Massachusetts Agreement for Withdrawal of Partner from Active Management

Description

How to fill out Agreement For Withdrawal Of Partner From Active Management?

Selecting the optimal legal document template can feel like a challenge. Of course, there are countless designs available online, but how can you find the legal document you require? Utilize the US Legal Forms website.

This service provides a vast array of templates, such as the Massachusetts Agreement for Withdrawal of Partner from Active Management, which you can use for both business and personal purposes. All forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Massachusetts Agreement for Withdrawal of Partner from Active Management. Use your account to access the legal forms you have previously acquired. Navigate to the My documents tab in your account and download another copy of the document you need.

Select the format and download the legal document template to your device. Complete, modify, print, and sign the acquired Massachusetts Agreement for Withdrawal of Partner from Active Management. US Legal Forms is the premier source of legal forms where you can explore various document formats. Utilize the service to download correctly crafted documents that adhere to state standards.

- First, ensure you have selected the correct form for your city/county.

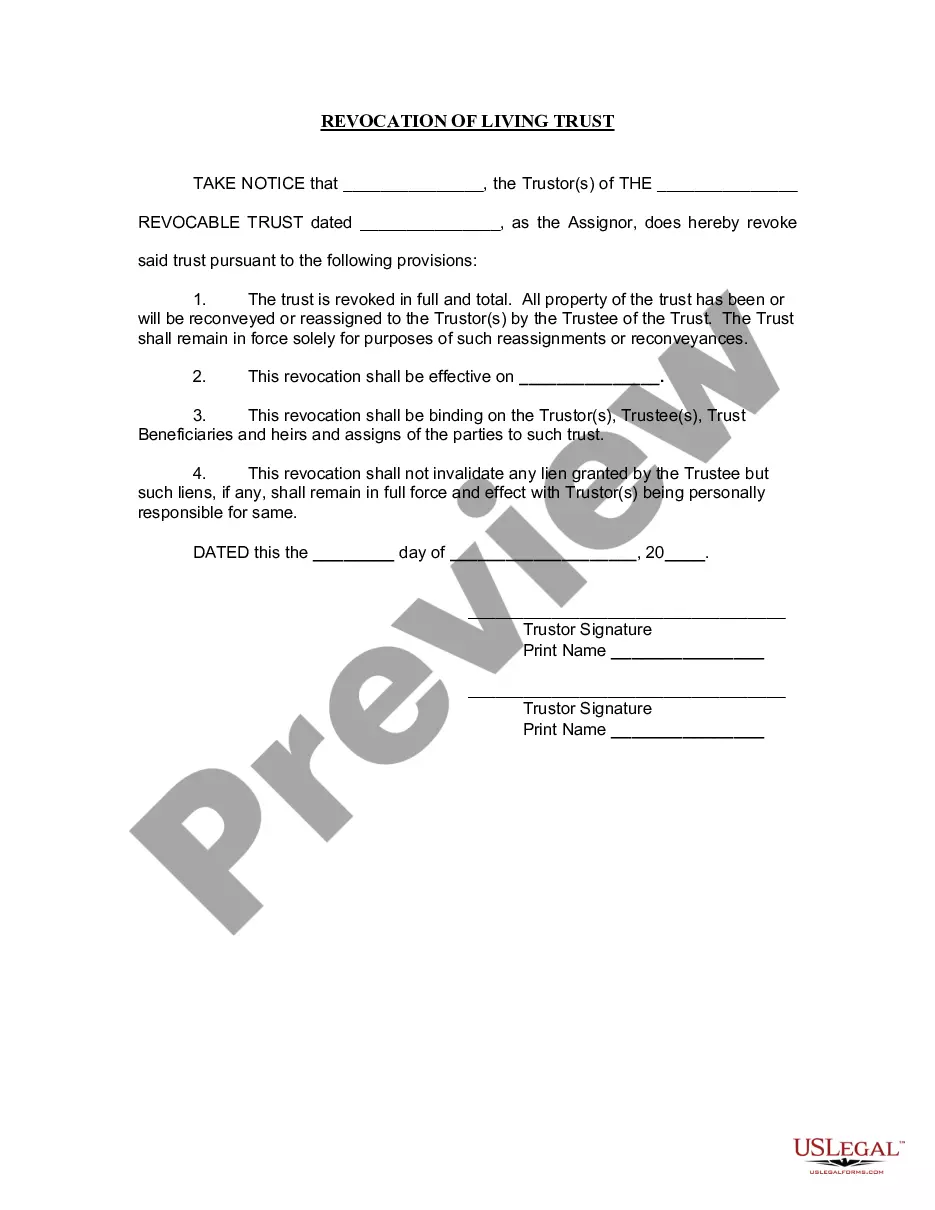

- You can preview the form using the Preview button and review the form description to confirm it meets your requirements.

- If the form does not align with your needs, use the Search field to find the correct form.

- Once you are confident the form is suitable, click the Buy now button to purchase the form.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

Exiting a 50/50 partnership can be complex, but clear communication is essential. Partners should discuss their intentions openly, considering the terms set forth in their agreement. Utilizing the Massachusetts Agreement for Withdrawal of Partner from Active Management can provide a formalized method for one partner to exit while protecting both parties' interests.

To dissolve a partnership in Massachusetts, start by consulting the partnership agreement for specific instructions. Then, partners must come to a mutual decision to dissolve, ideally documenting their choices in writing. Using the Massachusetts Agreement for Withdrawal of Partner from Active Management streamlines this process, ensuring all parties understand their rights and obligations during the dissolution.

While one partner may have significant influence, dissolving the entire partnership typically requires consensus among all partners. The partnership agreement may specify conditions under which a partner can withdraw or dissolve the business. In scenarios where withdrawal is anticipated, using the Massachusetts Agreement for Withdrawal of Partner from Active Management can help facilitate a smoother transition.

