If you have not been able to collect your judgment within that time, you will have to renew the judgment to continue your collection efforts.

A confession of judgment is a written agreement, signed by the defendant, that accepts the liability and amount of damages that was agreed on.Signing such a confession of forfeits any of the rights the defendant has to dispute the claim in the future.

The three-year shelf-life of affidavits of confession of judgment is sometimes overlooked by practitioners and is important to bear in mind.

Upon service, the Garnishee has 30 days to file a Confession of Assets with the court which lists any debtor assets held.Shortly thereafter, a judge rules on the request and if decided in your favor, the bank turns over debtor funds to you.