Massachusetts Certificate of Secretary that all Stockholders have Waived Notice of Meeting

Description

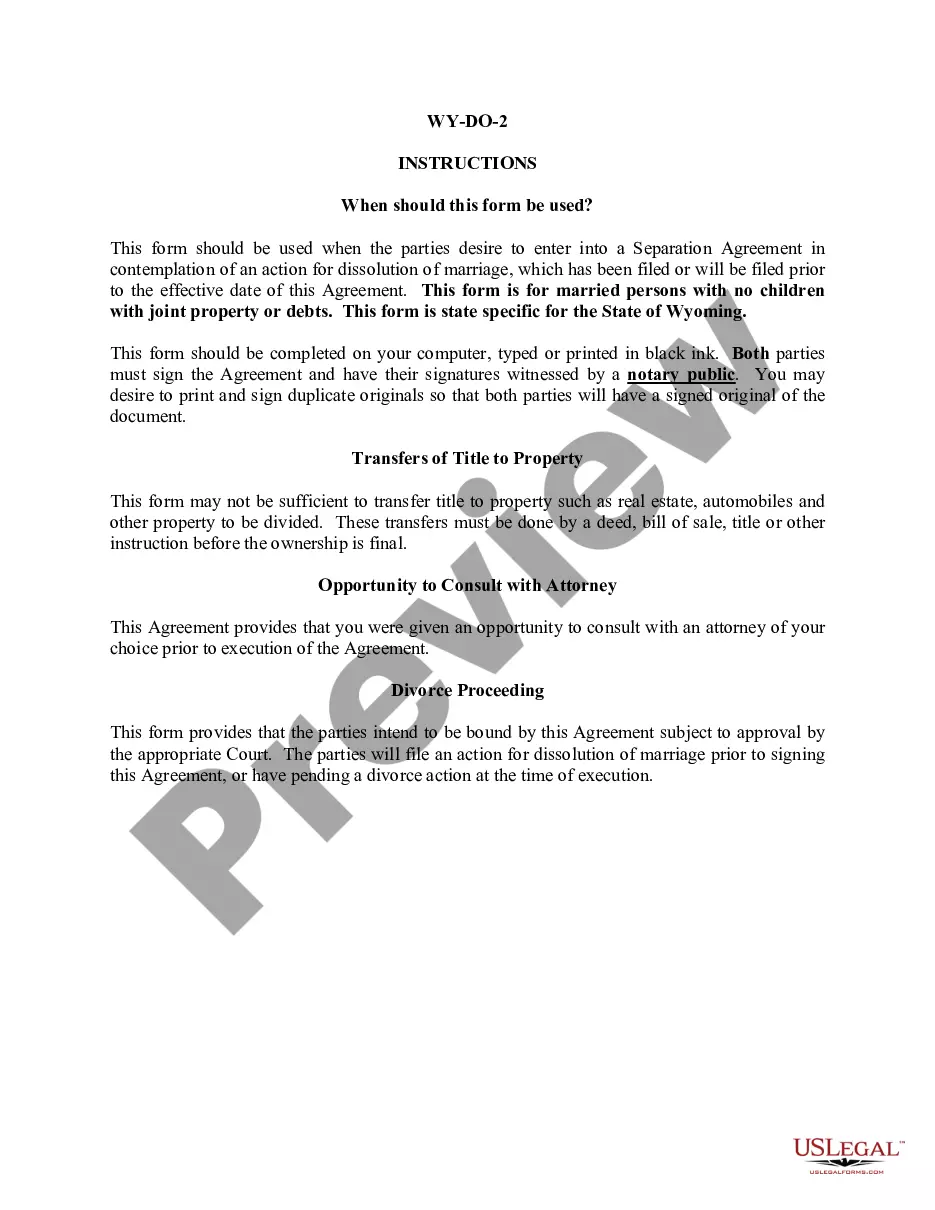

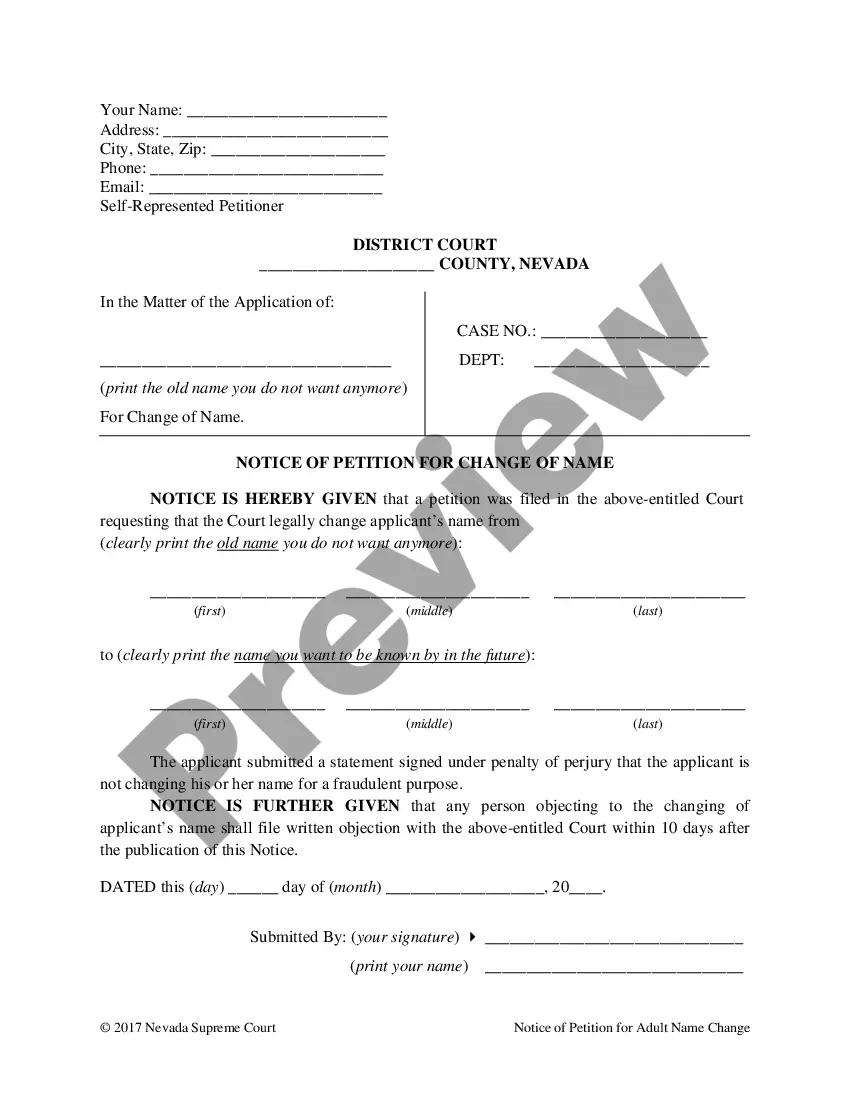

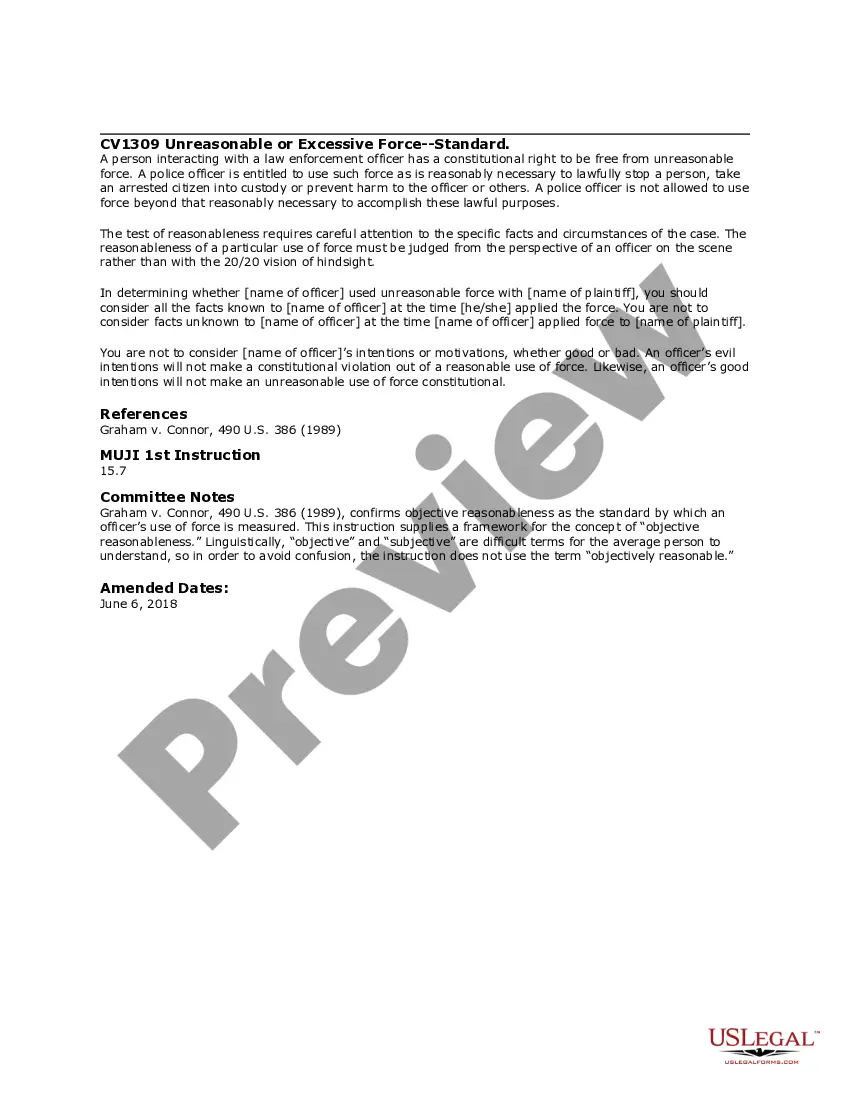

How to fill out Certificate Of Secretary That All Stockholders Have Waived Notice Of Meeting?

Finding the right authorized file design could be a have difficulties. Of course, there are a lot of layouts accessible on the Internet, but how do you get the authorized type you will need? Use the US Legal Forms web site. The assistance gives 1000s of layouts, like the Massachusetts Certificate of Secretary that all Stockholders have Waived Notice of Meeting, that can be used for company and private demands. All the forms are examined by specialists and fulfill state and federal demands.

Should you be previously listed, log in in your profile and click the Acquire option to obtain the Massachusetts Certificate of Secretary that all Stockholders have Waived Notice of Meeting. Utilize your profile to look through the authorized forms you might have purchased formerly. Proceed to the My Forms tab of your own profile and have one more copy in the file you will need.

Should you be a fresh consumer of US Legal Forms, listed here are simple recommendations for you to adhere to:

