Massachusetts Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc.

Description

How to fill out Demand For Information From Limited Liability Company LLC By Member Regarding Financial Records, Etc.?

Have you been within a situation in which you need documents for sometimes business or individual functions almost every working day? There are plenty of legal document templates available online, but finding types you can depend on isn`t effortless. US Legal Forms gives thousands of type templates, such as the Massachusetts Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc., which can be composed to meet state and federal needs.

When you are already informed about US Legal Forms site and have your account, merely log in. Next, you are able to acquire the Massachusetts Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc. design.

If you do not provide an accounts and need to start using US Legal Forms, follow these steps:

- Obtain the type you will need and make sure it is for your right metropolis/area.

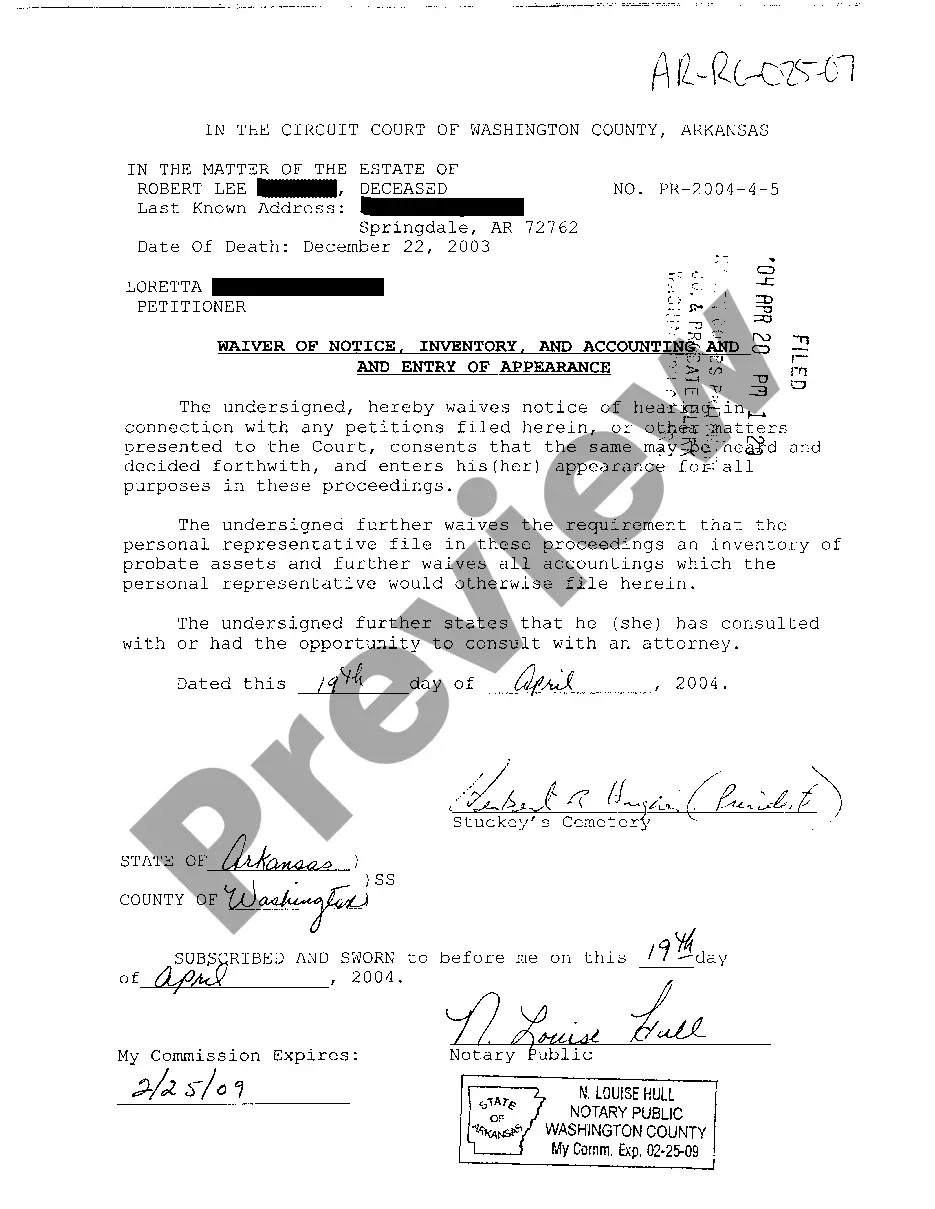

- Use the Review button to check the shape.

- Look at the description to actually have chosen the appropriate type.

- If the type isn`t what you`re seeking, take advantage of the Lookup area to get the type that suits you and needs.

- When you get the right type, just click Get now.

- Pick the rates strategy you would like, complete the required information and facts to generate your account, and buy the order using your PayPal or bank card.

- Pick a hassle-free file formatting and acquire your duplicate.

Find every one of the document templates you might have purchased in the My Forms menu. You may get a extra duplicate of Massachusetts Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc. any time, if possible. Just go through the necessary type to acquire or print the document design.

Use US Legal Forms, the most comprehensive variety of legal types, to save lots of time as well as steer clear of faults. The assistance gives skillfully manufactured legal document templates which you can use for an array of functions. Create your account on US Legal Forms and initiate creating your daily life a little easier.

Form popularity

FAQ

Information Needed for New Mexico Articles of Organization The street address of your LLC's registered office. The name of your LLC's registered agent. A statement that a manager will have management authority in your LLC (if applicable) A statement that your LLC can operate with only one member (if applicable)

A Massachusetts LLC is created by filing a Limited Liability Company Certificate of Organization with the Secretary of the Commonwealth Corporations Division. The certificate must include: the LLC's federal (employer) identification number (if any) the LLC's name and street address in Massachusetts.

To form an LLC, articles of organization must be filed with a central state agency - usually the secretary of states office. Typically, the articles must include the name of the business, it's principal address, the name of the address of a registered agent, the members names, and how the LLC will be managed.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

Massachusetts does not require you to submit an Operating Agreement to form your LLC.

Massachusetts state law requires all Massachusetts LLCs and Massachusetts corporations to maintain an MA registered agent and registered office to receive service of process.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, which means someone could sue you without there being any shield to protect your personal assets.

LLCs function under the terms of an operating agreement, a document comparable to a partnership agreement. LLCs must also file an annual report with the Secretary of the Commonwealth. See the Secretary of the Commonwealth website for additional information about becoming a LLC.