Massachusetts Sample Letter for Tax Exemption - Review of Applications

Description

How to fill out Sample Letter For Tax Exemption - Review Of Applications?

Are you presently within a placement where you will need files for either business or individual reasons just about every day? There are tons of legal file web templates available on the net, but getting types you can trust isn`t effortless. US Legal Forms offers a large number of develop web templates, much like the Massachusetts Sample Letter for Tax Exemption - Review of Applications, which are written in order to meet state and federal demands.

If you are presently knowledgeable about US Legal Forms website and get a free account, basically log in. Afterward, it is possible to obtain the Massachusetts Sample Letter for Tax Exemption - Review of Applications web template.

Unless you provide an account and wish to start using US Legal Forms, abide by these steps:

- Discover the develop you will need and ensure it is to the proper town/region.

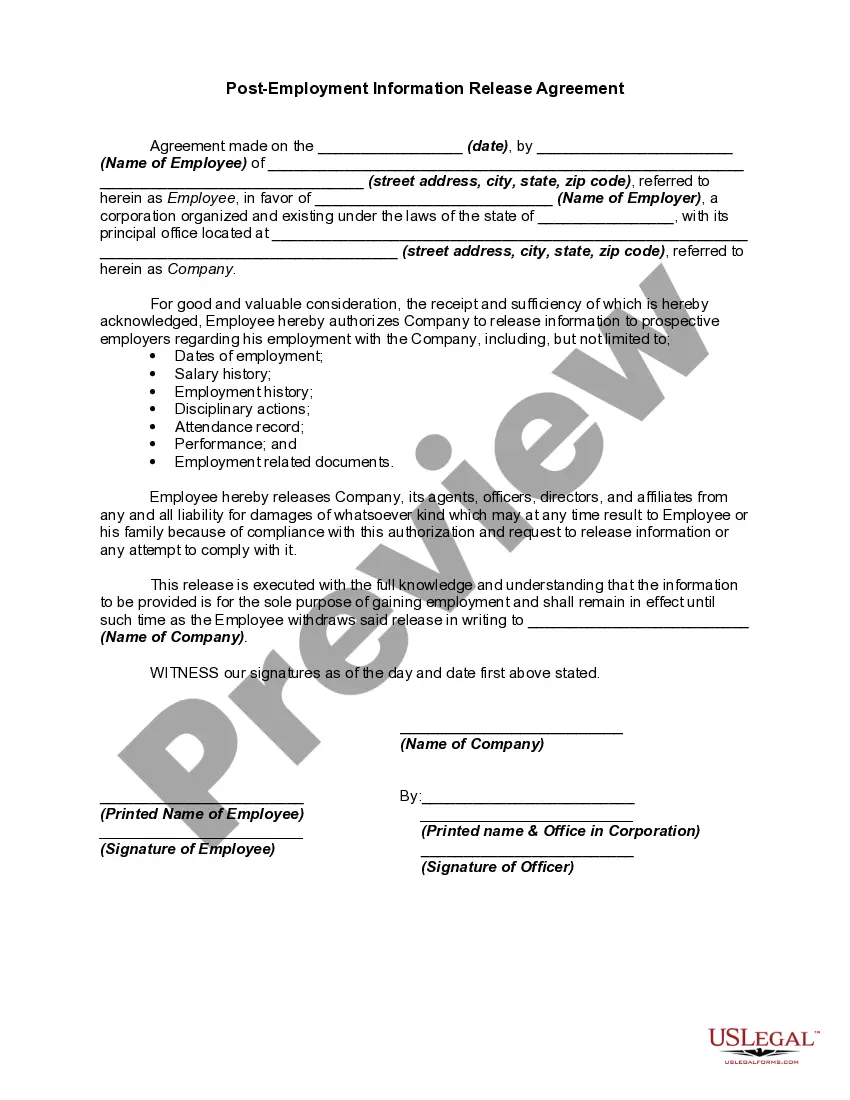

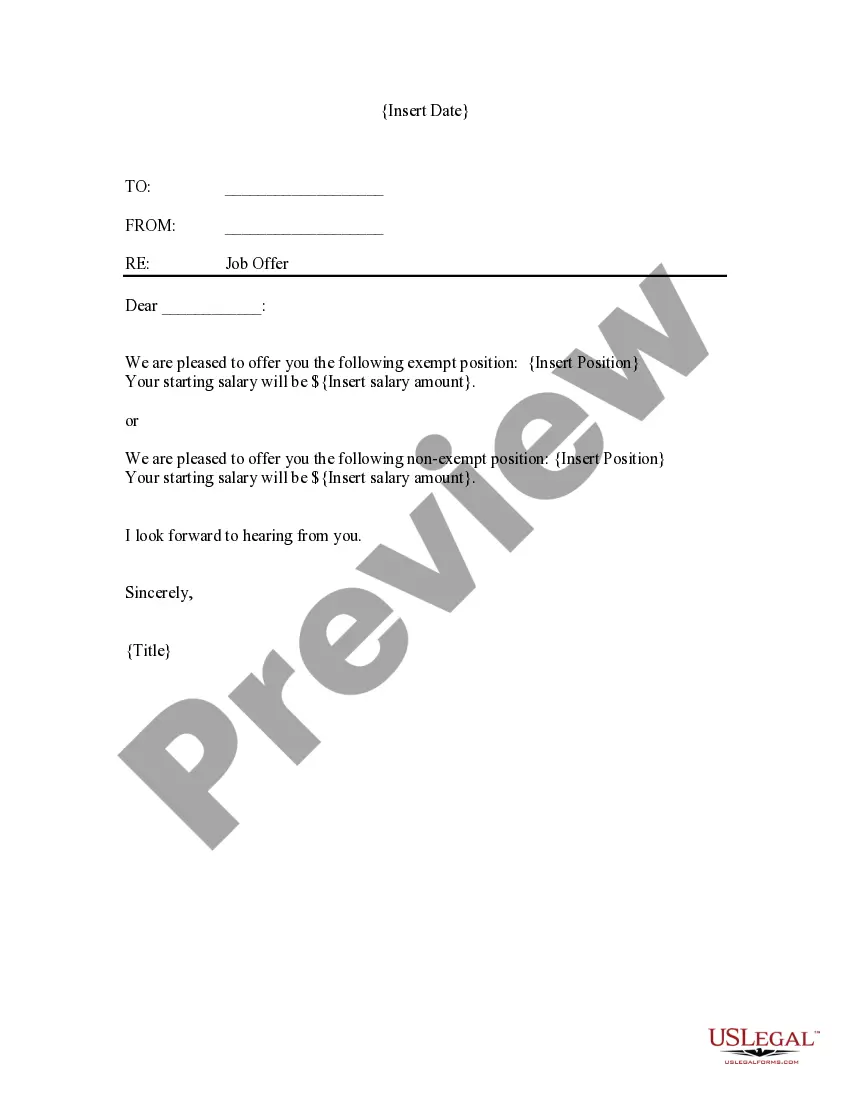

- Take advantage of the Review button to analyze the form.

- See the explanation to ensure that you have selected the proper develop.

- In case the develop isn`t what you are trying to find, utilize the Look for area to obtain the develop that meets your needs and demands.

- When you find the proper develop, click on Purchase now.

- Choose the prices prepare you desire, complete the specified information and facts to generate your money, and pay money for an order with your PayPal or credit card.

- Decide on a hassle-free data file file format and obtain your backup.

Locate each of the file web templates you may have purchased in the My Forms food selection. You can aquire a additional backup of Massachusetts Sample Letter for Tax Exemption - Review of Applications any time, if required. Just click on the necessary develop to obtain or produce the file web template.

