Massachusetts Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty

Description

How to fill out Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice Or Course Of Dealing Stockbroker Churning - Violation Of Blue Sky Law And Breach Of Fiduciary Duty?

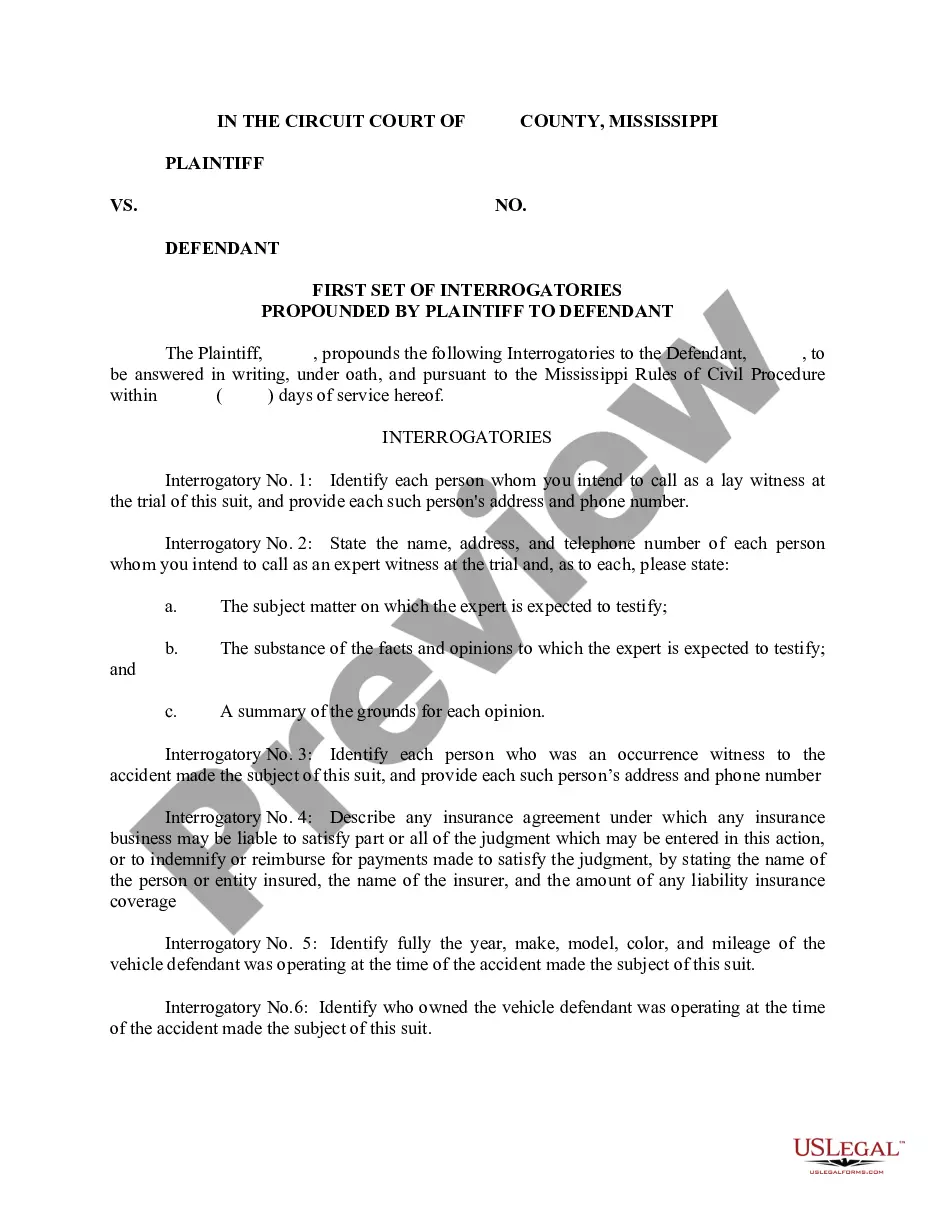

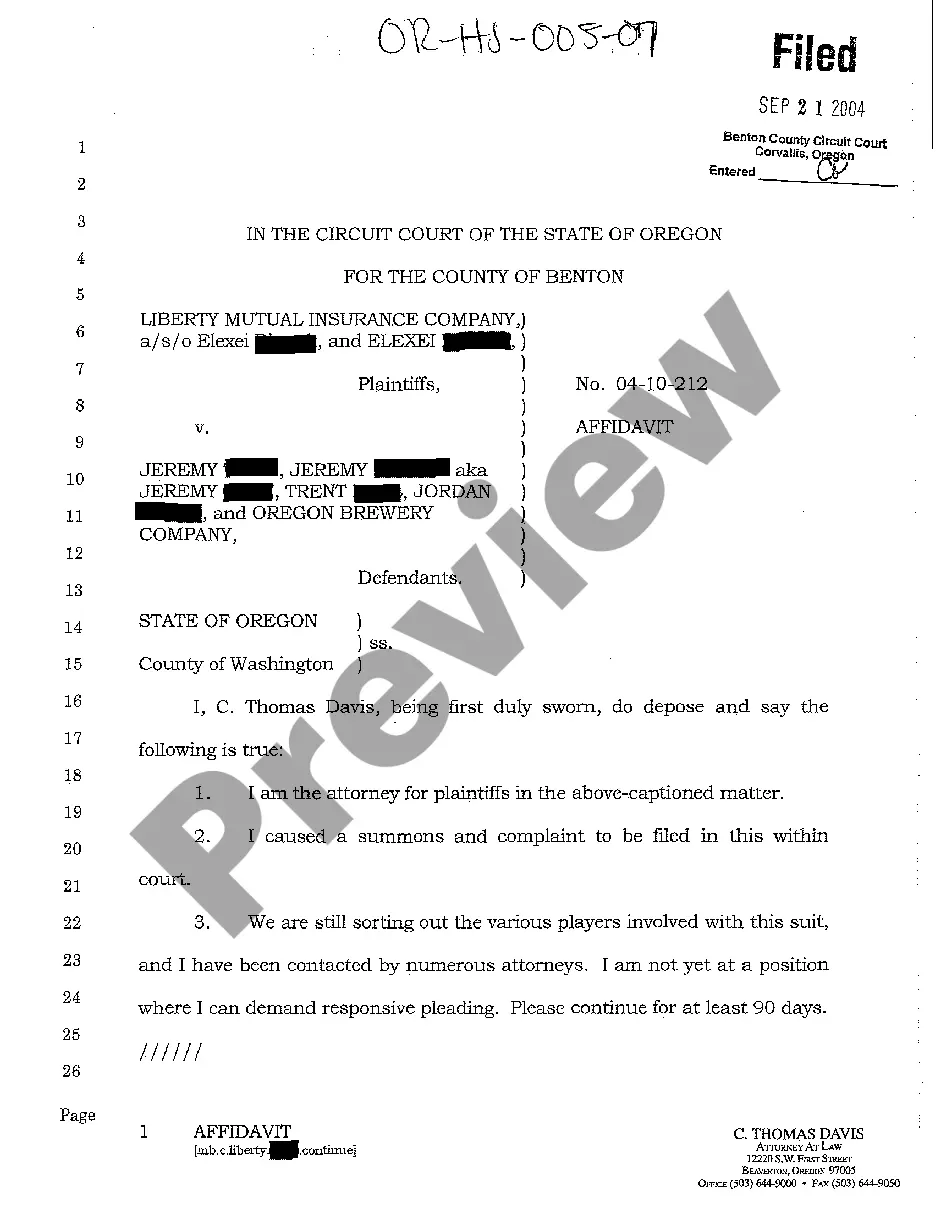

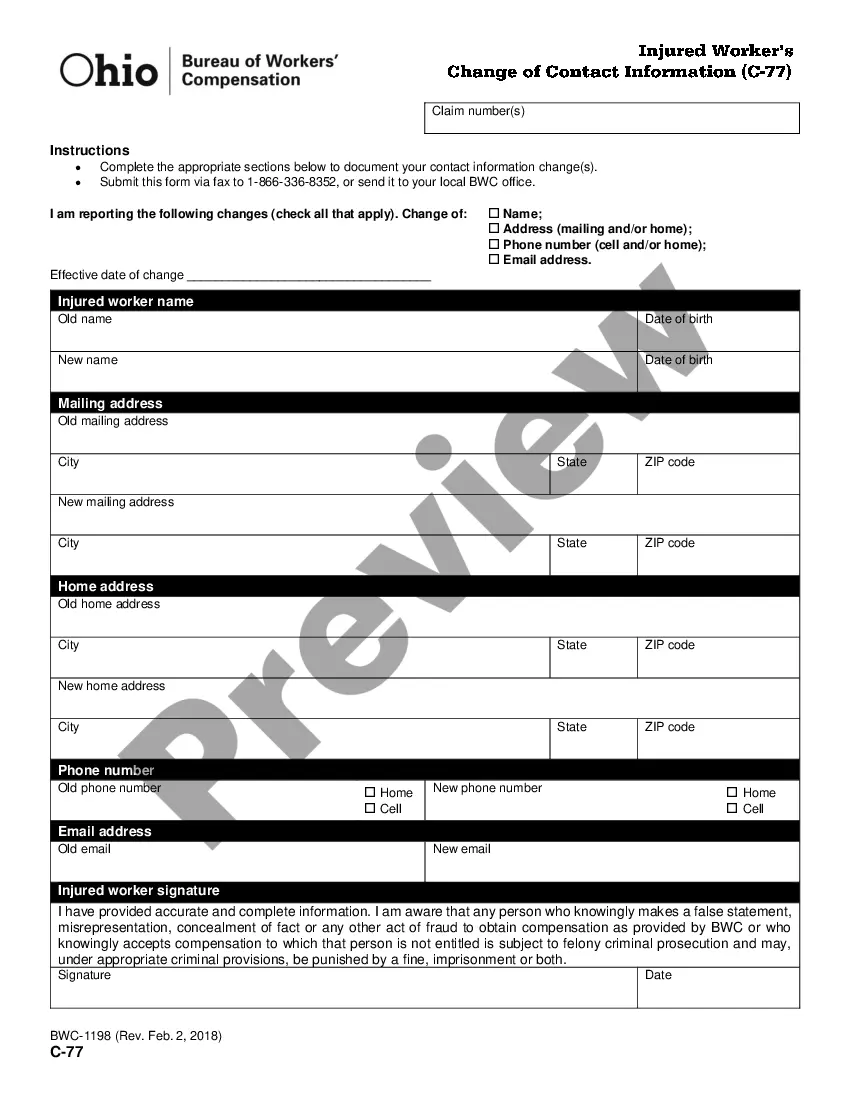

If you have to total, down load, or print legal file web templates, use US Legal Forms, the biggest selection of legal varieties, which can be found on the web. Utilize the site`s easy and hassle-free look for to find the documents you want. Various web templates for company and personal uses are categorized by groups and says, or keywords. Use US Legal Forms to find the Massachusetts Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty within a handful of mouse clicks.

In case you are previously a US Legal Forms client, log in to your bank account and click the Download switch to find the Massachusetts Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty. Also you can gain access to varieties you in the past acquired inside the My Forms tab of the bank account.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for that appropriate metropolis/nation.

- Step 2. Take advantage of the Review choice to look over the form`s articles. Don`t overlook to read through the description.

- Step 3. In case you are unhappy using the type, take advantage of the Research field on top of the display to get other variations in the legal type design.

- Step 4. Once you have found the shape you want, click the Purchase now switch. Pick the pricing plan you like and add your accreditations to sign up for the bank account.

- Step 5. Process the transaction. You can utilize your charge card or PayPal bank account to complete the transaction.

- Step 6. Choose the file format in the legal type and down load it in your gadget.

- Step 7. Full, edit and print or signal the Massachusetts Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty.

Every legal file design you acquire is yours eternally. You may have acces to each type you acquired with your acccount. Go through the My Forms area and select a type to print or down load once again.

Remain competitive and down load, and print the Massachusetts Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty with US Legal Forms. There are thousands of professional and express-distinct varieties you can use for your company or personal requirements.