Massachusetts Independent Sales Representative Agreement - Software and Computer Systems

Description

How to fill out Independent Sales Representative Agreement - Software And Computer Systems?

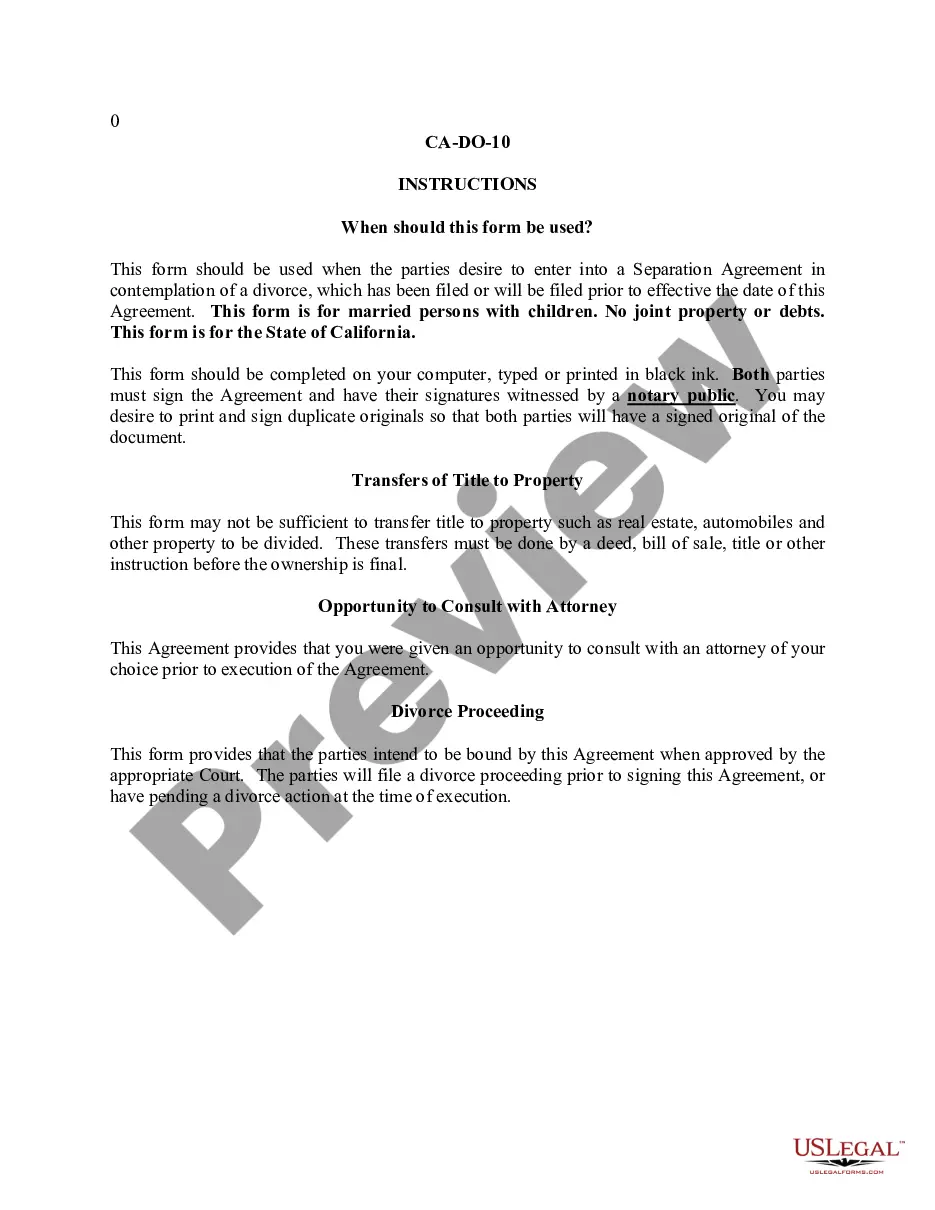

Are you presently in a position where you need documents for both business or personal uses nearly every day? There are many legal document templates available online, but finding ones you can trust isn’t straightforward. US Legal Forms offers thousands of form templates, including the Massachusetts Independent Sales Representative Agreement - Software and Computer Systems, that are crafted to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. Then, you can download the Massachusetts Independent Sales Representative Agreement - Software and Computer Systems template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Find the form you need and ensure it is for the correct city/region. Use the Review button to evaluate the document. Check the details to make sure you’ve selected the correct form. If the form isn’t what you’re looking for, use the Search field to find the form that suits your needs and requirements. Once you find the right form, click Purchase now. Choose the pricing plan you need, complete the required information to create your account, and pay for the order using your PayPal or credit card. Select a suitable file format and download your copy.

