Massachusetts Self-Employed Window Washer Services Contract

Description

How to fill out Self-Employed Window Washer Services Contract?

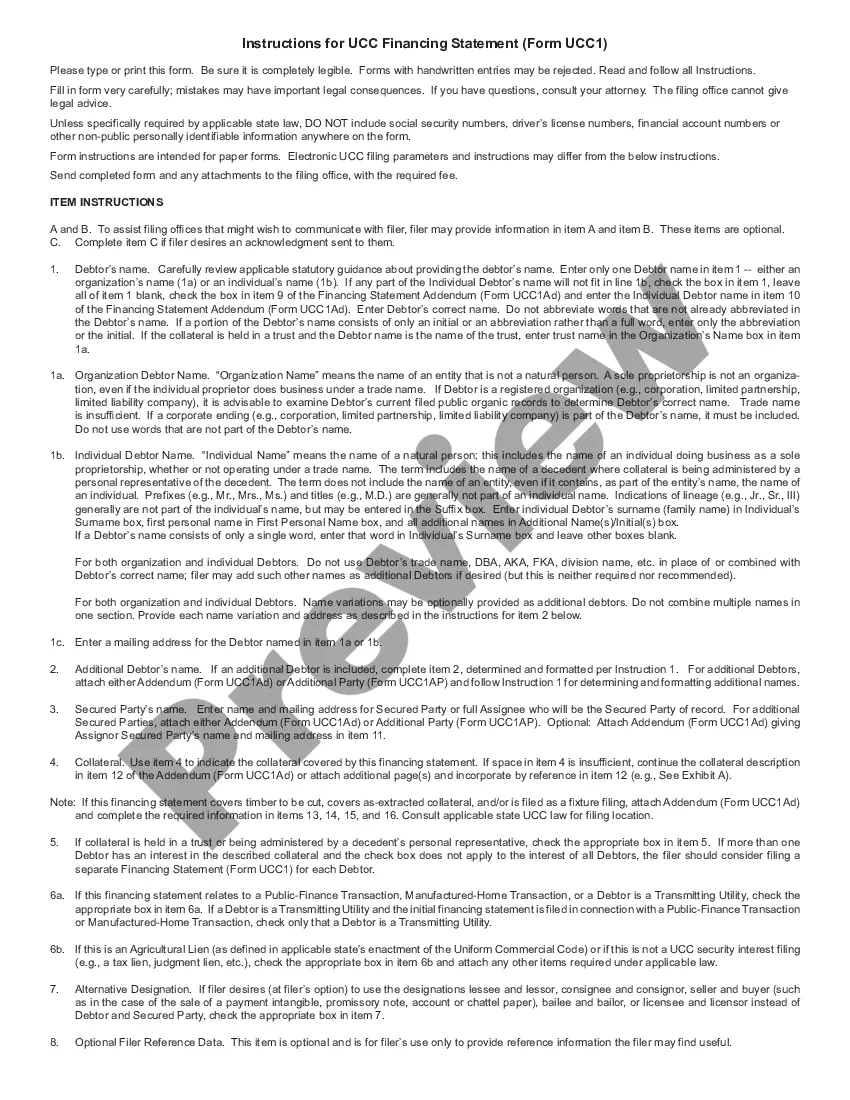

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal form templates that you can download or print. By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest documents like the Massachusetts Self-Employed Window Washer Services Contract in no time.

If you already have a subscription, Log In and download the Massachusetts Self-Employed Window Washer Services Contract from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your city/state. Click the Preview button to review the form’s details. Check the form description to confirm that you have chosen the right form. If the form does not meet your needs, utilize the Search box at the top of the page to find one that does. Once you are content with the form, confirm your choice by clicking the Buy now button. Then, select your preferred pricing plan and provide your information to register for an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Complete, adjust, print, and sign the downloaded Massachusetts Self-Employed Window Washer Services Contract. Every template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

US Legal Forms offers a comprehensive resource for individuals and businesses seeking legal document templates.

With a simple interface, it allows users to navigate and access a wide variety of forms efficiently.

- Access the Massachusetts Self-Employed Window Washer Services Contract with US Legal Forms, one of the most extensive libraries of legal document templates.

- Utilize numerous professional and state-specific templates that fulfill your business or personal requirements.

- Browse by categories, states, or keywords to find the forms you need.

- Enjoy unlimited access to your downloaded forms without expiration.

- Easily modify and print your legal documents as required.

- Make sure to review the form description to verify its suitability for your needs.

Form popularity

FAQ

In Massachusetts, personal service contracts can be taxable depending on the specific type of service rendered. If you provide services under a Massachusetts Self-Employed Window Washer Services Contract, it is important to assess whether your services fall into the taxable category. Understanding these tax implications will help ensure that you meet all legal requirements and avoid unexpected tax liabilities.

Yes, if your services are taxable under Massachusetts law, you should add the appropriate tax to your invoices. This is crucial for maintaining transparency with your clients and complying with state tax regulations. As part of a Massachusetts Self-Employed Window Washer Services Contract, it is advisable to clarify tax responsibilities upfront to prevent any confusion.

Service contracts are generally taxable in Massachusetts, particularly if they involve services that the state deems under taxable categories. When entering a Massachusetts Self-Employed Window Washer Services Contract, make sure to outline the services and verify their tax status. This will help you keep accurate records and manage any tax responsibilities effectively.

In most scenarios, contract labor, including those defined under a Massachusetts Self-Employed Window Washer Services Contract, is subject to taxation. However, the specific tax liabilities can depend on the type of services provided and the agreement in place. Stay informed on the tax laws to ensure compliance and avoid any penalties.

Yes, in Massachusetts, service labor can be taxable depending on the nature of the service provided. The state has specific rules governing the taxation of services, and it is essential to clarify if your services fall under taxable categories. If you are providing services under a Massachusetts Self-Employed Window Washer Services Contract, remember to consider local regulations when determining your tax obligations.

To secure a commercial window cleaning contract, start by networking and reaching out to local businesses. Demonstrating your professionalism through a solid portfolio and providing a well-written Massachusetts Self-Employed Window Washer Services Contract will bolster your chances. Consider using platforms like uslegalforms to streamline your contract process and present yourself as a reliable service provider.

Yes, window cleaning can be a highly profitable business, especially with commercial accounts. With low startup costs and recurring clients, many window cleaners enjoy a steady income. Having a solid Massachusetts Self-Employed Window Washer Services Contract can help secure long-term contracts and boost your profitability.

employed window cleaner’s earnings depend on the number of clients and jobs they secure. With regular contracts and satisfied customers, some professionals report making over $100,000 a year. Establishing a strong presence and a welldrafted Massachusetts SelfEmployed Window Washer Services Contract can significantly enhance your profitability.

The income of a self-employed window cleaner can vary based on factors like location, experience, and clientele. On average, you might expect to earn between $30,000 and $50,000 annually. The potential earnings increase with effective marketing and the right Massachusetts Self-Employed Window Washer Services Contract.

Typically, a contractor's license is not required specifically for window cleaning in Massachusetts. However, you should verify local laws for any licensing or insurance requirements. To protect your interests, ensure your Massachusetts Self-Employed Window Washer Services Contract outlines your service terms and any necessary legal protections.