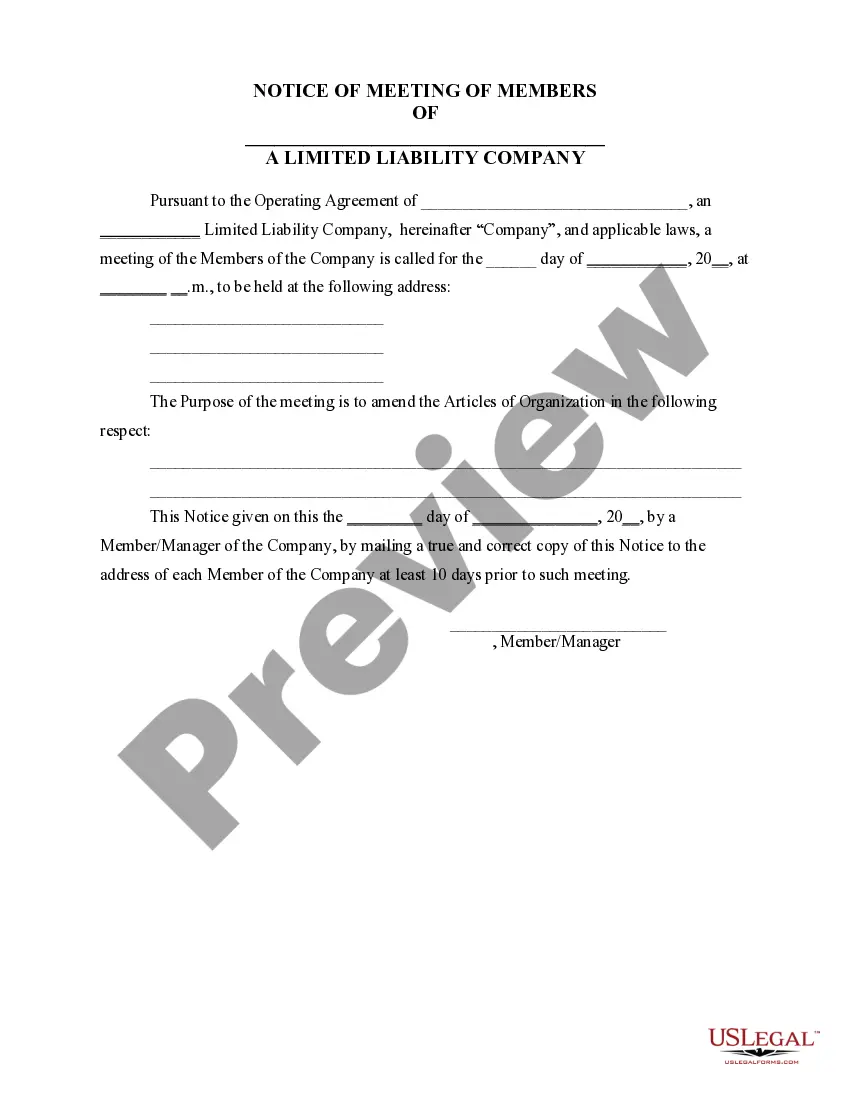

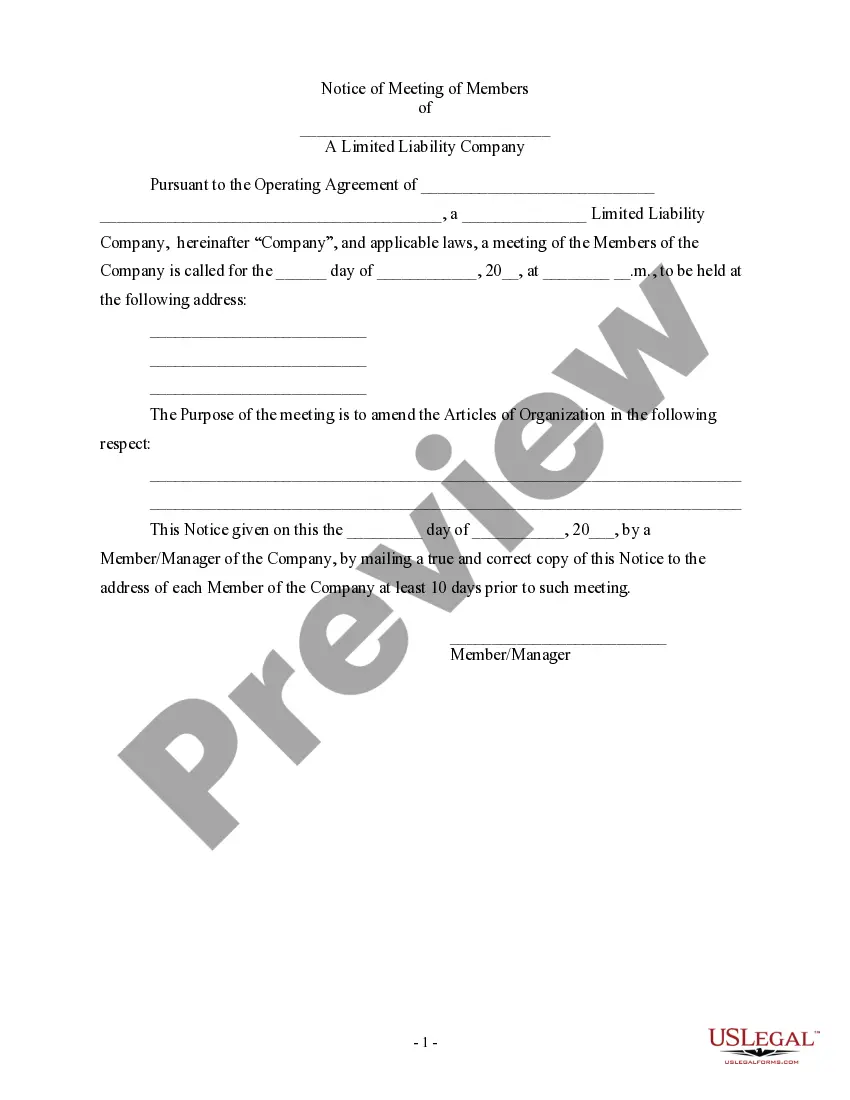

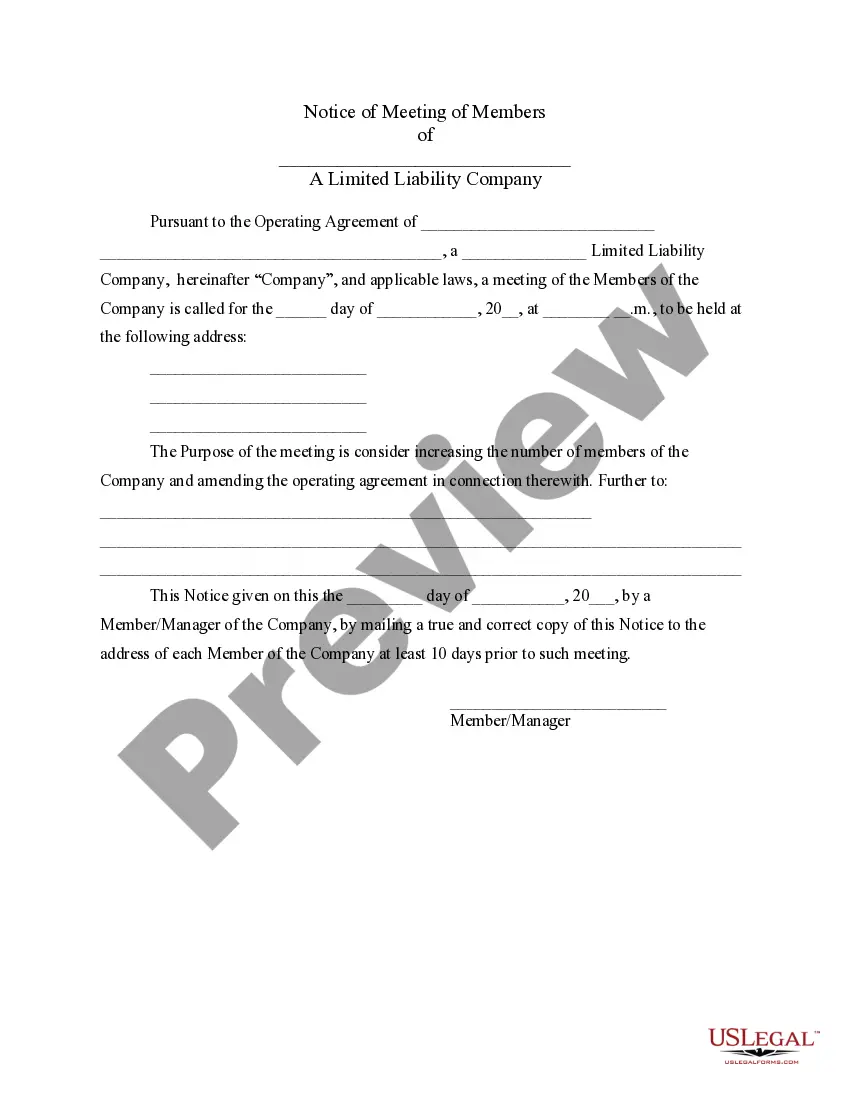

Massachusetts Notice of Meeting of LLC Members To Consider Increasing the Number of Members of Company and Amend the Operating Agreement

Description

How to fill out Notice Of Meeting Of LLC Members To Consider Increasing The Number Of Members Of Company And Amend The Operating Agreement?

