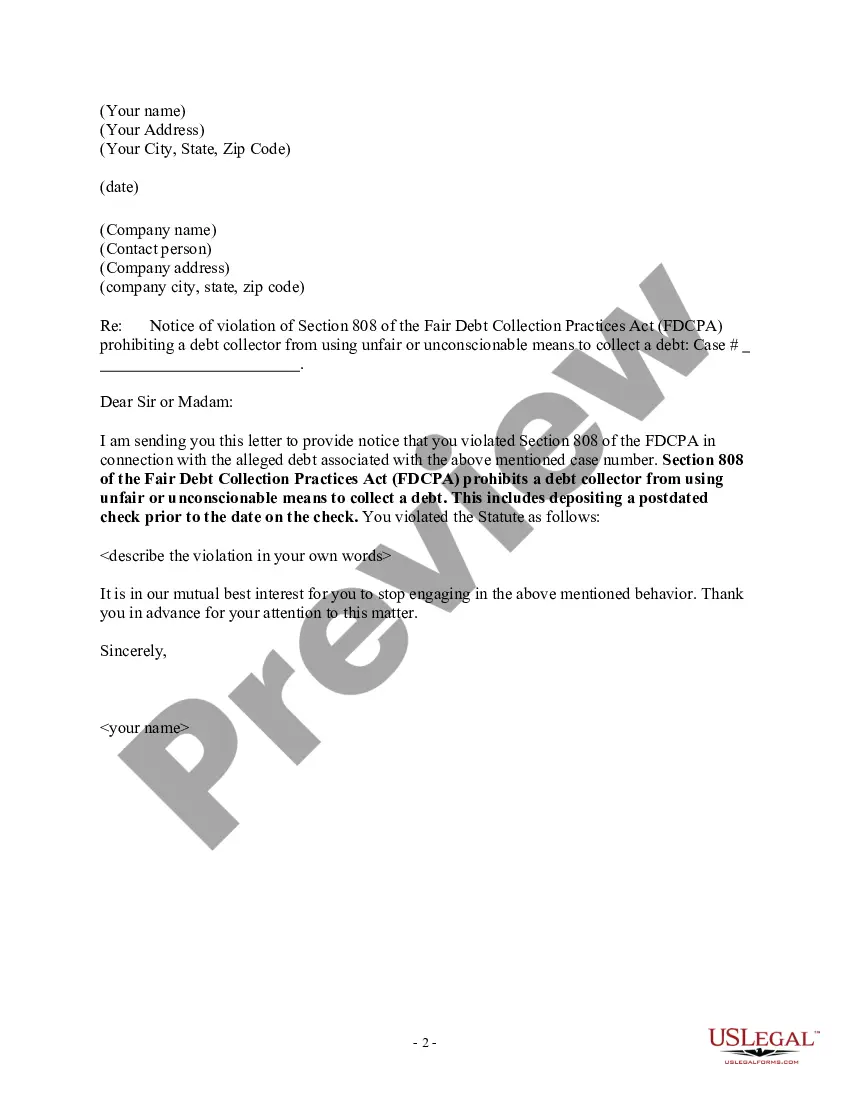

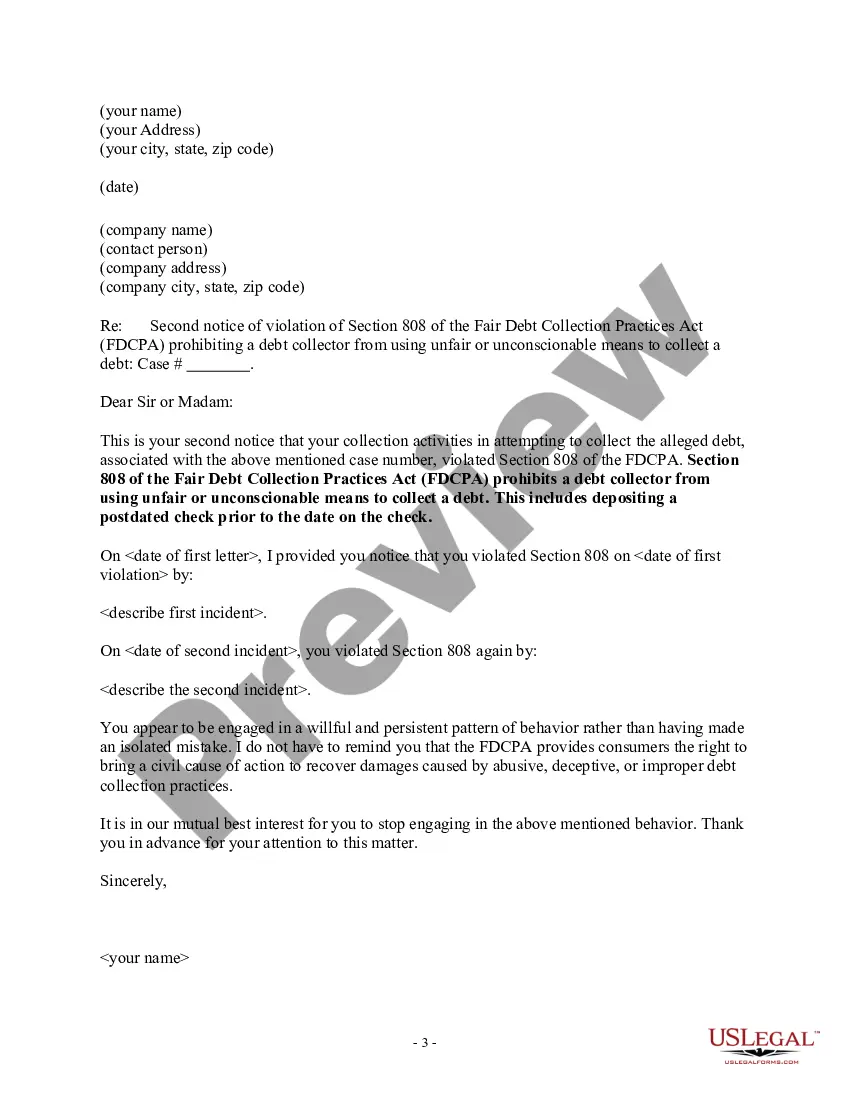

A debt collector may not use unfair or unconscionable means to collect a debt. This includes depositing a postdated check prior to the date on the check.

Massachusetts Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check

Description

How to fill out Notice To Debt Collector - Depositing A Postdated Check Prior To The Date On The Check?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal document templates that you can download or print.

Through the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Massachusetts Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check in moments.

Review the form summary to make sure you have chosen the appropriate form.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you have an account, Log In and download the Massachusetts Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously acquired forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some straightforward instructions to help you get started.

- Ensure you have selected the correct form for your locality/region.

- Click the Preview button to review the form's contents.

Form popularity

FAQ

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

Federal law restricts what a debt collector can and cannot do with your postdated check. Specifically, under the Fair Debt Collection Practices Act (FDCPA), a debt collector cannot: coerce you into making a postdated payment by threatening or instituting criminal prosecution.

Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.

From a criminal law perspective, there is nothing inherently illegal about postdating a check, says Eric Hintz, a criminal defense attorney in Sacramento, California. Hintz says that only criminal intent, such as intentionally not having enough money for a payment, can be grounds for check fraud.

Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.

Postdating a check is done by writing a check for a future date instead of the actual date the check was written. This is typically done with the intention that the check recipient will not cash or deposit the check until the future indicated date.

In most cases, when you receive a postdated check, you can deposit or cash a postdated check at any time. Debt collectors may be prohibited from processing a check before the date on the check, but most individuals are free to take postdated checks to the bank immediately.

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed. Ask your bank or credit union for their specific policy for postdated checks in their account disclosures.

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

Generally, state law provides that if you notified your bank or credit union about a post-dated check a reasonable time before it received the check, your notice is valid for six months. During that time, the bank or credit union should not cash the check before the date you wrote on the check.