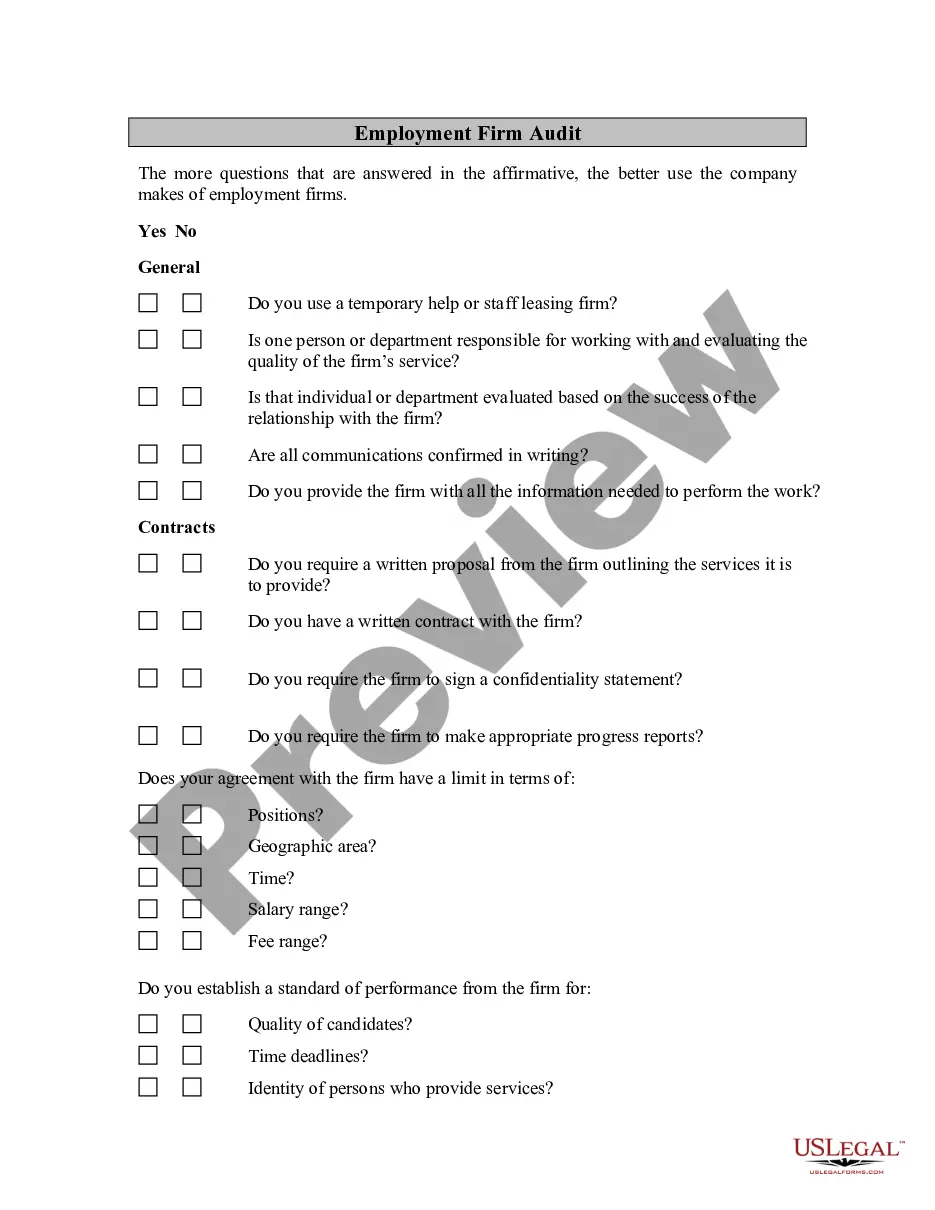

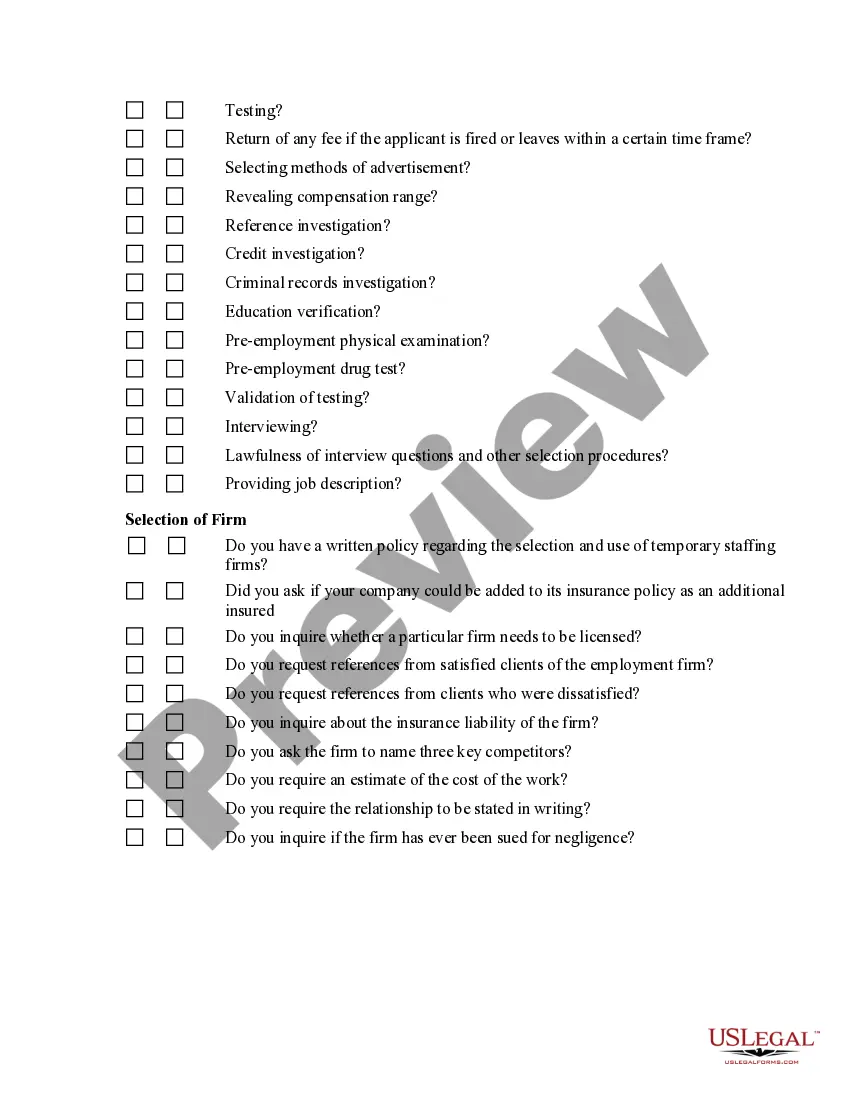

Massachusetts Employment Firm Audit

Description

How to fill out Employment Firm Audit?