You can invest time online searching for the valid document template that meets the federal and state requirements you will need.

US Legal Forms offers thousands of valid forms that have been reviewed by experts.

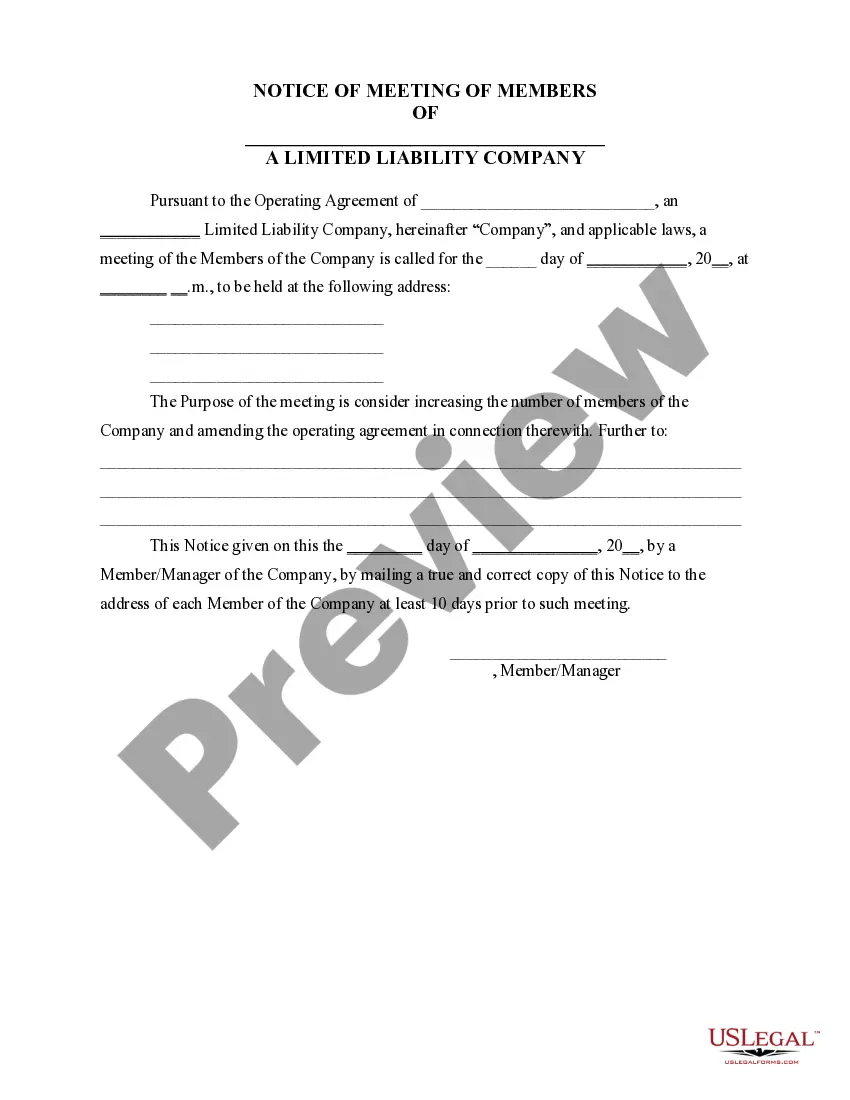

You can obtain or generate the Massachusetts Notice of Meeting of LLC Members To Consider Increasing the Number of Members of Company and Amend the Operating Agreement from this service.

If available, utilize the Review option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and select the Acquire option.

- Then, you can complete, modify, generate, or sign the Massachusetts Notice of Meeting of LLC Members To Consider Increasing the Number of Members of Company and Amend the Operating Agreement.

- Each valid document template you purchase is yours permanently.

- To obtain an additional copy of any purchased form, go to the My documents tab and select the corresponding option.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- Firstly, ensure that you have selected the correct document template for the state/town of your choice.

- Check the template outline to confirm you have selected the right form.

