Massachusetts Reservation of Production Payment

Description

How to fill out Reservation Of Production Payment?

Discovering the right authorized file web template can be quite a struggle. Needless to say, there are plenty of templates available on the Internet, but how do you discover the authorized form you need? Take advantage of the US Legal Forms internet site. The assistance gives a huge number of templates, for example the Massachusetts Reservation of Production Payment, which you can use for enterprise and personal demands. All of the types are examined by experts and fulfill state and federal needs.

If you are currently signed up, log in in your profile and click the Obtain key to find the Massachusetts Reservation of Production Payment. Utilize your profile to search with the authorized types you have purchased formerly. Check out the My Forms tab of the profile and obtain yet another version of your file you need.

If you are a fresh consumer of US Legal Forms, here are easy guidelines for you to adhere to:

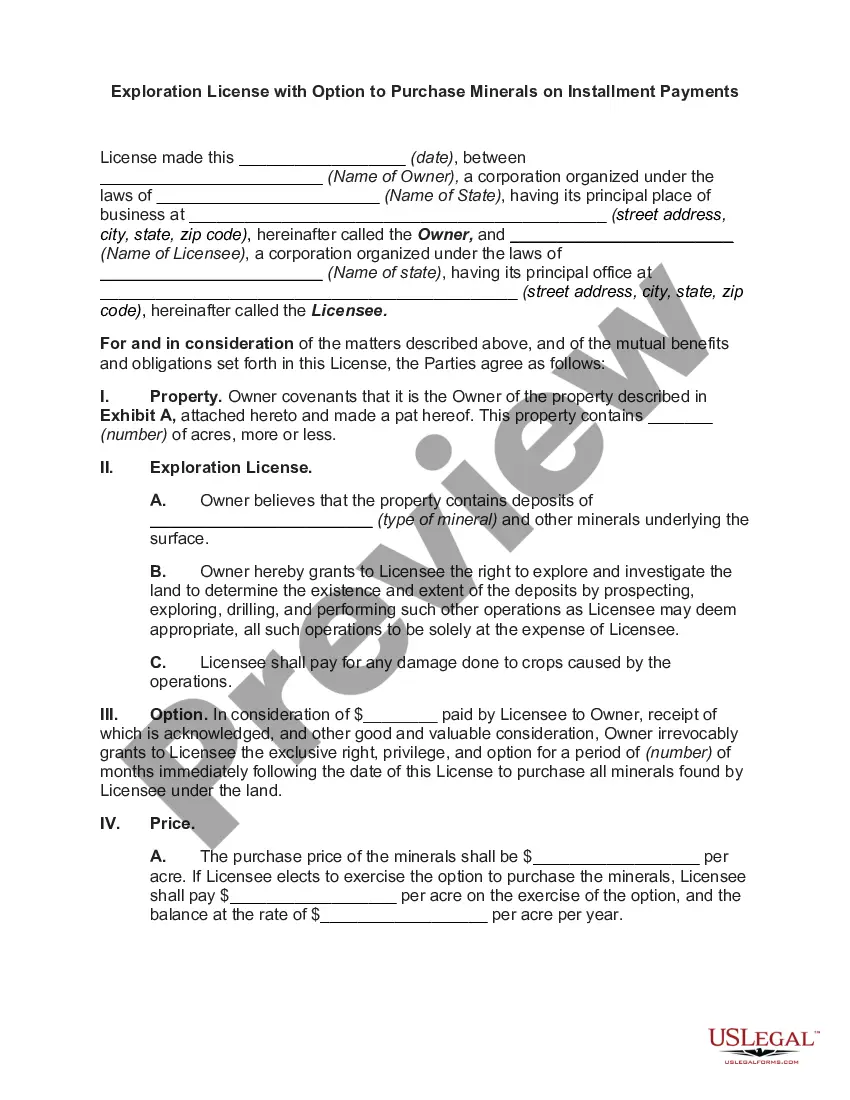

- Initially, be sure you have selected the proper form to your city/state. You may look over the shape utilizing the Review key and browse the shape outline to ensure this is basically the right one for you.

- In case the form fails to fulfill your expectations, make use of the Seach discipline to get the proper form.

- Once you are certain the shape is proper, go through the Acquire now key to find the form.

- Select the pricing prepare you need and enter in the required details. Build your profile and buy your order using your PayPal profile or credit card.

- Select the submit file format and down load the authorized file web template in your gadget.

- Full, revise and print and signal the attained Massachusetts Reservation of Production Payment.

US Legal Forms is definitely the biggest catalogue of authorized types for which you can discover a variety of file templates. Take advantage of the service to down load skillfully-manufactured documents that adhere to status needs.

