Massachusetts Equipment Inventory List

Description

How to fill out Equipment Inventory List?

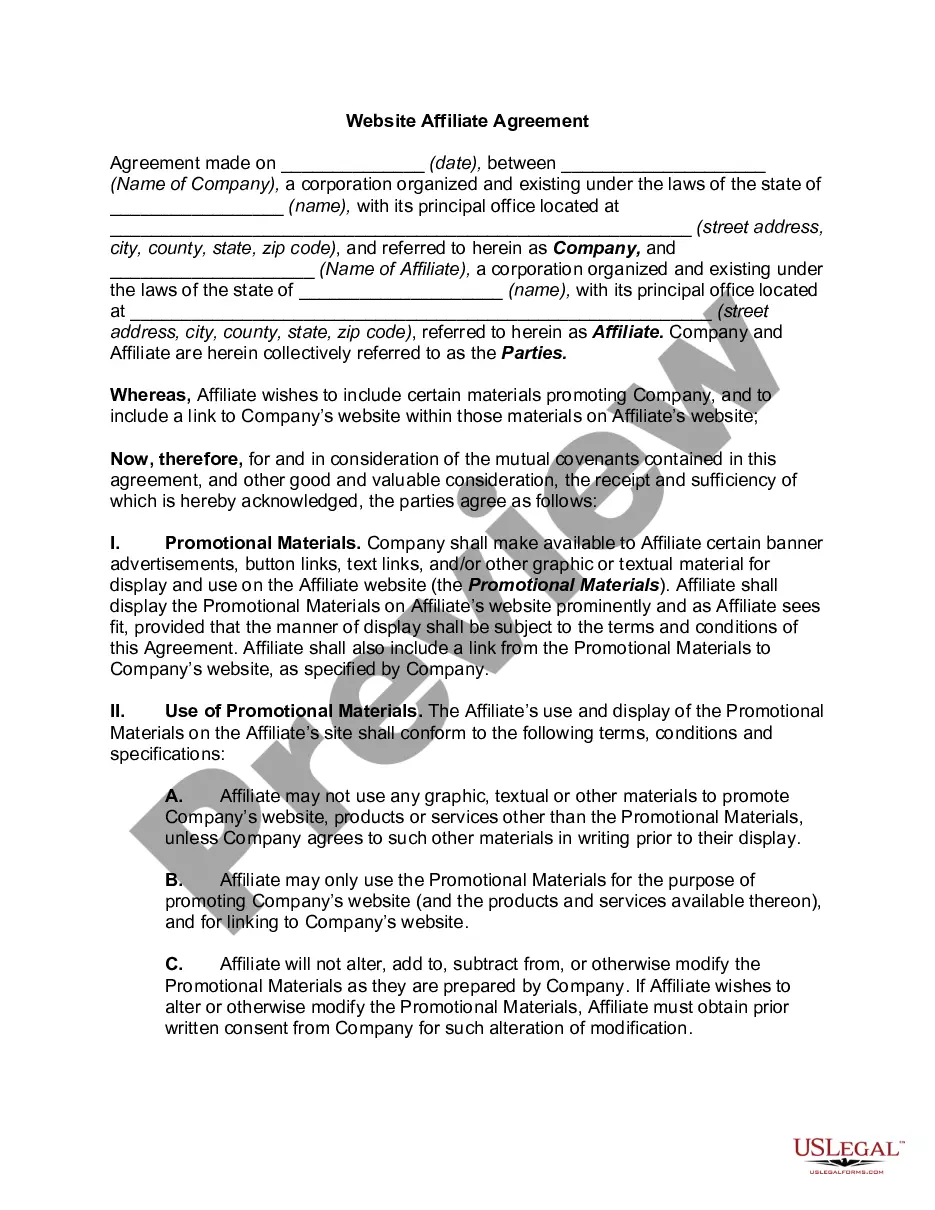

Are you in a circumstance where you require documents for certain organizations or specific functions almost every time.

There are numerous legitimate form templates accessible on the web, but finding reliable types can be challenging.

US Legal Forms offers a vast array of form templates, including the Massachusetts Equipment Inventory List, which are designed to meet both state and federal requirements.

Once you find the right form, click Acquire now.

Choose a payment plan you prefer, provide the required information to create your account, and complete your order with PayPal or credit card.

- If you are currently familiar with the US Legal Forms website and have an account, just Log In.

- Once logged in, you can download the Massachusetts Equipment Inventory List template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct region/county.

- Use the Preview button to check the form.

- Review the description to ensure you have selected the correct form.

- If the form isn’t what you are looking for, use the Search box to find the one that suits your needs.