- You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the Massachusetts Independent Sales Representative Agreement - Software and Computer Systems at any time, if necessary. Simply click on the required form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides properly crafted legal document templates that can be used for various purposes.

- Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

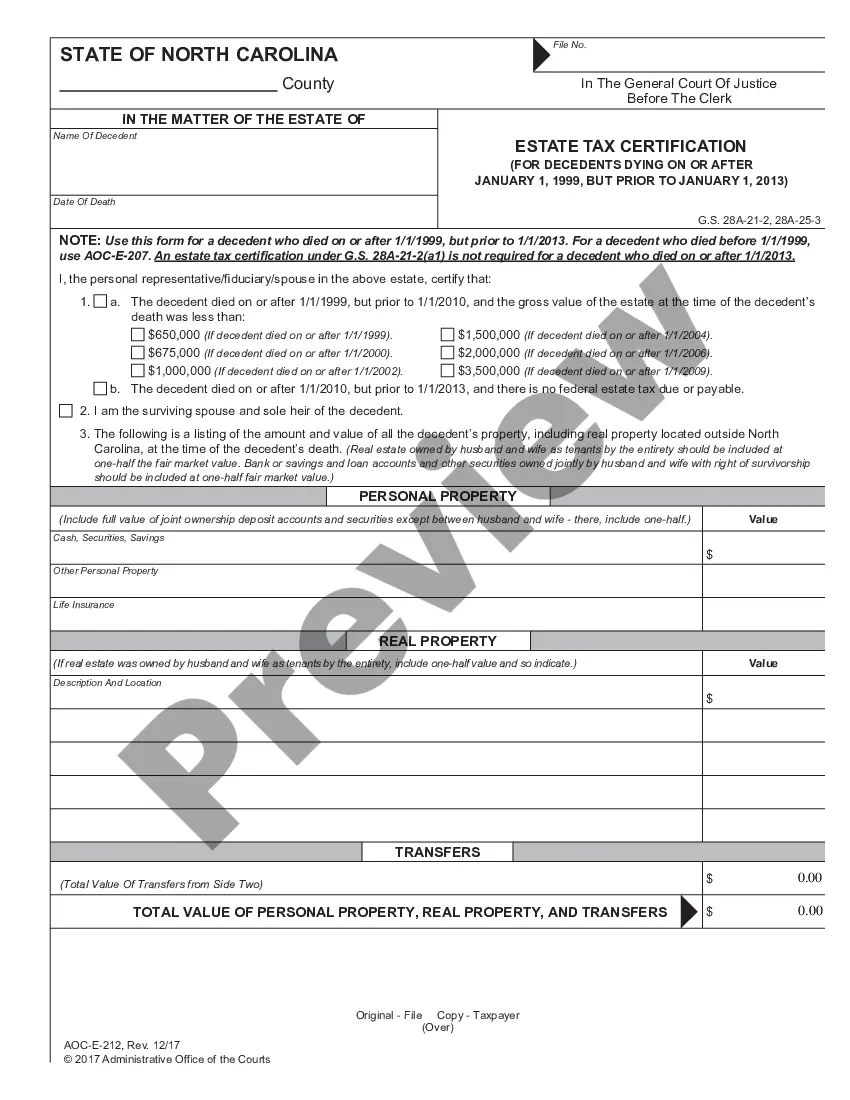

In Massachusetts, a contract becomes legally binding when it includes an offer, acceptance, and consideration, meaning something of value is exchanged. Additionally, all parties must have the legal capacity to enter into the contract, and the agreement must be for a lawful purpose. Clear written documentation, such as a Massachusetts Independent Sales Representative Agreement - Software and Computer Systems, adds an extra layer of protection and clarity to the terms agreed upon.

The agreement between a company and a sales agent outlines the terms and conditions of the sales relationship. It specifies the agent's responsibilities, compensation, and any exclusivity arrangements. This type of agreement protects both parties by clarifying expectations and preventing misunderstandings. For those in Massachusetts, a Massachusetts Independent Sales Representative Agreement - Software and Computer Systems can provide a solid foundation for this partnership.

A sales representative agreement is a contract that establishes the relationship between a company and a sales representative. This document details the commission structure, sales territories, and the expectations of both parties. It serves as a framework for how the sales representative will promote and sell the company's products or services. Utilizing a Massachusetts Independent Sales Representative Agreement - Software and Computer Systems can help ensure that all critical aspects are covered.

In Massachusetts, the taxability of software as a service (SaaS) depends on several factors. Generally, SaaS products are considered taxable unless they meet specific exemptions. Businesses should evaluate their services against Massachusetts tax laws to determine their liability. If your business involves a Massachusetts Independent Sales Representative Agreement - Software and Computer Systems, consulting with a tax professional can help clarify your obligations.

