Massachusetts Letter to Debt Collector - Only call me on the following days and times

Description

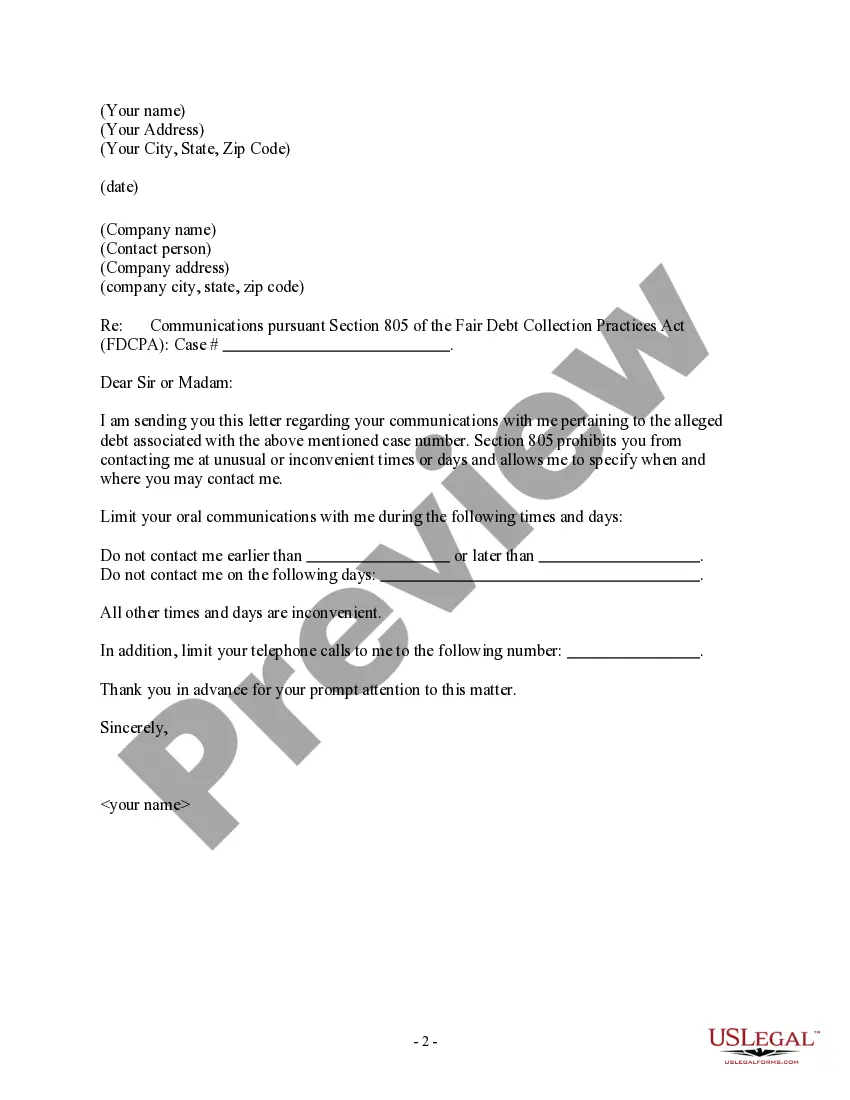

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

If you require to download, retrieve, or create legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you need.

A variety of templates for both commercial and personal purposes are organized by categories and states, or by keywords and phrases.

Any legal document template you purchase is yours permanently.

You have access to every document you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

- Utilize US Legal Forms to obtain the Massachusetts Letter to Debt Collector - Only contact me on the specified days and times with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to retrieve the Massachusetts Letter to Debt Collector - Only contact me on the specified days and times.

- You can also access forms you previously submitted electronically in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/region.

- Step 2. Utilize the Review feature to examine the form’s content. Be sure to read the summary.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find alternative templates in the legal document category.

- Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and input your details to create an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your system.

- Step 7. Complete, modify, and print or sign the Massachusetts Letter to Debt Collector - Only contact me on the specified days and times.

