Massachusetts Sample Partnership Interest Purchase Agreement between Franklin Covey Company, Daytracker.com, et al

Description

How to fill out Sample Partnership Interest Purchase Agreement Between Franklin Covey Company, Daytracker.com, Et Al?

Choosing the best authorized record format can be quite a have a problem. Needless to say, there are a variety of themes available on the net, but how can you find the authorized form you will need? Use the US Legal Forms internet site. The services offers thousands of themes, such as the Massachusetts Sample Partnership Interest Purchase Agreement between Franklin Covey Company, Daytracker.com, et al, that can be used for enterprise and personal demands. Each of the forms are inspected by pros and satisfy federal and state requirements.

If you are currently signed up, log in for your account and click the Obtain switch to obtain the Massachusetts Sample Partnership Interest Purchase Agreement between Franklin Covey Company, Daytracker.com, et al. Make use of your account to look with the authorized forms you have bought formerly. Visit the My Forms tab of your account and acquire another version from the record you will need.

If you are a new user of US Legal Forms, listed below are straightforward guidelines that you can follow:

- First, make certain you have chosen the right form to your metropolis/area. You are able to look over the shape using the Preview switch and browse the shape outline to ensure this is basically the best for you.

- In the event the form fails to satisfy your expectations, utilize the Seach industry to get the appropriate form.

- When you are sure that the shape would work, go through the Buy now switch to obtain the form.

- Opt for the rates prepare you desire and enter in the necessary information and facts. Make your account and buy the order with your PayPal account or Visa or Mastercard.

- Choose the submit structure and acquire the authorized record format for your gadget.

- Full, edit and produce and indication the obtained Massachusetts Sample Partnership Interest Purchase Agreement between Franklin Covey Company, Daytracker.com, et al.

US Legal Forms is the most significant local library of authorized forms that you can find different record themes. Use the company to acquire professionally-made paperwork that follow condition requirements.

Form popularity

FAQ

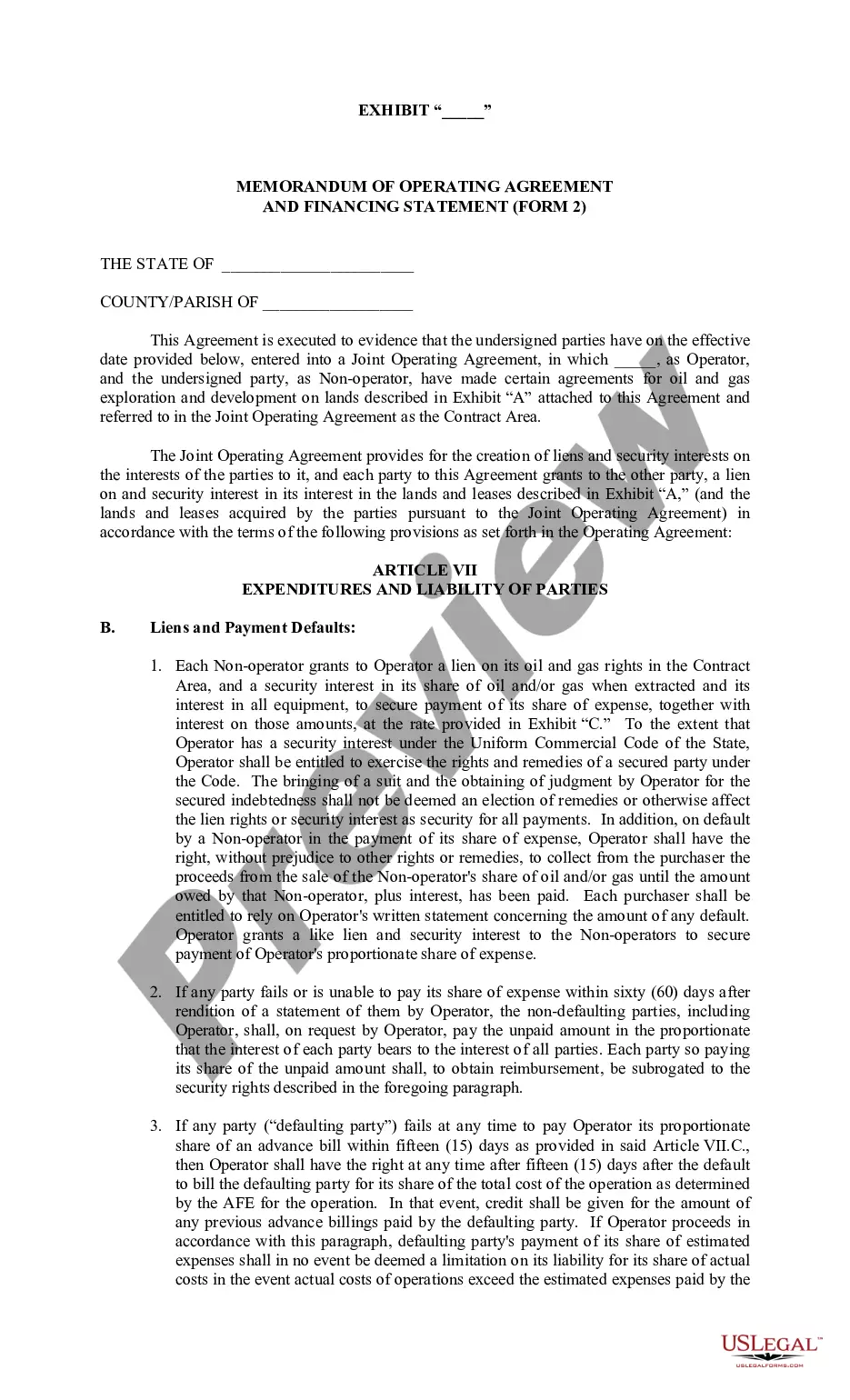

In the case of a sale or exchange of an interest in a partnership, liabilities shall be treated in the same manner as liabilities in connection with the sale or exchange of property not associated with partnerships.

Form 8308, Report of a Sale or Exchange of Certain Partnership Interests is completed only if there was a sale or exchange of partnership interest when any money or other property received in exchange for that interest is attributable to unrealized receivables or inventory items (also known as a Section 751(a) exchange ...

Gain Realized Generally, a partner selling his partnership interest recognizes capital gain or loss on the sale. The amount of the gain or loss recognized is the difference between the amount realized and the partner's adjusted tax basis in his partnership interest.

? Review Schedule D, Form 8949 and Form 4797 to determine the amount of gain or loss the partner reported on the sale of the partnership interest. After determining a partner sold its interest in the partnership, establish other relevant facts that can impact the tax treatment of this transaction.

Sale of a partnership interest generally gives the selling partner capital gain. Section 751, however, recharacterizes a portion of the amount realized as ordinary income to the partner, at times even in the absence of realized gain.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction.