Massachusetts Personal Representative Request Form

Description

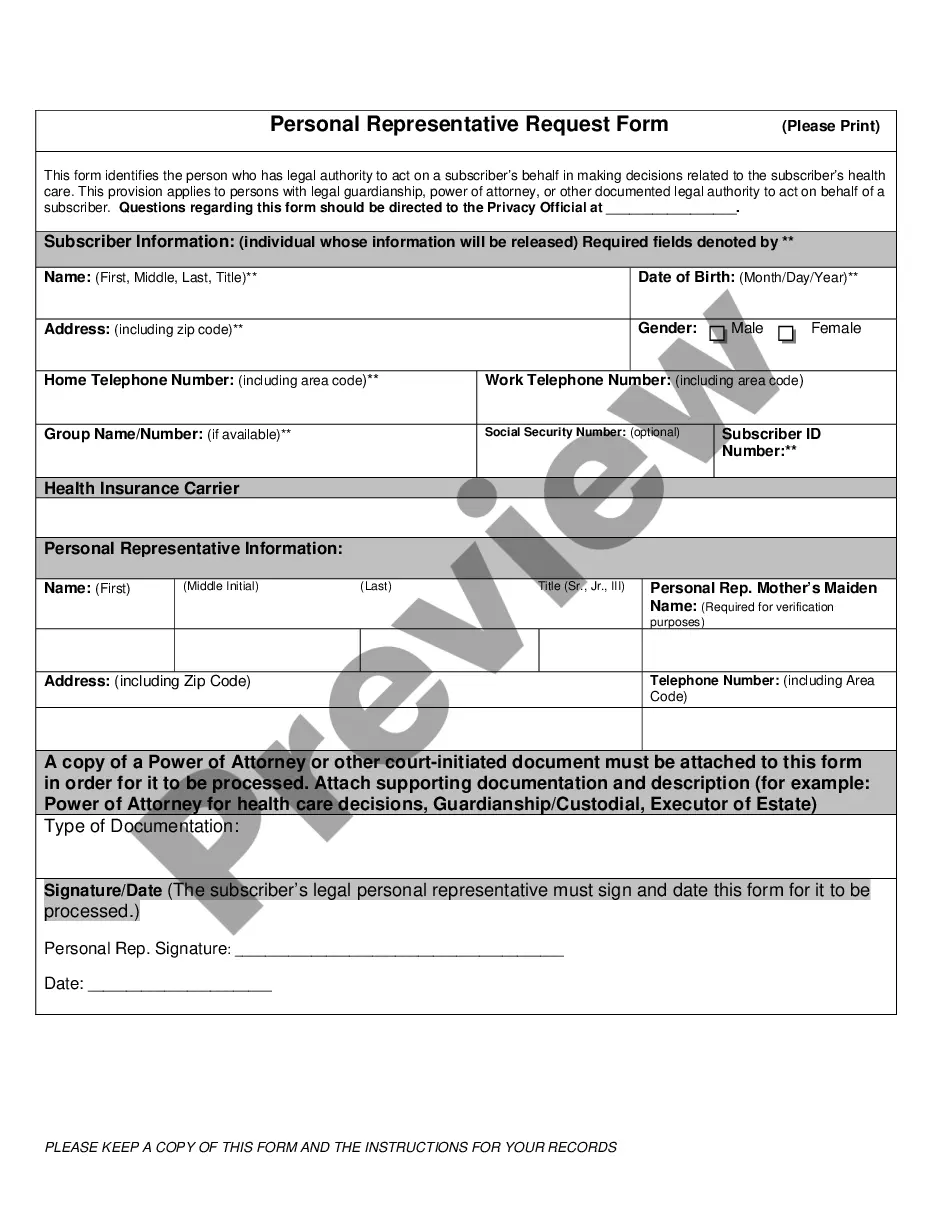

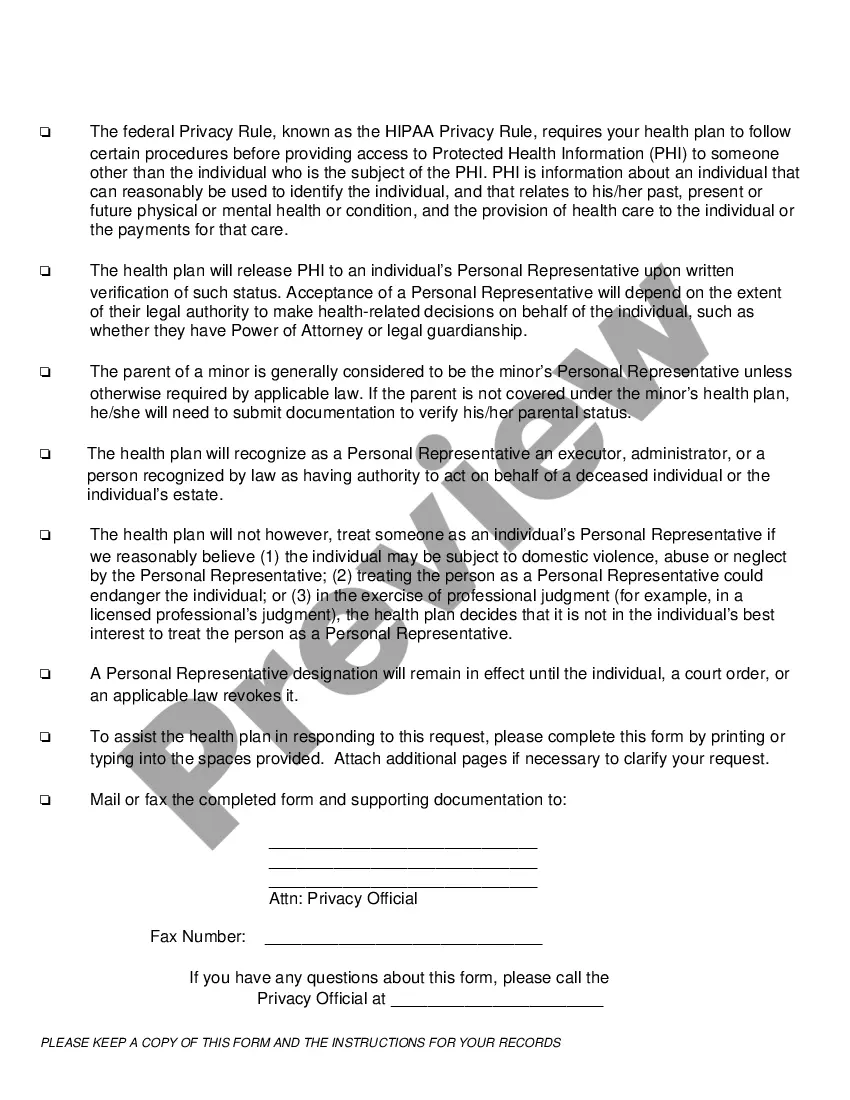

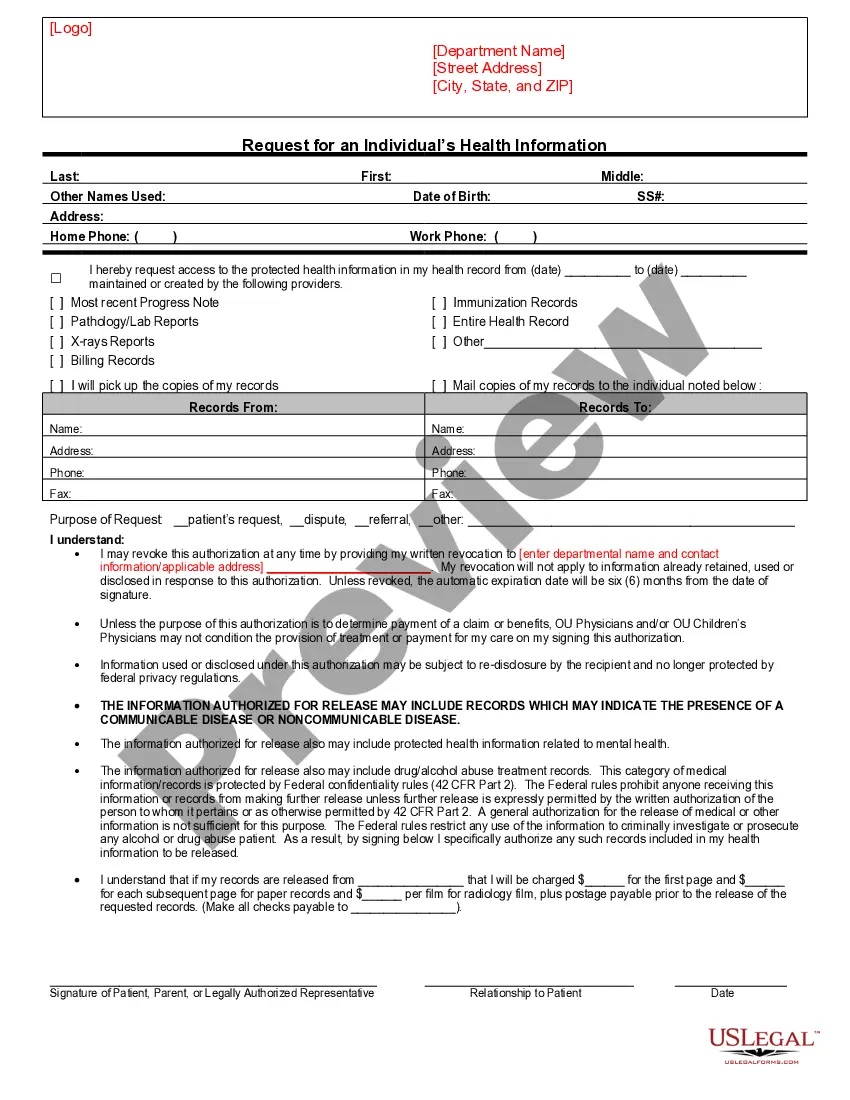

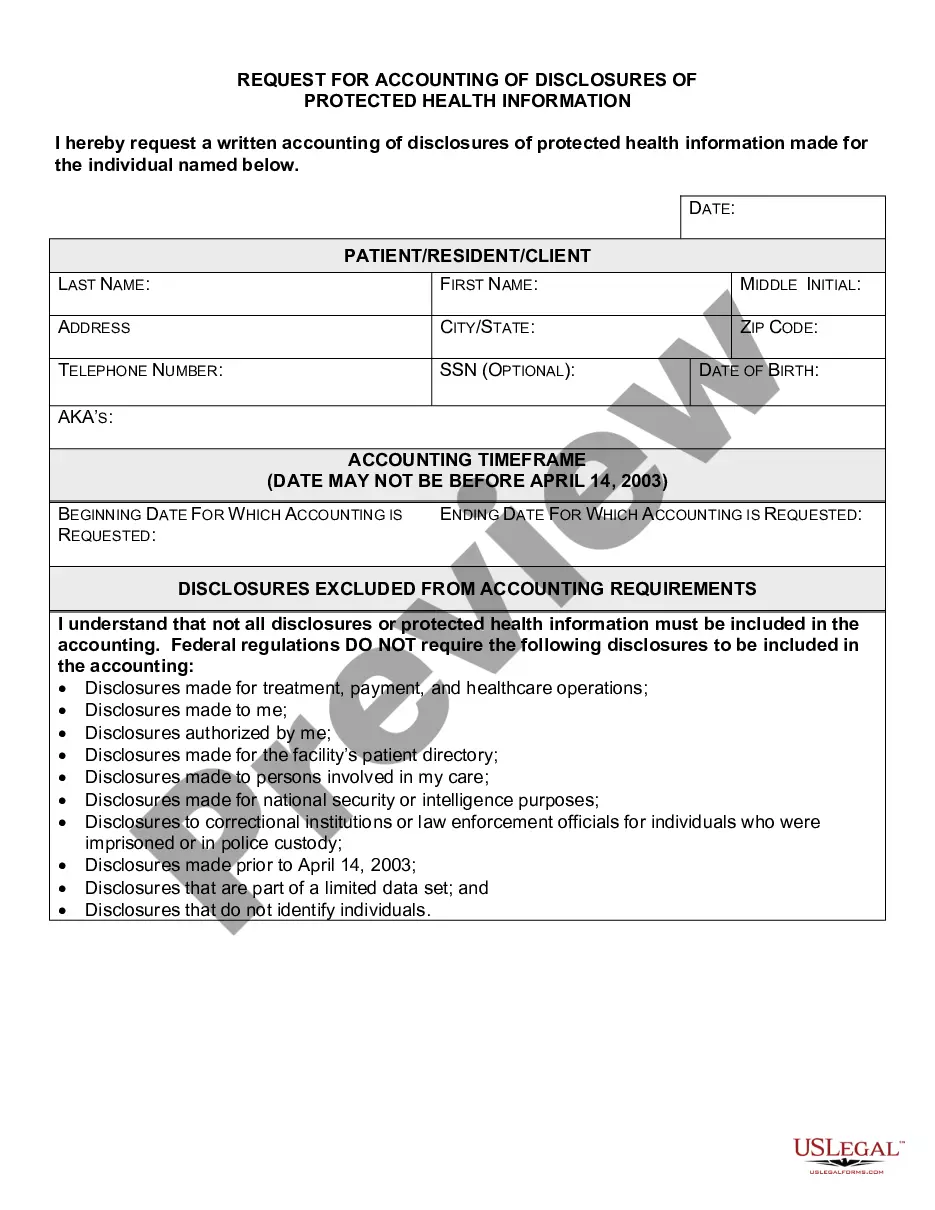

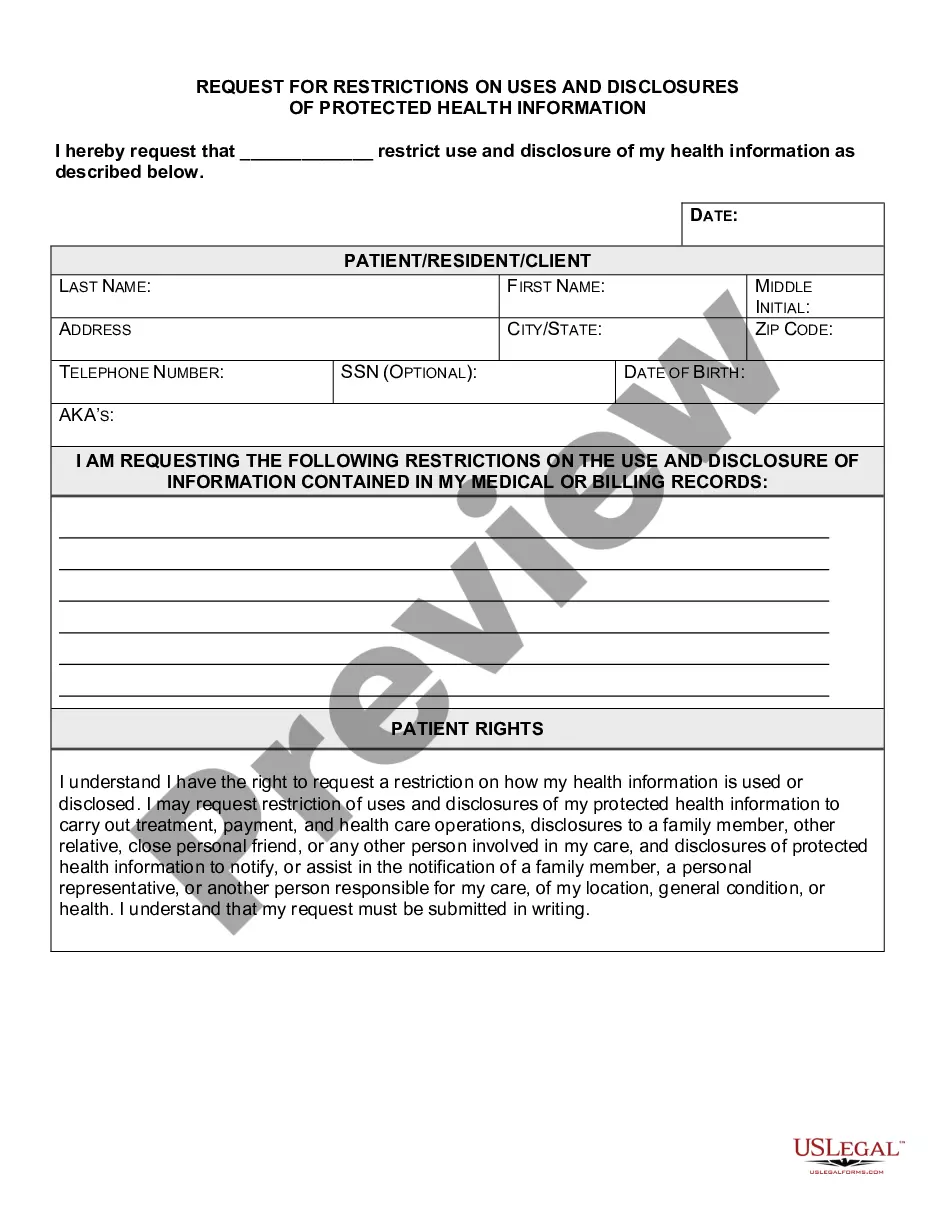

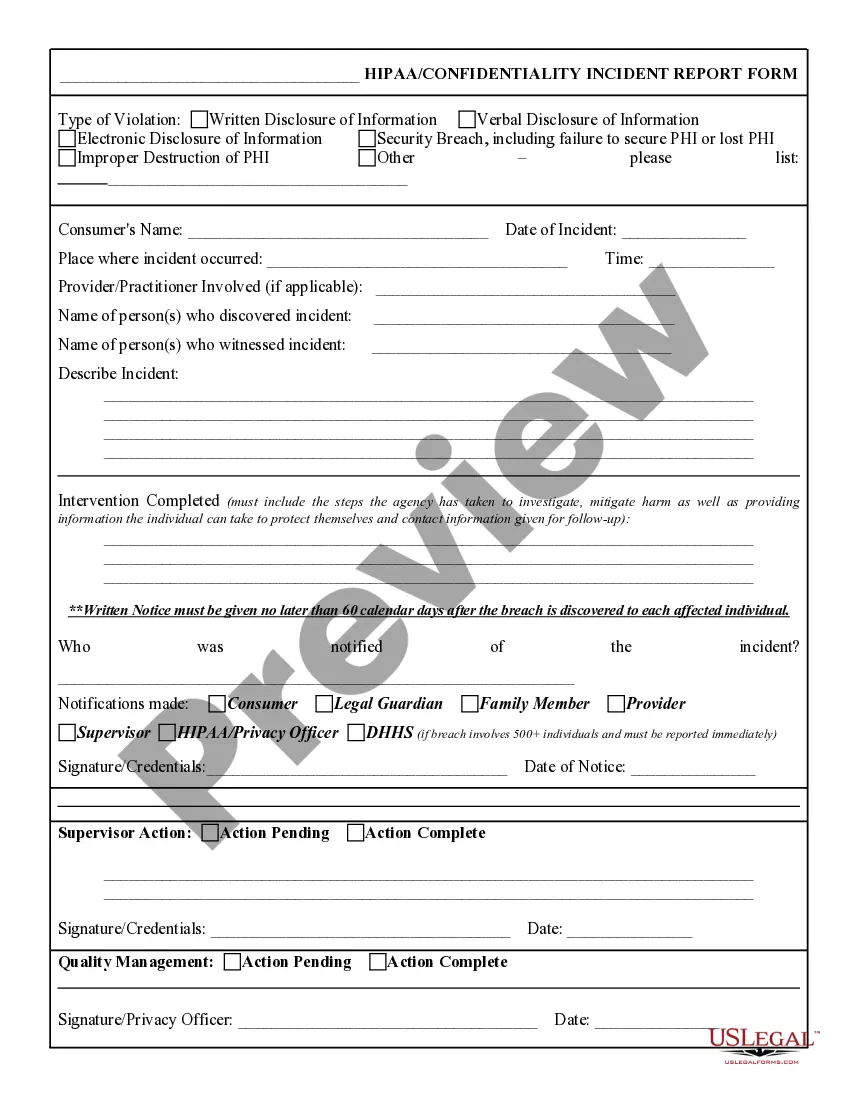

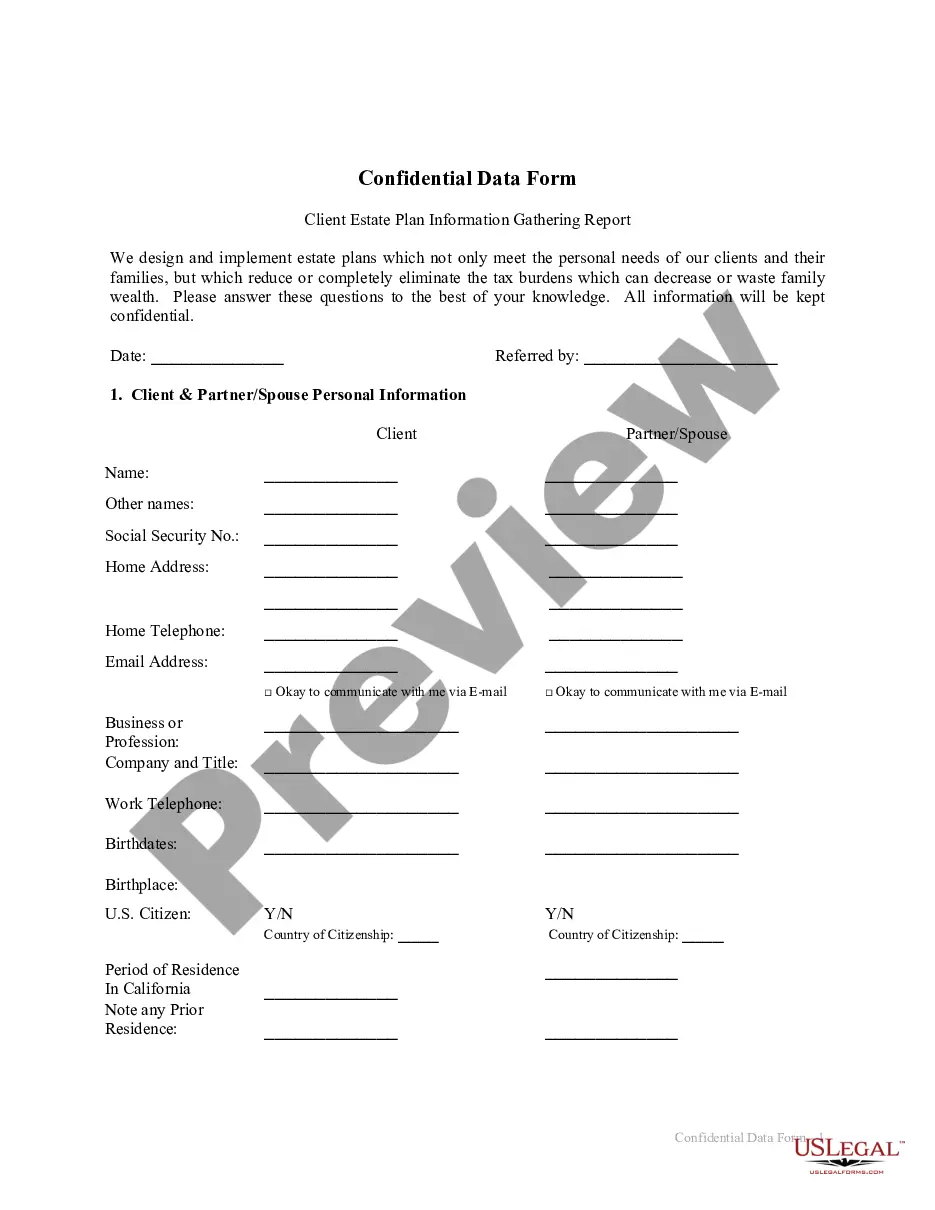

How to fill out Personal Representative Request Form?

Should you desire to finalize, obtain, or create sanctioned document templates, utilize US Legal Forms, the leading collection of legal documents available online.