Massachusetts Directive 03 12 provides guidance on the management of partnerships in the state, emphasizing clear communication and structured processes for withdrawals. This directive outlines best practices for partners when creating agreements like the Massachusetts Agreement for Withdrawal of Partner from Active Management, ensuring compliance with state regulations. Familiarizing yourself with this directive can enhance your understanding of partnership dynamics.

Dissolving a partnership begins with reviewing the partnership agreement to understand the required procedures. Generally, partners must vote to dissolve the business and settle all debts and obligations. After negotiating the terms, partners can use the Massachusetts Agreement for Withdrawal of Partner from Active Management to formally document their exit and closures.

MA form 3 is the official document used in Massachusetts to execute the Agreement for Withdrawal of Partner from Active Management. It provides a structured way for a partner to exit a partnership while ensuring clarity in responsibilities and obligations. Using this form helps prevent any potential disputes by outlining the terms of withdrawal clearly.

Any group of individuals or entities looking to carry on a business together might consider forming a partnership. There’s no strict requirement for a specific number of partners, but the partnership must have a structured agreement. Leveraging tools like the Massachusetts Agreement for Withdrawal of Partner from Active Management can ensure that when partners join or leave, the process remains smooth and legally sound.

Withdrawals from partnerships can be taxable, depending on the context of the withdrawal. If a partner exits the partnership, their share may be considered a distribution that could trigger tax obligations. The Massachusetts Agreement for Withdrawal of Partner from Active Management can clarify the tax implications of such withdrawals and guide partners effectively in addressing these matters.

Failing to file a partnership tax return can lead to significant penalties and interest, accruing over time. The IRS and Massachusetts Department of Revenue can impose fines for non-compliance. Additionally, if a partner withdraws, implementing the Massachusetts Agreement for Withdrawal of Partner from Active Management is crucial; otherwise, it might complicate taxation and liability for the remaining partners.

Massachusetts Form 3 must be filed by partnerships with income, gains, or deductions allocable to Massachusetts. If your partnership operates within Massachusetts borders and meets these criteria, it is required to file this form. This ensures compliance, especially if you are withdrawing a partner; consider using the Massachusetts Agreement for Withdrawal of Partner from Active Management to guide you through the necessary steps.