Form popularity

FAQ

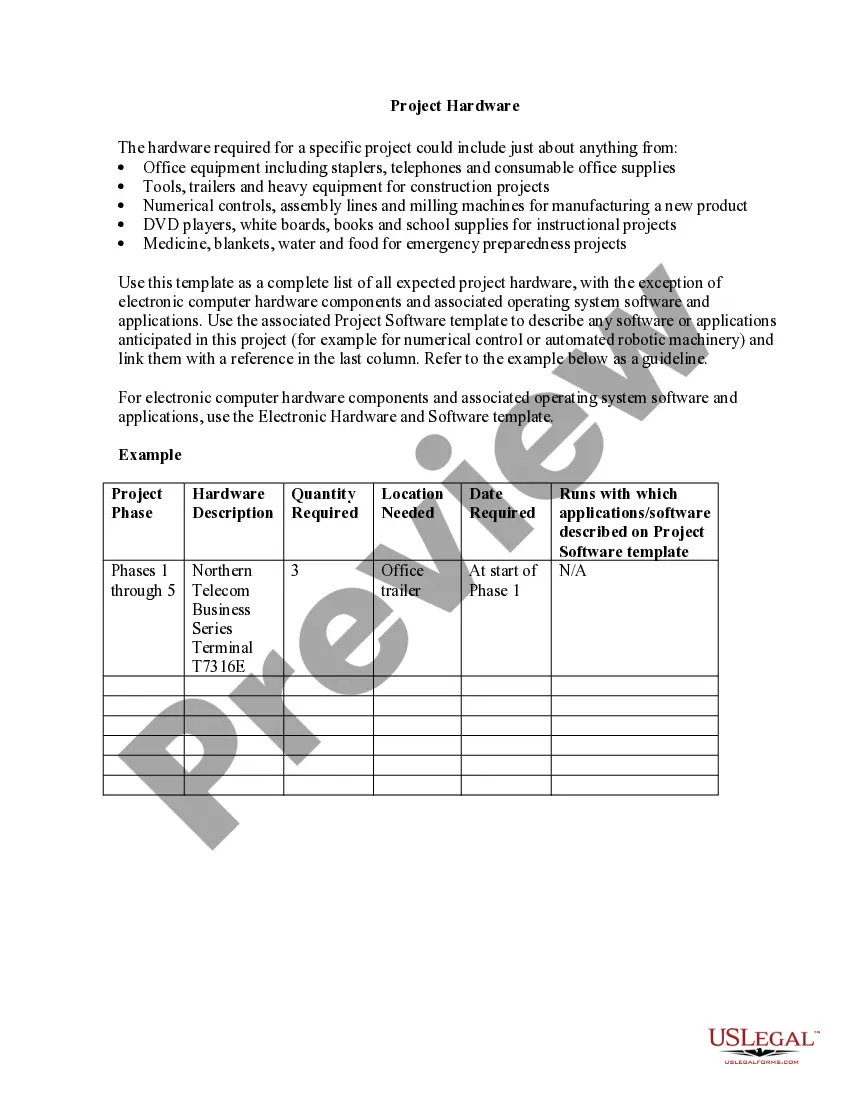

An inventory item list is a catalog of individual items that a business keeps on hand, which may include raw materials, supplies, or equipment. This list serves to monitor stock levels and plan for future needs. A clear Massachusetts Equipment Inventory List is essential to ensure you have the right items available to meet operational demands.

The inventory list of equipment is a detailed record of all equipment owned by a company, outlining specifics like type, number, and condition. This list helps businesses assess their available resources and make informed decisions about purchasing or replacing equipment. An updated Massachusetts Equipment Inventory List can aid in budget planning and forecasting.

Inventory equipment refers to all physical assets a business owns that are intended for use in operations, including tools, machines, and furniture. Essentially, it represents the resources that contribute to your business's productivity. Having a clear Massachusetts Equipment Inventory List will help you understand what resources you have and how they can benefit your operations.

To maintain an accurate Massachusetts Equipment Inventory List, you can use software that simplifies tracking and updating your inventory. Regularly conducting physical counts ensures that your records match actual equipment on hand. Implementing a barcode system or using mobile apps can further streamline the process, making it easy to stay organized.