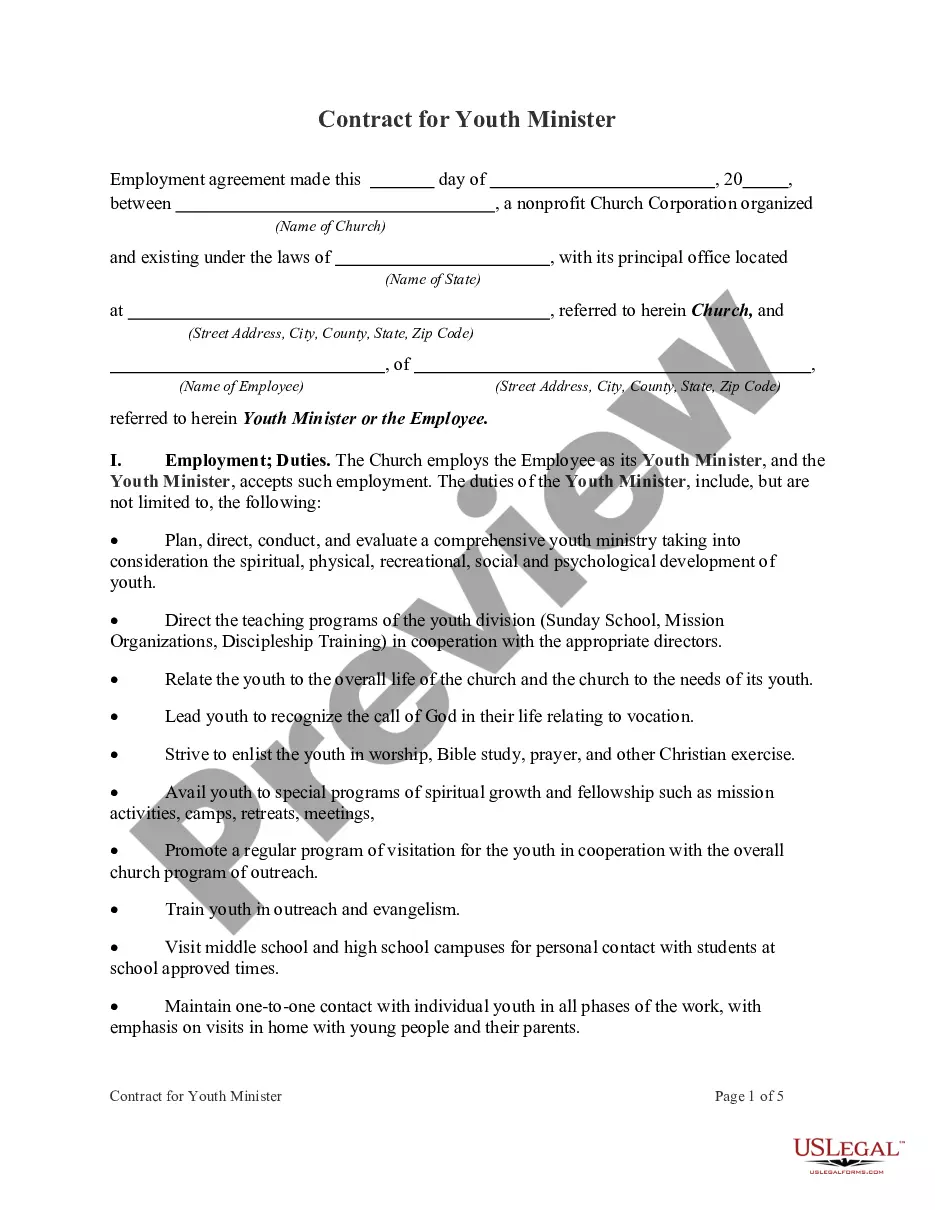

Choosing the right legal document template could be a battle. Needless to say, there are a variety of web templates available on the Internet, but how would you get the legal form you require? Utilize the US Legal Forms website. The support gives a huge number of web templates, such as the Massachusetts Employment Firm Audit, which you can use for enterprise and personal requires. All the forms are inspected by professionals and meet up with federal and state specifications.

In case you are already listed, log in to your accounts and click the Acquire key to find the Massachusetts Employment Firm Audit. Make use of accounts to appear throughout the legal forms you have bought earlier. Check out the My Forms tab of your own accounts and obtain one more version in the document you require.

In case you are a fresh customer of US Legal Forms, listed here are straightforward guidelines that you can comply with:

- Initially, make certain you have selected the appropriate form to your metropolis/region. You are able to look over the form making use of the Review key and read the form description to ensure it will be the best for you.

- In case the form is not going to meet up with your requirements, use the Seach industry to obtain the correct form.

- When you are certain that the form is acceptable, go through the Acquire now key to find the form.

- Select the rates prepare you need and enter the essential details. Make your accounts and pay money for an order utilizing your PayPal accounts or Visa or Mastercard.

- Select the submit formatting and acquire the legal document template to your device.

- Total, modify and produce and sign the attained Massachusetts Employment Firm Audit.

US Legal Forms may be the biggest library of legal forms in which you can discover different document web templates. Utilize the service to acquire professionally-manufactured documents that comply with status specifications.

Form popularity

FAQ

In essence, an HR audit involves identifying issues and finding solutions to problems before they become unmanageable. It is an opportunity to assess what an organization is doing right, as well as how things might be done differently, more efficiently or at a reduced cost.

9 Steps to Flawless Audit PreparationPlan ahead.Brush up on accounting standards.Reconcile all accounts.Learn from previous errors.Identify significant changes.Draw up a timeline.Divide responsibilities.Be proactive.More items...?

You can be audited for up to six years by the IRS if the income you report on your return is more than 25% less than what you actually took in. State tax rules can vary by state. Most IRS audits must occur within three years, but six states give themselves four years.

Statute of limitations DOR has the legal authority to audit any type of individual or business returns for up to 3 years after filing.

Under California Revenue and Taxation Code Section 19255, the statute of limitations to collect unpaid state tax debts is 20 years from the assessment date, but there are situations that may extend the period or allow debts to remain due and payable.

The general process of conducting an audit includes seven key steps, each of which is discussed in greater detail below:Determine the scope and type of audit.Develop the audit questionnaire.Collect the data.Benchmark the findings.Provide feedback about the results.Create action plans.More items...

