Massachusetts LLC Operating Agreement for Husband and Wife

Description

How to fill out LLC Operating Agreement For Husband And Wife?

If you wish to compile, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms, available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require. Numerous templates for professional and personal purposes are categorized by types and jurisdictions, or keywords.

Use US Legal Forms to locate the Massachusetts LLC Operating Agreement for Spouses in just a few clicks.

Every legal document template you acquire is yours permanently. You can access every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Be proactive and download, and print the Massachusetts LLC Operating Agreement for Spouses with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and then click the Acquire button to find the Massachusetts LLC Operating Agreement for Spouses.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the instructions outlined below.

- Step 1. Ensure you have chosen the form for the correct state/region.

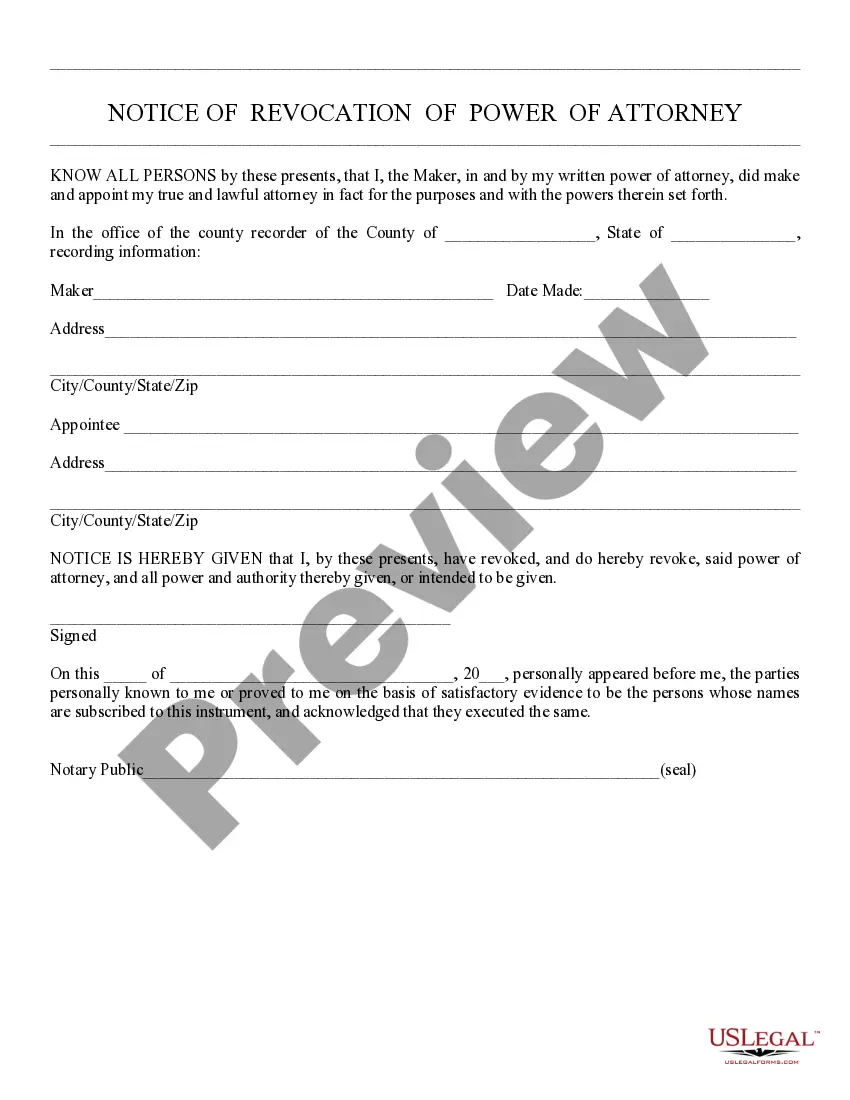

- Step 2. Utilize the Review option to check the form’s content. Don’t forget to read the details.

- Step 3. If you are unhappy with the form, use the Search area at the top of the screen to find additional templates from the legal document library.

- Step 4. Once you have identified the form you need, click the Buy now button. Select your preferred payment plan and provide your information to register for an account.

- Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finish the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Massachusetts LLC Operating Agreement for Spouses.

Form popularity

FAQ

Filing an LLC in Massachusetts involves several steps. Start by choosing a unique name for your business and confirming its availability with the state. Then, prepare and file the necessary formation documents with the Secretary of the Commonwealth and consider creating a Massachusetts LLC Operating Agreement for Husband and Wife to outline your operational structure. Finally, obtain any necessary licenses or permits to ensure compliance with local regulations.

Yes, both husband and wife can serve as owners of an LLC in Massachusetts. This structure is quite common and is often favored for its simplicity in management and decision-making. By creating a Massachusetts LLC Operating Agreement for Husband and Wife, you can outline each partner's rights and responsibilities. This clarity will not only streamline operations but also contribute to a healthier business relationship.

member LLC, especially one formed by a husband and wife, should consider having an operating agreement in place. The Massachusetts LLC Operating Agreement for Husband and Wife not only solidifies the business relationship but also clarifies the roles of each member. This agreement can help avoid misunderstandings and ensure that both partners are on the same page. Furthermore, it can enhance your LLC's credibility and professionalism.

Domestication of Foreign Corporation to Massachusetts Corporation. If a foreign business corporation's law permits the domestication of a foreign business corporation into a Massachusetts business corporation, Massachusetts law governs the domestication (M.G.L. ch. 156D, § 9.20(a)).

Prepare an Operating AgreementAn LLC operating agreement is not required in Massachusetts, but is highly advisable. This is an internal document that establishes how your LLC will be run. It is not filed with the state.

Massachusetts does not require an operating agreement in order to form an LLC, but executing one is highly advisable. . . An operating agreement is the basic written agreement between the members (i.e., owners) of the LLC, or between the members and the managers of the company, if there are managers.

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.

GENERAL. Massachusetts has approved single member LLCs to organize under state law. In the past, an LLC had to have two members. By allowing single member LLCs, a sole proprietorship can now convert to a single member LLC and get liability protection from creditors.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.