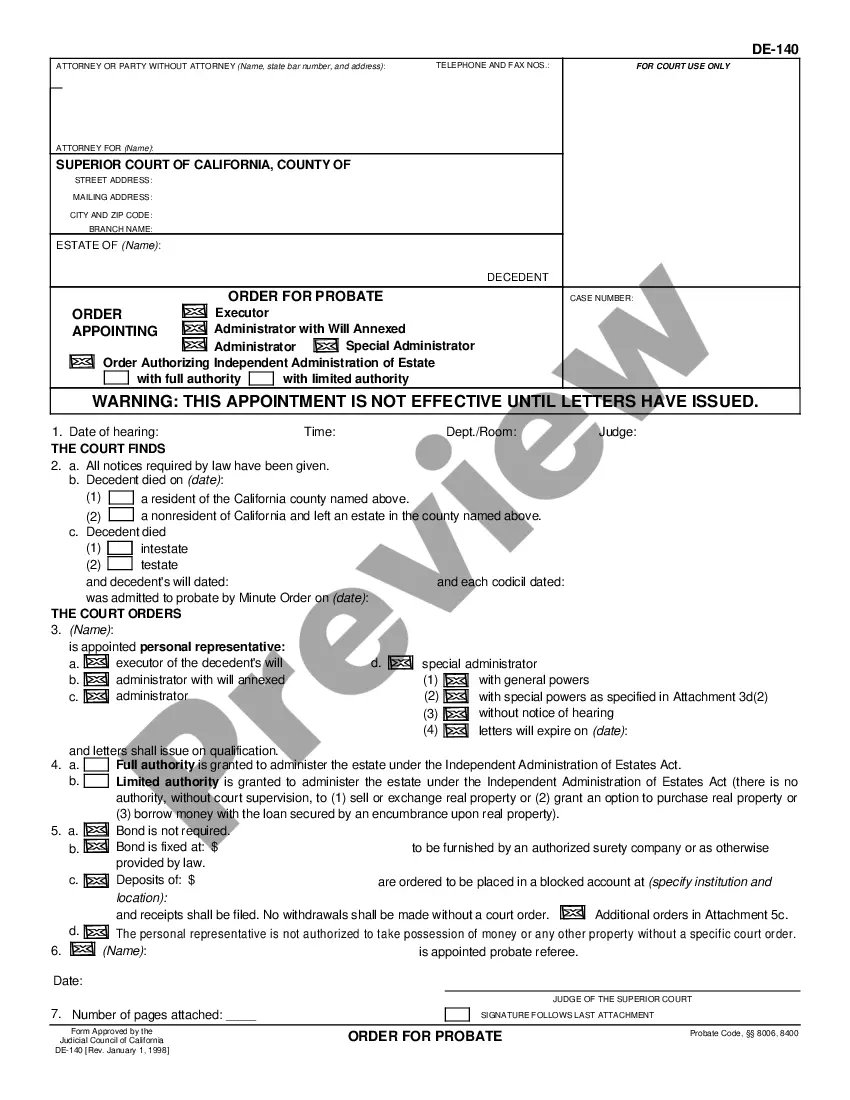

Yes, Massachusetts imposes a business personal property tax on tangible assets used in business operations. This tax applies to items listed in your Massachusetts Equipment Inventory List, such as machinery and equipment. Understanding this tax is essential for business owners to manage their budgets effectively. Consider consulting resources or templates from UsLegalForms to ensure you stay compliant.

MA State Tax Form 2 is used to report personal property owned by businesses in Massachusetts. This form requires a detailed listing of business assets, including those on your Massachusetts Equipment Inventory List. When completing this form, accuracy is crucial, as it determines your tax obligation. Using tools from UsLegalForms can streamline the completion process, ensuring you provide the necessary information.

Personal property tax is primarily based on the assessed value of tangible assets owned by a business. This includes equipment, machinery, furniture, and other property listed in a Massachusetts Equipment Inventory List. The total taxable amount is then applied to the local tax rate set by your municipality. Understanding what qualifies as taxable property can help you maintain compliance.

In Massachusetts, personal property tax is calculated by assessing the value of the business assets you own. This assessment is typically based on the fair market value of the equipment, machinery, and other assets listed in your Massachusetts Equipment Inventory List. To minimize surprises during tax season, it's wise to regularly update your inventory to reflect current values.

Property tax in Massachusetts is calculated based on the assessed value of the property multiplied by the local tax rate. Municipalities assess property values every few years, accounting for changes in market conditions. For businesses, keeping an updated Massachusetts Equipment Inventory List can help you understand how much you might owe. This proactive approach allows for better financial planning.

The rate of personal property tax in Massachusetts varies by municipality, but it typically falls between 1% and 3% of the assessed value. This assessment applies to assets that your business owns and utilizes. To accurately report your assets, maintaining a current Massachusetts Equipment Inventory List can be beneficial. This list helps you track your valuable assets and prepare for tax obligations.