Use US Legal Forms, the most substantial assortment of legal varieties, in order to save time and prevent errors. The service offers expertly created legal file web templates which you can use for a selection of reasons. Create a free account on US Legal Forms and begin generating your daily life easier.

Form popularity

FAQ

Most state sales tax exemption certificates do not expire and the seller is required to maintain exemption certificates for as long as sales continue to be made to the purchaser and sales tax is not collected. Exemption certificates are not required for items that are not taxable by statute.

You should claim the total number of exemptions to which you are entitled to prevent excessive over-withholding, unless you have a significant amount of other income. If you expect to owe more income tax than will be withheld, you may either claim a smaller number of exemptions or have additional amounts withheld.

More In Help. Personal exemption deductions for yourself, your spouse, or your dependents, have been eliminated by the Tax Cuts and Jobs Act beginning after December 31, 2017, and before January 1, 2026.

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax.

The 501(c)(3) determination letter is proof of your organization's tax-exempt status. By Christine Mathias, Attorney. After your organization submits an application for 501(c)(3) tax-exempt status, the IRS will respond with a determination letter.

LETTER OF EXEMPTION. This Letter of Exemption certifies that federal credit unions are exempt from all taxes imposed by the United States or by any state, territorial, or local taxing authority, except for local real or personal property tax.

Typically, you can be exempt from withholding tax only if two things are true: You got a refund of all your federal income tax withheld last year because you had no tax liability. You expect the same thing to happen this year.

How do I write a tax-exempt letter? A tax exempt letter needs to include the name and contact information of the organization. Then establish the reason for the tax exempt status such as listing what the organization does that will profit the public.