This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the standard lease form.

Massachusetts Shut-In Oil Royalty

Description

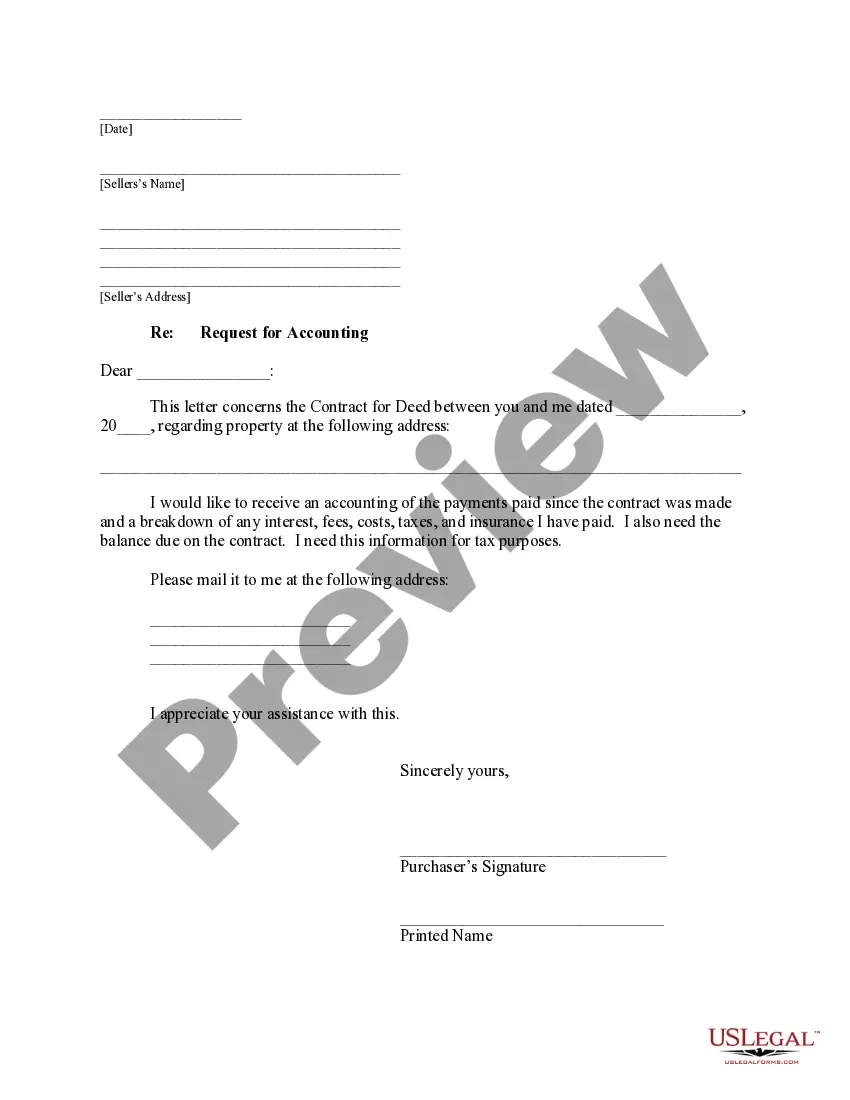

How to fill out Shut-In Oil Royalty?

US Legal Forms - among the largest libraries of authorized kinds in the USA - gives a wide range of authorized file layouts you may obtain or print out. While using site, you will get a huge number of kinds for enterprise and specific functions, categorized by groups, says, or keywords.You will find the latest variations of kinds such as the Massachusetts Shut-In Oil Royalty in seconds.

If you currently have a membership, log in and obtain Massachusetts Shut-In Oil Royalty through the US Legal Forms library. The Acquire switch will show up on each develop you see. You gain access to all formerly saved kinds from the My Forms tab of your respective account.

In order to use US Legal Forms initially, allow me to share simple directions to get you started off:

- Ensure you have picked out the right develop for the area/state. Select the Review switch to analyze the form`s content material. Look at the develop description to ensure that you have selected the proper develop.

- If the develop does not fit your specifications, make use of the Lookup field at the top of the display screen to obtain the the one that does.

- If you are pleased with the form, affirm your choice by clicking the Buy now switch. Then, opt for the rates program you want and give your credentials to sign up for the account.

- Approach the financial transaction. Make use of credit card or PayPal account to accomplish the financial transaction.

- Pick the file format and obtain the form on the product.

- Make alterations. Fill out, edit and print out and sign the saved Massachusetts Shut-In Oil Royalty.

Each and every format you put into your money does not have an expiry day which is yours permanently. So, if you want to obtain or print out another copy, just go to the My Forms area and click on about the develop you want.

Obtain access to the Massachusetts Shut-In Oil Royalty with US Legal Forms, the most substantial library of authorized file layouts. Use a huge number of professional and express-specific layouts that meet your organization or specific requirements and specifications.

Form popularity

FAQ

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

The Federal onshore oil and gas rate is 16.67% for leases issued after August 16, 2022. However, there are a few exceptions, including different royalty rates on older leases, reduced royalty rates on certain oil leases with declining production, and increased royalty rates for reinstated leases.

A clause in an oil & gas lease that allows a lessee to keep the lease in effect past the primary term by substituting payment of shut-in royalty for actual production.

Investors who receive royalty income will get the payments as long as a copyright, patent, trademark, mine, oil well or other source is generating income. This makes royalties a potential source of long-term and relatively stable income.

The royalty rate is negotiated between the owner of the mineral rights and the company extracting the oil and gas, and can range from 12.5% to 25% of the production value. Royalties are an important source of income for landowners who have mineral rights.

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.

Oil & Gas Production Date or Month Your royalty checks will arrive 2-3 months after production begins, as there is a tremendous amount of accounting and production sales information that require delayed payments. After you receive your first payment, you will then receive them monthly.

Traditionally 12.5%, but more recently around 18% ? 25%. The percentage varies upon how well the landowner negotiated and how expensive the oil company expects the extraction of oil and gas to be.