Form popularity

FAQ

A member of the LLC should have an ethical responsibility to meet the obligations of the firm. They should have duty of care.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

GENERAL. Massachusetts has approved single member LLCs to organize under state law. In the past, an LLC had to have two members. By allowing single member LLCs, a sole proprietorship can now convert to a single member LLC and get liability protection from creditors.

To amend your Massachusetts LLC you will have to file a Certificate of Amendment with the Massachusetts Secretary of the Commonwealth, Corporations Division (SOC). There is no SOC form for LLC amendments. LLCs have to draft their own amendments based on Massachusetts statutory requirements.

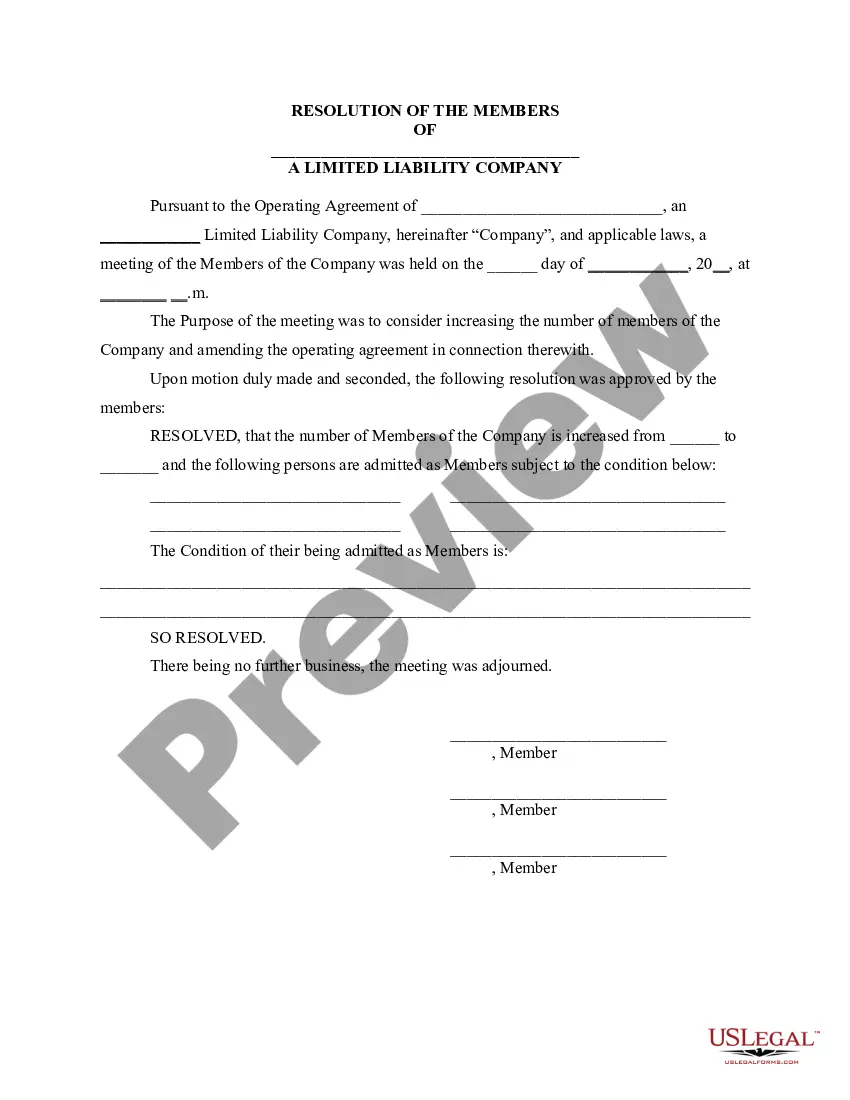

Generally speaking, the process for how to add an LLC member involves amending the LLC's operating agreement that brings in the new member. Current LLC members must then vote on the amendment for it to passand most states, as well as many LLC operating agreements, require unanimous approval.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

The LLC is wholly owned by the husband and wife as community property under state law. no one else would be considered an owner for federal tax purposes, and. the business is not otherwise treated as a corporation under federal law.

Massachusetts does not require an operating agreement in order to form an LLC, but executing one is highly advisable. . . An operating agreement is the basic written agreement between the members (i.e., owners) of the LLC, or between the members and the managers of the company, if there are managers.

Single-member LLCs are taxed as sole proprietorships, but if a new member is added, making it a multi-member LLC, the taxation status will change. Multi-member LLCs can choose to be taxed as partnerships or corporations.

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities. There is no maximum number of members. Most states also permit single-member LLCs, those having only one owner.