Massachusetts Land Installment Contract

Description

How to fill out Land Installment Contract?

Are you in a situation where you need documentation for both business or personal reasons nearly every day? There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast collection of form templates, such as the Massachusetts Land Installment Contract, that are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Massachusetts Land Installment Contract template.

Choose a convenient document format and download your copy.

You can find all of the document templates you have purchased in the My documents section. You can obtain another copy of the Massachusetts Land Installment Contract anytime, if needed. Just select the required form to download or print the document template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

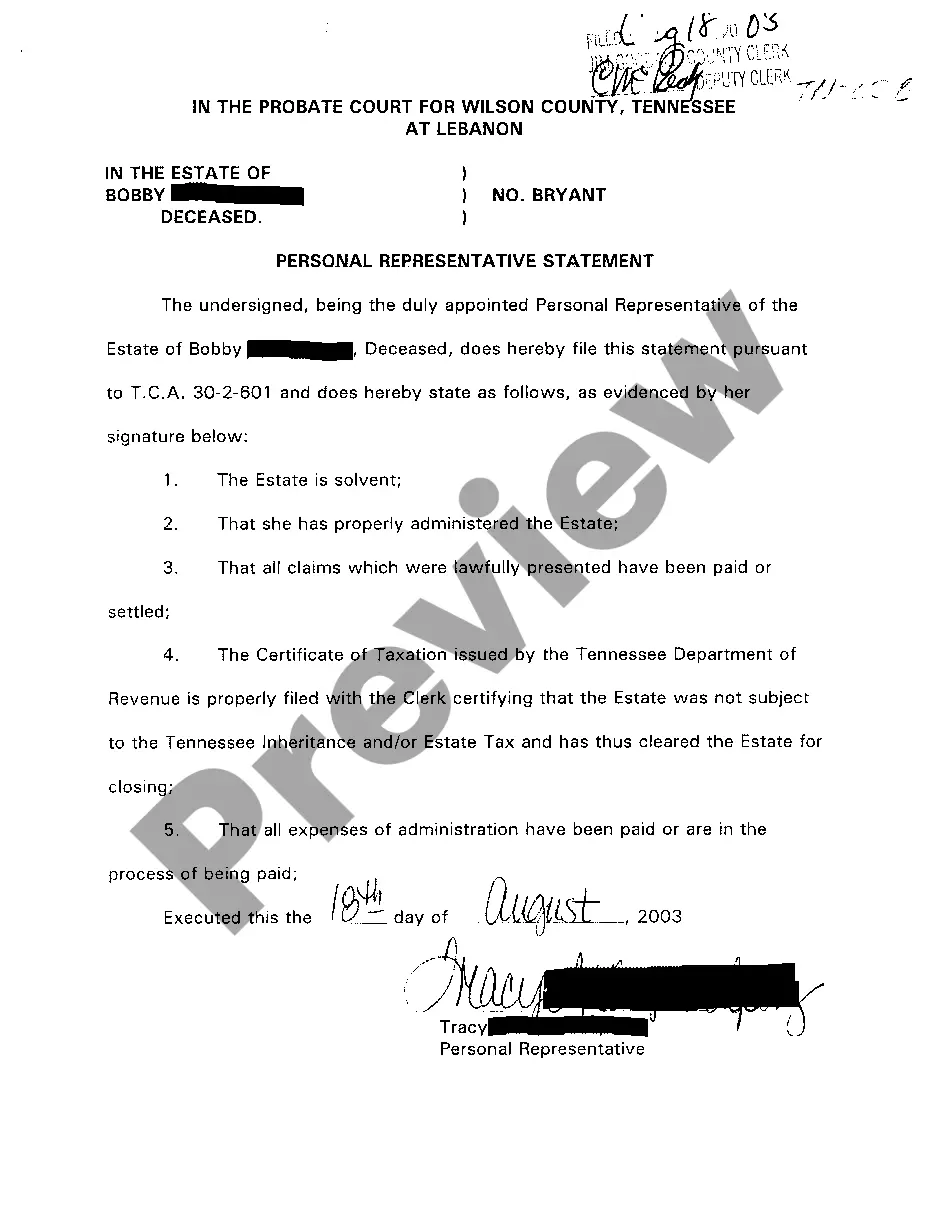

- Utilize the Review button to check the form.

- Read the description to confirm that you have chosen the right form.

- If the form isn’t what you are looking for, use the Lookup field to find the form that meets your needs and criteria.

- Once you have the correct form, click on Buy now.

- Select the pricing plan of your choice, enter the necessary information to set up your account, and complete your purchase using PayPal or credit card.

Form popularity

FAQ

Introduction. An installment contract (also called a land contract or articles of agreement for warranty deed or contract for deed) is an agreement between a real estate seller and buyer, under which the buyer agrees to pay to the seller the purchase price plus interest in installments over a set period of time.

An installment sale is a sale of property where you receive at least one payment after the tax year of the sale. If you dispose of property in an installment sale, you report part of your gain when you receive each installment payment.

Maryland has a statute expressly dealing with land installment contracts. A seller must consult and follow the statutory provisions closely or risk being liable to the purchaser for substantial money.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

The two key differences between installment and credits sales are the duration the credit is offered and the collateral used to back the credit. Credit sales are typically of shorter duration and installment sales spread payments out over longer periods of time.

An installment land sales contract is an agreement to buy land over time, without transferring title to the land until all the payment have been made. The Seller agrees to allow the Buyer to pay the purchase price over a period of time in installment amounts.

Qualifying as an Installment Sale Note: installment sales do not require multiple payments over multiple years. For example, a sale by a calendar year taxpayer that is closed on 12/31/2021 and paid for on 1/1/2022 is considered an installment sale because at least one payment is made in a year after the year of sale.

An installment agreement requires the buyer of real estate to pay the seller the purchase price in installments over time; the buyer takes immediate possession of the property but the seller retains legal title as security until the buyer pays in full.

In an installment sale contract sometimes called a contract for deed generally the owner agrees to sell the real estate to the buyer for periodic payments to be applied to the purchase price in some fashion.

One of the primary benefits of an installment sale is that it gives the seller an opportunity to partially defer capital gains from the sale to future tax years. By using an installment sale, the seller may benefit by: Partially deferring taxes while simultaneously improving cash flow.