Massachusetts Business Trust

Description

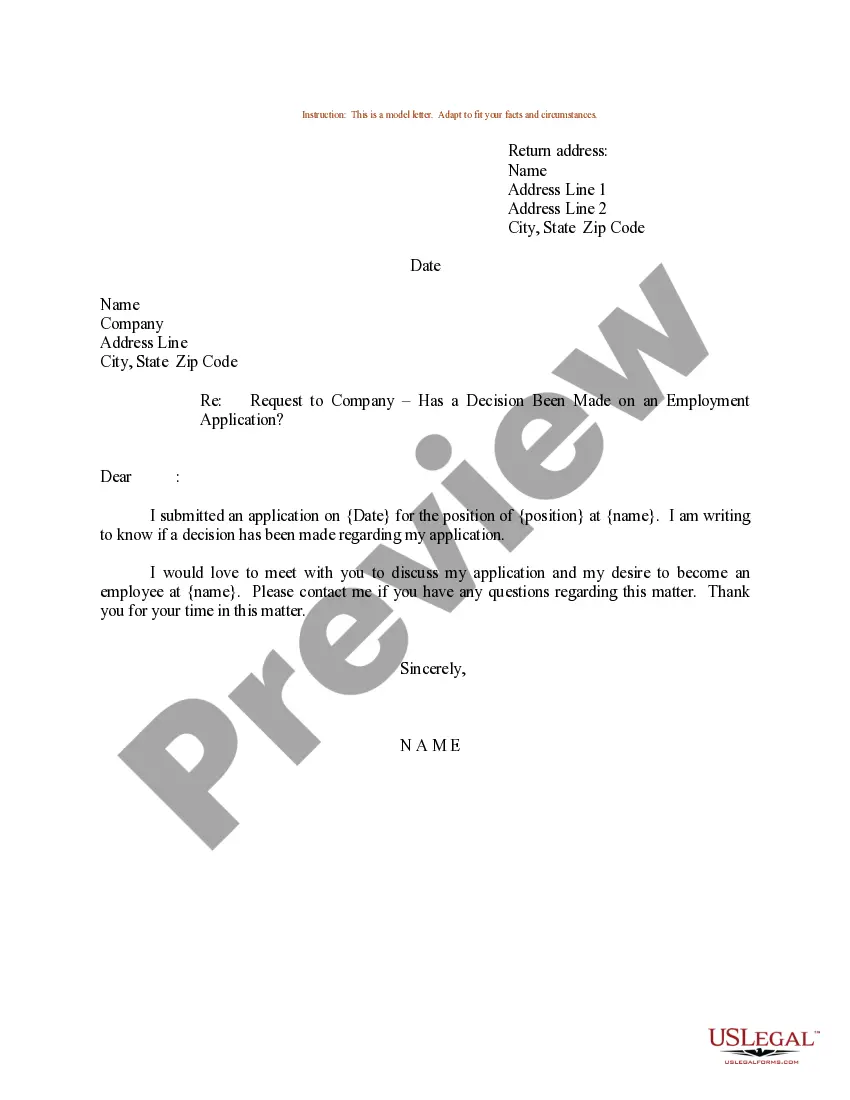

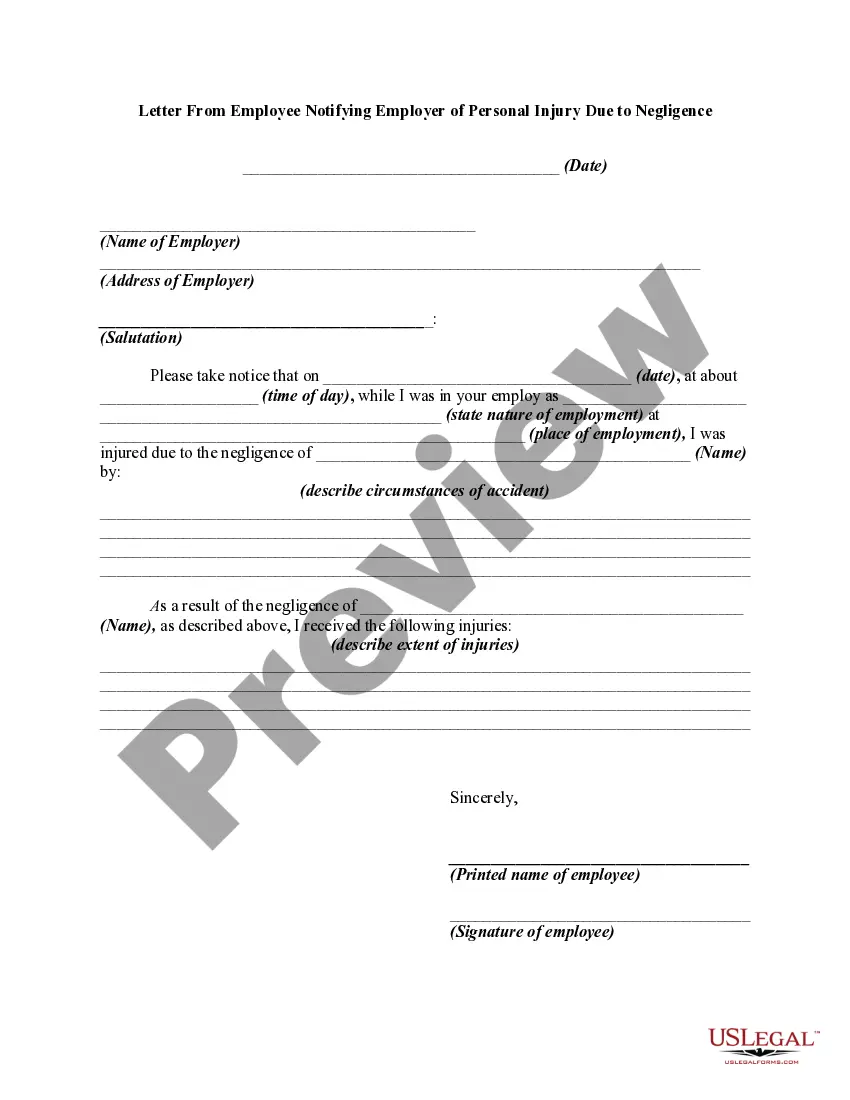

How to fill out Business Trust?

You have the capability to spend hours online searching for the legal document template that meets the federal and state requirements that you will require. US Legal Forms offers thousands of legal templates that are verified by professionals.

You can easily download or print the Massachusetts Business Trust from my service.

If you possess a US Legal Forms account, you can Log In and click on the Download button. Then, you can complete, modify, print, or sign the Massachusetts Business Trust. Every legal document template you purchase is yours permanently.

Complete the transaction. You can use your credit card or PayPal account to buy the legal template. Select the format of your document and download it to your device. Make modifications to your document if necessary. You can complete, modify, sign, and print the Massachusetts Business Trust. Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of a purchased form, head to the My documents tab and click on the corresponding button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the document description to confirm you have selected the right form.

- If available, use the Preview button to browse through the document template as well.

- To locate another version of the form, use the Search field to find the template that addresses your needs and requirements.

- Once you have found the template you require, click on Order now to continue.

- Choose the pricing plan you prefer, enter your details, and create an account on US Legal Forms.

Form popularity

FAQ

