Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Temporary Worker Agreement - Self-Employed Independent Contractor?

If you desire to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, accessible online.

Employ the site's straightforward and user-friendly search to find the documents you need. Various templates for commercial and personal uses are organized by categories and states, or keywords.

Use US Legal Forms to obtain the Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor in just a few clicks.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor. Every legal document template you acquire is yours permanently. You have access to every form you saved within your account. Click on the My documents section and select a form to print or download again. Compete and acquire, and print the Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

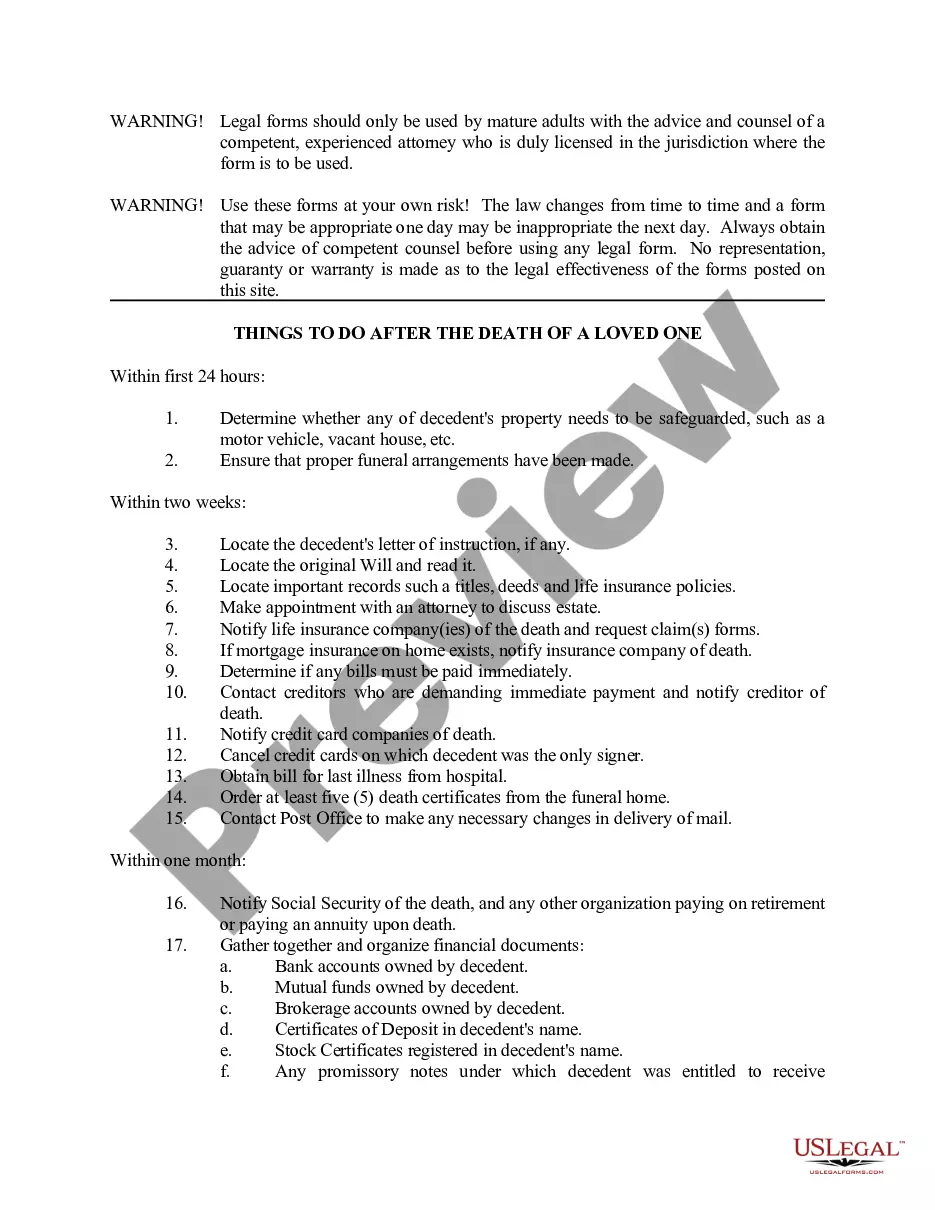

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

An independent contractor in Massachusetts is a self-employed individual who provides services to a client under a contract. Unlike employees, independent contractors operate with more freedom regarding how and when they complete their work. They are responsible for their taxes and do not receive typical employee benefits. To formalize this relationship, a Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor is essential.

Generally, 1099 employees are classified as independent contractors rather than temporary employees. They work on a contract basis, usually without a long-term commitment, which often leads to their designation as temporary. However, the key difference lies in the control over their work and operational independence. For those working under a Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor, understanding these distinctions helps in compliance.

To fill out an independent contractor agreement, begin by entering the names and contact information of both parties. Next, include a detailed description of the work to be done, along with specific deadlines and payment terms. It is important to ensure clarity and mutual understanding in every section. Using a Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor template from trusted sources can streamline this process.

In Massachusetts, the independent contractor agreement is a legal document that defines the relationship between a business and a self-employed individual. It clarifies how the contractor will deliver services and manage tasks in a freelance capacity. This agreement helps to avoid misclassification issues, especially with labor laws. For an effective and compliant Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor, consider using reliable templates.

A basic independent contractor agreement outlines the terms between a client and a contractor. It specifies the services provided, payment terms, deadlines, and responsibilities. This agreement serves as a foundation for understanding the relationship, ensuring both parties are clear on their obligations. Utilizing a Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor can simplify this process.

Filling out an independent contractor form involves several key steps. Begin by providing your personal and business details, followed by a description of the services you will be offering. Clearly indicate payment terms and any other relevant information required by the client or agency. For further guidance, US Legal Forms offers templates and examples to help you correctly complete a Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor, making the process seamless.

To create a clear independent contractor agreement in Massachusetts, start by identifying the parties involved, including the contractor and the client. Next, outline the scope of work, payment terms, and deadlines. Additionally, include terms that cover confidentiality, ownership of work, and how to handle disputes. Utilizing tools from US Legal Forms can simplify this process, ensuring you have a comprehensive Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor.

Obtaining a work visa while self-employed is possible but requires careful planning. You must demonstrate that your work meets the requirements for a work visa. A Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor can help you present your case more effectively—providing details about your business and income to support your application.

Yes, self-employed individuals can acquire a visa, but specific criteria must be met. Your visa application will depend on the nature of your self-employment, and often, documentation that outlines your work, such as a Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor, is beneficial. Consulting with an immigration lawyer can guide you through the process.

Creating an independent contractor agreement is straightforward with the right tools. Start by outlining the scope of work, payment terms, and responsibilities of both parties. Using platforms like uslegalforms can simplify this process, especially when formulating a Massachusetts Temporary Worker Agreement - Self-Employed Independent Contractor that meets legal requirements.