Massachusetts Personal Property - Schedule B - Form 6B - Post 2005

Description

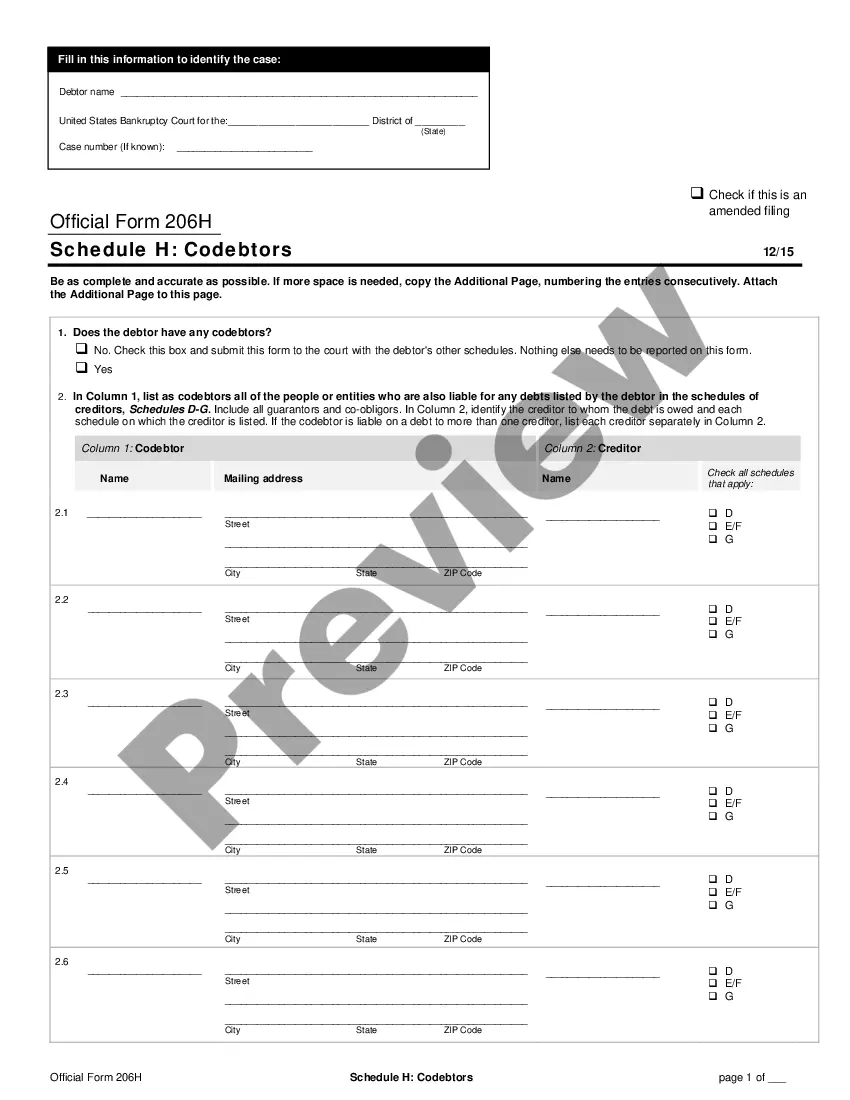

How to fill out Personal Property - Schedule B - Form 6B - Post 2005?

If you have to total, down load, or produce legitimate papers web templates, use US Legal Forms, the most important assortment of legitimate forms, which can be found on-line. Use the site`s basic and practical look for to find the files you require. Different web templates for enterprise and person purposes are categorized by groups and says, or keywords and phrases. Use US Legal Forms to find the Massachusetts Personal Property - Schedule B - Form 6B - Post 2005 within a few mouse clicks.

When you are currently a US Legal Forms buyer, log in to the profile and then click the Download switch to get the Massachusetts Personal Property - Schedule B - Form 6B - Post 2005. You may also access forms you previously delivered electronically within the My Forms tab of your respective profile.