Trusts created under the will of a person who died a resident of any other state or foreign country are subject to the taxing jurisdiction of Massachusetts only to the extent of income derived by the trustee (regardless of his residence) from the carrying on of a profession, trade or business within Massachusetts.

A business trust is considered a corporation for purposes of federal Income Tax and similarly under various state income tax laws.

At the end of the trust's length, the business interests transfer to its beneficiaries. Business trusts are treated as corporations and may conduct business transactions just like individuals.

Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

Business trusts are taxed similarly to corporations for intents and purposes related to federal income taxes and other state income tax regulations. Since a business trust is managed by trustees, they have a financial responsibility to act in the best interest of the beneficiaries.

How to Create a Business Trust in MassachusettsWrite: Your business's trustee will write the declaration of trust to create the trust entity.Record: Your trustee can record this declaration of trust with the registry of deeds where the trust is located.

In Massachusetts, business trusts are subject to personal income tax and taxed as individuals because they enjoy no franchise conferred by the Legislature.

Trust advantages and disadvantageslimited liability is possible if a corporate trustee is appointed.the structure provides more privacy than a company.there can be flexibility in distributions among beneficiaries.trust income is generally taxed as income of an individual.

The define business trust is an entity that has a business purpose, functions as a business and is treated as a legal entity by the tax authorities. Basically, a business trust is a commercial organization that is managed by appointed trustees for the benefit of its beneficiaries.