Massachusetts Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

Selecting the appropriate legal document template can be a challenge. Clearly, there are numerous templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website.

The service offers thousands of templates, including the Massachusetts Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, which you can utilize for both business and personal purposes. All of the forms are reviewed by experts and meet federal and state regulations.

If you are already registered, Log In to your account and click the Acquire button to access the Massachusetts Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions. Use your account to check the legal forms you have previously purchased. Navigate to the My documents section of the account and download another copy of the document you need.

Select the document format and download the legal document template for your device. Complete, modify, print, and sign the acquired Massachusetts Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to download professionally crafted paperwork that adhere to state regulations.

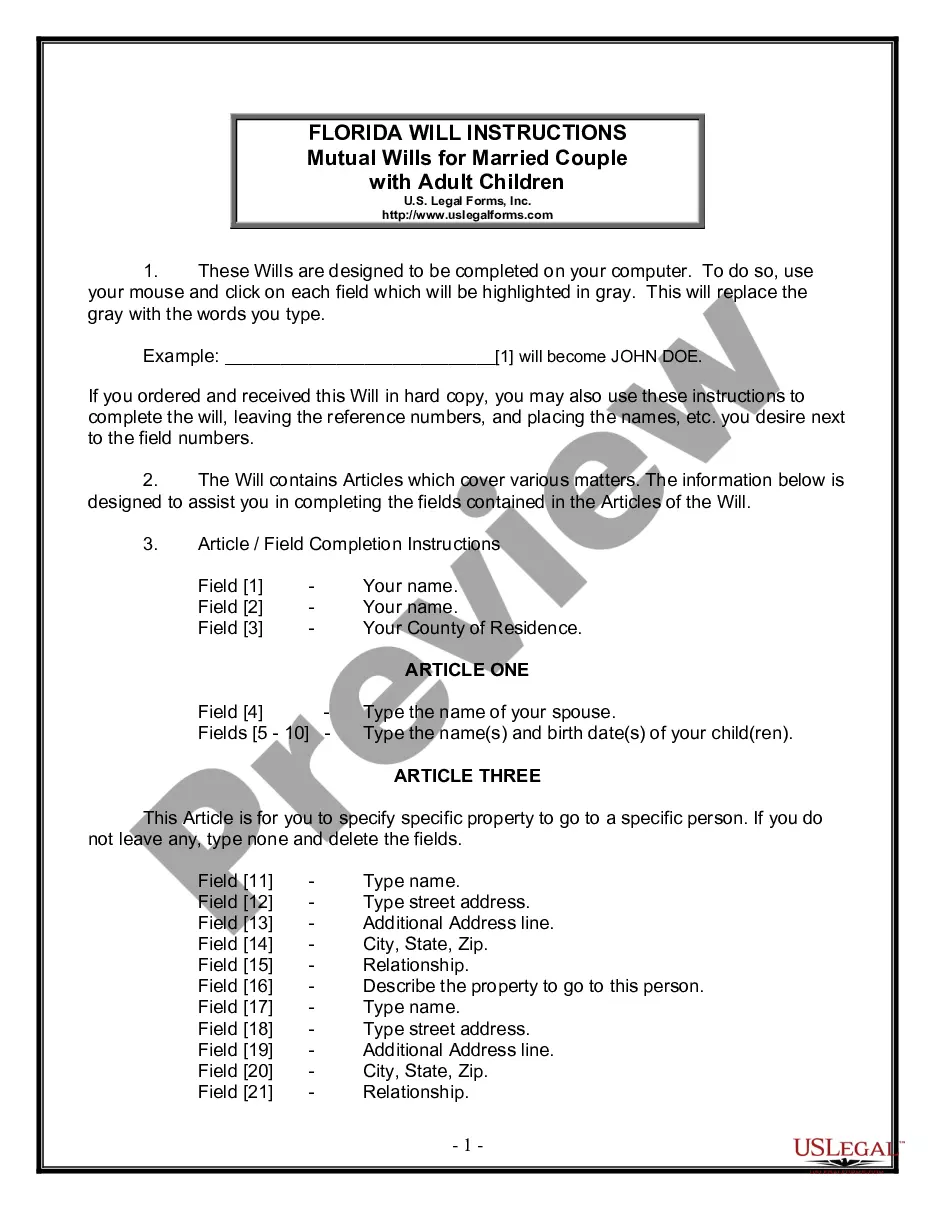

- First, make sure you have selected the correct form for your location/area.

- You can review the form using the Review button and check the form description to ensure it is suitable for you.

- If the form does not meet your needs, use the Search box to find the correct form.

- Once you are confident the form is appropriate, click the Buy now button to obtain the form.

- Choose the payment method you prefer and input the required information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

One disadvantage of a buy-sell agreement is the financial burden it may impose on shareholders when trying to buy out someone's shares. Additionally, if not written clearly, the terms can create conflicts among shareholders, particularly regarding valuation methods. By considering these factors when drafting a Massachusetts Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, you can mitigate potential issues.

A Shareholders Agreement is a contract concluded between shareholders to a company that formalizes the relationship and governs the duties and responsibilities between all stakeholders to the company.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the

What is a Buy-Sell Agreement? Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.

Step 1: Decide on the issues the agreement should coverCommon problem areas include the following:Directors -v- members.Transfer of shares.Approving a change in business direction.Managing changes in the roles shareholders play.Injection of debt.Competition.Exit.More items...

An agreement between two parties in which the seller agrees to sell the stated number of shares to the buyer at a particular price.

Drafting a Successful Shareholders' AgreementDrafting a successful shareholders' agreement.Understand your client's business.Don't overcomplicate decision making.Decide how to deal with stalemates.You need an exit.Think through all the possible outcomes for your exit mechanism it needs to work.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

The two most common types of buy-sell agreements are entity-purchase and cross-purchase agreements.