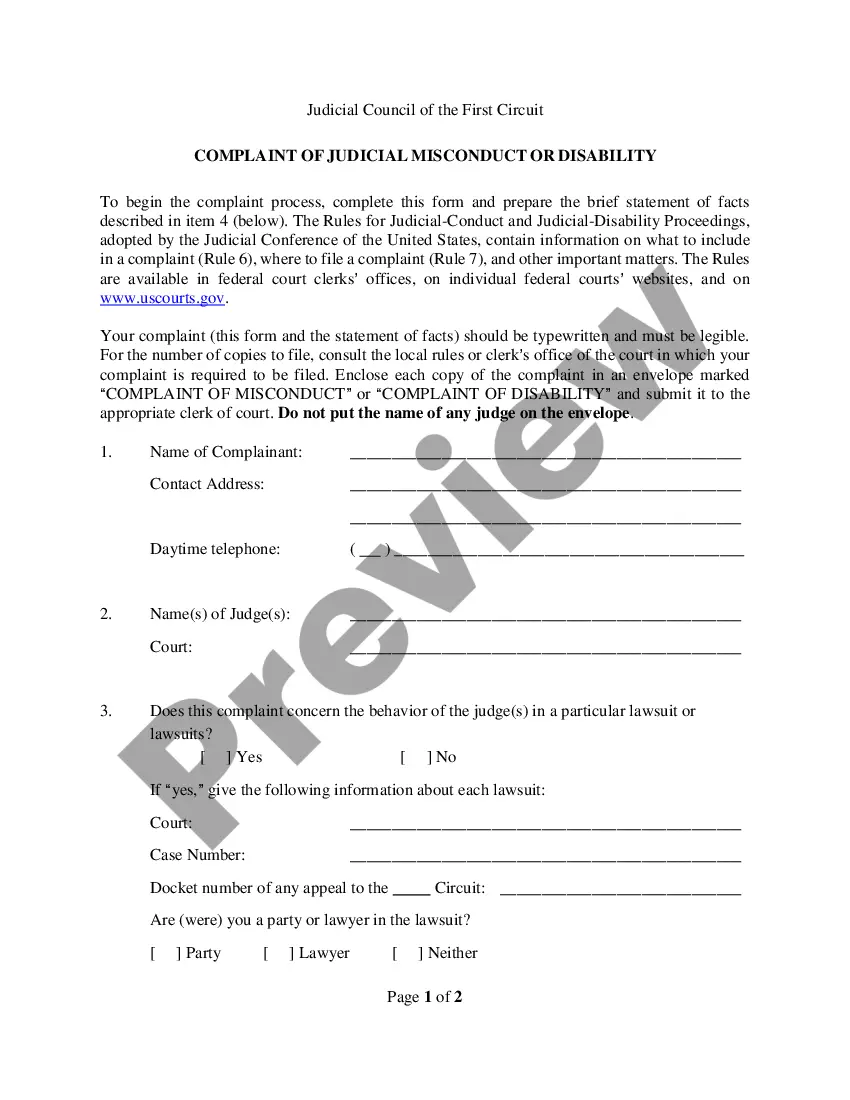

If you are using US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for your correct area/nation.

- Step 2. Take advantage of the Review choice to look through the form`s information. Do not neglect to read through the description.

- Step 3. When you are unsatisfied with all the kind, take advantage of the Lookup area near the top of the display to find other variations in the legitimate kind format.

- Step 4. When you have identified the form you require, click the Buy now switch. Select the prices program you like and add your accreditations to sign up to have an profile.

- Step 5. Approach the financial transaction. You should use your bank card or PayPal profile to finish the financial transaction.

- Step 6. Choose the formatting in the legitimate kind and down load it in your system.

- Step 7. Full, edit and produce or indicator the Massachusetts Personal Property - Schedule B - Form 6B - Post 2005.

Every legitimate papers format you purchase is your own permanently. You have acces to each kind you delivered electronically within your acccount. Click on the My Forms segment and choose a kind to produce or down load once again.

Be competitive and down load, and produce the Massachusetts Personal Property - Schedule B - Form 6B - Post 2005 with US Legal Forms. There are many professional and express-certain forms you can use for your personal enterprise or person requires.

Form popularity

FAQ

As stated above, if you are a homeowner whose primary residence is a property in Massachusetts, you automatically receive up to $125,000 in Homestead Exemption protection. Anyone who owns and occupies a primary residence in Massachusetts may apply for additional Homestead Exemption protection.

If you own and live in your property as a primary residence, you may qualify for the residential exemption. The residential exemption reduces your tax bill by excluding a portion of your residential property's value from taxation.

You must be 70 or older. For Clauses 41C and 41C½, the eligible age may be reduced to 65 or older, by vote of the legislative body of your city or town. You must own and occupy the property as your domicile.

Massachusetts laws Includes clauses for real estate tax exemptions for blind persons, qualifying senior citizens, qualifying surviving spouses, minor children and elderly persons, qualifying veterans, and religious and charitable organizations.

Exemption Programs Blind Exemption 37A. Learn more about how to apply for a 37A Blind exemption. Co-op Housing Exemption. ... Elderly Exemption 41C. ... Hardship Exemption Clause 18. ... National Guard Exemption. ... Residential Exemption. ... Statutory Exemption. ... Surviving Spouse, Minor Child of Deceased Parent, Elderly Exemption 17D.

Interest income excluded from federal gross income under IRC Sec. 103 is generally taxable in Massachusetts.

Tax rates in Massachusetts are determined by cities and towns. They are expressed in dollars per $1,000 of assessed value (often referred to as mill rates). For example, if your assessed value is $200,000 and your tax rate is 10, your total annual tax would be $2,000.

All personal property situated in the commonwealth is subject to tax, unless specifically exempt by law. See Massachusetts GL c. 59, §2. Property is situated in a particular city or town in the commonwealth if it is present on January 1 with the owner's intention that it remain with some degree of permanence.