Form popularity

FAQ

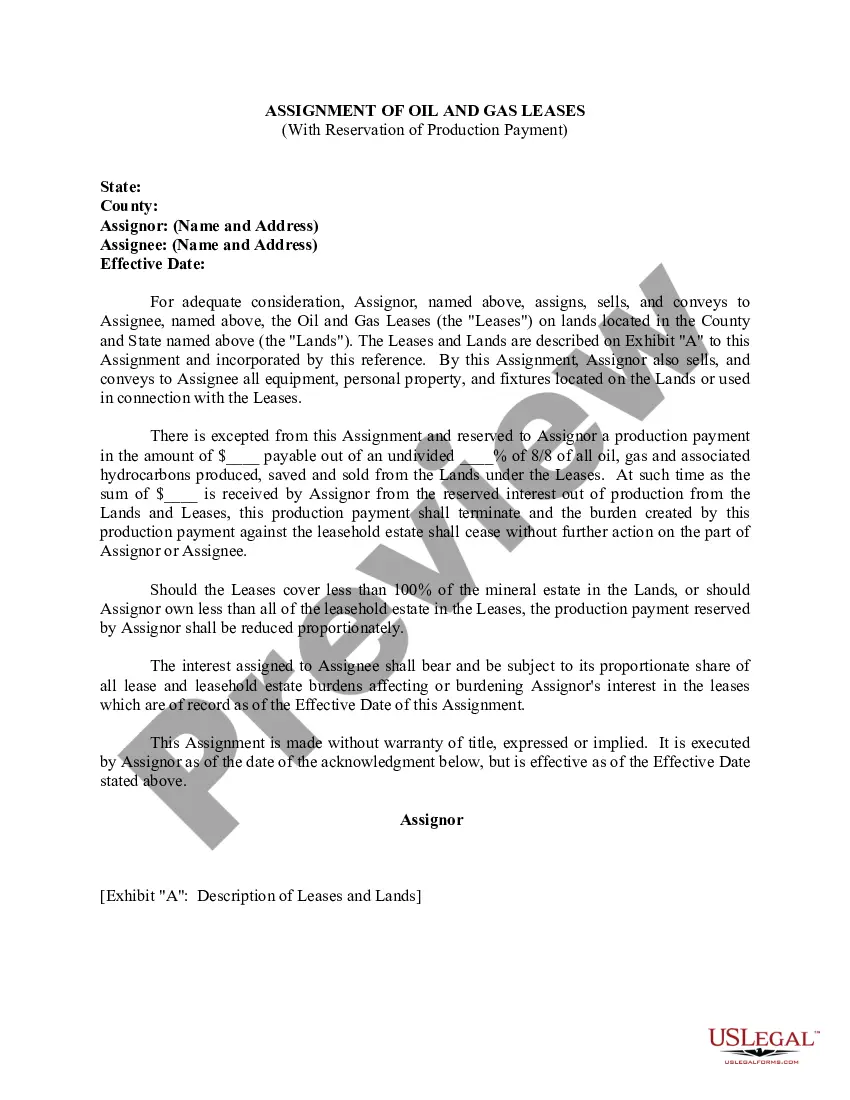

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

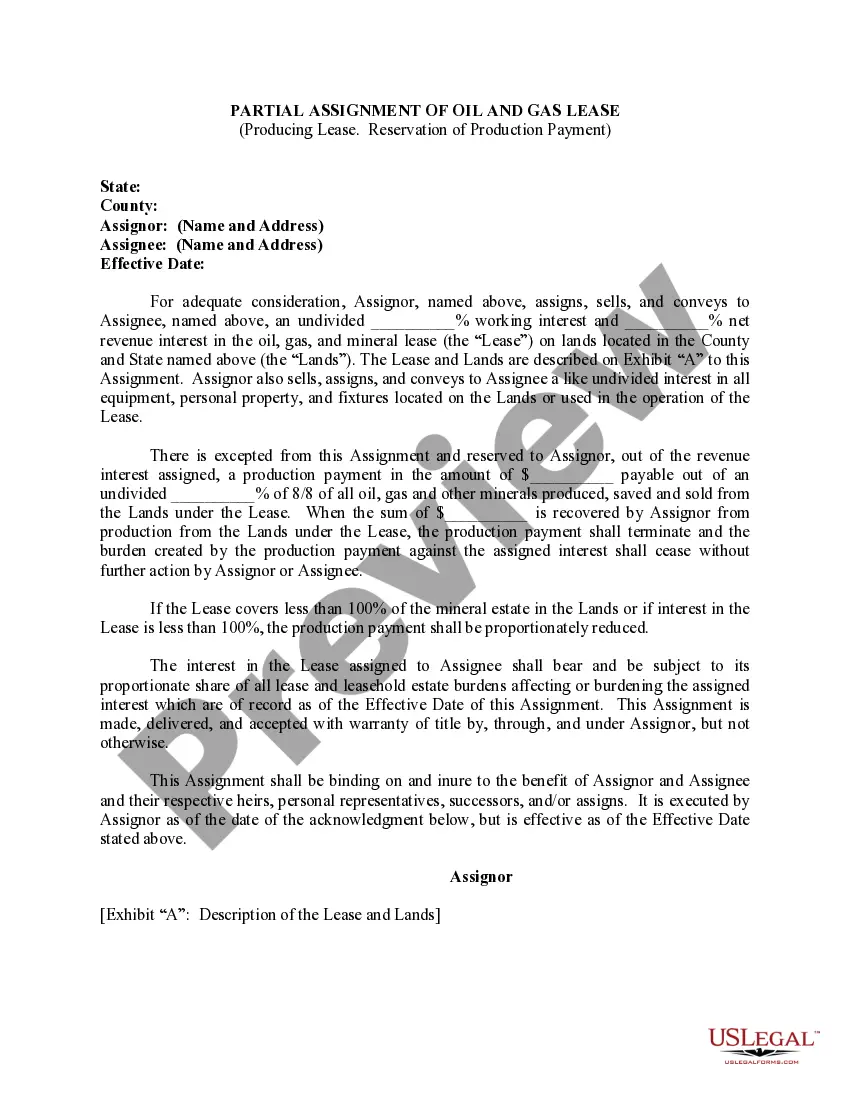

