Massachusetts Insurance Agents Stock option plan

Description

How to fill out Insurance Agents Stock Option Plan?

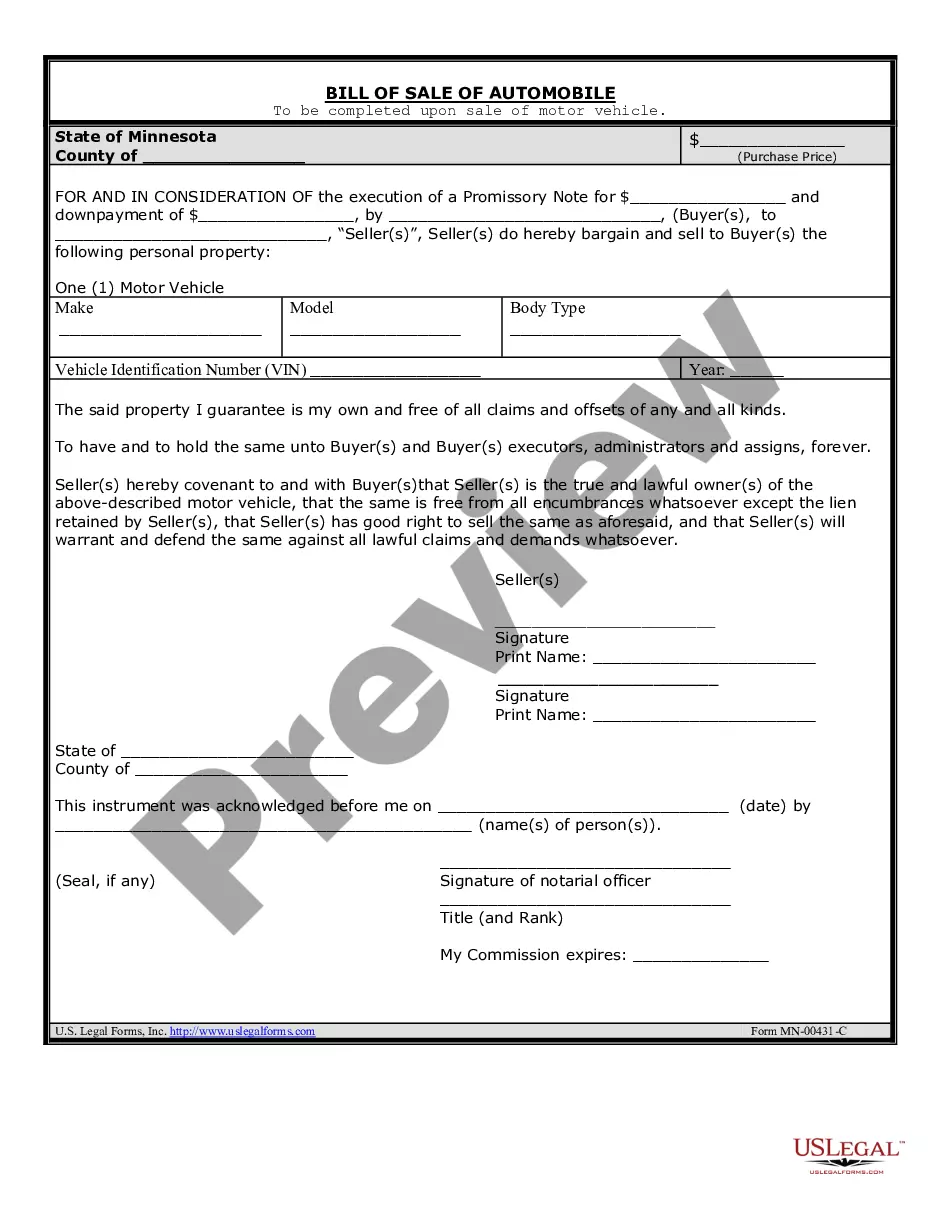

You may spend hours on the web looking for the lawful file format that suits the state and federal specifications you need. US Legal Forms supplies a huge number of lawful varieties that happen to be analyzed by experts. You can actually obtain or printing the Massachusetts Insurance Agents Stock option plan from our assistance.

If you already possess a US Legal Forms account, you can log in and then click the Down load option. Afterward, you can comprehensive, revise, printing, or signal the Massachusetts Insurance Agents Stock option plan. Every lawful file format you acquire is your own permanently. To get one more version for any acquired kind, proceed to the My Forms tab and then click the related option.

Should you use the US Legal Forms website initially, adhere to the easy recommendations below:

- First, be sure that you have selected the best file format for your region/town of your choice. See the kind explanation to make sure you have picked the right kind. If available, take advantage of the Review option to look from the file format also.

- If you would like get one more variation from the kind, take advantage of the Look for field to obtain the format that fits your needs and specifications.

- After you have identified the format you need, click Get now to move forward.

- Pick the costs strategy you need, type in your qualifications, and sign up for an account on US Legal Forms.

- Total the deal. You may use your Visa or Mastercard or PayPal account to pay for the lawful kind.

- Pick the formatting from the file and obtain it for your system.

- Make adjustments for your file if necessary. You may comprehensive, revise and signal and printing Massachusetts Insurance Agents Stock option plan.

Down load and printing a huge number of file layouts making use of the US Legal Forms website, which offers the largest selection of lawful varieties. Use expert and state-distinct layouts to take on your organization or personal requires.

Form popularity

FAQ

The primary mission of the Division of Insurance (DOI) is to monitor the solvency of its licensees in order to promote a healthy, responsive and willing marketplace for consumers who purchase insurance products.

The NAIC sets standards and establishes best practices for the U.S. insurance industry and provides support to insurance regulators. It also provides information and resources to consumers. 1 Insurance products sold in the U.S. are largely regulated by the states, rather than the federal government.

The Federal Insurance Office (FIO) was established by Title V of the federal Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank). The FIO is housed within the U.S. Department of the Treasury and is headed by a director who is appointed by the secretary of the Treasury.

Ricardo Lara is California's 8th Insurance Commissioner since voters created the elected position in 1988.

The National Association of Insurance Commissioners (NAIC) provides expertise, data, and analysis for insurance commissioners to effectively regulate the industry and protect consumers.

Gary Anderson - Commissioner - Massachusetts Division of Insurance | LinkedIn.

You Can Help Others. A good insurance professional has the potential to help those in need, such as victims of natural disasters and people enduring a health crisis. Insurance professionals also help make it possible for an individual to buy a home or start a business. Wherever there is value, you can help protect it.

California Department of Insurance (CDI)