Massachusetts Subordination of Lien (Deed of Trust/Mortgage)

Description

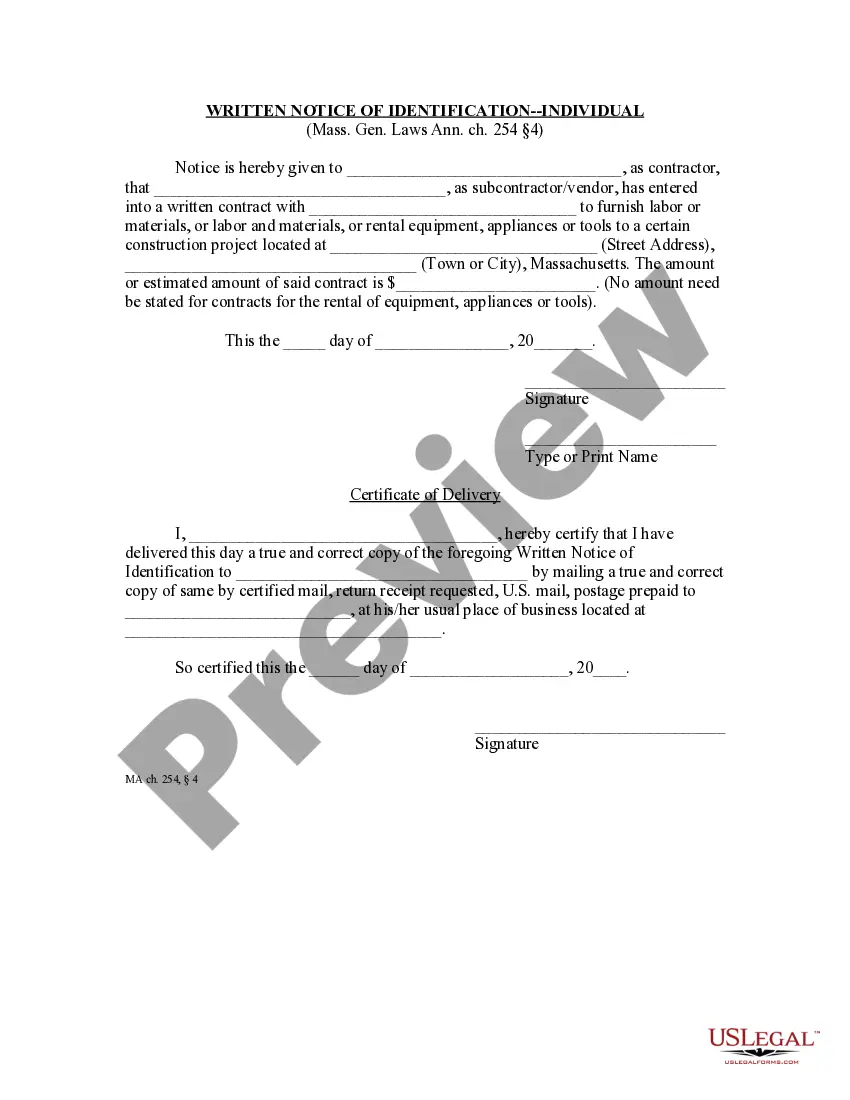

How to fill out Subordination Of Lien (Deed Of Trust/Mortgage)?

US Legal Forms - one of several greatest libraries of legitimate forms in America - provides a wide range of legitimate document templates you are able to obtain or produce. While using web site, you can find a large number of forms for company and personal functions, categorized by categories, suggests, or search phrases.You will find the newest variations of forms like the Massachusetts Subordination of Lien (Deed of Trust/Mortgage) within minutes.

If you currently have a registration, log in and obtain Massachusetts Subordination of Lien (Deed of Trust/Mortgage) from the US Legal Forms local library. The Acquire option can look on every single form you see. You gain access to all formerly delivered electronically forms within the My Forms tab of your own accounts.

If you wish to use US Legal Forms the very first time, listed below are basic recommendations to obtain started:

- Be sure you have selected the proper form to your town/state. Select the Review option to analyze the form`s content material. Read the form description to ensure that you have chosen the proper form.

- In case the form does not satisfy your demands, use the Research industry towards the top of the monitor to get the one that does.

- Should you be satisfied with the shape, verify your decision by clicking the Buy now option. Then, select the prices plan you want and give your qualifications to register for an accounts.

- Method the deal. Utilize your credit card or PayPal accounts to complete the deal.

- Pick the file format and obtain the shape on the product.

- Make modifications. Complete, revise and produce and indication the delivered electronically Massachusetts Subordination of Lien (Deed of Trust/Mortgage).

Each and every design you included with your account does not have an expiration date and is also your own property forever. So, if you would like obtain or produce yet another version, just proceed to the My Forms portion and then click around the form you will need.

Gain access to the Massachusetts Subordination of Lien (Deed of Trust/Mortgage) with US Legal Forms, one of the most considerable local library of legitimate document templates. Use a large number of expert and express-certain templates that meet your organization or personal demands and demands.

Form popularity

FAQ

The new lender prepares the subordination agreement in conjunction with the subordinating lienholder. Then, the parties typically sign the agreement. But in some cases, just the subordinating lender will need to sign the paperwork.

Subordination agreements ensure that a primary lender will be paid in the event the borrower takes on more debt. As with most legal documents, subordination agreements need to be notarized in order to be official in the eyes of the law.

A mortgage subordination refers to the order the outstanding liens on your property get repaid if you stop making your mortgage payments. For example, your first home loan (primary mortgage) is repaid first, with any remaining funds paying off additional liens, including second mortgages, HELOCs and home equity loans.

Contractual subordination is an arrangement where senior and junior loans are made to the same borrower (common debtor) but the senior creditor and junior creditor agree by contract priority of payment.

The creditor usually will require the debtor to sign a subordination agreement which ensures they get paid before other creditors, ensuring they are not taking on high risks.

Subordination is a way of changing the priority of claims against a debtor so that one creditor or group of creditors (the junior creditor(s)) agree that their debt will not be paid until debts owed to another creditor or group of creditors (the senior creditor(s)) have been paid.

This Security Instrument secures to Lender (i) the. repayment of the Loan, and all renewals, extensions, and modifications of the Note, and (ii) the performance. of Borrower's covenants and agreements under this Security Instrument and the Note.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.