Massachusetts Fire Protection Service Contract - Self-Employed

Description

How to fill out Fire Protection Service Contract - Self-Employed?

Are you currently in a situation where you need to obtain documents for business or personal use almost daily.

There are numerous legal document templates available online, but finding reliable ones isn't straightforward.

US Legal Forms provides thousands of form templates, such as the Massachusetts Fire Protection Service Contract - Self-Employed, designed to comply with federal and state regulations.

When you find the right form, simply click Purchase now.

Select the pricing plan you need, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Massachusetts Fire Protection Service Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

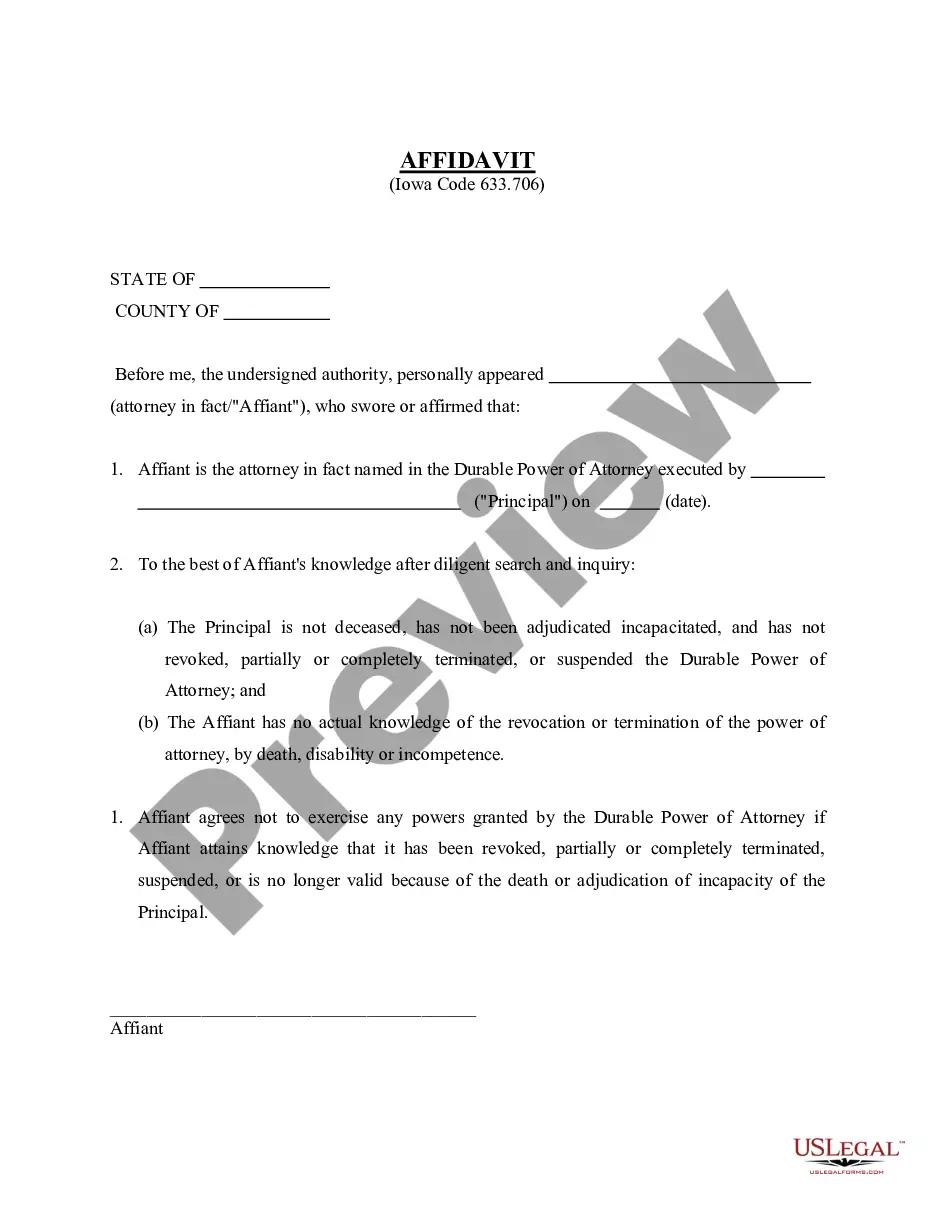

- Use the Preview button to review the form.

- Check the description to ensure you have chosen the right form.

- If the form isn't what you're looking for, utilize the Search field to find a form that meets your needs and requirements.

Form popularity

FAQ

The 3 hour rule in Massachusetts pertains to the minimum work expectation for certain employees. It requires that workers receive a minimum payment if they work less than 3 hours, promoting fair compensation in various contracts. If you are involved in a Massachusetts Fire Protection Service Contract - Self-Employed, it is essential to be aware of this regulation. For comprehensive insights and documentation, consider exploring the services offered by uslegalforms.

The new federal rule for independent contractors aims to clarify who qualifies as an independent contractor versus an employee. This rule impacts how individuals approach contracts, including the Massachusetts Fire Protection Service Contract - Self-Employed. Understanding these regulations is crucial for compliance and ensuring proper classification. Resources available through uslegalforms can guide you in aligning with these new standards.

Yes, contract workers are generally considered self-employed individuals. They operate independently, manage their own taxes, and determine their work schedule. When engaging in a Massachusetts Fire Protection Service Contract - Self-Employed, it's important to understand your responsibilities regarding taxes and benefits. Utilizing platforms like uslegalforms can help you navigate these obligations effectively.

To get authorized as an independent contractor in the U.S., first, determine the specific requirements in your state. This may include obtaining licenses, permits, or certifications relevant to your work. For example, if you focus on the Massachusetts Fire Protection Service Contract - Self-Employed, be sure to follow Massachusetts regulations. Consulting uslegalforms can provide further insights and resources.

An independent contractor agreement in Massachusetts outlines the terms of the working relationship between the contractor and the client. This document includes details such as payment terms, project scope, and duration. For a successful venture in services like the Massachusetts Fire Protection Service Contract - Self-Employed, having a clear and legally sound agreement is key.

To be an independent contractor, you typically need to establish your business, have the necessary skills, and obtain relevant licenses. In the case of the Massachusetts Fire Protection Service Contract - Self-Employed, it is essential to understand local regulations and industry standards. Using platforms like uslegalforms can simplify the process of creating needed documents and ensure compliance.

Working as an independent contractor in the USA involves setting up your business structure, marketing your services, and networking within your industry. For services like the Massachusetts Fire Protection Service Contract - Self-Employed, having a clear understanding of your niche and client needs is crucial. Additionally, establishing a solid contract can help set expectations and protect your interests.

The 20% self-employment deduction allows self-employed individuals, including those under the Massachusetts Fire Protection Service Contract - Self-Employed, to deduct a percentage of their qualified business income from federal taxes. This deduction can significantly lower taxable income and thereby reduce overall tax liability. It's beneficial to consult a tax professional for personalized advice.

To become authorized as an independent contractor, you typically need to register your business and obtain necessary licenses or permits. This process can vary by state, so focusing on your specific field, like the Massachusetts Fire Protection Service Contract - Self-Employed, can make the requirements clearer. Resources like uslegalforms can help guide you through the necessary steps.

Yes, independent contractors in the United States must obtain work authorization, especially if they are not U.S. citizens or permanent residents. For those involved in services like the Massachusetts Fire Protection Service Contract - Self-Employed, having the right documentation ensures compliance with state and federal laws. Always check local regulations to avoid misunderstandings.