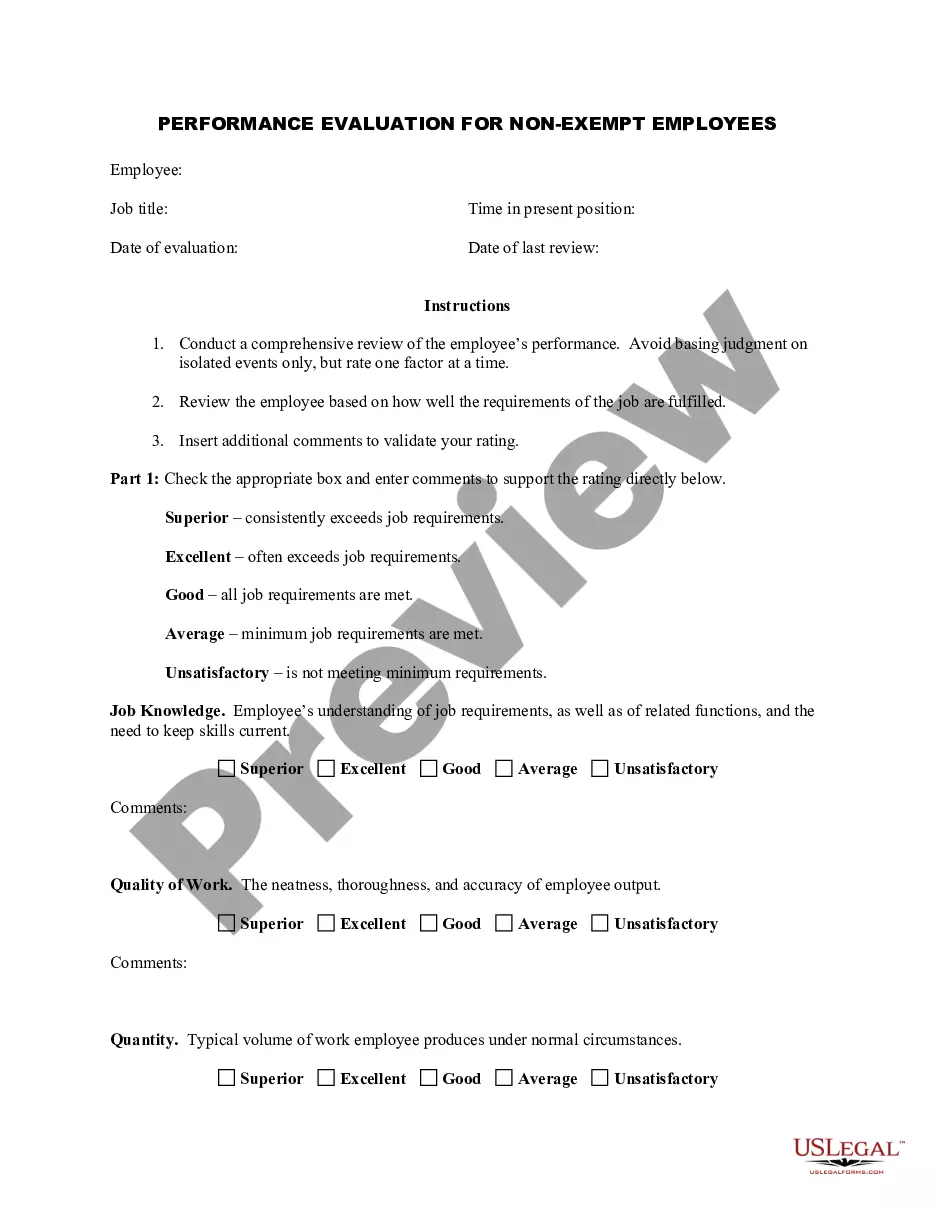

A job audit is a formal procedure in which a compensation professional meets with the manager and employee to discuss and explore the position's current responsibilities.

A job audit is a formal review of the current duties and responsibilities assigned to a position to ensure appropriate classification within the classified pay program. An audit should be requested if the duties and responsibilities of a position have significantly changed.

Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years. We usually don't go back more than the last six years. The IRS tries to audit tax returns as soon as possible after they are filed.

An audit can be as simple as reviewing employment files to ensure that they are in order or it can involve reviewing effectiveness of corporate HR policies, which may include interviewing supervisors, managers and employees. Audits can be broad, incorporating how a business operates and reviewing efficiencies.