Massachusetts Partial Release of Liens for Notes and Security Agreements

Description

How to fill out Partial Release Of Liens For Notes And Security Agreements?

Finding the right legal papers web template might be a battle. Obviously, there are plenty of web templates available on the Internet, but how will you get the legal form you will need? Utilize the US Legal Forms web site. The service provides a large number of web templates, such as the Massachusetts Partial Release of Liens for Notes and Security Agreements, that you can use for enterprise and private requires. All of the varieties are checked out by pros and satisfy federal and state specifications.

When you are currently signed up, log in in your bank account and click the Acquire switch to have the Massachusetts Partial Release of Liens for Notes and Security Agreements. Make use of your bank account to search from the legal varieties you might have acquired earlier. Proceed to the My Forms tab of your own bank account and acquire yet another version from the papers you will need.

When you are a brand new consumer of US Legal Forms, allow me to share easy recommendations that you can adhere to:

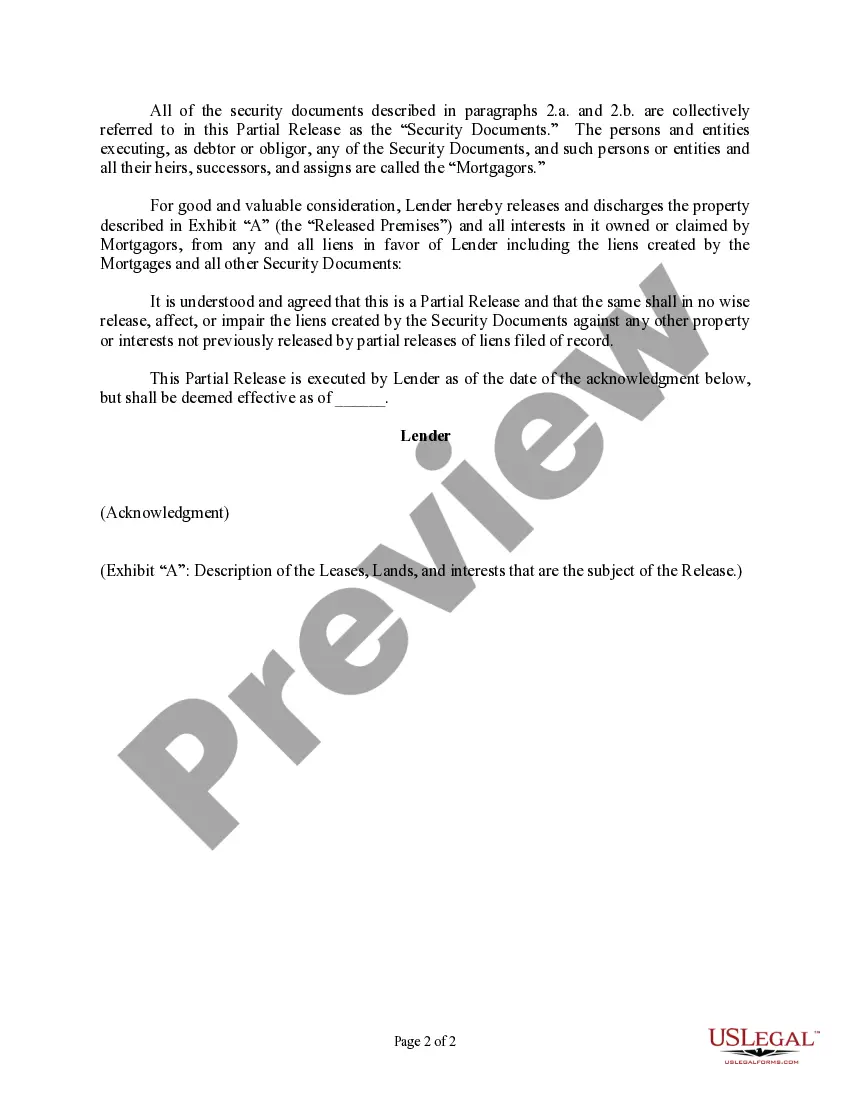

- Very first, be sure you have selected the correct form for the city/area. You can look over the form while using Preview switch and read the form description to guarantee this is the best for you.

- If the form is not going to satisfy your needs, take advantage of the Seach industry to discover the proper form.

- Once you are certain that the form is proper, click on the Buy now switch to have the form.

- Select the rates program you need and enter the essential info. Design your bank account and pay for an order making use of your PayPal bank account or credit card.

- Opt for the file file format and down load the legal papers web template in your system.

- Comprehensive, modify and produce and indication the obtained Massachusetts Partial Release of Liens for Notes and Security Agreements.

US Legal Forms is definitely the greatest catalogue of legal varieties for which you can see numerous papers web templates. Utilize the service to down load appropriately-manufactured files that adhere to status specifications.

Form popularity

FAQ

The correct answer is (a) Property Tax Liens. Property Tax Liens: Property tax liens are given priority over earlier recorded liens on real estate under many states' laws.

Mortgage liens usually take priority over any other lien except tax liens.

How Can I Get Rid of my Judgement Lien in Massachusetts? Contact the creditor that filed the lien and try to come to a deal with them directly. Make payment arrangements with the creditor if you cannot pay in full. Simply pay the lien amount in full.

Property tax liens: Liens put in place specifically for unpaid property taxes are often given super-priority?they may even have priority over mortgages and other forms of tax liens.

The standard method of obtaining a release of estate tax lien is to file an estate tax return with the Massachusetts Department of Revenue (DOR) and obtain from the DOR a Release of Estate Tax Lien, known as an M-792 certificate. This is the required method when dealing with estates that are worth $1,000,000 or more.

The Massachusetts mechanic's lien law establishes a system for owners, contractors, and subcontractors to notify each other about the existence of construction contracts. A lien becomes effective when a lien notice is filed on the land records. The law sets three optional deadlines for filing it.

The correct answer is (a) Property Tax Liens. The correct answer is (a) Property Tax Liens. Property Tax Liens: Property tax liens are given priority over earlier recorded liens on real estate under many states' laws.

A lien that has priority over another lien is called a "superior" lien. A low-priority lien is called a "junior" lien. If a home has more than one lien, priority determines the lienholders' rights following a foreclosure sale.