Take advantage of the website's straightforward and user-friendly search to locate the forms you require.

Various templates for business and personal purposes are categorized by regions and states, or by keywords.

Every legal document format you receive belongs to you indefinitely. You have access to every form you obtained in your account.

Stay competitive and obtain, and print the Massachusetts Personal Representative Request Form with US Legal Forms. There are countless professional and state-specific forms available for your personal or business needs.

- Use US Legal Forms to get the Massachusetts Personal Representative Request Form in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and hit the Download button to find the Massachusetts Personal Representative Request Form.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Preview option to view the content of the form. Remember to examine the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find other versions in the legal form format.

- Step 4. Once you have found the form you need, click on the Get now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Massachusetts Personal Representative Request Form.

Form popularity

FAQ

In any event, where it is accepted that payment is due, the executor can seek to pay you (the creditor) from the deceased's estate. There is normally a six-month period from the deceased's death for creditors to advise the executor of any sums due to them from the estate.

Settling an Estate in MassachusettsFile a petition for probate and the will with the court in the county where the decedent lived along with any necessary fees.An executor or personal representative will be appointed or approved by the court to act on behalf of the estate.More items...

The probate process can take about 12-18 months. Per Massachusetts law, an estate must be probated within three years. Many factors can delay the probate process. As a Massachusetts probate lawyer, I can help work to avoid the delays and ensure that any complications that occur are resolved quickly.

A bank trust department or an estate planning lawyer can serve as a personal representative. One of the benefits of appointing a paid executor is that it shifts the burden away from unpaid family members onto a professional with experience.

Under Massachusetts law, general (unsecured) creditors have one (1) year from the date of death to file a claim against an estate. An example of a general creditor is a collection agency attempting to obtain payment on outstanding credit card debt.

After receiving the tax return, the IRS will issue a closing letter, which allows the personal representative of the estate to finalize probate. This step typically takes from four to 12 months, depending on whether the IRS decides to use the tax return for an audit.

Under Massachusetts law, general (unsecured) creditors have one (1) year from the date of death to file a claim against an estate.

In Massachusetts, creditors have up to 12 months to make claims against the estate for payment of the debt.

It generally takes about six to eight weeks from the time the papers are presented to the probate court to the time the executor becomes legally appointed. During that time, the executor has very little actual power over the assets of the decedent.

Remember, credit does not die and continues after the death of the debtor, meaning that creditors have a right to claim from the deceased's estate. Remember, the executor is obliged to pay all the estate's debts before distributing anything to their heirs or legatees of the deceased.