Yes, while Massachusetts does not legally require an LLC to have an operating agreement, it is highly advisable to create one. An operating agreement outlines the management structure and operating procedures of the LLC, which can help prevent conflicts among members. Furthermore, having an operating agreement can provide clarity when entering into agreements, such as a Massachusetts Independent Sales Representative Agreement - Software and Computer Systems. Utilizing resources like uslegalforms can assist in drafting this important document.

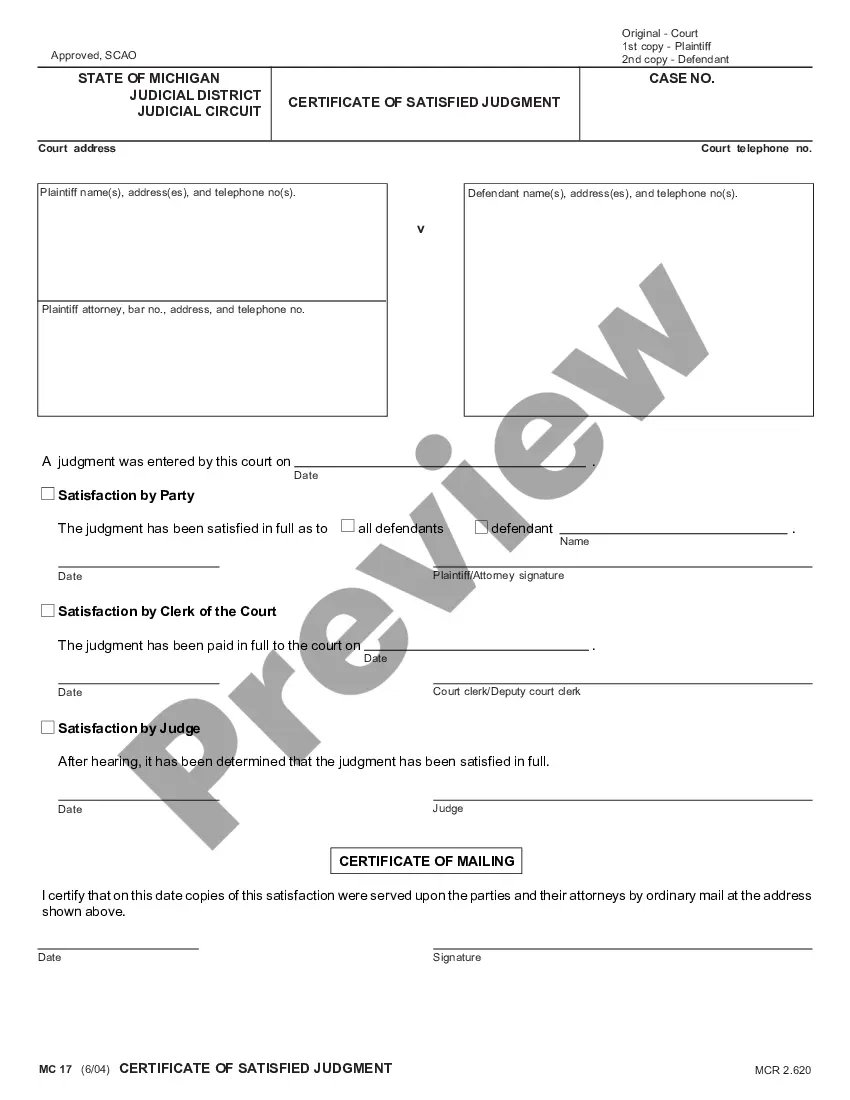

Put It In Writing: California Requires Written Commission Plans Beginning January 1, 2013. Effective January 1, 2013, California's new Labor Code section 2751 requires employers to provide written commission plan agreements to all employees who perform services in California and whose compensation involves commissions.

Each commission agreement should include the following info:Names of both signing parties.The legal relationship between the parties.Employment date.Non-compete clause.Commission structure.Potential base salary.Non-disclosure clause.

Commission only pay refers to how some California sales employees are paid for their work and/or services. In this arrangement, an employee earns a commission, or an amount of money, when he sells something. This amount is determined by either the quantity of items the worker sells, or the value of the item sold.

1. A representation of the system expressed at some level of abstraction, in some modality, and at certain level of formality. Learn more in: Communicability of Natural Language in Software Representations. Find more terms and definitions using our Dictionary Search.

Sales Rep Overview is for reps that own opportunities and carry a quota. Gain instant insight into your business over any time frame. Track won oppportunites, open pipe, and activities completed.