Massachusetts Assignment of Equipment Lease by Dealer to Manufacturer

Description

How to fill out Assignment Of Equipment Lease By Dealer To Manufacturer?

US Legal Forms - one of the largest collections of legitimate documents in America - provides a diverse range of authentic paper templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You will find the latest versions of forms like the Massachusetts Assignment of Equipment Lease by Dealer to Manufacturer in just a few minutes.

If you have a membership, Log In and download the Massachusetts Assignment of Equipment Lease by Dealer to Manufacturer from the US Legal Forms local library. The Obtain button will appear on every form you view. You have access to all previously acquired forms in the My documents section of your account.

Make edits. Complete, modify, print, and sign the downloaded Massachusetts Assignment of Equipment Lease by Dealer to Manufacturer.

Every template you added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Massachusetts Assignment of Equipment Lease by Dealer to Manufacturer with US Legal Forms, the most comprehensive library of legitimate document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- To use US Legal Forms for the first time, follow these simple steps.

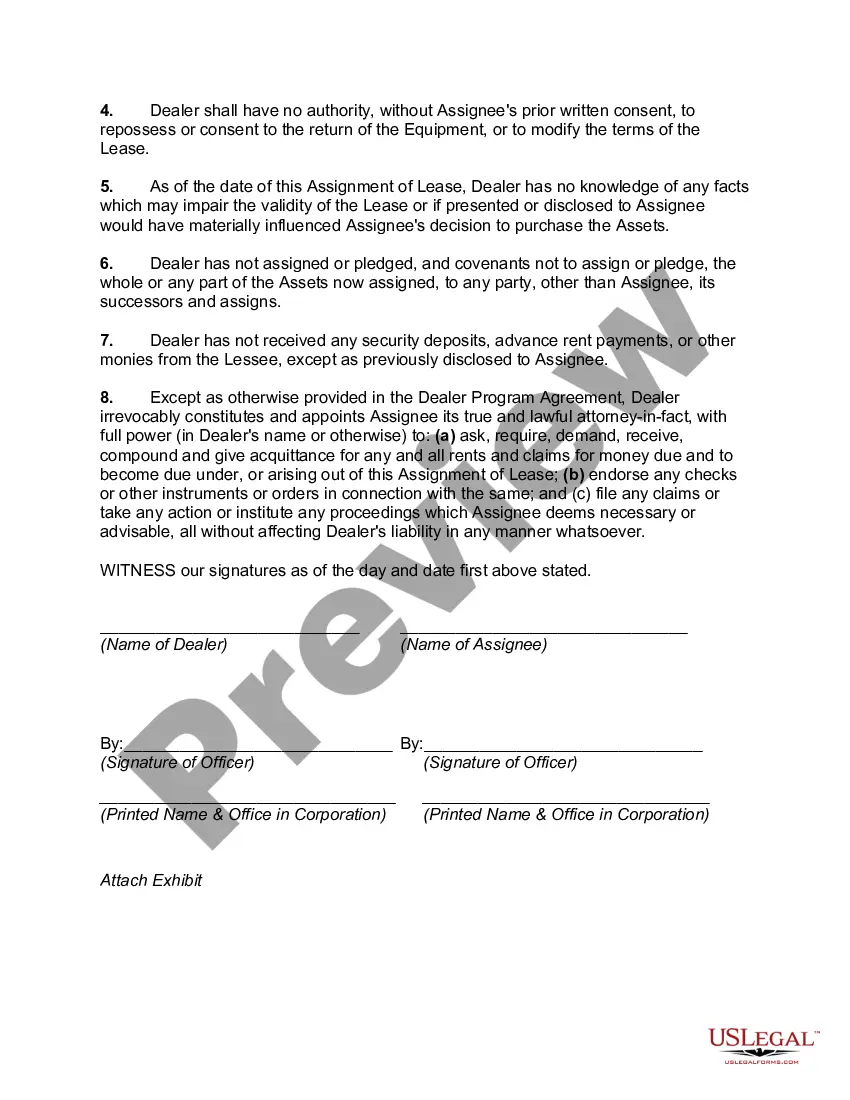

- Ensure you have chosen the correct form for your city/county. Click on the Preview button to review the form's details. Check the form information to make sure you have the right form.

- If the form does not meet your needs, use the Search box at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose the pricing plan that suits you and provide your details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

- Select the format and download the form to your device.

Form popularity

FAQ

To get out of an equipment lease, you should first review the terms of your lease agreement to understand your options. Many contracts in Massachusetts include clauses for breaking a lease, but if not, you may need to negotiate with the dealer. Enlisting the help of a service like USLegalForms can guide you through the process and help navigate the complexities associated with the Assignment of Equipment Lease by Dealer to Manufacturer.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

An equipment lease agreement is a contractual agreement where the lessor, who is the owner of the equipment, allows the lessee to use the equipment for a specified period in exchange for periodic payments. The subject of the lease may be vehicles, factory machines, or any other equipment.

An assignment of leases and rents is used to create a security interest in the rent and other income generated by real property securing a commercial real estate loan.

A lessee must capitalize a leased asset if the lease contract entered into satisfies at least one of the four criteria published by the Financial Accounting Standards Board (FASB). An asset should be capitalized if: The lessee automatically gains ownership of the asset at the end of the lease.

A Capital Lease is treated like a purchase for tax and depreciation purposes. The leased equipment is shown as an asset and/or a liability on the lessee's balance sheet, and the tax benefits of ownership may be realized, including Section 179 deductions.

An assignment is when the tenant transfers their lease interest to a new tenant using a Lease Assignment. The assignee takes the assignor's place in the landlord-tenant relationship, although the assignor may remain liable for damages, missed rent payments, and other lease violations.

Leasing works like a rental agreement. You pay the equipment's owner a set fee every agreed period and you can use the asset as though it was your own. Under a lease, nobody else can use the equipment without your permission and for all intents and purposes, it's as though you own the piece of equipment.

A sublease can be for less than all of the leased premises, while an assignment that transfers the entire lease must be for all of the premises. A sublease is a more involved transaction, as it requires a full sublease document between the commercial tenant as sublessor and the sublessee.

For example, if the present value of all lease payments for a production machine is $100,000, record it as a debit of $100,000 to the production equipment account and a credit of $100,000 to the capital lease liability account. Lease payments.