- First, make sure you have selected the right type for your personal city/state. You are able to examine the shape utilizing the Review option and read the shape outline to guarantee this is the best for you.

- If the type will not fulfill your needs, use the Seach discipline to find the appropriate type.

- Once you are sure that the shape is suitable, select the Purchase now option to obtain the type.

- Pick the prices prepare you need and enter the required details. Create your profile and pay for the transaction utilizing your PayPal profile or credit card.

- Opt for the submit formatting and obtain the authorized file design in your gadget.

- Complete, change and print out and signal the acquired Massachusetts Certificate of Secretary that all Stockholders have Waived Notice of Meeting.

US Legal Forms is definitely the greatest local library of authorized forms that you can see different file layouts. Use the service to obtain expertly-made papers that adhere to status demands.

Form popularity

FAQ

If the articles of organization or bylaws do not define the size of the board of directors, the Massachusetts default rules apply: if the corporation has three or more shareholders, the corporation must have no fewer than three directors.

A Massachusetts corp is a legal entity that designates ownership through shareholders. To form this type of business, a corporation's shareholders will need to select an incorporator who will go through the process of creating the corporation.

The following are the Massachusetts requirements for directors of corporations: Minimum number. Corporations must have no fewer than three directors, unless there are two or fewer shareholders. In such case, there may be one or two directors.

An LLP or an LLC with two or more members will be treated as a partnership if it's treated as a partnership for federal tax purposes. An LLP or LLC will be treated as a corporation for Massachusetts income tax purposes if it is classified as such for federal tax purposes.

Each entity registered with the Massachusetts Secretary of the Commonwealth (the ?Secretary?) may be required to register for corporate excise and file an annual corporate return with the Massachusetts Department of Revenue (the ?DOR?).

The Massachusetts Business Corporation Act (the ?Act?) is codified at Massachusetts General Laws, Chapter 156D. It sets forth the rules and regulations for corporations and applies to all Massachusetts business corporations governed by G.L. C156B, Foreign Corporations under G.L.

A Massachusetts LLC is similar to a corporation but less formal. The owners are referred to as ?members,? whereas the owners of a corporation are its ?shareholders.? Members of an LLC are taxed like a sole proprietorship, partnership, or S Corp, with income from the LLC passing through to the LLC members.