Form popularity

FAQ

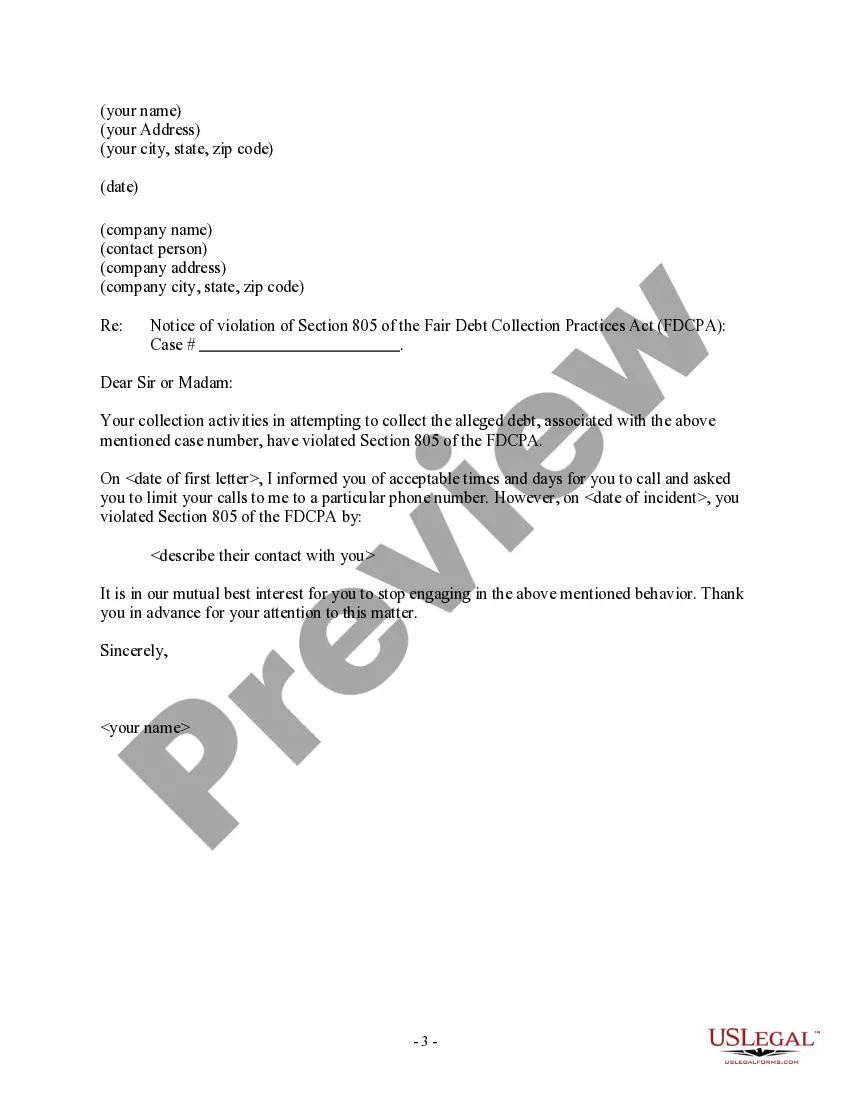

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Communication with Creditors and Collection Agencies The Attorney General's debt collection regulations prohibit: Calling you at home more than twice for each debt in any seven-day period, or more than twice for each debt in any 30-day period at some place other than your home, such as your place of work.

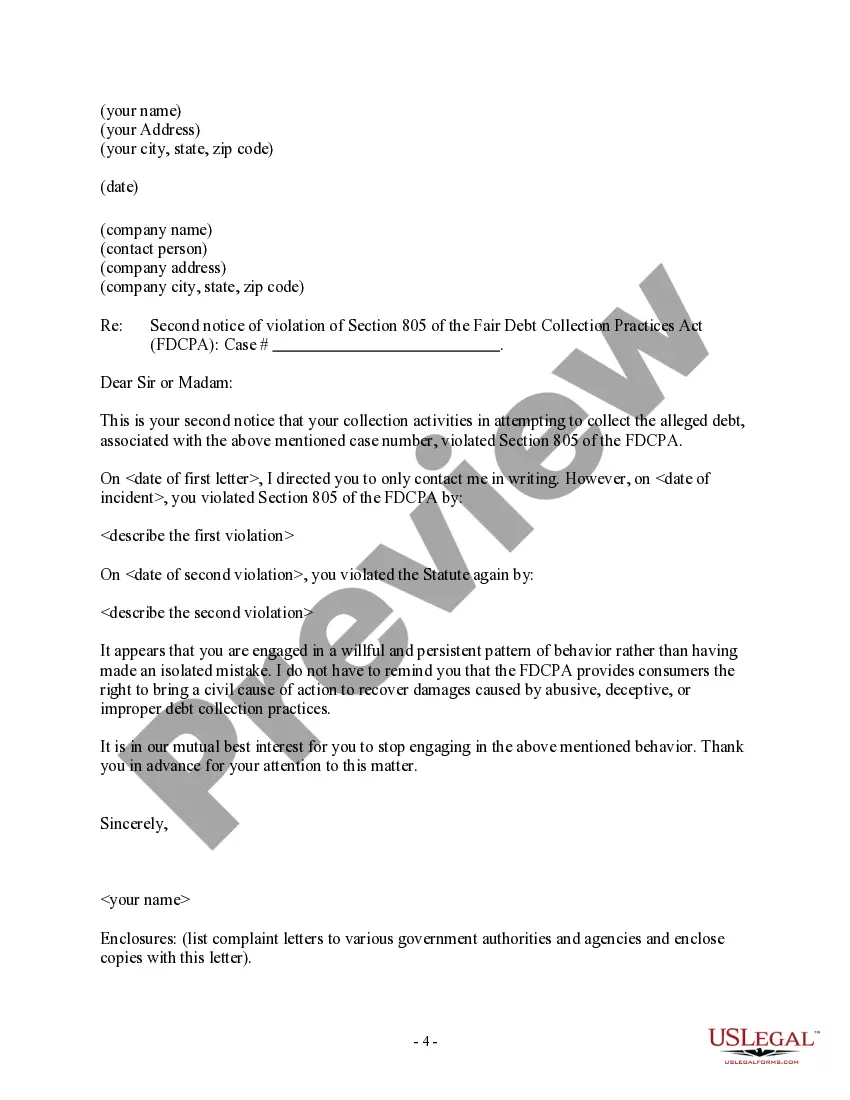

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Collection agencies should not be calling your employer except once to confirm your employment. They should not be speaking to family and/or friends unless those people are jointly responsible for the debt. Contact is limited to 3 times a week. It is only considered contact if you answer the phone and speak to them.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

The only permissible means of communicating is by regular mail. Alberta and Nova Scotia have a similar "three strikes" rule limiting the amount of contact from collectors within a seven-day consecutive period.