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

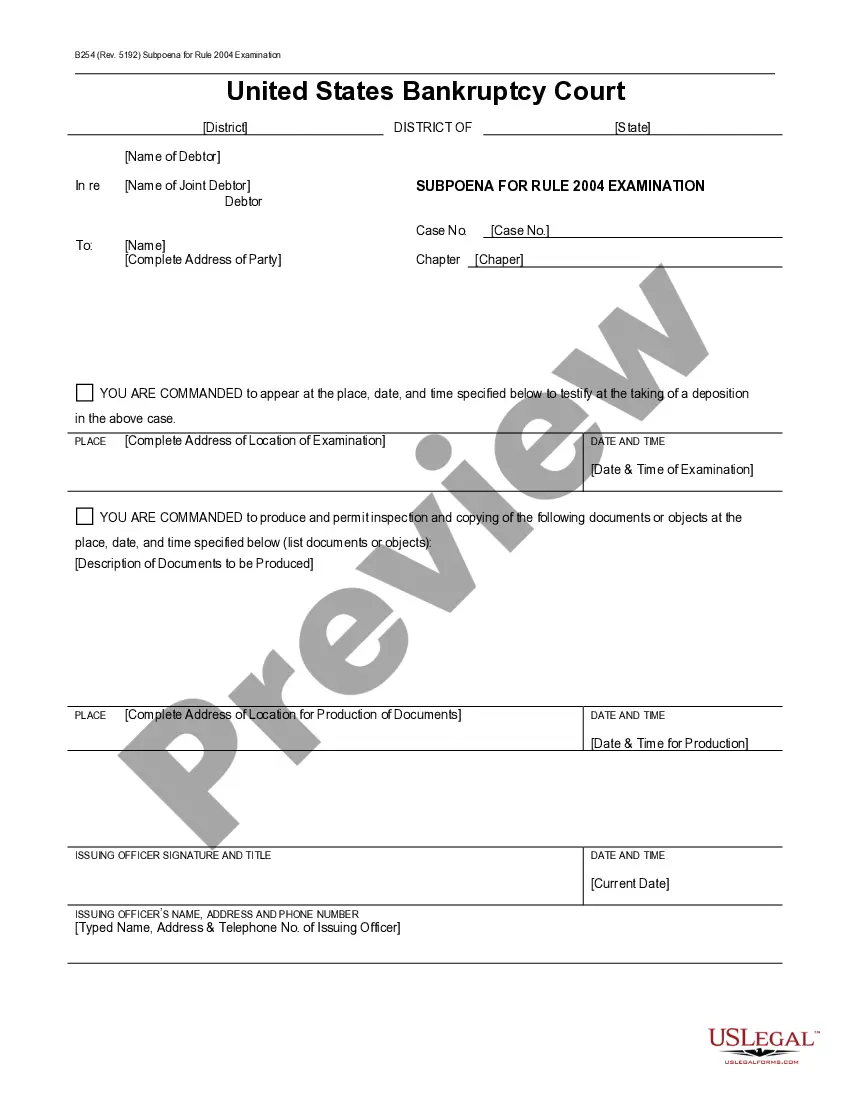

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.